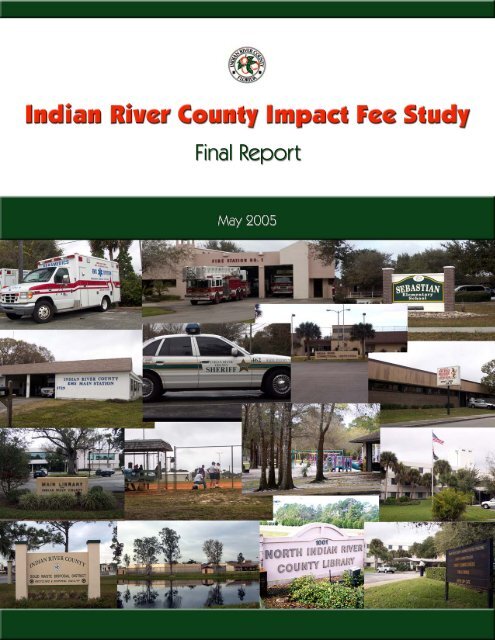

Indian River County Impact Fee Study Final Report - irccdd.com

Indian River County Impact Fee Study Final Report - irccdd.com

Indian River County Impact Fee Study Final Report - irccdd.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(This page left blank intentionally)

Table of Contents<br />

FINAL REPORT<br />

INDIAN RIVER COUNTY IMPACT FEE STUDY<br />

I. Introduction and Policy Summary............................................................. I-1<br />

Introduction.................................................................................................... I-1<br />

Policy Summary............................................................................................. I-2<br />

Overview............................................................................................ I-3<br />

Purpose of the Policy Summary......................................................... I-3<br />

Legal Requirements for <strong>Impact</strong> <strong>Fee</strong>s ............................................................. I-3<br />

<strong>Impact</strong> <strong>Fee</strong> Definition ........................................................................ I-3<br />

<strong>Impact</strong> <strong>Fee</strong> vs. Tax............................................................................. I-3<br />

Legal Framework for Imposing <strong>Impact</strong> <strong>Fee</strong>s..................................... I-3<br />

Authority to Impose <strong>Impact</strong> <strong>Fee</strong>s in IRC........................................... I-3<br />

Compliance with State and Federal Constitutional Requirements .... I-4<br />

Defensible <strong>Impact</strong> <strong>Fee</strong> Methodology................................................. I-4<br />

Level of Service (LOS) Standards ..................................................... I-4<br />

Revenue Credits................................................................................. I-5<br />

<strong>Impact</strong> <strong>Fee</strong> Implementation Considerations .................................................. I-5<br />

Administration ................................................................................... I-5<br />

Effective Date of Implementation...................................................... I-5<br />

Applicability of <strong>Impact</strong> <strong>Fee</strong>s on Future Development....................... I-6<br />

Intergovernmental Coordination and <strong>County</strong>wide Administration ... I-6<br />

Imposition, Calculation, and Collection of <strong>Impact</strong> <strong>Fee</strong>s.................... I-7<br />

Use of <strong>Impact</strong> <strong>Fee</strong> Revenue ............................................................... I-7<br />

Developer Credits .............................................................................. I-8<br />

Exempting or Paying <strong>Impact</strong> <strong>Fee</strong>s from Other Revenue Sources...... I-9<br />

Updating the <strong>Impact</strong> <strong>Fee</strong> Program and Indexing the <strong>Fee</strong>s................. I-10<br />

Appeals Process ................................................................................. I-10<br />

LOS Standards and <strong>Fee</strong> Review .................................................................... I-10<br />

Funding Source Review................................................................................. I-11<br />

Review of Current Capital Funding Sources by Program Area......... I-11<br />

Summary of Legal Requirements .................................................................. I-15<br />

II. Current & Projected Population ................................................................ II-1<br />

Population Assumptions ................................................................................ II-1<br />

Apportionment of Demand by Residential Unit Type and Size .................... II-3<br />

Functional Population .................................................................................... II-6<br />

III.<br />

Correctional Facilities ................................................................................. III-1<br />

Inventory........................................................................................................ III-1<br />

Population ...................................................................................................... III-5<br />

Level of Service ............................................................................................. III-5<br />

Cost Component............................................................................................. III-7<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 i <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Credit Component.......................................................................................... III-9<br />

Existing Deficiencies ..................................................................................... III-12<br />

Net Correctional Facilities <strong>Impact</strong> Cost......................................................... III-12<br />

Proposed Correctional Facilities <strong>Impact</strong> <strong>Fee</strong> Schedule ................................. III-13<br />

Future Demand Analysis................................................................................ III-15<br />

Estimated Revenues....................................................................................... III-15<br />

IV. Solid Waste Facilities................................................................................... IV-1<br />

Inventory ....................................................................................................... IV-1<br />

Population ...................................................................................................... IV-7<br />

Level of Service ............................................................................................. IV-7<br />

