Does Tail Dependence Make A Difference In the ... - Boston College

Does Tail Dependence Make A Difference In the ... - Boston College

Does Tail Dependence Make A Difference In the ... - Boston College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

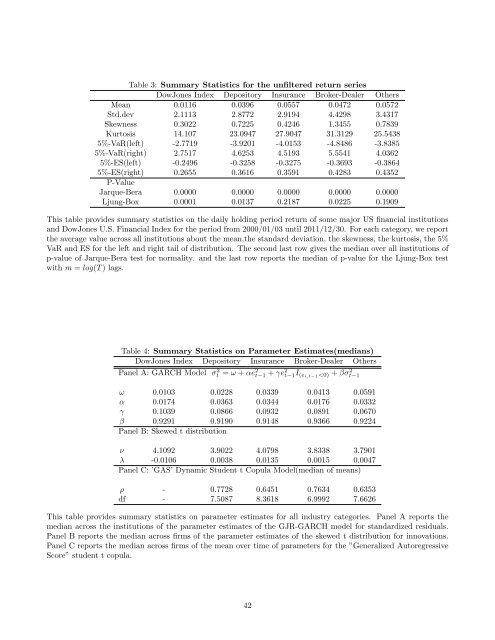

Table 3: Summary Statistics for <strong>the</strong> unfiltered return series<br />

DowJones <strong>In</strong>dex Depository <strong>In</strong>surance Broker-Dealer O<strong>the</strong>rs<br />

Mean 0.0116 0.0396 0.0557 0.0472 0.0572<br />

Std.dev 2.1113 2.8772 2.9194 4.4298 3.4317<br />

Skewness 0.3022 0.7225 0.4246 1.3455 0.7839<br />

Kurtosis 14.107 23.0947 27.9047 31.3129 25.5438<br />

5%-VaR(left) -2.7719 -3.9201 -4.0153 -4.8486 -3.8385<br />

5%-VaR(right) 2.7517 4.6253 4.5193 5.5541 4.0362<br />

5%-ES(left) -0.2496 -0.3258 -0.3275 -0.3693 -0.3864<br />

5%-ES(right) 0.2655 0.3616 0.3591 0.4283 0.4352<br />

P-Value<br />

Jarque-Bera 0.0000 0.0000 0.0000 0.0000 0.0000<br />

Ljung-Box 0.0001 0.0137 0.2187 0.0225 0.1909<br />

This table provides summary statistics on <strong>the</strong> daily holding period return of some major US financial institutions<br />

and DowJones U.S. Financial <strong>In</strong>dex for <strong>the</strong> period from 2000/01/03 until 2011/12/30. For each category, we report<br />

<strong>the</strong> average value across all institutions about <strong>the</strong> mean,<strong>the</strong> standard deviation, <strong>the</strong> skewness, <strong>the</strong> kurtosis, <strong>the</strong> 5%<br />

VaR and ES for <strong>the</strong> left and right tail of distribution. The second last row gives <strong>the</strong> median over all institutions of<br />

p-value of Jarque-Bera test for normality. and <strong>the</strong> last row reports <strong>the</strong> median of p-value for <strong>the</strong> Ljung-Box test<br />

with m = log(T ) lags.<br />

Table 4: Summary Statistics on Parameter Estimates(medians)<br />

DowJones <strong>In</strong>dex Depository <strong>In</strong>surance Broker-Dealer O<strong>the</strong>rs<br />

Panel A: GARCH Model σt 2 = ω + αe 2 t−1 + γe 2 t−1I (ei,t−1