Main Conference Day 1 - Jade Invest

Main Conference Day 1 - Jade Invest

Main Conference Day 1 - Jade Invest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DAY<br />

3<br />

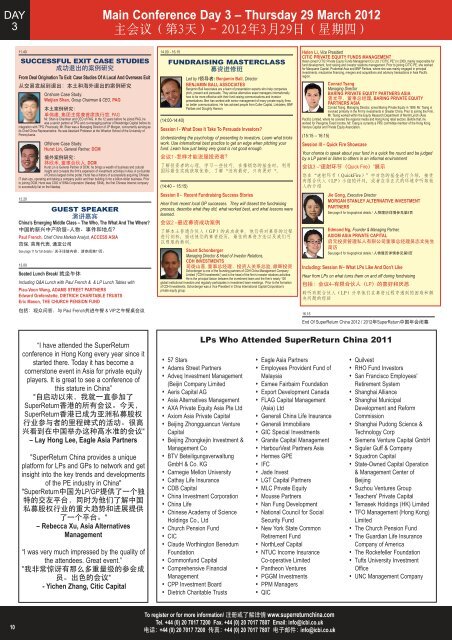

<strong>Main</strong> <strong>Conference</strong> <strong>Day</strong> 3 – Thursday 29 March 2012<br />

主 会 议 ( 第 3 天 )- 2012 年 3 月 29 日 ( 星 期 四 )<br />

11.40<br />

SUCCESSFUL EXIT CASE STUDIES<br />

成 功 退 出 的 案 例 研 究<br />

From Deal Origination To Exit: Case Studies Of A Local And Overseas Exit<br />

从 交 易 发 起 到 退 出 : 本 土 和 海 外 退 出 的 案 例 研 究<br />

Onshore Case Study:<br />

Weijian Shan, Group Chairman & CEO, PAG<br />

本 土 案 例 研 究 :<br />

单 伟 建 , 集 团 主 席 兼 首 席 执 行 官 , PAG<br />

Mr. Shan is Chairman and CEO of PAG. In the 12 years before he joined PAG, he<br />

was a senior partner at TPG and co-managing partner of Newbridge Capital before its<br />

integration with TPG. Previously, Mr. Shan was a Managing Director of JP Morgan, concurrently serving as<br />

its Chief China Representative. He was Assistant Professor at the Wharton School of the University of<br />

Pennsylvania.<br />

Offshore Case Study:<br />

Hurst Lin, General Partner, DCM<br />

境 外 案 例 研 究 :<br />

林 欣 禾 , 董 事 合 伙 人 , DCM<br />

Hurst Lin is General Partner of DCM, he brings a wealth of business and cultural<br />

insight and co-leads the firm’s expansion of investment activities in Asia. A co-founder<br />

of China’s largest online portal, Hurst has a history of successfully acquiring Chinese<br />

IT start-ups, operating and taking a company public and then building it into a billion-dollar business. Prior<br />

to joining DCM, Hurst was COO of SINA Corporation (Nasdaq: SINA), the first Chinese Internet company<br />

to successfully list on the Nasdaq.<br />

12.20<br />

GUEST SPEAKER<br />

演 讲 嘉 宾<br />

China’s Emerging Middle Class – The Who, The What And The Where<br />

中 国 的 新 兴 中 产 阶 层 – 人 物 、 事 件 和 地 点 <br />

Paul French, Chief China Markets Analyst, ACCESS ASIA<br />

范 保 , 首 席 代 表 , 通 亚 公 司<br />

See page 11 for full details / 关 于 详 细 内 容 , 请 参 阅 第 11 页 。<br />

13.00<br />

Seated Lunch Break/ 就 坐 午 休<br />

Including Q&A Lunch with Paul French & & LP Lunch Tables with<br />

Piau-Voon Wang, ADAMS STREET PARTNERS<br />

Edward Grefenstette, DIETRICH CHARITABLE TRUSTS<br />

Eric Mason, THE CHURCH PENSION FUND<br />

包 括 : 观 众 问 答 , 与 Paul French 共 进 午 餐 & VIP 之 午 餐 桌 会 议<br />

14.00 - 16.15<br />

FUNDRAISING MASTERCLASS<br />

募 资 进 修 班<br />

Led by / 领 导 者 : Benjamin Ball, Director<br />

BENJAMIN BALL ASSOCIATES<br />

Benjamin Ball Associates are a team of presentation experts who help companies<br />

pitch, present and persuade. They advise alternative asset managers internationally<br />

how to be more effective with their fund raising communications and investor<br />

presentations. Ben has worked with senior management of many private equity firms<br />

on better communications. He has advised people from Coller Capital, Linklaters, BNP<br />

