HII Newport News Operations Summary Plan ... - Benefits Connect

HII Newport News Operations Summary Plan ... - Benefits Connect

HII Newport News Operations Summary Plan ... - Benefits Connect

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

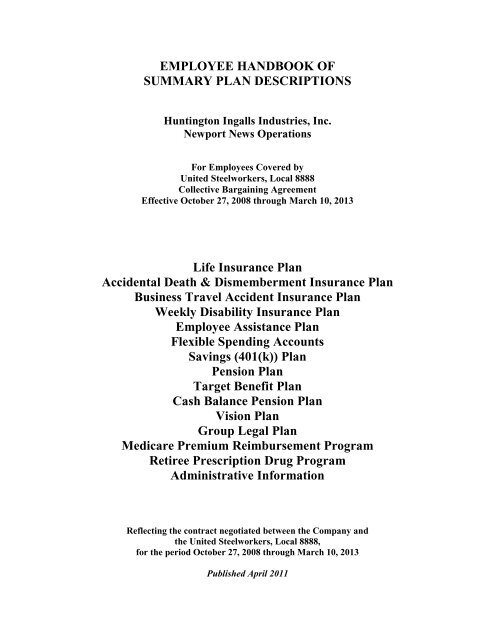

EMPLOYEE HANDBOOK OF<br />

SUMMARY PLAN DESCRIPTIONS<br />

Huntington Ingalls Industries, Inc.<br />

<strong>Newport</strong> <strong>News</strong> <strong>Operations</strong><br />

For Employees Covered by<br />

United Steelworkers, Local 8888<br />

Collective Bargaining Agreement<br />

Effective October 27, 2008 through March 10, 2013<br />

Life Insurance <strong>Plan</strong><br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

Business Travel Accident Insurance <strong>Plan</strong><br />

Weekly Disability Insurance <strong>Plan</strong><br />

Employee Assistance <strong>Plan</strong><br />

Flexible Spending Accounts<br />

Savings (401(k)) <strong>Plan</strong><br />

Pension <strong>Plan</strong><br />

Target Benefit <strong>Plan</strong><br />

Cash Balance Pension <strong>Plan</strong><br />

Vision <strong>Plan</strong><br />

Group Legal <strong>Plan</strong><br />

Medicare Premium Reimbursement Program<br />

Retiree Prescription Drug Program<br />

Administrative Information<br />

Reflecting the contract negotiated between the Company and<br />

the United Steelworkers, Local 8888,<br />

for the period October 27, 2008 through March 10, 2013<br />

Published April 2011

SUMMARY PLAN DESCRIPTION<br />

Huntington Ingalls Industries, Inc.<br />

<strong>Newport</strong> <strong>News</strong> <strong>Operations</strong><br />

Life Insurance <strong>Plan</strong><br />

For Employees Covered by<br />

United Steelworkers, Local 8888<br />

Collective Bargaining Agreement<br />

Effective October 27, 2008, through March 10, 2013

Table of Contents<br />

Eligibility ............................................................................................................................ 1<br />

Payment of <strong>Benefits</strong> ............................................................................................................ 1<br />

Death Claim Procedure ....................................................................................................... 7<br />

Disability Benefit ................................................................................................................ 7<br />

Accelerated Benefit Option (ABO) .................................................................................... 9<br />

Loss of <strong>Benefits</strong> .................................................................................................................. 9<br />

Conversion Option ............................................................................................................ 10<br />

Appeal Procedure .............................................................................................................. 14<br />

Your Rights ....................................................................................................................... 16

This <strong>Summary</strong> <strong>Plan</strong> Description (SPD) describes the Huntington Ingalls Industries, Inc.<br />

<strong>Newport</strong> <strong>News</strong> <strong>Operations</strong> Life Insurance <strong>Plan</strong> for Employees Covered by the United<br />

Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service<br />

Workers International Union (United Steelworkers), Local 8888, Collective Bargaining<br />

Agreement Effective October 27, 2008, through March 10, 2013 (the “<strong>Plan</strong>”) and is<br />

intended to describe the benefits the <strong>Plan</strong> provides for eligible employees. References in<br />

this booklet to the “Company” mean Huntington Ingalls Industries, Inc. <strong>Newport</strong> <strong>News</strong><br />

<strong>Operations</strong>.<br />

Eligibility<br />

1. Who may participate in the Life Insurance <strong>Plan</strong><br />

All active, full-time employees covered by the collective bargaining agreement<br />

between Huntington Ingalls Industries, Inc. <strong>Newport</strong> <strong>News</strong> <strong>Operations</strong> and United<br />

Steelworkers, Local 8888, (bargaining unit), become eligible for coverage on the first<br />

day following the completion of three months of continuous active employment,<br />

provided the employee is actively at work on that day. No employee contributions<br />

(premiums) are required for Basic Life Insurance.<br />

2. Are dependents eligible for coverage under the <strong>Plan</strong><br />

Yes. You may elect optional life insurance coverage for your eligible spouse and/or<br />

dependent child(ren).<br />

Payment of <strong>Benefits</strong><br />

3. What benefits are provided by the <strong>Plan</strong><br />

Basic Life Insurance<br />

The <strong>Plan</strong> provides Basic term life insurance for each active full-time employee in the<br />

bargaining unit in the amount of $35,000.<br />

Optional Life Insurance<br />

Effective July 1, 2009, you may purchase optional life insurance for yourself and<br />

your eligible dependents. If you select optional life insurance, you pay the full cost<br />

with after-tax dollars, based on group rates negotiated by Huntington Ingalls<br />

Industries, Inc.<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-1-

Your cost for optional life insurance for yourself and your spouse is determined by<br />

the employee’s age as of December 31 of the benefit plan year and the coverage level<br />

selected. As your base pay changes, so will your coverage amount and rate for<br />

coverage for yourself and your spouse, if applicable. Your cost for child life<br />

insurance is determined as a flat rate per option.<br />

You can select optional life insurance at the following times:<br />

• Within 31 days of when you (and your dependents) first become eligible for<br />

coverage (which is usually 90 days from your date of hire)<br />

• Anytime during the benefit plan year, subject to Evidence of Insurability (EOI)<br />

requirements.<br />

Depending on the amount of coverage you choose, you may need to provide<br />

satisfactory EOI. See “When Evidence of Insurability Is Required” for details.<br />

For your optional life insurance to take effect, you must be an active employee and<br />

not on a leave of absence at the start of the benefit plan year. If you are on a leave of<br />

absence, and you want to increase your coverage, you must call the Huntington<br />

Ingalls <strong>Benefits</strong> Center (HIBC) when you return to work.<br />

For your dependent’s coverage to take effect, he or she must not be confined for<br />

medical care or treatment — either in a medical treatment facility or at home — on<br />

the effective date of the coverage. If your dependent is confined, coverage begins<br />

when he or she is released from confinement.<br />

You can purchase dependent life insurance regardless of whether you purchase<br />

optional life insurance for yourself, but your spouse’s life coverage cannot exceed<br />

50% of your combined basic and optional insurance coverage.<br />

If you are still covered by the optional life insurance plan at age 65, your benefit will<br />

be reduced by the plan’s age reduction factors. See “What Happens to Your Coverage<br />

at Age 65” for details.<br />

Optional Life Insurance for Yourself<br />

If you select optional life insurance for yourself, your beneficiary will receive<br />

benefits under both your basic and optional life insurance in the event of your death.<br />

The optional life insurance options for employees are:<br />

• 1 x your annual base pay up to a maximum of $1 million<br />

• 2 x your annual base pay up to a maximum of $1 million<br />

• 3 x your annual base pay up to a maximum of $1 million<br />

• 4 x your annual base pay up to a maximum of $1 million<br />

• 5 x your annual base pay up to a maximum of $1 million<br />

• 6 x your annual base pay up to a maximum of $1 million<br />

• 7 x your annual base pay up to a maximum of $1 million<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-2-

