Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

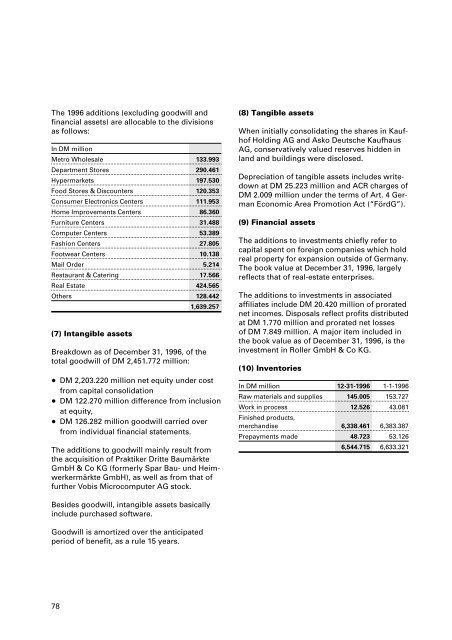

The 1996 additions (excluding goodwill and<br />

financial assets) are allocable to the divisions<br />

as follows:<br />

In DM million<br />

Metro Wholesale 133.993<br />

Department Stores 290.461<br />

Hypermarkets 197.530<br />

Food Stores & Discounters 120.353<br />

Consumer Electronics Centers 111.953<br />

Home Improvements Centers 86.360<br />

Furniture Centers 31.488<br />

Computer Centers 53.389<br />

Fashion Centers 27.805<br />

Footwear Centers 10.138<br />

Mail Order 5.214<br />

Restaurant & Catering 17.566<br />

Real Estate 424.565<br />

Others 128.442<br />

(7) Intangible assets<br />

1,639.257<br />

Breakdown as of December 31, 1996, of the<br />

total goodwill of DM 2,451.772 million:<br />

DM 2,203.220 million net equity under cost<br />

from capital consolidation<br />

DM 122.270 million difference from inclusion<br />

at equity,<br />

DM 126.282 million goodwill carried over<br />

from individual financial statements.<br />

The additions to goodwill mainly result from<br />

the acquisition of Praktiker Dritte Baumärkte<br />

GmbH & Co KG (formerly Spar Bau- und Heimwerkermärkte<br />

GmbH), as well as from that of<br />

further Vobis Microcomputer <strong>AG</strong> stock.<br />

Besides goodwill, intangible assets basically<br />

include purchased software.<br />

Goodwill is amortized over the anticipated<br />

period of benefit, as a rule 15 years.<br />

78<br />

(8) Tangible assets<br />

When initially consolidating the shares in Kaufhof<br />

Holding <strong>AG</strong> and Asko Deutsche Kaufhaus<br />

<strong>AG</strong>, conservatively valued reserves hidden in<br />

land and buildings were disclosed.<br />

Depreciation of tangible assets includes writedown<br />

at DM 25.223 million and ACR charges of<br />

DM 2.009 million under the terms of Art. 4 German<br />

Economic Area Promotion Act (“FördG”).<br />

(9) Financial assets<br />

The additions to investments chiefly refer to<br />

capital spent on foreign companies which hold<br />

real property for expansion outside of Germany.<br />

The book value at December 31, 1996, largely<br />

reflects that of real-estate enterprises.<br />

The additions to investments in associated<br />

affiliates include DM 20.420 million of prorated<br />

net incomes. Disposals reflect profits distributed<br />

at DM 1.770 million and prorated net losses<br />

of DM 7.849 million. A major item included in<br />

the book value as of December 31, 1996, is the<br />

investment in Roller GmbH & Co KG.<br />

(10) Inventories<br />

In DM million 12-31-1996 1-1-1996<br />

Raw materials and supplies 145.005 153.727<br />

Work in process<br />

Finished products,<br />

12.526 43.081<br />

merchandise 6,338.461 6,383.387<br />

Prepayments made 48.723 53.126<br />

6,544.715 6,633.321