financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5 / Creative Financing through Institutional Lenders 73<br />

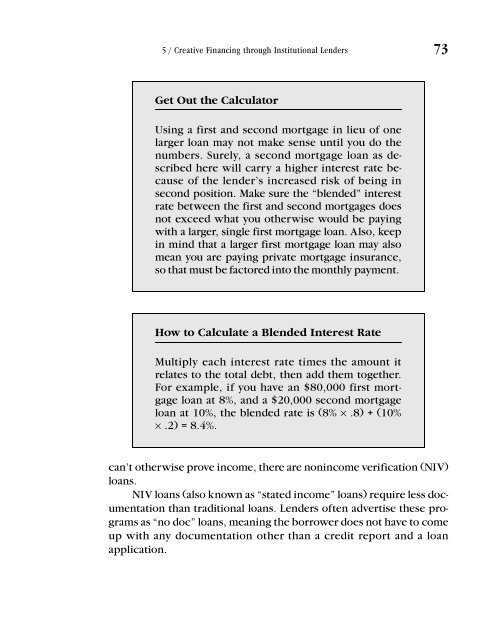

Get Out the Calculator<br />

Using a first and second mortgage in lieu <strong>of</strong> one<br />

larger loan may not make sense until you do the<br />

numbers. Surely, a second mortgage loan as described<br />

here will carry a higher interest rate because<br />

<strong>of</strong> the lender’s increased risk <strong>of</strong> being in<br />

second position. Make sure the “blended” interest<br />

rate between the first and second mortgages does<br />

not exceed what you otherwise would be paying<br />

with a larger, single first mortgage loan. Also, keep<br />

in mind that a larger first mortgage loan may also<br />

mean you are paying private mortgage insurance,<br />

so that must be factored into the monthly payment.<br />

How to Calculate a Blended Interest Rate<br />

Multiply each interest rate times the amount it<br />

relates to the total debt, then add them together.<br />

For example, if you have an $80,000 first mortgage<br />

loan at 8%, and a $20,000 second mortgage<br />

loan at 10%, the blended rate is (8% × .8) + (10%<br />

× .2) = 8.4%.<br />

can’t otherwise prove income, there are nonincome verification (NIV)<br />

loans.<br />

NIV loans (also known as “stated income” loans) require less documentation<br />

than traditional loans. Lenders <strong>of</strong>ten advertise these programs<br />

as “no doc” loans, meaning the borrower does not have to come<br />

up with any documentation other than a credit report and a loan<br />

application.