• 8 x your annual base pay up to a maximum of $1 million<br />

• No optional life insurance.<br />

If the amount of your annual base pay is not an even $1,000 multiple, the amount of<br />

your coverage is rounded up to the next-higher thousand-dollar amount. For example,<br />

if your annual base pay amount is $42,100 and you select the three times your annual<br />

base pay, your benefit will be: $42,100 x 3 = $126,300, rounded up to $127,000.<br />

Optional Life Insurance for Your Spouse<br />

The optional spouse life insurance options are:<br />

• $25,000<br />

• $50,000<br />

• 1 x your annual base pay<br />

• 2 x your annual base pay<br />

• 3 x your annual base pay<br />

• 4 x your annual base pay.<br />

The amount of your spouse’s life insurance cannot be more than the lesser of:<br />

• 50% of the total amount of your own basic and/or optional life insurance<br />

combined amount<br />

• $500,000.<br />

For example, if your annual base pay amount is $40,000, and you select optional life<br />

insurance equal to one times this amount, the total of your basic and optional life<br />

insurance is $75,000 (basic life insurance of $35,000 + optional life insurance of<br />

$40,000). You could choose optional life insurance for your spouse of $25,000.<br />

However, you could not choose any of the other options.<br />

You do not have to purchase optional life insurance for yourself in order to buy<br />

spouse life insurance. If both you and your spouse work for Huntington Ingalls<br />

Industries, Inc., you may select optional life insurance for one another.<br />

Federal tax law requires that you pay imputed income taxes on the value of your<br />

employer-provided life insurance in excess of $50,000 and on all spouse life<br />

insurance. See “Imputed Income” for details.<br />

Optional Life Insurance for Your Children<br />

The optional child life insurance options are:<br />

• $10,000 per child<br />

• $20,000 per child<br />

• $30,000 per child.<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-3-

This coverage is available for eligible children who are at least 14 days old. If both<br />

you and your spouse work for Huntington Ingalls Industries, Inc., only one of you<br />

may elect optional life insurance coverage for your eligible dependent children.<br />

Upon the death of a covered dependent child between the ages of 19 and 25, the<br />

insurance carrier may require proof of student status before paying any life insurance<br />

benefit.<br />

When Evidence of Insurability Is Required<br />

Evidence of insurability (EOI) refers to proof that you and/or your spouse are in good<br />

health at the time you enroll for optional life insurance. You must provide EOI under<br />

the following circumstances:<br />

• When you (and your dependents) first become eligible (usually 90 days from your<br />

date of hire), and you choose:<br />

⎯ Optional coverage for yourself that is greater than five times your salary or<br />

$600,000, whichever is less<br />

⎯ Optional coverage for your spouse that is greater than $50,000.<br />

• You select or increase optional coverage for yourself (and your dependents) at<br />

any time other than within 31 days of the date you first become eligible (e.g., in<br />

the event of a qualified life event). However, if you gain a new dependent through<br />

marriage, birth, or adoption, or purchase a home, you can:<br />

⎯ Select employee coverage of one times your pay or increase your current<br />

coverage by one level (up to $600,000) without EOI<br />

⎯ Select spouse coverage up to $50,000 without EOI.<br />

If your spouse loses his or her life insurance from another source, you may select<br />

spouse coverage up to $50,000 without EOI. Also, you may enroll in or increase child<br />

life insurance without EOI, if you experience a qualified life event.<br />

• You receive a salary increase that causes your optional life insurance to exceed<br />

$600,000. EOI for automatic benefit increases due to a salary change will be<br />

required only with the initial salary increase that results in your coverage being<br />

greater than $600,000.<br />

• You receive a salary increase that causes your spouse’s life insurance coverage<br />

automatically to increase to greater than $50,000. EOI for automatic benefit<br />

increases due to a salary change will be required only with the initial salary<br />

increase that results in your spouse’s life insurance coverage being greater than<br />

$50,000.<br />

When EOI is required, you must complete and submit your EOI form to MetLife (the<br />

life insurance company). Employee EOI can be completed and submitted<br />

electronically through the online enrollment system or by electronically submitting a<br />

Statement of Health, which is accessible from the Provider List at <strong>HII</strong> <strong>Benefits</strong><br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-4-

<strong>Connect</strong> (when you get to the MetLife site, select the Statement of Health link), or by<br />

paper. Spouse EOI must be submitted by paper.<br />

You can download a paper EOI form through the Forms link at <strong>HII</strong> <strong>Benefits</strong> <strong>Connect</strong><br />

or request an EOI form from the Huntington Ingalls <strong>Benefits</strong> Center (HIBC) at 1-<br />

877-216-3222. You must return the completed EOI form to MetLife at the address<br />

provided on the form as soon as possible. MetLife will review your form and notify<br />

you and the HIBC when your coverage is accepted or rejected. If your coverage is<br />

accepted, MetLife informs you of the date your coverage begins.<br />

The EOI process requires information about your health, medical history, and preexisting<br />

conditions. In addition, your doctor may be required to submit information<br />

regarding your health or give you a physical exam. You may be required to pay the<br />

cost of any physical exams performed to obtain coverage.<br />

Until your EOI is processed, your coverage will be limited to an amount allowed<br />

without EOI. For example, if you enroll as a new employee and choose coverage<br />

equal to four times your annual base pay of $155,000, your coverage will be limited<br />

to $600,000 until your EOI is processed and your coverage is approved.<br />

Imputed Income<br />

Federal tax law requires you to pay income taxes on the value of your employerprovided<br />

group life insurance in excess of $50,000 and on spouse life insurance when<br />

applicable. This is called imputed income. You may choose to avoid imputed income<br />

by not electing any spouse life insurance.<br />

What Happens to Your Optional Coverage at Age 65<br />

If you have optional life insurance coverage at age 65, the original amount of your<br />

optional coverage is reduced the first of the month following your 65th birthday,<br />

based on the following chart:<br />

Age<br />

Percentage of Your Original<br />

Benefit Amount Payable<br />

65 92% of the original amount<br />

66 84% of the original amount<br />

67 76% of the original amount<br />

68 68% of the original amount<br />

69 60% of the original amount<br />

70 and older 50% of the original amount<br />

This reduction will also affect your spouse’s life insurance benefit. Note that your<br />

spouse’s reduction is based on when you reach age 65 (the first of the month<br />

following your 65th birthday). Your spouse’s benefit is not affected by his or her age.<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-5-

For example, let’s assume:<br />

• Your annual base pay is $40,000<br />

• You are age 64 and your spouse is age 63<br />

• You choose optional employee life insurance of two times your base pay<br />

($40,000) for a total life insurance benefit of $80,000<br />

• You choose optional spouse life insurance of one times your annual base pay, or<br />

$40,000.<br />

When you reach age 65 (the first of the month following your 65th birthday):<br />

• Your coverage amount will reduce to $73,600 (92% X $80,000)<br />

• Your spouse’s coverage amount will reduce to $36,800 (92% X $40,000).<br />

When you reach 66 (the first of the month following your 66th birthday):<br />

• Your coverage amount will reduce to $67,200 (84% X $80,000)<br />

• Your spouse’s coverage amount will reduce to $33,600 (84% X $40,000).<br />

Your basic life insurance coverage will not be reduced at age 65.<br />

4. In the event of the death of an insured employee, to whom will the life insurance<br />

benefit be paid<br />

The benefit will be paid to the designated beneficiary or beneficiaries. If the<br />

employee has not designated a beneficiary, or if a designated beneficiary has<br />

predeceased the employee, the life insurance benefit will be paid in the following<br />

order to the employee’s:<br />

• Spouse<br />

• Estate.<br />

5. May the designated beneficiary be changed<br />

Yes, the employee may change the designated beneficiary at any time by going online<br />

to Your <strong>Benefits</strong> Resources via <strong>HII</strong> <strong>Benefits</strong> <strong>Connect</strong> at http://hiibenefits.com. If you<br />

do not have Internet access, please call the Huntington Ingalls <strong>Benefits</strong> Center<br />