Paribas and Doughty Hanson.<br />

(14:00-14:40)<br />

Session I - What Does It Take To Persuade <strong>Invest</strong>ors<br />

Understanding the psychology of presenting to investors. Learn what tricks<br />

work. Use international best practice to get an edge when pitching your<br />

fund. Learn how just being very good is not good enough.<br />

会 议 1 - 怎 样 才 能 说 服 投 资 者 <br />

了 解 投 资 者 的 心 理 。 学 习 一 些 技 巧 。 在 推 销 您 的 基 金 时 , 利 用<br />

国 际 最 佳 实 践 获 取 优 势 。 了 解 “ 没 有 最 好 , 只 有 更 好 “。<br />

(14:40 – 15:15)<br />

Session II - Recent Fundraising Success Stories<br />

Hear from recent local GP successes. They will dissect the fundraising<br />

process, describe what they did, what worked best, and what lessons were<br />

learned.<br />

会 议 2 – 最 近 募 资 成 功 案 例<br />

了 解 本 土 普 通 合 伙 人 (GP) 的 成 功 故 事 。 他 们 将 对 募 资 的 过 程<br />

进 行 剖 析 , 描 述 他 们 的 募 资 经 历 , 最 佳 的 募 资 方 法 以 及 我 们 可<br />

以 吸 取 的 教 训 。<br />

Stuart Schonberger<br />

Managing Director & Head of <strong>Invest</strong>or Relations,<br />

CDH INVESTMENTS<br />

司 徒 山 客 , 董 事 总 经 理 , 投 资 人 关 系 总 监 , 鼎 晖 投 资<br />

Schonberger is one of the founding partners of CDH China Management Company<br />

Limited (“CDH <strong>Invest</strong>ments”) and is the head of the firm’s investor relations activities.<br />

He is the principal liaison between the investment team and the firm’s nearly 100<br />

global institutional investors and regularly participates in investment team meetings. Prior to the formation<br />

of CDH <strong>Invest</strong>ments, Schonberger was a Vice President in China International Capital Corporation’s<br />

private equity group.<br />

Helen Li, Vice President<br />

CITIC PRIVATE EQUITY FUNDS MANAGEMENT<br />

Helen joined CITIC Private Equity Funds Management Co Ltd. (“CITIC PE”) in 2009, mainly responsible for<br />

fund development, fund raising and investor relations management. Prior to joining CITIC PE, she worked<br />

for Macquarie Capital, Prudential Asia and BNP Paribas, where she was mainly engaged in principal<br />

investments, mezzanine financing, mergers and acquisitions and advisory transactions in Asia Pacific<br />

region.<br />

Conrad Tsang<br />

Managing Director<br />

BARING PRIVATE EQUITY PARTNERS ASIA<br />

曾 光 宇 , 董 事 总 经 理 , BARING PRIVATE EQUITY<br />

PARTNERS ASIA<br />

Conrad Tsang, Managing Director, joined Baring Private Equity in 1999. Mr. Tsang is<br />

involved primarily in the Firm’s investments in Greater China. Prior to joining the Firm,<br />

Mr. Tsang worked within the Equity Research Department of Merrill Lynch (Asia<br />

Pacific) Limited, where he covered the regional media and Hong Kong retail sectors. Before that, he<br />

worked for Peregrine Fixed Income. Mr. Tsang is currently a PRC committee member of the Hong Kong<br />

