financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

130 FINANCING SECRETS OF A MILLIONAIRE REAL ESTATE INVESTOR<br />

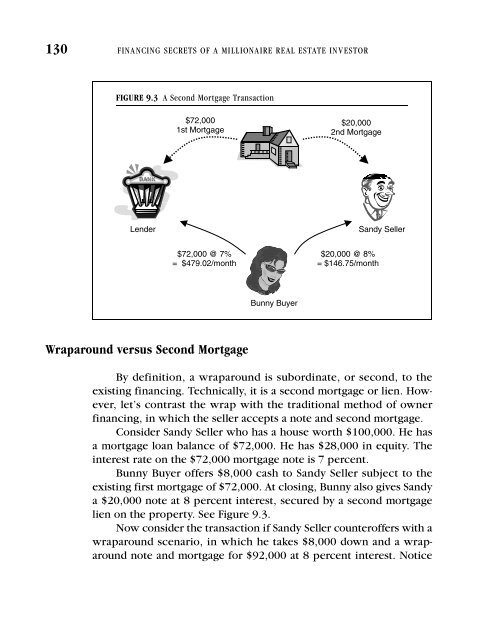

FIGURE 9.3 A Second Mortgage Transaction<br />

$72,000<br />

1st Mortgage<br />

$20,000<br />

2nd Mortgage<br />

Lender<br />

Sandy Seller<br />

$72,000 @ 7%<br />

= $479.02/month<br />

$20,000 @ 8%<br />

= $146.75/month<br />

Bunny Buyer<br />

Wraparound versus Second Mortgage<br />

By definition, a wraparound is subordinate, or second, to the<br />

existing <strong>financing</strong>. Technically, it is a second mortgage or lien. However,<br />

let’s contrast the wrap with the traditional method <strong>of</strong> owner<br />

<strong>financing</strong>, in which the seller accepts a note and second mortgage.<br />

Consider Sandy Seller who has a house worth $100,000. He has<br />

a mortgage loan balance <strong>of</strong> $72,000. He has $28,000 in equity. The<br />

interest rate on the $72,000 mortgage note is 7 percent.<br />

Bunny Buyer <strong>of</strong>fers $8,000 cash to Sandy Seller subject to the<br />

existing first mortgage <strong>of</strong> $72,000. At closing, Bunny also gives Sandy<br />

a $20,000 note at 8 percent interest, secured by a second mortgage<br />

lien on the property. See Figure 9.3.<br />

Now consider the transaction if Sandy Seller counter<strong>of</strong>fers with a<br />

wraparound scenario, in which he takes $8,000 down and a wraparound<br />

note and mortgage for $92,000 at 8 percent interest. Notice