financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

financing secrets of a millionaire real estate investor.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4/Working with Lenders 49<br />

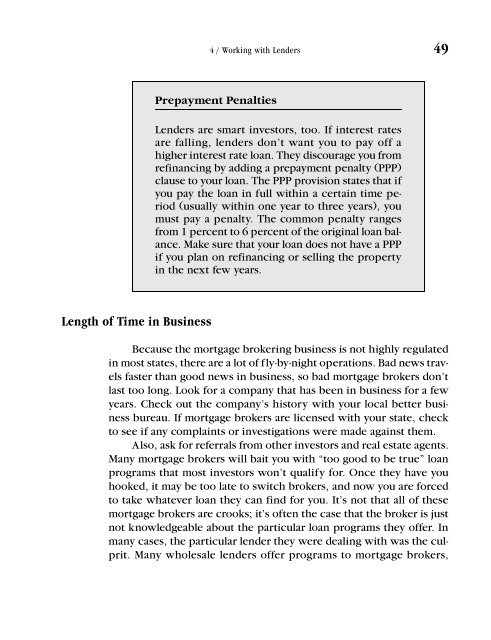

Prepayment Penalties<br />

Lenders are smart <strong>investor</strong>s, too. If interest rates<br />

are falling, lenders don’t want you to pay <strong>of</strong>f a<br />

higher interest rate loan. They discourage you from<br />

re<strong>financing</strong> by adding a prepayment penalty (PPP)<br />

clause to your loan. The PPP provision states that if<br />

you pay the loan in full within a certain time period<br />

(usually within one year to three years), you<br />

must pay a penalty. The common penalty ranges<br />

from 1 percent to 6 percent <strong>of</strong> the original loan balance.<br />

Make sure that your loan does not have a PPP<br />

if you plan on re<strong>financing</strong> or selling the property<br />

in the next few years.<br />

Length <strong>of</strong> Time in Business<br />

Because the mortgage brokering business is not highly regulated<br />

in most states, there are a lot <strong>of</strong> fly-by-night operations. Bad news travels<br />

faster than good news in business, so bad mortgage brokers don’t<br />

last too long. Look for a company that has been in business for a few<br />

years. Check out the company’s history with your local better business<br />

bureau. If mortgage brokers are licensed with your state, check<br />

to see if any complaints or investigations were made against them.<br />

Also, ask for referrals from other <strong>investor</strong>s and <strong>real</strong> <strong>estate</strong> agents.<br />

Many mortgage brokers will bait you with “too good to be true” loan<br />

programs that most <strong>investor</strong>s won’t qualify for. Once they have you<br />

hooked, it may be too late to switch brokers, and now you are forced<br />

to take whatever loan they can find for you. It’s not that all <strong>of</strong> these<br />

mortgage brokers are crooks; it’s <strong>of</strong>ten the case that the broker is just<br />

not knowledgeable about the particular loan programs they <strong>of</strong>fer. In<br />

many cases, the particular lender they were dealing with was the culprit.<br />

Many wholesale lenders <strong>of</strong>fer programs to mortgage brokers,