FORM 20-F THOMSON multimedia - Technicolor

FORM 20-F THOMSON multimedia - Technicolor

FORM 20-F THOMSON multimedia - Technicolor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

As a result of the Tax Indemnification Agreement, Thomson S.A. paid us 0 30 million for 1998<br />

(plus 0 21 million for the gross-up), 0 35 million for 1999 (plus 0 23 million in respect of the gross-up)<br />

and 0 51 million for <strong>20</strong>00 (plus 0 31 million in respect of the gross-up).<br />

In addition, in <strong>20</strong>00, we recorded a deferred income tax gain of 0 106 million, principally due to<br />

0 25 million of timing differences and to 0 81 million on valuation allowance reversals concerning<br />

mainly deferred tax assets of U.S. and France affiliates. This reversal was possible because of<br />

confirmed profitability of these companies for three continuing years.<br />

Net Income<br />

Minority interests represented a net loss of 0 18 million in <strong>20</strong>00 compared with a net loss of<br />

0 7 million in 1999.<br />

As a result of the factors discussed above, we posted net income of 0 394 million in <strong>20</strong>00,<br />

which represented an increase of 70% compared with net income of 0 231 million in 1999. Net<br />

income as a percentage of net sales reached 4.3%, an increase of 0.8 percentage point compared<br />

with 1999.<br />

Earnings per share reached 0 1.56 in <strong>20</strong>00, compared with 0 1.17 in 1999, or an increase<br />

of 33.5%. This progression takes into account an increase in the average number of shares to<br />

252.0 million shares in <strong>20</strong>00 from 197.5 million in 1999 (restated to take into account the two-for-one<br />

stock split realized on June 16, <strong>20</strong>00) as a result of the November 1999 and October <strong>20</strong>00 capital<br />

increases.<br />

U.S. GAAP<br />

Under U.S. GAAP, we recorded a net income of 0 136 million for <strong>20</strong>00 compared to<br />

0 148 million in 1999. The lower net income under U.S. GAAP versus French GAAP in <strong>20</strong>00 resulted<br />

mainly from restatements related to the employee offerings of February 1999, November 1999 and<br />

October <strong>20</strong>00, to sale/ leaseback accounting and to tax effects of restatements.<br />

Please refer to Notes 29 and 30 of our consolidated financial statements for a further discussion<br />

on the principal differences between French GAAP and U.S. GAAP.<br />

Liquidity and Capital Resources<br />

Cash Flows<br />

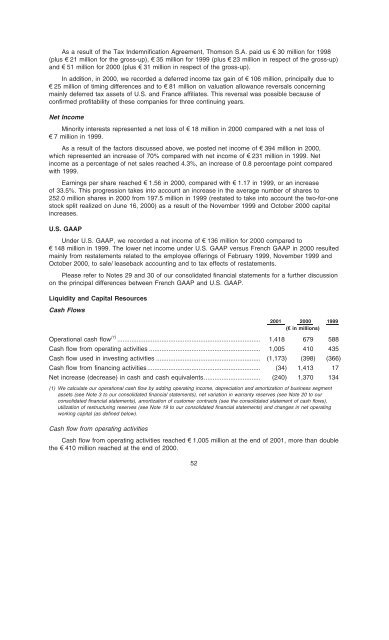

<strong>20</strong>01 <strong>20</strong>00 1999<br />

(1 in millions)<br />

Operational cash flow (1) ................................................................................. 1,418 679 588<br />

Cash flow from operating activities ............................................................... 1,005 410 435<br />

Cash flow used in investing activities ........................................................... (1,173) (398) (366)<br />

Cash flow from financing activities................................................................ (34) 1,413 17<br />

Net increase (decrease) in cash and cash equivalents................................ (240) 1,370 134<br />

(1) We calculate our operational cash flow by adding operating income, depreciation and amortization of business segment<br />

assets (see Note 3 to our consolidated financial statements), net variation in warranty reserves (see Note <strong>20</strong> to our<br />

consolidated financial statements), amortization of customer contracts (see the consolidated statement of cash flows),<br />

utilization of restructuring reserves (see Note 19 to our consolidated financial statements) and changes in net operating<br />

working capital (as defined below).<br />

Cash flow from operating activities<br />

Cash flow from operating activities reached 0 1,005 million at the end of <strong>20</strong>01, more than double<br />

the 0 410 million reached at the end of <strong>20</strong>00.<br />

52