(HIBC) at 1-877-216-3222.<br />

6. In what form are life insurance benefits paid<br />

The life insurance benefit will be paid as a lump sum to your designated<br />

beneficiary(ies). Your beneficiary(ies) have the option to receive the lump sum or<br />

have it deposited into an account reserved for this benefit and access the money when<br />

necessary.<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-6-

Death Claim Procedure<br />

7. What is the procedure for filing a death claim<br />

The deceased insured employee’s beneficiary, or other appropriate representative,<br />

should contact the HIBC at 1-877-216-3222. However, if this is not done and the<br />

HIBC becomes aware of the employee’s death by some other means, the designated<br />

beneficiary will be contacted by the HIBC.<br />

In either case, the HIBC will prepare and process the required Death Claim Form. It<br />

will be necessary for the beneficiary, or other appropriate representative, to provide a<br />

certified copy of the Certificate of Death.<br />

Disability Benefit<br />

8. What happens to life insurance coverage if an employee or covered dependent<br />

becomes permanently and totally disabled<br />

Basic Life Insurance<br />

You may remain eligible for Life Insurance coverage (also known as an “extension”)<br />

if you become permanently and totally disabled as defined by the <strong>Plan</strong> (see Q&A 9),<br />

if the total disability starts:<br />

• While you are insured, and<br />

• Before you retire.<br />

You will no longer be eligible for the extension because of disability the earliest of:<br />

• The date you are no longer permanently and totally disabled as defined by the<br />

<strong>Plan</strong> (see Q&A 9)<br />

• The date you reach age 65, if your total disability starts prior to age 60<br />

• The date you reach the following ages shown below, if your total disability starts<br />

on or after age 60:<br />

Age<br />

Extension<br />

60-64 5 years<br />

65-69 To age 70<br />

Age 70 and over<br />

3 months<br />

9. For the purpose of determining eligibility to receive a basic life insurance<br />

disability benefit, what is the definition of “total and permanent disability”<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-7-

• The disability is considered to be total when the employee is unable to engage in<br />

any occupation or perform any work for compensation or profit because of the<br />

disability.<br />

• The disability is considered to be permanent when it is present and has existed<br />

continuously for at least six consecutive months.<br />

• The employee will be deemed to be disabled upon qualification for Social<br />

Security Disability.<br />

Optional Life Insurance (Employee, Spouse, and Child)<br />

Regardless of your age when you become disabled, your optional life insurance<br />

continues while you are disabled, up to a maximum of 24 months or retirement,<br />

whichever comes first, provided you make the required contributions and remain<br />

totally disabled as defined by the <strong>Plan</strong>. See Q&A 9. When coverage ends:<br />

• You may convert your basic life insurance to an individual policy<br />

• You and your dependents may convert any optional life insurance coverage to an<br />

individual policy or choose portability within 31 days of the coverage termination<br />

date.<br />

If the provisions of the life insurance plan would otherwise call for benefits to<br />

terminate or reduce prior to the end of the 24-month period (commencing on your last<br />

day of work), then benefits will terminate or reduce as of that date.<br />

10. What procedure must be followed by the employee in order to receive the<br />

disability benefit<br />

The employee must contact the Huntington Ingalls <strong>Benefits</strong> Center (HIBC) and<br />

provide his or her Social Security disability award letter.<br />

11. Are there any additional requirements for continuation of the extended<br />

insurance benefit throughout the authorized period of coverage<br />

The Company may require at any time proof of the continued existence of the<br />

disability.<br />

12. Under what circumstances will the extended insurance coverage stop before the<br />

end of the authorized period<br />

Coverage will end on the 31st day following the date the employee:<br />

• Ceases to be disabled; or<br />

• Fails to provide proof of continued disability, or<br />

• Refuses to undergo a periodic medical examination<br />

13. What should I do if my application for extended coverage is denied<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-8-

Please refer to Q&A 19 for the appeals procedure if any of the benefit provisions of<br />

the <strong>Plan</strong> are denied.<br />

Accelerated Benefit Option (ABO)<br />

14. Is a benefit payable if I become terminally ill<br />

Yes. The basic and optional life insurance coverage includes a special feature that<br />

helps you cope with the financial difficulties often associated with terminal illness.<br />

You or your legal representative can apply for an accelerated benefit if your life<br />

expectancy is less than 12 months because of illness or injury. The amount of the<br />

accelerated benefit is 50% of the total life insurance amount. The benefit is payable as<br />

long as it not has been previously assigned and proof of your terminal illness is<br />

received.<br />

The amount of life insurance paid upon your death will be decreased by the amount<br />

of the accelerated benefit that has been paid.<br />

15. Is the accelerated benefit taxed<br />

The Life Insurance accelerated benefit is intended to qualify for favorable tax<br />

treatment under the Internal Revenue Code of 1986. If so, the benefit will be excluded<br />

from your income and won’t be subject to federal taxation. However, tax laws related<br />

to accelerated benefits are complex and you should consult with a qualified tax<br />

advisor about your individual situation.<br />

16. Can the accelerated benefit affect my or my family’s eligibility for public<br />

programs<br />

Receipt of an accelerated benefit may affect your, your spouse’s or your family’s<br />

eligibility for public assistance programs such as Medical Assistance (Medicaid) and<br />

Supplementary Social Security Income (SSI). You should consult with social service<br />

agencies and with a qualified tax advisor about your individual situation.<br />

Loss of <strong>Benefits</strong><br />

17. Under what conditions might benefits outlined in this SPD become unavailable<br />

Entitlement to the benefits which are provided by this <strong>Plan</strong> would be lost or forfeited:<br />

• 30 days after last day of work or 31 days after last day on roll for an employee not<br />

working due to illness or injury;<br />

• Upon transfer to a job classification out of the bargaining unit;<br />

• If an employee or a beneficiary, in connection with the filing of a claim, fails in<br />

any respect to fulfill <strong>Plan</strong> requirements as they are stated herein;<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-9-

• If the <strong>Plan</strong> is terminated by the Company.<br />

Conversion Option<br />

18. Can the life insurance coverage be converted to an individual policy<br />

Basic Life Insurance<br />

You have the option to buy an individual life insurance policy (or an individual<br />

certificate under a designated group policy) up to $35,000 (less any amount paid as an<br />

accelerated benefit) from the Insurance Company without having to provide evidence<br />

of insurability during the application period described below if your Life Insurance<br />

ends because:<br />

• You are no longer eligible to participate<br />

• Your employment with the Company ends<br />

• The Group Policy ends, provided you have been insured for life insurance for at<br />

least 5 years<br />

• The Group Policy is amended and you are no longer eligible to participate,<br />

provided you have been insured for Life insurance for at least 5 years.<br />

If you choose to convert your Life Insurance for any of the reasons stated above, the<br />

Insurance Company must receive a completed conversion form from you within the<br />

Application Period and Option conditions described below:<br />

• Written application for the coverage and payment of the first premium must be<br />

made within 31 days after termination of insurance<br />

• Evidence of insurability is not required.<br />

• The policy may be in any of the forms of insurance customarily issued by The<br />

