CovEr STory - Mjunction

CovEr STory - Mjunction

CovEr STory - Mjunction

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

fEATURE<br />

Union Budget a mixed bag for metals,<br />

mining sectors<br />

Coal Insights Bureau<br />

The Union Budget 2012-13 was a mixed bag for the<br />

metals and mining sector. While the increase in<br />

excise duty would be marginally negative for metal<br />

producers, exemption from import duty on coal would be<br />

slightly positive for thermal coal importers, including nonferrous<br />

metal producers, JSW Steel and some sponge iron<br />

producers.<br />

Moreover, the increase in customs duty on non-alloy flatrolled<br />

steel from 5.0 percent to 7.5 percent would be slightly<br />

positive for flat steel producers.<br />

Expectations<br />

• Increase in import duty on steel from the current level of<br />

5 percent.<br />

• Removal of import duty/CVD on thermal coal from<br />

current levels of 5 percent/5 percent.<br />

• Hike of excise duty to 12 percent, from 10 percent.<br />

Announced measures<br />

• Excise duty has been raised to 12 percent, as expected.<br />

• Import duty on flat steel products has been increased to 7.5<br />

percent, from 5 percent.<br />

• For the infrastructure (mainly power) sector, import duty<br />

on thermal coal has been removed, while CVD has been<br />

reduced to 1 percent, from 5 percent.<br />

Impact: A mixed bag<br />

• Higher import duty on flats positive for steel companies.<br />

The increase in import duty on flat steel to 7.5 percent<br />

(from 5 percent) is positive for domestic steel companies.<br />

• Flat steel producers should benefit from this development<br />

while margins for long steel producers would not decline.<br />

JSW Steel should benefit the most as flat products<br />

contribute 75-80 percent to its volumes, followed by SAIL<br />

(flat steel represents 55-60 percent volumes) and Tata<br />

Steel (flat steel accounts for 55-60 percent of domestic<br />

volumes).<br />

• Hike in excise duty is negative for non-ferrous companies.<br />

The hike of excise duty to 12 percent (from 10 percent)<br />

is negative for non-ferrous companies, as their net<br />

realisations will now decrease accordingly. Hindalco and<br />

Sterlite should be most impacted from this move, followed<br />

by Nalco and Hindustan Zinc.<br />

• Removal of import duty/cut in CVD on thermal coal<br />

is negative for Coal India. Removal of import duty<br />

(currently 5 percent) on thermal coal and the cut in CVD<br />

to 1 percent (from 5 percent) are negatives for Coal India<br />

as its e-auction realisations will decline with the decline in<br />

landed cost of imported coal. E-auction contributes about<br />

10 percent to Coal India’s volumes and 40-45 percent to<br />

EBITDA.<br />

• No substantial impact on pure-play miners. Pure-play<br />

miners such as Sesa Goa, NMDC and MOIL should see<br />

little impact from the changes proposed in the Union<br />

Budget.<br />

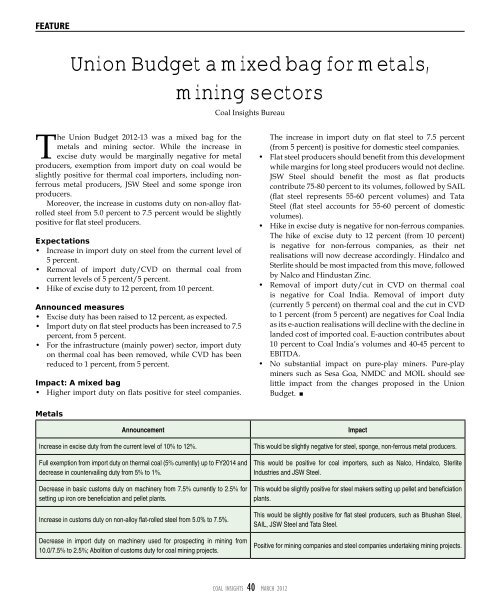

Metals<br />

Announcement<br />

Increase in excise duty from the current level of 10% to 12%.<br />

Full exemption from import duty on thermal coal (5% currently) up to FY2014 and<br />

decrease in countervailing duty from 5% to 1%.<br />

Decrease in basic customs duty on machinery from 7.5% currently to 2.5% for<br />

setting up iron ore beneficiation and pellet plants.<br />

Increase in customs duty on non-alloy flat-rolled steel from 5.0% to 7.5%.<br />

Decrease in import duty on machinery used for prospecting in mining from<br />

10.0/7.5% to 2.5%; Abolition of customs duty for coal mining projects.<br />

Impact<br />

This would be slightly negative for steel, sponge, non-ferrous metal producers.<br />

This would be positive for coal importers, such as Nalco, Hindalco, Sterlite<br />

Industries and JSW Steel.<br />

This would be slightly positive for steel makers setting up pellet and beneficiation<br />

plants.<br />

This would be slightly positive for flat steel producers, such as Bhushan Steel,<br />

SAIL, JSW Steel and Tata Steel.<br />

Positive for mining companies and steel companies undertaking mining projects.<br />

COAL INSIGHTS 40 March 2012