Venture Capital and Private Equity Association.<br />

(15:15 – 16:15)<br />

Session III – Quick Fire Showcase<br />

Your chance to speak about your fund in a quick fire round and be judged<br />

by a LP panel or listen to others in an informal environment<br />

会 议 3 –“ 速 射 环 节 (Quick Fire)” 展 示<br />

您 在 “ 速 射 环 节 (QuickFire)” 中 对 您 的 基 金 进 行 介 绍 , 接 受<br />

有 限 合 伙 人 (LP) 小 组 的 评 判 , 或 者 在 非 正 式 的 环 境 中 听 取 他<br />

人 的 介 绍<br />

Jie Gong, Executive Director<br />

MORGAN STANLEY ALTERNATIVE INVESTMENT<br />

PARTNERS<br />

See page 8 for biographical details / 人 物 履 历 详 情 参 见 第 8 页<br />

Edmond Ng, Founder & Managing Partner,<br />

AXIOM ASIA PRIVATE CAPITAL<br />

启 元 投 资 管 理 私 人 有 限 公 司 董 事 总 经 理 吴 志 文 先 生<br />

简 历<br />

See page 8 for biographical details / 人 物 履 历 详 情 参 见 第 8 页<br />

Including: Session IV– What LPs Like And Don’t Like<br />

Hear from LPs on what turns them on and off during fundraising<br />

包 括 : 会 议 4– 有 限 合 伙 人 (LP) 的 喜 好 和 厌 恶<br />

聆 听 有 限 合 伙 人 (LP) 分 享 他 们 在 募 资 过 程 中 遇 到 的 困 难 和 解<br />

决 问 题 的 经 验<br />

16.15<br />

End Of SuperReturn China 2012 / 2012 年 SuperReturn 中 国 年 会 闭 幕<br />

“I have attended the SuperReturn<br />

conference in Hong Kong every year since it<br />

started there. Today it has become a<br />

cornerstone event in Asia for private equity<br />

players. It is great to see a conference of<br />

this stature in China”<br />

" 自 启 动 以 来 , 我 就 一 直 参 加 了<br />

SuperReturn 香 港 的 所 有 会 议 。 今 天 ,<br />

SuperReturn 香 港 已 成 为 亚 洲 私 募 股 权<br />

行 业 参 与 者 的 里 程 碑 式 的 活 动 。 很 高<br />

兴 看 到 在 中 国 举 办 这 种 高 水 准 的 会 议 "<br />

– Lay Hong Lee, Eagle Asia Partners<br />

"SuperReturn China provides a unique<br />

platform for LPs and GPs to network and get<br />

insight into the key trends and developments<br />

of the PE industry in China"<br />

"SuperReturn 中 国 为 LP/GP 提 供 了 一 个 独<br />

特 的 交 友 平 台 , 同 时 为 他 们 了 解 中 国<br />

私 募 股 权 行 业 的 重 大 趋 势 和 进 展 提 供<br />

了 一 个 平 台 。"<br />

– Rebecca Xu, Asia Alternatives<br />

Management<br />

“I was very much impressed by the quality of<br />

the attendees. Great event.”<br />

" 我 非 常 惊 讶 有 那 么 多 重 量 级 的 参 会 成<br />

员 。 出 色 的 会 议 "<br />

- Yichen Zhang, Citic Capital<br />

LPs Who Attended SuperReturn China 2011<br />

• 57 Stars<br />

• Adams Street Partners<br />

• Adveq <strong>Invest</strong>ment Management<br />

(Beijin Company Limited<br />

• Aeris Capital AG<br />

• Asia Alternatives Management<br />

• AXA Private Equity Asia Pte Ltd<br />

• Axiom Asia Private Capital<br />

• Beijing Zhongguancun Venture<br />

Capital<br />

• Beijing Zhongkejin <strong>Invest</strong>ment &<br />

Management Co<br />

• BTV Beteiligungsverwaltung<br />

GmbH & Co. KG<br />

• Carnegie Mellon University<br />

• Cathay Life Insurance<br />

• CDB Capital<br />

• China <strong>Invest</strong>ment Corporation<br />

• China Life<br />

• Chinese Academy of Science<br />

Holdings Co., Ltd<br />

• Church Pension Fund<br />

• CIC<br />

• Claude Worthington Benedum<br />

Foundation<br />

• Commonfund Capital<br />

• Comprehensive Financial<br />

Management<br />

• CPP <strong>Invest</strong>ment Board<br />

• Dietrich Charitable Trusts<br />

• Eagle Asia Partners<br />

• Employees Provident Fund of<br />

Malaysia<br />

• Esmee Fairbairn Foundation<br />

• Export Development Canada<br />

• FLAG Capital Management<br />

(Asia) Ltd<br />

• Generali China Life Insurance<br />

• Generali Immobiliare<br />

• GIC Special <strong>Invest</strong>ments<br />

• Granite Capital Management<br />

• HarbourVest Partners Asia<br />

• Hermes GPE<br />

• IFC<br />

• <strong>Jade</strong> <strong>Invest</strong><br />

• LGT Capital Partners<br />

• MLC Private Equity<br />

• Mousse Partners<br />

• Nan Fung Development<br />

• National Council for Social<br />

Security Fund<br />

• New York State Common<br />

Retirement Fund<br />

• NorthLeaf Capital<br />

• NTUC Income Insurance<br />

Co-operative Limited<br />

• Pantheon Ventures<br />

• PGGM <strong>Invest</strong>ments<br />

• PPM Managers<br />

• QIC<br />

• Quilvest<br />

• RHO Fund <strong>Invest</strong>ors<br />

• San Francisco Employees'<br />

Retirement System<br />

• Shanghai Alliance<br />

• Shanghai Municipal<br />

Development and Reform<br />

Commission<br />

• Shanghai Pudong Science &<br />

Technology Corp<br />

• Siemens Venture Capital GmbH<br />

• Siguler Guff & Company<br />

• Squadron Capital<br />

• State-Owned Capital Operation<br />

& Management Center of<br />

Beijing<br />

• Suzhou Ventures Group<br />

• Teachers' Private Capital<br />

• Temasek Holdings (HK) Limited<br />

• TFO Management (Hong Kong)<br />

Limited<br />

• The Church Pension Fund<br />

• The Guardian Life Insurance<br />

Company of America<br />

• The Rockefeller Foundation<br />

• Tufts University <strong>Invest</strong>ment<br />

Office<br />

• UNC Management Company<br />

10 8<br />

To register or for more information/ 注 册 或 了 解 详 情 www.superreturnchina.com<br />

Tel. +44 (0) 20 7017 7200 Fax. +44 (0) 20 7017 7807 Email: info@icbi.co.uk<br />

电 话 :+44 (0) 20 7017 7200 传 真 :+44 (0) 20 7017 7807 电 子 邮 件 :info@icbi.co.uk