Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

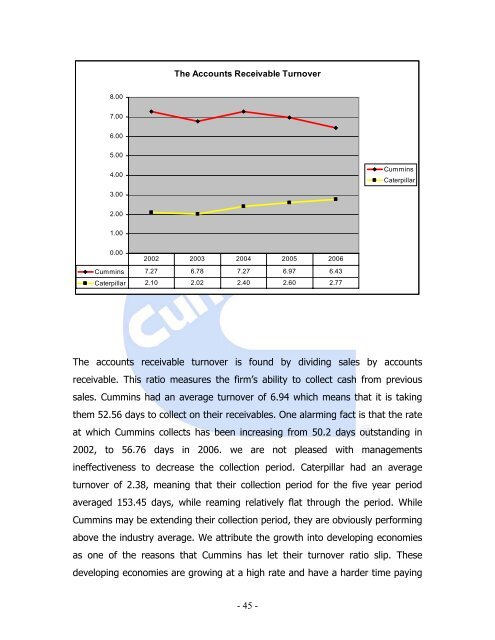

The Accounts Receivable Turnover<br />

8.00<br />

7.00<br />

6.00<br />

5.00<br />

4.00<br />

<strong>Cummins</strong><br />

Caterpillar<br />

3.00<br />

2.00<br />

1.00<br />

0.00<br />

2002 2003 2004 2005 2006<br />

<strong>Cummins</strong> 7.27 6.78 7.27 6.97 6.43<br />

Caterpillar 2.10 2.02 2.40 2.60 2.77<br />

The accounts receivable turnover is found by dividing sales by accounts<br />

receivable. This ratio measures the firm’s ability to collect cash from previous<br />

sales. <strong>Cummins</strong> had an average turnover of 6.94 which means that it is taking<br />

them 52.56 days to collect on their receivables. One alarming fact is that the rate<br />

at which <strong>Cummins</strong> collects has been increasing from 50.2 days outst<strong>and</strong>ing in<br />

2002, to 56.76 days in 2006. we are not pleased with managements<br />

ineffectiveness to decrease the collection period. Caterpillar had an average<br />

turnover of 2.38, meaning that their collection period for the five year period<br />

averaged 153.45 days, while reaming relatively flat through the period. While<br />

<strong>Cummins</strong> may be extending their collection period, they are obviously performing<br />

above the industry average. We attribute the growth into developing economies<br />

as one of the reasons that <strong>Cummins</strong> has let their turnover ratio slip. These<br />

developing economies are growing at a high rate <strong>and</strong> have a harder time paying<br />

- 45 -