Demand Component ...................................................................................... IV-8<br />

Cost Component............................................................................................. IV-9<br />

Credit Component.......................................................................................... IV-13<br />

Existing Deficiencies ..................................................................................... IV-18<br />

Net Solid Waste Facilities <strong>Impact</strong> Cost ......................................................... IV-18<br />

Proposed Solid Waste <strong>Impact</strong> <strong>Fee</strong> Schedule.................................................. IV-19<br />

Future Demand Analysis................................................................................ IV-21<br />

Estimated Revenues....................................................................................... IV-22<br />

V. Public Buildings ........................................................................................... V-1<br />

Inventory........................................................................................................ V-1<br />

Population ...................................................................................................... V-5<br />

Level of Service ............................................................................................. V-6<br />

Cost Component............................................................................................. V-7<br />

Credit Component.......................................................................................... V-9<br />

Existing Deficiencies ..................................................................................... V-12<br />

Net Public Building <strong>Impact</strong> Cost ................................................................... V-12<br />

Proposed Public Building <strong>Impact</strong> <strong>Fee</strong> Schedule............................................ V-13<br />

Future Demand Analysis................................................................................ V-15<br />

Estimated Revenues....................................................................................... V-16<br />

VI. Libraries........................................................................................................ VI-1<br />

Inventory........................................................................................................ VI-1<br />

Population ...................................................................................................... VI-6<br />

Level of Service ............................................................................................. VI-6<br />

Cost Component............................................................................................. VI-9<br />

Credit Component.......................................................................................... VI-14<br />

Existing Deficiencies ..................................................................................... VI-19<br />

Net Library Facility, Items, and Equipment <strong>Impact</strong> Cost.............................. VI-19<br />

Persons per Housing Unit by Land Use......................................................... VI-19<br />

Proposed Library <strong>Impact</strong> <strong>Fee</strong> Schedule ......................................................... VI-20<br />

Future Demand Analysis................................................................................ VI-21<br />

Estimated Revenues....................................................................................... VI-23<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 ii <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

VII.<br />

Emergency Services ..................................................................................... VII-1<br />

Inventory........................................................................................................ VII-1<br />

Population ...................................................................................................... VII-6<br />

Level of Service ............................................................................................. VII-7<br />

Cost Component............................................................................................. VII-8<br />

Credit Component.......................................................................................... VII-11<br />

Existing Deficiencies ..................................................................................... VII-14<br />

Net Fire/EMS <strong>Impact</strong> Cost............................................................................. VII-14<br />

Proposed Fire/EMS <strong>Impact</strong> <strong>Fee</strong> Schedule ..................................................... VII-15<br />

Future Demand Analysis................................................................................ VII-17<br />

Estimated Revenues....................................................................................... VII-18<br />

VIII. Law Enforcement......................................................................................... VIII-1<br />

Inventory........................................................................................................ VIII-1<br />

Population ...................................................................................................... VIII-2<br />

Level of Service ............................................................................................. VIII-5<br />

Cost Component............................................................................................. VIII-6<br />

Credit Component.......................................................................................... VIII-9<br />

Existing Deficiencies .....................................................................................VIII-13<br />

Net Law Enforcement <strong>Impact</strong> Cost................................................................VIII-13<br />

Proposed Law Enforcement <strong>Impact</strong> <strong>Fee</strong> Schedule ........................................VIII-14<br />

Future Demand Analysis................................................................................VIII-16<br />

Estimated Revenues.......................................................................................VIII-17<br />

IX. Public Education Facilities.......................................................................... IX-1<br />

Inventory........................................................................................................ IX-1<br />

Population ...................................................................................................... IX-5<br />

Level of Service ............................................................................................. IX-5<br />

Cost Component............................................................................................. IX-6<br />

Credit Component.......................................................................................... IX-9<br />

Existing Deficiencies ..................................................................................... IX-13<br />

Net <strong>Impact</strong> Cost per Student.......................................................................... IX-13<br />

Student Generation Rate ................................................................................ IX-14<br />

Proposed School <strong>Impact</strong> <strong>Fee</strong> Schedule.......................................................... IX-15<br />

Future Demand Analysis................................................................................ IX-15<br />

Estimated Revenues....................................................................................... IX-16<br />

X. Parks and Recreation Facilities .................................................................. X-1<br />

Inventory........................................................................................................ X-1<br />

Population ...................................................................................................... X-9<br />

Level of Service Standard.............................................................................. X-9<br />

Cost Component............................................................................................. X-11<br />

Credit Component.......................................................................................... X-16<br />

Existing Deficiencies ..................................................................................... X-21<br />

Net Parks and Recreational Facilities <strong>Impact</strong> Cost........................................ X-21<br />

Residents per Housing Unit by Housing Type .............................................. X-22<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 iii <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Tables<br />

Proposed Parks and Recreation <strong>Impact</strong> <strong>Fee</strong> Schedule ................................... X-23<br />

