Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Cummins</strong> <strong>Inc</strong>. does not distinguish raw materials from work-in-progress because<br />

of the constant movement of resources from different locations. They also<br />

recognize their inventories using either the lower of cost or the net realizable<br />

value. Inventory management is a huge component of <strong>Cummins</strong> <strong>Inc</strong>. key<br />

accounting policies. Choice of accounting policy for valuing inventory can have a<br />

significant influence on the assets of the balance sheet. <strong>Cummins</strong> <strong>Inc</strong>. values<br />

78% of its domestic inventory using FIFO <strong>and</strong> the remaining 22%, comprised<br />

mostly of heavy-duty, high-horsepower engines <strong>and</strong> parts are valued using LIFO.<br />

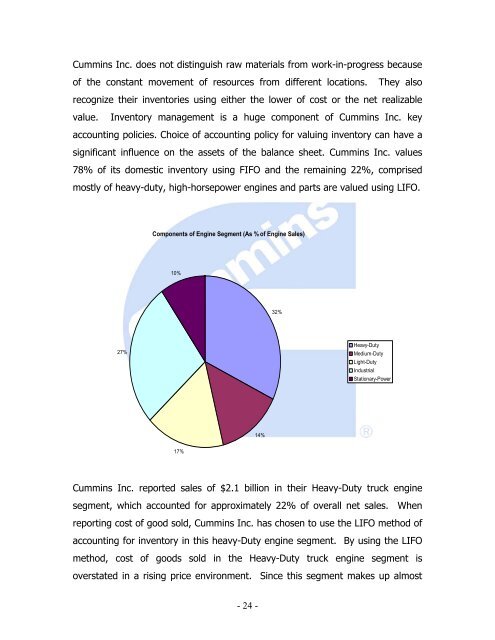

Components of Engine Segment (As % of Engine Sales)<br />

10%<br />

32%<br />

27%<br />

Heavy-Duty<br />

Medium-Duty<br />

Light-Duty<br />

Industrial<br />

Stationary-Power<br />

14%<br />

17%<br />

<strong>Cummins</strong> <strong>Inc</strong>. reported sales of $2.1 billion in their Heavy-Duty truck engine<br />

segment, which accounted for approximately 22% of overall net sales. When<br />

reporting cost of good sold, <strong>Cummins</strong> <strong>Inc</strong>. has chosen to use the LIFO method of<br />

accounting for inventory in this heavy-Duty engine segment. By using the LIFO<br />

method, cost of goods sold in the Heavy-Duty truck engine segment is<br />

overstated in a rising price environment. Since this segment makes up almost<br />

- 24 -