- Page 5 and 6:

This publication is designed to pro

- Page 7 and 8:

vi CONTENTS Government Loan Program

- Page 9 and 10:

viii CONTENTS 8. The Lease Option 9

- Page 12 and 13:

CHAPTER1 Introduction to Real Estat

- Page 14 and 15:

1 / Introduction to Real Estate Fin

- Page 16 and 17:

1 / Introduction to Real Estate Fin

- Page 18 and 19:

1 / Introduction to Real Estate Fin

- Page 20 and 21:

1 / Introduction to Real Estate Fin

- Page 22 and 23:

CHAPTER2 A Legal Primer on Real Est

- Page 24 and 25:

2 /A Legal Primer on Real Estate Lo

- Page 26 and 27:

2 /A Legal Primer on Real Estate Lo

- Page 28 and 29:

2 /A Legal Primer on Real Estate Lo

- Page 30:

2 /A Legal Primer on Real Estate Lo

- Page 33 and 34:

22 FINANCING SECRETS OF A MILLIONAI

- Page 35 and 36:

24 FINANCING SECRETS OF A MILLIONAI

- Page 37 and 38:

26 FINANCING SECRETS OF A MILLIONAI

- Page 39 and 40:

28 FINANCING SECRETS OF A MILLIONAI

- Page 41 and 42:

30 FINANCING SECRETS OF A MILLIONAI

- Page 43 and 44:

32 FINANCING SECRETS OF A MILLIONAI

- Page 45 and 46:

34 FINANCING SECRETS OF A MILLIONAI

- Page 47 and 48:

36 FINANCING SECRETS OF A MILLIONAI

- Page 49 and 50:

38 FINANCING SECRETS OF A MILLIONAI

- Page 51 and 52:

40 FINANCING SECRETS OF A MILLIONAI

- Page 53 and 54:

42 FINANCING SECRETS OF A MILLIONAI

- Page 55 and 56:

44 FINANCING SECRETS OF A MILLIONAI

- Page 57 and 58:

46 FINANCING SECRETS OF A MILLIONAI

- Page 59 and 60:

48 FINANCING SECRETS OF A MILLIONAI

- Page 61 and 62:

50 FINANCING SECRETS OF A MILLIONAI

- Page 63 and 64:

52 FINANCING SECRETS OF A MILLIONAI

- Page 65 and 66:

54 FINANCING SECRETS OF A MILLIONAI

- Page 67 and 68:

56 FINANCING SECRETS OF A MILLIONAI

- Page 69 and 70:

58 FINANCING SECRETS OF A MILLIONAI

- Page 71 and 72:

60 FINANCING SECRETS OF A MILLIONAI

- Page 73 and 74:

62 FINANCING SECRETS OF A MILLIONAI

- Page 75 and 76:

64 FINANCING SECRETS OF A MILLIONAI

- Page 77 and 78:

66 FINANCING SECRETS OF A MILLIONAI

- Page 79 and 80:

68 FINANCING SECRETS OF A MILLIONAI

- Page 81 and 82:

70 FINANCING SECRETS OF A MILLIONAI

- Page 83 and 84:

72 FINANCING SECRETS OF A MILLIONAI

- Page 85 and 86:

74 FINANCING SECRETS OF A MILLIONAI

- Page 87 and 88:

76 FINANCING SECRETS OF A MILLIONAI

- Page 89 and 90:

