financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

80 FINANCING SECRETS OF A MILLIONAIRE REAL ESTATE INVESTOR<br />

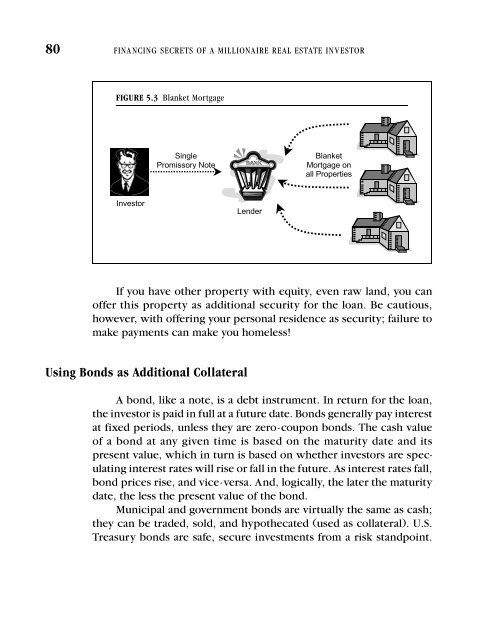

FIGURE 5.3 Blanket Mortgage<br />

Single<br />

Promissory Note<br />

Blanket<br />

Mortgage on<br />

all Properties<br />

Investor<br />

Lender<br />

If you have other property with equity, even raw land, you can<br />

<strong>of</strong>fer this property as additional security for the loan. Be cautious,<br />

however, with <strong>of</strong>fering your personal residence as security; failure to<br />

make payments can make you homeless!<br />

Using Bonds as Additional Collateral<br />

A bond, like a note, is a debt instrument. In return for the loan,<br />

the <strong>investor</strong> is paid in full at a future date. Bonds generally pay interest<br />

at fixed periods, unless they are zero-coupon bonds. The cash value<br />

<strong>of</strong> a bond at any given time is based on the maturity date and its<br />

present value, which in turn is based on whether <strong>investor</strong>s are speculating<br />

interest rates will rise or fall in the future. As interest rates fall,<br />

bond prices rise, and vice-versa. And, logically, the later the maturity<br />

date, the less the present value <strong>of</strong> the bond.<br />

Municipal and government bonds are virtually the same as cash;<br />

they can be traded, sold, and hypothecated (used as collateral). U.S.<br />

Treasury bonds are safe, secure investments from a risk standpoint.