Insurance Company except term insurance<br />

• The policy may have a face value up to the amount of the group coverage which<br />

stopped<br />

• The premium rates for the new policy will be based on the Insurance Company<br />

rates in use at the time, the form and amount of insurance, your class of risk, and<br />

your attained age when your Life Insurance ends<br />

• The new policy will take effect on the 32nd day after the date your life insurance<br />

ends, regardless of the duration of your application period.<br />

Conversion forms are available by calling the HIBC at 1-877-216-3<br />

222.<br />

Optional Life Insurance<br />

If your (or your spouse’s or dependents’) coverage ends because your employment<br />

with Huntington Ingalls Industries, Inc. ends or because you (or your spouse or<br />

dependents) are no longer eligible for coverage, you (and your spouse and<br />

dependents) may choose to either:<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-10-

• Convert the terminating coverage to an individual policy of your own; or<br />

• Use the plan’s portability feature to continue the terminating coverage as part of<br />

the Huntington Ingalls Health <strong>Plan</strong>.<br />

Conversion and portability are characterized as follows:<br />

• Conversion allows you to convert all or a portion of the terminating coverage to<br />

an individual policy (subject to conversion amount limitations). Amounts you<br />

convert are no longer part of your Huntington Ingalls Industries, Inc. coverage,<br />

and you are solely responsible for keeping the individual policy(ies) active. You<br />

pay the insurance company directly. Your cost is based on the insurance<br />

company’s standard individual rates, which may differ from the rates you<br />

currently pay.<br />

• Portability allows you to continue all or a portion of your optional life insurance<br />

(for yourself, your spouse and/or your dependents) under the Huntington Ingalls<br />

Health <strong>Plan</strong> when that coverage would otherwise terminate. You pay the<br />

insurance company directly. Your cost is based on the insurance company’s<br />

standard group rates, which may differ from the rates you currently pay.<br />

The following chart shows when the conversion features apply, and the conditions<br />

and limitations surrounding your choice to convert your terminating coverage.<br />

Conversion<br />

What coverage can be converted • Your optional life coverage for yourself,<br />

your spouse and your dependent children<br />

When can you convert • When your employment ends (voluntarily or<br />

involuntarily)<br />

• When your coverage ends<br />

• When the Huntington Ingalls Industries, Inc.<br />

group insurance policy terminates (life<br />

insurance only). Most states limit the amount<br />

that can be converted in this case<br />

• When the amount of your coverage reduces<br />

• When you retire<br />

• When your job changes and, as a result, you<br />

are no longer eligible to participate in the<br />

plan<br />

Can a spouse and dependent child(ren)<br />

convert their coverage<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-11-<br />

• Yes, your spouse and child(ren) coverage can<br />

be converted<br />

When can covered dependents convert • When your employment ends (voluntarily or<br />

involuntarily)<br />

• When you, the employee, retires<br />

• When you, the employee, exercise the

Conversion<br />

portability feature for your coverage<br />

• When you, the employee, die<br />

• When you and your spouse divorce<br />

• When the Huntington Ingalls Industries, Inc.<br />

group insurance policy terminates (life<br />

insurance only); most states limit the amount<br />

that can be converted in this case<br />

What amount can be converted • You and/or your eligible dependent(s) can<br />

choose an amount to convert equal to but not<br />

greater than the amount of the group life<br />

insurance benefits being terminated or<br />

reduced<br />

• When benefits end at retirement, you can<br />

convert up to the full amount of group life<br />

insurance benefits that ended on the date of<br />

retirement<br />

Must I choose conversion within a certain<br />

time frame<br />

• If you would like to convert to an individual<br />

policy, you (or your spouse or dependent)<br />

must choose conversion, in writing, within<br />

31 days of the date coverage ends or reduces<br />

• When you convert, the insurance company<br />

will issue a new policy, which becomes<br />

effective the first day after the 31-day<br />

conversion period; exceptions are not<br />

permitted<br />

Is evidence of insurability (EOI) required • No, EOI is not required<br />

What happens if I die within the first 31 days<br />

after coverage ends<br />

• If you die during the 31-day conversion<br />

period immediately after your coverage<br />

ended, your benefits are payable under the<br />

group life insurance policy<br />

The following chart shows when the portability features apply, and the conditions and<br />

limitations surrounding your choice to port your terminating optional life insurance<br />

coverage.<br />

Portability<br />

What coverage can be ported • Your optional life coverage for yourself,<br />

your spouse and your dependent child(ren)<br />

When can you port your coverage • When your employment ends (voluntarily or<br />

involuntarily)<br />

• When you retire and you do not have access<br />

to the same coverage through a retiree option<br />

• When your job changes and, as a result, you<br />

are no longer eligible to participate in the<br />

plan<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-12-

Portability<br />

When can you NOT port your coverage • When you retire and you have access to the<br />

same coverage through a retiree option<br />

• When the Huntington Ingalls Industries, Inc.<br />

group insurance policy terminates<br />

How long will the portable coverage be in<br />

effect, and what reductions apply<br />

Can a spouse and dependent child(ren) port<br />

their coverage<br />

When can a spouse and dependent child(ren)<br />

port their coverage<br />

How long will the ported dependent coverage<br />

remain in effect<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-13-<br />

• Coverage terminates on January 1 of the year<br />

that you reach age 80<br />

• Coverage reduces 50% on January 1 of the<br />

year that you reach age 70<br />

• Yes, your spouse and child(ren) coverage can<br />

be ported<br />

• When your employment ends (voluntarily or<br />

involuntarily)<br />

• When you, the employee, retires<br />

• When your job changes and, as a result, you<br />

are no longer eligible to participate in the<br />

plan<br />

• When you, the employee, die<br />

• When you and your spouse divorce.<br />

• Ported employee coverage reduces at age 70<br />

and terminates at age 80<br />

• Ported spouse coverage continues until your<br />

spouse reaches age 70<br />

• Ported child(ren) coverage continues until<br />

the child(ren) reaches the limiting age<br />

What amount can be ported • The maximum amount of coverage that can<br />

be ported is the current amount of coverage,<br />

up to $1,000,000<br />

What is the minimum and maximum portable<br />

benefit<br />

Can ported coverage be increased or<br />

decreased<br />

• The minimum amount of coverage that can<br />

be ported is:<br />

• $20,000 of group term life coverage for the<br />

employee<br />

• $10,000 for the spouse<br />

• $1,000 for dependent child(ren)<br />

• Coverage cannot be increased<br />

• Coverage can be decreased; however, once<br />

coverage is decreased, it cannot be increased<br />

later<br />

Is evidence of insurability (EOI) required • No, EOI is not required<br />

Can you choose to convert your ported<br />

coverage.<br />

• You may convert the ported amount;<br />

however, the ported coverage must terminate<br />

before a conversion policy will be issued.<br />

Choosing Conversion or Portability<br />

You must choose conversion or portability in writing within 31 days of the date<br />

coverage ends. Converted coverage becomes effective the first day after the 31-day

conversion period ends. Ported coverage becomes effective the first of the month<br />

following the 31-day election period.<br />

For more information or to request a conversion or portable policy, contact the<br />

Huntington Ingalls <strong>Benefits</strong> Center (HIBC) at 1-877-216-3222.<br />

Appeal Procedure<br />

19. What should a beneficiary do if benefits applied for are denied<br />

If a claim for benefits is wholly or partially denied, within a reasonable period of time<br />

the applicant will be provided with written notice of the denial containing:<br />

• The reasons for the denial;<br />

• Reference to the <strong>Plan</strong> provisions upon which the denial was based;<br />

