CovEr STory - Mjunction

CovEr STory - Mjunction

CovEr STory - Mjunction

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

coal market fundamentals<br />

Price fixed for Q1<br />

Coal Insights Bureau<br />

An agreement has been reached after price<br />

negotiations with regard to hard coking coal and<br />

LV PCI coal for blast furnace for the first quarter<br />

(April to June) of FY2012.<br />

Out of the above, the first quarter contract price of highgrade<br />

hard coking coal of Queensland, Australian and<br />

Canadian origins is around $205-210 per ton fob, nearly 11<br />

percent less from the previous term (January to March). On<br />

the other hand, the first quarter contract price of LV PCI<br />

coal of Queensland and Canadian origins is around $153.30<br />

per ton fob, 10.4 percent less from the previous term.<br />

As a result of these, the prices of both hard coking coal<br />

and LV PCI coal have been reduced in four consecutive<br />

terms since second quarter (July to September) of FY2011.<br />

Incidentally, the contract prices of high-grade hard coking<br />

coal and LV PCI coal for first quarter of FY2011 were $330<br />

per per ton fob and $275 per ton fob respectively.<br />

The prices have been reduced because of the worldwide<br />

dwindling demand on the steel products attributed to the<br />

economic crisis in the European Union.<br />

The contract price for the fourth quarter of 2011-<br />

12 (January to March in 2012) was $230-235 per ton fob<br />

Australia. Therefore, it becomes a price reduction by around<br />

$25 (nearly 11 percent) from the one for the previous term.<br />

The contract for third quarter (October-December) was<br />

signed at around $285 a ton, but since then the spot prices<br />

had dipped sharply on low demand from European, US<br />

and Chinese steel makers. The contract for second quarter<br />

(July-September) was signed at $315 a ton compared with<br />

$330 for the first quarter (April-June) of 2011-12.<br />

Coking coal prices, which was earlier fixed on yearly<br />

basis, was around $97 per ton fob during 2007-08. The<br />

prices touched a higher of $300 per ton in 2008-09 before<br />

dropping to $129 per ton in 2009-10.<br />

However, prices started rising again from 2010-11 and<br />

the miners started quarterly contract from Q1 of 2010-11<br />

and touched a high of $225 per ton for the fourth quarter<br />

of the year.<br />

Prices peaked to $330 per ton in the first quarter of 2011-<br />

12 owing to floods in the Queensland region of Australia,<br />

but gradually fell to current levels as supply became<br />

normal over time.<br />

Met coke import prices rise<br />

in March<br />

Met coke import prices rose in March on some<br />

rebound in demand from steel mills and<br />

supply constraints of coking coal following<br />

the bad weather in Queensland region of Australia.<br />

The import prices of met coke were hovering<br />

around $385 per ton currently, up from $372 per ton at<br />

the end of February.<br />

LAM coke demand, which is currently at 33 million<br />

tons per annum (mtpa) domestically, is expected to<br />

shoot up to 58 mtpa in the next five years, as steel<br />

makers increase capacity, according to industry<br />

estimates.<br />

transportation link for Bowen Basin coking coal mines was<br />

shut on March 20 after heavy rainfall caused flooding on a<br />

section of the track, operator QR National said. According to<br />

reports, the world’s largest coking coal export port Dalrymple<br />

Bay Coal Terminal was also closed. The likely duration of the<br />

rail closure was unclear.<br />

The Goonyella system links 30 mines to DBCT and Hay<br />

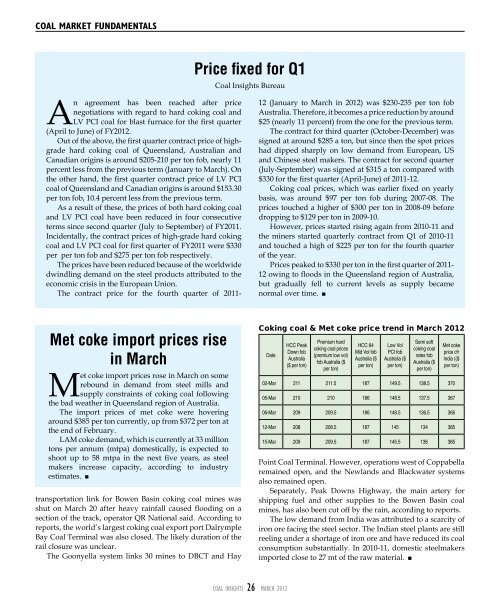

Coking coal & Met coke price trend in March 2012<br />

Date<br />

HCC Peak<br />

Down fob<br />

Australia<br />

($ per ton)<br />

Premium hard<br />

coking coal prices<br />

(premium low vol)<br />

fob Australia ($<br />

per ton)<br />

HCC 64<br />

Mid Vol fob<br />

Australia ($<br />

per ton)<br />

Low Vol<br />

PCI fob<br />

Australia ($<br />

per ton)<br />

Semi soft<br />

coking coal<br />

rates fob<br />

Australia ($<br />

per ton)<br />

Met coke<br />

price cfr<br />

India (($<br />

per ton)<br />

02-Mar 211 211.5 187 149.5 138.5 370<br />

05-Mar 210 210 186 148.5 137.5 367<br />

06-Mar 209 209.5 186 148.5 136.5 366<br />

12-Mar 208 208.5 187 145 134 385<br />

15-Mar 209 209.5 187 145.5 136 385<br />

Point Coal Terminal. However, operations west of Coppabella<br />

remained open, and the Newlands and Blackwater systems<br />

also remained open.<br />

Separately, Peak Downs Highway, the main artery for<br />

shipping fuel and other supplies to the Bowen Basin coal<br />

mines, has also been cut off by the rain, according to reports.<br />

The low demand from India was attributed to a scarcity of<br />

iron ore facing the steel sector. The Indian steel plants are still<br />

reeling under a shortage of iron ore and have reduced its coal<br />

consumption substantially. In 2010-11, domestic steelmakers<br />

imported close to 27 mt of the raw material.<br />

COAL INSIGHTS 26 March 2012