Does Tail Dependence Make A Difference In the ... - Boston College

Does Tail Dependence Make A Difference In the ... - Boston College

Does Tail Dependence Make A Difference In the ... - Boston College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

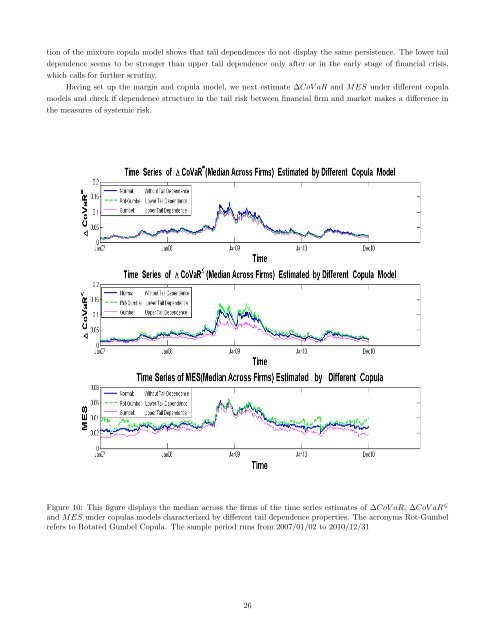

tion of <strong>the</strong> mixture copula model shows that tail dependences do not display <strong>the</strong> same persistence. The lower tail<br />

dependence seems to be stronger than upper tail dependence only after or in <strong>the</strong> early stage of financial crisis,<br />

which calls for fur<strong>the</strong>r scrutiny.<br />

Having set up <strong>the</strong> margin and copula model, we next estimate ∆CoV aR and MES under different copula<br />

models and check if dependence structure in <strong>the</strong> tail risk between financial firm and market makes a difference in<br />

<strong>the</strong> measures of systemic risk.<br />

Figure 10: This figure displays <strong>the</strong> median across <strong>the</strong> firms of <strong>the</strong> time series estimates of ∆CoV aR, ∆CoV aR <br />

and MES under copulas models characterized by different tail dependence properties. The acronyms Rot-Gumbel<br />

refers to Rotated Gumbel Copula. The sample period runs from 2007/01/02 to 2010/12/31<br />

26