• A summary of additional material or information, if any, required to complete the<br />

application; and<br />

• An explanation of the appeal procedure and your right to begin legal action if you<br />

request a review of your claim and it is denied after the review.<br />

Within 90 days from the date of receipt of the written denial notice, your beneficiary<br />

may submit a request to the Insurance Company in writing for a review of the denial.<br />

The request should contain facts that support the claim for benefits, and reasons why<br />

it should not have been denied. The request for review should be addressed and sent<br />

to:<br />

METLIFE<br />

Group Life Claims<br />

Oneida County Industrial park<br />

Oneida 5950 Airport Road<br />

Oriskany, NY 13424<br />

The request for review will be considered by the insurance company’s Claims Group,<br />

who will provide a written response, usually within 60 days, including specific<br />

reasons for the decision. If the claim is denied on review, the written response will<br />

include:<br />

• The reasons for the denial;<br />

• Reference to the <strong>Plan</strong> provisions upon which the denial was based;<br />

• A statement that you are entitled to receive, upon request and free of charge,<br />

reasonable access to and copies of all documents, records, and other information<br />

relevant to your claim for benefits;<br />

• A statement of your right to begin a lawsuit under the Employee Retirement<br />

Income Security Act (ERISA) of 1974.<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-14-

If the claim for benefits is again wholly or partially denied, the beneficiary, within 90<br />

days after the date of the notification, may submit a request in writing for a further<br />

and final review to:<br />

METLIFE<br />

Group Life Claims<br />

Oneida County Industrial park<br />

Oneida 5950 Airport Road<br />

Oriskany, NY 13424<br />

The insurance company will consider the claim as promptly as possible, based upon<br />

the claim itself and the record of the previous review, and will issue its decision, in<br />

writing, within 60 days after receipt of the request for review.<br />

Additional Information about the Appeals Process ⎯ In filing an appeal, your<br />

beneficiary has the opportunity to:<br />

• Submit written comments, documents, records and other information relating to<br />

your claim for benefits<br />

• Have reasonable access to and review, upon request and free of charge, copies of<br />

all documents, records and other information relevant to your claim, including the<br />

name of any medical or vocational expert whose advice was obtained in<br />

connection with your initial claim<br />

• Have all relevant information considered on appeal, even if it wasn’t submitted or<br />

considered in your initial claim.<br />

The decision on the appeal will be made by a person or persons at the claim<br />

administrator who is not the person who made the initial claim decision and who is<br />

not a subordinate of that person. In making the decision on the appeal, the claims<br />

administrator will give no deference to the initial claim decision<br />

If the determination is based in whole or part on a medical judgment, the claims<br />

administrator will consult with a health care professional who has appropriate training<br />

and experience in the field of medicine involved in the medical judgment. The health<br />

care professional will not be the same individual who was consulted (if one was<br />

consulted) with regard to the initial claim decision and will not be a subordinate of<br />

that person.<br />

At both the initial claim level, and on appeal, your beneficiary or authorized<br />

representative may submit the appeal. In this case, the administrator may require the<br />

beneficiary to certify that the representative has permission to act for him or her. The<br />

representative may be a health care or other professional. However, even at the appeal<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-15-

level, neither your beneficiary nor your representative has a right to appear in person<br />

before the claims administrator or the review panel.<br />

During the entire review process, your beneficiary may review pertinent documents at<br />

the Employee <strong>Benefits</strong> Office, during regular business hours.<br />

Your Rights<br />

You have certain legal rights which are explained in the description of “ERISA” rights in<br />

the Administrative Information section of this Employee Handbook.<br />

Life Insurance <strong>Plan</strong><br />

April 2011<br />

-16-

SUMMARY PLAN DESCRIPTION<br />

Huntington Ingalls Industries, Inc.<br />

<strong>Newport</strong> <strong>News</strong> <strong>Operations</strong><br />

Accidental Death & Dismemberment<br />

Insurance <strong>Plan</strong><br />

For Employees Covered by<br />

United Steelworkers, Local 8888<br />

Collective Bargaining Agreement<br />

Effective October 27, 2008, through March 10, 2013

Table of Contents<br />

Eligibility ............................................................................................................................ 1<br />

Payment of <strong>Benefits</strong> ............................................................................................................ 1<br />

Claim Procedure.................................................................................................................. 4<br />

Loss of <strong>Benefits</strong> .................................................................................................................. 4<br />

Conversion Option .............................................................................................................. 5<br />

Exclusions ........................................................................................................................... 5<br />

Appeal Procedure ................................................................................................................ 6<br />

Your Rights ......................................................................................................................... 8<br />

APPENDIX A ..................................................................................................................... 9<br />

APPENDIX B ................................................................................................................... 13

This <strong>Summary</strong> <strong>Plan</strong> Description (SPD) describes the Huntington Ingalls Industries, Inc.<br />

<strong>Newport</strong> <strong>News</strong> <strong>Operations</strong> Accidental Death & Dismemberment Insurance <strong>Plan</strong> for<br />

Employees Covered by the United Steel, Paper and Forestry, Rubber, Manufacturing,<br />

Energy, Allied Industrial and Service Workers International Union (United<br />

Steelworkers), Local 8888, Collective Bargaining Agreement Effective October 27, 2008,<br />

through March 10, 2013 (the “<strong>Plan</strong>”) and is intended to describe the benefits the <strong>Plan</strong><br />

provides for eligible employees. References in this booklet to the “Company” mean<br />

Huntington Ingalls Industries, Inc. <strong>Newport</strong> <strong>News</strong> <strong>Operations</strong>.<br />

Eligibility<br />

1. Who may participate in the Accidental Death & Dismemberment Insurance<br />

(AD&D) <strong>Plan</strong><br />

All active, full-time employees covered by the Collective Bargaining Agreement<br />

between Huntington Ingalls Industries, Inc. <strong>Newport</strong> <strong>News</strong> <strong>Operations</strong> (the<br />

“Company”) and United Steelworkers, Local 8888, (bargaining unit), become<br />

eligible for coverage on the first day following the completion of three months of<br />

continuous active employment, provided the employee is actively at work on that<br />

day. The Company pays 100% of the cost for coverage and no employee<br />

contributions (premiums) are required.<br />

Effective July 1, 2009, Eligible employees may also purchase optional AD&D<br />

coverage.<br />

2. Are dependents eligible for coverage under the <strong>Plan</strong><br />

Yes. You may purchase optional AD&D coverage for your eligible spouse and/or<br />

dependent child(ren) effective July 1, 2009.<br />

Payment of <strong>Benefits</strong><br />

3. What benefits are provided by the <strong>Plan</strong><br />

Basic AD&D Insurance<br />

<strong>Benefits</strong> are payable to the employee (or to the employee’s estate) when he or she<br />

suffers a loss that is:<br />

• The result of a covered accident that is directly and independently of all other<br />

causes<br />

• One of the covered losses specified in Appendix A<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

1

• Suffered by the employee within 365 days of the covered accident.<br />

Additional benefits are available for certain circumstances – see Appendix B.<br />

<strong>Benefits</strong> for loss of life will be payable in accordance with the beneficiary provision.<br />