78 FINANCING SECRETS OF A MILLIONAI

- Page 91 and 92: 80 FINANCING SECRETS OF A MILLIONAI

- Page 93 and 94: 82 FINANCING SECRETS OF A MILLIONAI

- Page 95 and 96: 84 FINANCING SECRETS OF A MILLIONAI

- Page 97 and 98: 86 FINANCING SECRETS OF A MILLIONAI

- Page 100 and 101: CHAPTER7 Partnerships and Equity Sh

- Page 102 and 103: 7/ Partnerships and Equity Sharing

- Page 104 and 105: 7/ Partnerships and Equity Sharing

- Page 106 and 107: 7/ Partnerships and Equity Sharing

- Page 108 and 109: 7/ Partnerships and Equity Sharing

- Page 110 and 111: CHAPTER8 The Lease Option The road

- Page 112 and 113: 8/The Lease Option 101 is not relie

- Page 114 and 115: 8/The Lease Option 103 Famous Optio

- Page 116 and 117: 8/The Lease Option 105 job just a s

- Page 118 and 119: 8/The Lease Option 107 The house ne

- Page 120 and 121: 8/The Lease Option 109 your option

- Page 122 and 123: 8/The Lease Option 111 • whether

- Page 124 and 125: CHAPTER9 Owner Financing If you’d

- Page 126 and 127: 9 / Owner Financing 115 FIGURE 9.1

- Page 128 and 129: 9 / Owner Financing 117 a corporate

- Page 130 and 131: 9 / Owner Financing 119 long before

- Page 132 and 133: 9 / Owner Financing 121 Simply tell

- Page 134 and 135: 9 / Owner Financing 123 FIGURE 9.2

- Page 136 and 137: 9 / Owner Financing 125 Problems wi

- Page 138 and 139: 9 / Owner Financing 127 one willing

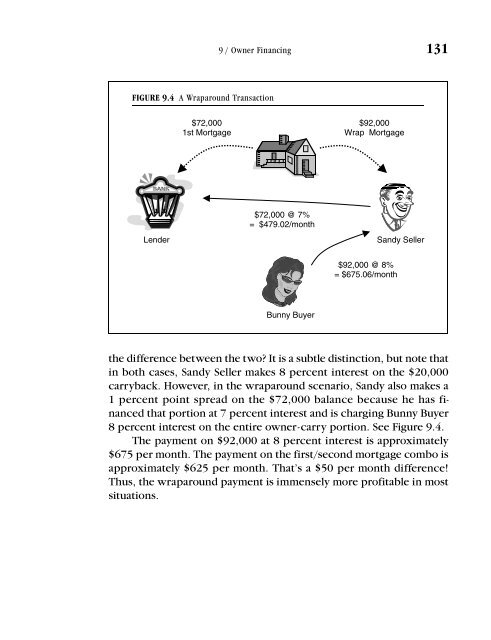

- Page 140 and 141: 9 / Owner Financing 129 This is a b

- Page 144: 9 / Owner Financing 133 of each mon

- Page 147 and 148: 136 FINANCING SECRETS OF A MILLIONA

- Page 150 and 151: APPENDIXA Interest Payments Chart 1

- Page 152 and 153: APPENDIXB State-by-State Foreclosur

- Page 154 and 155: APPENDIXC Sample Forms Uniform Resi

- Page 156 and 157: SAMPLE FORMS 145

- Page 158 and 159: SAMPLE FORMS 147

- Page 160 and 161: SAMPLE FORMS 149

- Page 162 and 163: SAMPLE FORMS 151

- Page 164 and 165: SAMPLE FORMS 153

- Page 166 and 167: SAMPLE FORMS 155

- Page 168 and 169: SAMPLE FORMS 157

- Page 170 and 171: SAMPLE FORMS 159

- Page 172 and 173: SAMPLE FORMS 161

- Page 174 and 175: SAMPLE FORMS 163

- Page 176 and 177: SAMPLE FORMS 165

- Page 178 and 179: SAMPLE FORMS 167

- Page 180 and 181: SAMPLE FORMS 169

- Page 182 and 183: SAMPLE FORMS 171

- Page 184 and 185: SAMPLE FORMS 173

- Page 186 and 187: SAMPLE FORMS 175

- Page 188 and 189: SAMPLE FORMS 177

- Page 190 and 191: GL OSSARY abstract of title A compi

- Page 192 and 193:

GLOSSARY 181 improvements. Also use

- Page 194 and 195:

GLOSSARY 183 applied towards the pu

- Page 196 and 197:

GLOSSARY 185 security instrument A

- Page 198 and 199:

RE SOURCES Suggested Reading Altern

- Page 200 and 201:

IN DEX A Acceleration clause, 118 A

- Page 202 and 203:

INDEX 191 blended, 73 Federal Reser

- Page 204 and 205:

INDEX 193 W Washington Mutual, 22 W