Annual Report 2005 (6 MB) - Lundin Petroleum

Annual Report 2005 (6 MB) - Lundin Petroleum

Annual Report 2005 (6 MB) - Lundin Petroleum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

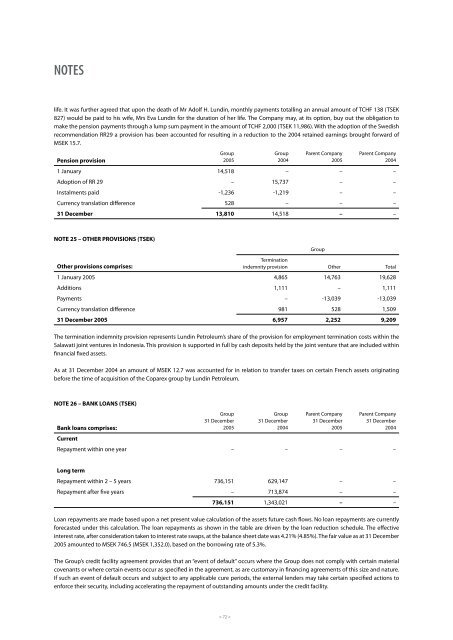

NOTES<br />

life. It was further agreed that upon the death of Mr Adolf H. <strong>Lundin</strong>, monthly payments totalling an annual amount of TCHF 138 (TSEK<br />

827) would be paid to his wife, Mrs Eva <strong>Lundin</strong> for the duration of her life. The Company may, at its option, buy out the obligation to<br />

make the pension payments through a lump sum payment in the amount of TCHF 2,000 (TSEK 11,986). With the adoption of the Swedish<br />

recommendation RR29 a provision has been accounted for resulting in a reduction to the 2004 retained earnings brought forward of<br />

MSEK 15.7.<br />

Group<br />

Group Parent Company Parent Company<br />

Pension provision<br />

<strong>2005</strong><br />

2004<br />

<strong>2005</strong><br />

2004<br />

1 January 14,518 – – –<br />

Adoption of RR 29 – 15,737 – –<br />

Instalments paid -1,236 -1,219 – –<br />

Currency translation diff erence 528 – – –<br />

31 December 13,810 14,518 – –<br />

NOTE 25 – OTHER PROVISIONS (TSEK)<br />

Other provisions comprises:<br />

Termination<br />

indemnity provision Other Total<br />

1 January <strong>2005</strong> 4,865 14,763 19,628<br />

Additions 1,111 – 1,111<br />

Payments – -13,039 -13,039<br />

Currency translation diff erence 981 528 1,509<br />

31 December <strong>2005</strong> 6,957 2,252 9,209<br />

The termination indemnity provision represents <strong>Lundin</strong> <strong>Petroleum</strong>’s share of the provision for employment termination costs within the<br />

Salawati joint ventures in Indonesia. This provision is supported in full by cash deposits held by the joint venture that are included within<br />

fi nancial fi xed assets.<br />

As at 31 December 2004 an amount of MSEK 12.7 was accounted for in relation to transfer taxes on certain French assets originating<br />

before the time of acquisition of the Coparex group by <strong>Lundin</strong> <strong>Petroleum</strong>.<br />

NOTE 26 – BANK LOANS (TSEK)<br />

Group<br />

Group Parent Company Parent Company<br />

31 December<br />

31 December<br />

31 December<br />

31 December<br />

Bank loans comprises:<br />

Current<br />

<strong>2005</strong><br />

2004<br />

<strong>2005</strong><br />

2004<br />

Repayment within one year – – – –<br />

Long term<br />

Repayment within 2 – 5 years 736,151 629,147 – –<br />

Repayment after fi ve years – 713,874 – –<br />

736,151 1,343,021 – –<br />

Loan repayments are made based upon a net present value calculation of the assets future cash fl ows. No loan repayments are currently<br />

forecasted under this calculation. The loan repayments as shown in the table are driven by the loan reduction schedule. The eff ective<br />

interest rate, after consideration taken to interest rate swaps, at the balance sheet date was 4.21% (4.85%). The fair value as at 31 December<br />

<strong>2005</strong> amounted to MSEK 746.5 (MSEK 1,352.0), based on the borrowing rate of 5.3%.<br />

The Group’s credit facility agreement provides that an “event of default” occurs where the Group does not comply with certain material<br />

covenants or where certain events occur as specifi ed in the agreement, as are customary in fi nancing agreements of this size and nature.<br />

If such an event of default occurs and subject to any applicable cure periods, the external lenders may take certain specifi ed actions to<br />

enforce their security, including accelerating the repayment of outstanding amounts under the credit facility.<br />

> 72 <<br />

Group