Optional AD&D Insurance<br />

You may purchase optional accidental death and dismemberment (AD&D)<br />

insurance for yourself only or for yourself and your eligible family members. If you<br />

select optional AD&D insurance, you pay the full cost with after-tax dollars, based<br />

on rates negotiated by Huntington Ingalls Industries, Inc.<br />

You can choose optional AD&D insurance when you are first hired and during<br />

annual enrollment. Because you pay for optional AD&D insurance with after-tax<br />

dollars, you can also enroll in optional AD&D insurance for yourself and your<br />

dependents at any time during the benefit plan year.<br />

If you and your spouse work for Huntington Ingalls Industries, Inc., only one of you<br />

may cover the entire family for AD&D insurance. The other employee may elect<br />

employee-only coverage.<br />

Optional AD&D Insurance for Yourself Effective July 1, 2009<br />

If you select optional coverage and suffer an eligible loss, you will receive benefits<br />

under both your basic and optional AD&D insurance.<br />

The optional employee AD&D insurance options are:<br />

• 1 x your annual base pay up to a maximum of $1 million<br />

• 2 x your annual base pay up to a maximum of $1 million<br />

• 3 x your annual base pay up to a maximum of $1 million<br />

• 4 x your annual base pay up to a maximum of $1 million<br />

• 5 x your annual base pay up to a maximum of $1 million<br />

• 6 x your annual base pay up to a maximum of $1 million<br />

• 7 x your annual base pay up to a maximum of $1 million<br />

• 8 x your annual base pay up to a maximum of $1 million<br />

• 9 x your annual base pay up to a maximum of $1 million<br />

• 10 x your annual base pay up to a maximum of $1 million<br />

• No optional employee AD&D insurance.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

2

Optional AD&D Insurance for Your Eligible Family Members Effective July<br />

1, 2009<br />

You also may purchase optional AD&D insurance for your eligible family<br />

members including yourself and your eligible dependents, up to a maximum of<br />

$1 million. The optional family AD&D insurance options are:<br />

• 1 x your annual base pay up to a maximum of $1 million<br />

• 2 x your annual base pay up to a maximum of $1 million<br />

• 3 x your annual base pay up to a maximum of $1 million<br />

• 4 x your annual base pay up to a maximum of $1 million<br />

• 5 x your annual base pay up to a maximum of $1 million<br />

• 6 x your annual base pay up to a maximum of $1 million<br />

• 7 x your annual base pay up to a maximum of $1 million<br />

• 8 x your annual base pay up to a maximum of $1 million<br />

• 9 x your annual base pay up to a maximum of $1 million<br />

• 10 x your annual base pay up to a maximum of $1 million<br />

• No optional AD&D insurance for your family.<br />

If you select family coverage, your spouse and/or child(ren)’s coverage is based<br />

on your eligible family members at the time of the loss, as shown in this chart:<br />

Amount of Dependent Coverage<br />

Spouse only<br />

75% of your optional coverage<br />

Spouse and children Spouse: 60% of your optional coverage<br />

Children: 15% of your optional coverage per child (up to<br />

$50,000)<br />

Children only 25% of your optional coverage per child (up to $50,000)<br />

For example, let’s assume:<br />

• Your annual base pay is $40,000<br />

• You choose family AD&D coverage equal to 2 x your annual base pay<br />

• You are married and have two children.<br />

In this example,<br />

• Your AD&D coverage amount is $80,000 (2 x $40,000)<br />

• Your spouse’s coverage amount is $48,000 (60% x $80,000)<br />

• Your children’s coverage amount is $12,000 per child (15% x $80,000).<br />

If you and your spouse work for Huntington Ingalls Industries, Inc., only one of<br />

you may cover the entire family for AD&D insurance.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

3

Upon the death of a covered dependent child between the ages of 19 and 25, the<br />

insurance carrier may require proof of student status before paying any AD&D<br />

benefit.<br />

AD&D insurance pays a percentage of the AD&D coverage amount based on the<br />

type of loss incurred, as shown in the chart in Appendix A.<br />

4. In the event of the death of an employee while a benefit is payable, to whom<br />

will the benefit be paid<br />

The benefit will be paid to the designated beneficiary or beneficiaries. If the<br />

employee has not designated a beneficiary, or if a designated beneficiary has<br />

predeceased the employee, the accident insurance benefit will be paid in the<br />

following order to the employee’s:<br />

1) Spouse<br />

2) Estate<br />

5. May the designated beneficiary be changed<br />

Yes, the employee may change the designated beneficiary at any time by going<br />

online to Your <strong>Benefits</strong> Resources via <strong>HII</strong> <strong>Benefits</strong> <strong>Connect</strong> at http://hiibenefits.com.<br />

If you do not have Internet access, please call the Huntington Ingalls <strong>Benefits</strong><br />

Center (HIBC) at 1-877-216-3222.<br />

6. In what form are AD&D insurance benefits paid<br />

Payment will be made in a lump sum unless otherwise specified in Appendix A or<br />

Appendix B.<br />

Claim Procedure<br />

7. What is the procedure for filing an AD&D claim<br />

The employee, or other appropriate representative, should contact the HIBC<br />

at 1-877-216-3222 within 31 days after a covered loss occurs or begins, or as soon<br />

as reasonably possible. The HIBC will provide the claim form for you to complete<br />

and return within 90 days of the loss for which the claim is made.<br />

Loss of <strong>Benefits</strong><br />

8. Under what conditions might benefits outlined in this SPD become<br />

unavailable<br />

Entitlement to the benefits that are provided by this <strong>Plan</strong> would be lost or forfeited:<br />

• 30 days after the last day of work or 31 days after the last day on roll for an<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

4

employee not working due to illness or injury<br />

• Upon transfer to a job classification out of the bargaining unit<br />

• If an employee or beneficiary, in connection with the filing of a claim, fails in<br />

any respect to fulfill <strong>Plan</strong> requirements as they are stated herein<br />

• If the <strong>Plan</strong> is terminated by the Company.<br />

Conversion Option<br />

9. Can the AD&D coverage be converted to an individual policy<br />

An employee under age 70 has the option to buy an individual AD&D policy (or an<br />

individual certificate under a designated group policy), without having to provide<br />

evidence of insurability, if the employee’s AD&D insurance, or any portion of it,<br />

ends because of the employee’s termination of employment or is no longer eligible<br />

for the <strong>Plan</strong>. The converted policy may exclude some benefits provided under this<br />

group policy.<br />

The covered person may apply for an amount of coverage that is:<br />

• In $1,000 increments<br />

• Not less than $25,000, regardless of the amount of insurance under the <strong>Plan</strong><br />

• Not more than the amount of insurance while the covered person was in the<br />

<strong>Plan</strong>, except as provided above, up to a maximum of $250,000.<br />

The employee must apply for the individual policy within 31 days after his or her<br />

coverage under this group policy ends and pay the required premium. If the<br />

employee has assigned ownership of his group coverage, the owner/assignee must<br />

apply for the individual policy.<br />

If the employee dies during this 31-day period as a result of an accident that would<br />

have been covered under the group policy, the insurance company will pay as a<br />

claim the amount of insurance that the employee was entitled to convert. It does not<br />

matter whether the employee applied for the individual policy or certificate.<br />

However, if such policy or certificate is issued, it will be in exchange for any other<br />

benefits under this group policy.<br />

The individual policy or certificate will take effect on the day following the date<br />

coverage under the group policy ended or, if later, the date application is made.<br />

Exclusions<br />

10. Are there any exclusions to the <strong>Plan</strong><br />

Yes. No payment shall be made for any loss which, directly or indirectly, in whole<br />

or in part, is caused by or results from:<br />

• Intentionally self-inflicted Injury, suicide or any attempt thereat while sane or<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

5

insane<br />

• Commission or attempt to commit a felony or an assault<br />

• Declared or undeclared war or act of war<br />

• Flight in, boarding or alighting from an aircraft or any craft designed to fly<br />

above the Earth’s surface, except as a passenger in an aircraft piloted by<br />

properly qualified and licensed pilots holding current and valid certificates of<br />

competency of a rating authorizing them to pilot such aircraft<br />

• Sickness, disease, bodily or mental infirmity, bacterial or viral infection or<br />

medical or surgical treatment thereof (except surgical or medical treatment<br />

required by an accident), except for any bacterial infection resulting from an<br />

accidental external cut or wound or accidental ingestion of contaminated food<br />

