Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

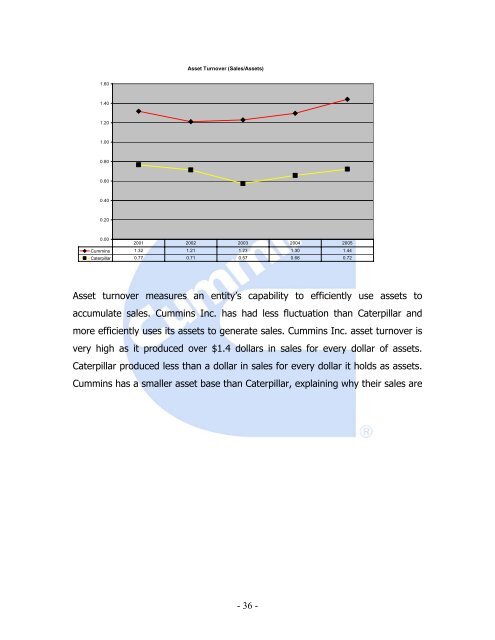

Asset Turnover (Sales/Assets)<br />

1.60<br />

1.40<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

0.00<br />

2001 2002 2003 2004 2005<br />

<strong>Cummins</strong> 1.32 1.21 1.23 1.30 1.44<br />

Caterpillar 0.77 0.71 0.57 0.66 0.72<br />

Asset turnover measures an entity’s capability to efficiently use assets to<br />

accumulate sales. <strong>Cummins</strong> <strong>Inc</strong>. has had less fluctuation than Caterpillar <strong>and</strong><br />

more efficiently uses its assets to generate sales. <strong>Cummins</strong> <strong>Inc</strong>. asset turnover is<br />

very high as it produced over $1.4 dollars in sales for every dollar of assets.<br />

Caterpillar produced less than a dollar in sales for every dollar it holds as assets.<br />

<strong>Cummins</strong> has a smaller asset base than Caterpillar, explaining why their sales are<br />

- 36 -