Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

Cummins Inc. Equity Valuation and Analysis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

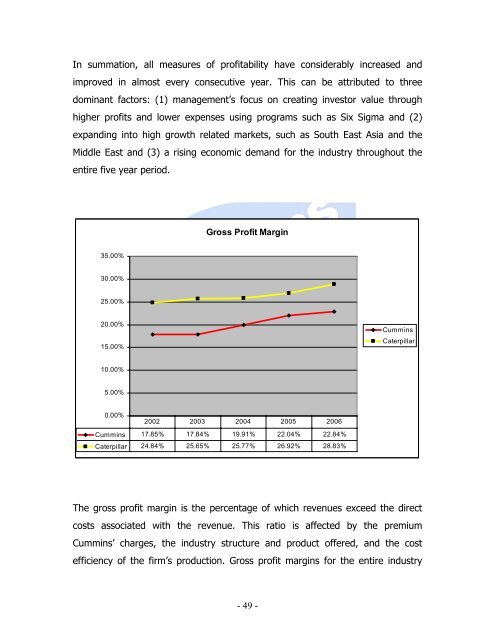

In summation, all measures of profitability have considerably increased <strong>and</strong><br />

improved in almost every consecutive year. This can be attributed to three<br />

dominant factors: (1) management’s focus on creating investor value through<br />

higher profits <strong>and</strong> lower expenses using programs such as Six Sigma <strong>and</strong> (2)<br />

exp<strong>and</strong>ing into high growth related markets, such as South East Asia <strong>and</strong> the<br />

Middle East <strong>and</strong> (3) a rising economic dem<strong>and</strong> for the industry throughout the<br />

entire five year period.<br />

Gross Profit Margin<br />

35.00%<br />

30.00%<br />

25.00%<br />

20.00%<br />

15.00%<br />

<strong>Cummins</strong><br />

Caterpillar<br />

10.00%<br />

5.00%<br />

0.00%<br />

2002 2003 2004 2005 2006<br />

<strong>Cummins</strong> 17.85% 17.84% 19.91% 22.04% 22.84%<br />

Caterpillar 24.84% 25.65% 25.77% 26.92% 28.83%<br />

The gross profit margin is the percentage of which revenues exceed the direct<br />

costs associated with the revenue. This ratio is affected by the premium<br />

<strong>Cummins</strong>’ charges, the industry structure <strong>and</strong> product offered, <strong>and</strong> the cost<br />

efficiency of the firm’s production. Gross profit margins for the entire industry<br />

- 49 -