• Voluntary ingestion of any narcotic, drug, poison, gas or fumes, unless<br />

prescribed or taken under the direction of a Physician and taken in accordance<br />

with the prescribed dosage<br />

• Any accident that occurs while engaged in the activities of active duty service in<br />

the military, Navy or Air Force of any country or international organization<br />

• Covered accidents that occur while engaged in Reserve or National Guard<br />

training after the 31 st day of training<br />

• Operating any type of vehicle while under the influence of alcohol or any drug,<br />

narcotic or other intoxicant including any prescribed drug for which the<br />

employee has been provided a written warning against operating a vehicle while<br />

taking it. “Under the influence of alcohol” means intoxicated, as defined by the<br />

law of the state in which the covered accident occurred.<br />

Appeal Procedure<br />

11. What procedure should be followed if benefits applied for are denied<br />

If a claim for benefits is wholly or partially denied, within a reasonable period of<br />

time the applicant will be provided with written notice of the denial containing:<br />

• The reasons for the denial<br />

• Reference to the <strong>Plan</strong> provisions upon which the denial was based<br />

• A summary of additional material or information, if any, required to complete<br />

the application<br />

• An explanation of the appeal procedure and your right to begin legal action if<br />

you request a review of your claim and it is denied after the review.<br />

The notice of denial will be provided within 90 days after the claim for benefits is<br />

received, unless the insurance company determines that special circumstances<br />

require an extension of time for processing the claim. If the insurance company<br />

determines that an extension of time is required, written notice of the extension will<br />

be provided prior to the end of the initial 90-day period, indicating the special<br />

circumstances that require an extension and the date by which a decision will be<br />

rendered.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

6

Within 60 days after the date of the written denial notice, the employee, a<br />

beneficiary, or an authorized representative of either may submit a request in<br />

writing for a review of the denial. The request should contain facts that support the<br />

claim for benefits, and reasons why it should not have been denied. The request for<br />

review should be addressed and sent to:<br />

CIGNA Group Insurance<br />

1601 Chestnut Street<br />

Philadelphia, PA 19192<br />

The request for review will be considered by the insurance company’s Claims<br />

Group who will provide a written response, usually within 60 days, including<br />

specific reasons for the decision. If the claim is denied on review, the written<br />

response will include:<br />

• The reasons for the denial<br />

• Reference to the <strong>Plan</strong> provisions upon which the denial was based<br />

• A statement that you are entitled to receive, upon request and free of charge,<br />

reasonable access to and copies of all documents, records, and other information<br />

relevant to your claim for benefits<br />

• A statement of your right to begin a lawsuit under the Employee Retirement<br />

Income Security Act (ERISA) of 1974.<br />

The notice of denial will be provided within 60 days after the claim for benefits is<br />

received, unless the insurance company determines that special circumstances<br />

require an extension of time for processing the claim. If the insurance company<br />

determines that an extension of time is required, written notice of the extension will<br />

be provided prior to the end of the initial 60-day period, indicating the special<br />

circumstances that require an extension and the date by which a decision will be<br />

rendered.<br />

Additional Information about the Appeals Process In filing an appeal, you<br />

have the opportunity to:<br />

• Submit written comments, documents, records and other information relating to<br />

your claim for benefits<br />

• Have reasonable access to and review, upon request and free of charge, copies<br />

of all documents, records and other information relevant to your claim,<br />

including the name of any medical or vocational expert whose advice was<br />

obtained in connection with your initial claim<br />

• Have all relevant information considered on appeal, even if it wasn’t submitted<br />

or considered in your initial claim.<br />

The decision on the appeal will be made by a person or persons at the claims<br />

administrator who is not the person who made the initial claim decision and who is<br />

not a subordinate of that person. In making the decision on the appeal, the claims<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

7

administrator will give no deference to the initial claim decision.<br />

If the determination is based in whole or part on a medical judgment, the claims<br />

administrator will consult with a health care professional who has appropriate<br />

training and experience in the field of medicine involved in the medical judgment.<br />

The health care professional will not be the same individual who was consulted (if<br />

one was consulted) with regard to the initial claim decision and will not be a<br />

subordinate of that person.<br />

At both the initial claim level, and on appeal, you may have an authorized<br />

representative submit your claim for you. In this case, the administrator may require<br />

you to certify that the representative has permission to act for you. The<br />

representative may be a health care or other professional. However, even at the<br />

appeal level, neither you nor your representative has a right to appear in person<br />

before the claims administrator or the review panel.<br />

During the entire review process, the applicant may review pertinent documents at<br />

the Employee <strong>Benefits</strong> Office during regular business hours.<br />

Your Rights<br />

You have certain legal rights which are explained in the description of “ERISA” rights in<br />

the Administrative Information section of this Employee Handbook.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

8

Basic AD&D Insurance<br />

APPENDIX A<br />

Schedule of Insurance for Steelworkers<br />

For Collective Bargaining Agreement<br />

Loss of:<br />

Life<br />

Two or more hands or feet<br />

Sight of both eyes<br />

One Hand or one foot and sight in one<br />

eye<br />

Speech and hearing (both ears)<br />

Quadriplegia<br />

Paraplegia<br />

Hemiplegia<br />

Coma:<br />

Monthly benefit<br />

Number of monthly benefits<br />

When payable<br />

Lump sum benefit<br />

When payable<br />

One hand or foot<br />

Sight in one eye<br />

Speech<br />

Hearing (both ears)<br />

Severance and reattachment of one hand<br />

or foot<br />

Loss of thumb and index finger of the<br />

same hand<br />

$20,000<br />

$20,000<br />

$20,000<br />

$20,000<br />

$20,000<br />

$20,000<br />

$15,000<br />

$10,000<br />

$200<br />

11<br />

End of each month during<br />

which the employee remains<br />

comatose<br />

$20,000<br />

Beginning of the 12 th month<br />

$15,000<br />

$12,000<br />

$17,000<br />

$17,000<br />

$5,000<br />

$5,000<br />

If an insured suffers more than one of the losses described above as a result of any one<br />

accident, no more than $20,000 shall be payable. The amount for loss of life is in addition<br />

to the Basic Life Insurance amount of $35,000. See the Life Insurance SPD for further<br />

information.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

9

APPENDIX A<br />

(cont.)<br />

Schedule of Insurance for Steelworkers<br />

For Collective Bargaining Agreement October 27, 2008, through March 10, 2013<br />

Definitions for Basic AD&D:<br />

Loss of a Hand or Foot - complete severance through or above the wrist or ankle joint.<br />

Loss of Sight - the total and permanent loss of all vision in one eye which is<br />

irrecoverable by natural, surgical or artificial means.<br />

Loss of Speech - the total and permanent loss of audible communication which is<br />

irrecoverable by natural, surgical or artificial means.<br />

Loss of Hearing - the total and permanent loss of ability to hear any sound in both ears<br />

which is irrecoverable by natural, surgical or artificial means.<br />

Loss of a Thumb and Index Finger of the Same Hand - complete severance through or<br />

above the metacarpophalangeal joints of the same hand (the joints between the fingers<br />

and the hand).<br />

Paralysis or Paralyzed - the total loss of use of a limb. A physician must determine the<br />

loss of use to be complete and irreversible.<br />

Quadriplegia - the total paralysis of both upper and both lower limbs.<br />

Hemiplegia - the total paralysis of the upper and lower limbs on one side of the body.<br />

Paraplegia - total paralysis of both lower limbs or both upper limbs.<br />

Coma - a profound state of unconsciousness which resulted directly and independently<br />

from all other causes from a covered accident, and from which the employee is not likely<br />

to be aroused through powerful stimulation. This condition must be diagnosed and treated<br />

regularly by a physician. Coma does not mean any state of unconsciousness intentionally<br />

induced during the course of treatment of a covered Injury unless the state of<br />

unconsciousness results from the administration of anesthesia in preparation for surgical<br />

treatment of that covered accident.<br />

Severance - the complete and permanent separation and dismemberment of the part from<br />

the body.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

10

APPENDIX A<br />

(cont.)<br />

Schedule of Insurance for Steelworkers<br />

For Collective Bargaining Agreement October 27, 2008, through March 10, 2013<br />

Optional AD&D Insurance<br />

Optional AD&D insurance pays a percentage of the AD&D coverage amount based on<br />

the type of loss incurred, as shown in this chart:<br />

Type of Loss*:<br />

Percentage of AD&D Coverage Amount Paid<br />

If You Suffer a<br />

Loss<br />

If Your<br />

Covered<br />

Spouse Suffers<br />

a Loss<br />

If Your<br />

Covered Child<br />

Suffers a Loss<br />

Life 100% 100% 100%<br />

Two or more (hands or feet) 100% 100% 200%<br />

Sight in both eyes 100% 100% 200%<br />

One hand and one foot 100% 100% 200%<br />

One hand or one foot and sight 100% 100% 200%<br />

in one eye<br />

Speech and hearing in both 100% 100% 200%<br />

ears<br />

Use of four limbs<br />

100% 100% 200%<br />

(quadriplegia)<br />

Use of both lower limbs or<br />

75% 75% 150%<br />

both upper limbs (paraplegia)<br />

Use of both limbs on the same 50% 50% 100%<br />

side of the body (hemiplegia)<br />

One hand or one foot 75% 75% 150%<br />

Sight in one eye 60% 60% 120%<br />

Speech or hearing in both ears 85% 85% 170%<br />

Thumb and index finger of<br />

same hand<br />

Severance and reattachment of<br />

one hand or foot<br />

Maximum benefit for all losses<br />

in any one accident<br />

25% 25% 50%<br />

25% 25% 50%<br />

100% 100% $100,000<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

11

* A loss is defined as:<br />

• For a hand or a foot: severance through or above the wrist or ankle<br />

• For sight: complete, total and irrecoverable loss to the sight of the eye<br />

• For speech: complete, total and irrecoverable loss of speech<br />

• For hearing: complete, total and irrecoverable loss of hearing<br />

• For thumb and index finger: complete and total severance at or above the knuckles<br />

• For quadriplegia: total paralysis of both arms and legs<br />

• For paraplegia: total paralysis of both arms or both legs<br />

• For hemiplegia: total paralysis of the arm and leg on the same side of the body.<br />

Paralysis means the total loss of use of an arm or leg. Severance means the complete and<br />

permanent separation and dismemberment of the part from the body.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

12

APPENDIX B<br />

Additional <strong>Benefits</strong> for Steelworkers<br />

For Collective Bargaining Agreement October 27, 2008, through March 10, 2013<br />

The following benefits are paid in addition to any other Accidental Death &<br />

Dismemberment (AD&D) benefits payable.<br />

Brain Damage Benefit: The benefit shown will be paid if an<br />

employee suffers a covered injury that results directly and<br />

independently of all other causes from a covered accident and<br />

results in brain damage. The benefit will be payable if all of<br />

the following conditions are met:<br />

• Brain damage begins within 60 days from the date of<br />

the covered accident<br />

• The employee is hospitalized for treatment of brain<br />

damage at least seven days within the first 120 days<br />

following the covered accident<br />

• Brain damage continues for 12 consecutive months<br />

• A physician determines that as a result of brain<br />

damage, the employee is permanently and totally<br />

disabled at the end of the 12 consecutive month<br />

period.<br />

The benefit will be paid in one lump sum at the beginning of<br />

the 13 th month following the date of the covered accident if<br />

brain damage continues longer than 12 consecutive months.<br />

The amount payable will not exceed $20,000.<br />

$20,000<br />

Definitions:<br />

Brain Damage – physical damage to the brain that results<br />

directly and independently of all other causes from a Covered<br />

Accident and causes the covered person to be permanently<br />

and totally disabled.<br />

Permanently and Totally Disabled – a covered person who<br />

is totally disabled and is expected to remain totally disabled,<br />

as certified by a physician, for the rest of his life.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

13

Felonious Assault and Violent Crime Benefit: The benefit<br />

shown will be paid, subject to the following conditions and<br />

exclusions, when the employee suffers a covered loss<br />

resulting directly and independently of all other causes from a<br />

covered accident that occurs during a violent crime or<br />

felonious assault as described below. A police report<br />

detailing the felonious assault or violent crime must be<br />

provided before any benefits will be paid.<br />

10% of the applicable<br />

benefits, subject to a<br />

minimum of $100 and<br />

a maximum of $10,000<br />

To qualify for a benefit payment, the covered accident must<br />

occur during any of the following:<br />

• Actual or attempted robbery or holdup<br />

• Actual or attempted kidnapping<br />

• Any other type of intentional assault that is a crime<br />

classified as a felony by the governing statute or common<br />

law in the state where the felony occurred.<br />

Exclusions:<br />

<strong>Benefits</strong> will not be paid for treatment of any covered injury<br />

sustained or covered loss incurred during any:<br />

• Violent crime or felonious assault committed by the<br />

covered person<br />

• Felonious assault or violent crime committed upon the<br />

employee by a fellow employee, family member, or<br />

member of the same household.<br />

Definitions:<br />

Family Member - the covered person’s parent, step-parent,<br />

spouse or domestic partner or former spouse or domestic<br />

partner, son, daughter, brother, sister, mother-in-law, fatherin-law,<br />

son-in-law, daughter-in-law, brother-in-law, sister-inlaw,<br />

aunt, uncle, cousins, grandparent, grandchild and<br />

stepchild.<br />

Fellow Employee - a person employed by the same employer<br />

as the employee or by an employer that is an affiliated or<br />

subsidiary corporation. It shall also include any person who<br />

was so employed, but whose employment was terminated not<br />

more than 45 days prior to the date on which the defined<br />

violent crime/felonious assault was committed.<br />

Member of the Same Household - a person who maintains<br />

residence at the same address as the covered person.<br />

Accidental Death & Dismemberment Insurance <strong>Plan</strong><br />

April 2011<br />

14

Home Alternation and Vehicle Modification Benefit: The<br />

benefit shown will be paid, subject to the following conditions<br />

and exclusions in Q&A10, when the employee suffers a<br />

covered loss, other than a loss of life, resulting directly and<br />

independently of all other causes from a covered accident.<br />

$2,000<br />

This benefit will be payable if all of the following conditions<br />

are met:<br />

• The employee did not require the use of any adaptive<br />

devices or adaptation of residence and/or vehicle prior to<br />

the date of the covered accident causing such covered loss<br />

• The employee now requires such adaptive devices or<br />

adaptation of residence and/or vehicle to maintain an<br />

independent lifestyle as a direct result of such covered loss<br />

• The employee requires home alteration or vehicle<br />

modification within one year of the date of the covered<br />

accident.<br />

Hospital Stay Benefit: The benefit shown will be paid,<br />

subject to the following conditions and exclusions (refer to the<br />

“Exclusions” section), if the covered person requires a<br />

hospital stay due to a covered loss resulting directly and<br />

independently of all other causes from a covered accident.<br />

The hospital stay must meet all of the following:<br />

• Be at the direction and under the care of a physician<br />

• Begin within 90 days of the covered accident<br />

• Begin while the covered person’s AD&D insurance is in<br />

effect.<br />

The benefit will be paid for each day of a continuous hospital<br />

stay that continues after the end of the benefit waiting period<br />