Future Demand Analysis................................................................................ X-23<br />

Estimated Revenues....................................................................................... X-24<br />

Table I-1 <strong>Impact</strong> <strong>Fee</strong> Service Area Considerations by Program Area .............. I-9<br />

Table I-2 Current and Re<strong>com</strong>mended Standards by <strong>Impact</strong> <strong>Fee</strong><br />

Program Area..................................................................................... I-12<br />

Table I-3 Comparison of <strong>Fee</strong>s by <strong>Impact</strong> <strong>Fee</strong> Program Area............................ I-13<br />

Table I-4 Historical and Projected Capital Facility Expenditures..................... I-14<br />

Table II-1 IRC Population Estimates and Projections ........................................ II-2<br />

Table II-2 <strong>County</strong>wide Residents per Housing Unit........................................... II-3<br />

Table II-3 <strong>County</strong>wide Residents per Housing Unit Excluding<br />

<strong>Indian</strong> <strong>River</strong> Shores............................................................................ II-3<br />

Table II-4 Unincorporated <strong>County</strong> Area Residents per Housing Unit................ II-4<br />

Table II-5 Nationwide Residents per Housing Unit – Single Family................. II-4<br />

Table II-6 <strong>County</strong>wide Residents per Housing Unit........................................... II-5<br />

Table II-7 <strong>County</strong>wide Excluding <strong>Indian</strong> <strong>River</strong> Shores – Residents<br />

per Housing Unit................................................................................ II-5<br />

Table II-8 Unincorporated <strong>County</strong> Area – Residents per Housing Unit............. II-6<br />

Table II-9 24-Hour/7-Day General Functional Population Coefficients ............ II-9<br />

Table II-10 11-Hour/5-Day General Functional Population Coefficients ............ II-10<br />

Table II-11 <strong>County</strong>wide Functional Population – Year 2004<br />

(24-Hour Analysis) ............................................................................ II-11<br />

Table II-12<br />

<strong>County</strong>wide Excluding <strong>Indian</strong> <strong>River</strong> Shores Functional<br />

Population - Year 2004 (24-Hour Analysis)...................................... II-12<br />

Table II-13 Unincorporated <strong>County</strong> Area Functional Population –<br />

Year 2004 (24-Hour Analysis)........................................................... II-13<br />

Table II-14 <strong>County</strong>wide Functional Population – Year 2004<br />

(11-Hour Analysis) ............................................................................ II-14<br />

Table II-15 Functional Residents for Residential Land Uses –<br />

Correctional Facilities (<strong>County</strong>wide)................................................. II-15<br />

Table II-16 Functional Residents for Residential Land Uses –<br />

Public Buildings................................................................................. II-16<br />

Table II-17 Functional Residents for Residential Land Uses –<br />

FIRE/EMS.......................................................................................... II-16<br />

Table II-18 Functional Residents for Residential Land Uses –<br />

Law Enforcement............................................................................... II-17<br />

Table II-19<br />

Assumptions for Nonresidential Land Uses and Functional<br />

Population Coefficients for <strong>Impact</strong> <strong>Fee</strong> Schedule -<br />

Public Buildings................................................................................. II-18<br />

Table II-20 Assumptions for Nonresidential Land Uses and Functional<br />

Population Coefficients for <strong>Impact</strong> <strong>Fee</strong> Schedule –<br />

Correctional Facilities, Fire/EMS, and Law Enforcement................. II-19<br />

Table III-1 Land & Buildings Inventory .............................................................. III-2<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 iv <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Table III-2 Current Level of Service.................................................................... III-5<br />

Table III-3 Level of Service Comparison – Year 2004........................................ III-6<br />

Table III-4 Functional Residents Level of Service .............................................. III-6<br />

Table III-5 Land & Buildings Cost ...................................................................... III-7<br />

Table III-6 Equipment Cost.................................................................................. III-8<br />

Table III-7 Programmed Capital Costs ................................................................ III-8<br />

Table III-8 Unit Cost per Functional Resident..................................................... III-9<br />

Table III-9 Historical Capital Expenditures – Funding Sources .......................... III-10<br />

Table III-10 Revenue per Functional Resident ...................................................... III-11<br />

Table III-11 Credit per Functional Resident .......................................................... III-11<br />

Table III-12 Net <strong>Impact</strong> Cost ................................................................................. III-12<br />

Table III-13 <strong>Impact</strong> <strong>Fee</strong> Schedule.......................................................................... III-13<br />

Table III-14 2025 Demand and Cost Forecast ...................................................... III-15<br />

Table III-15 Annual <strong>Impact</strong> <strong>Fee</strong> Revenue Estimates ............................................. III-16<br />

Table IV-1 Summary of SWDD Capital Facilities Inventory .............................. IV-3<br />

Table IV-2 Current Level of Service.................................................................... IV-7<br />

Table IV-3 Demand Component .......................................................................... IV-8<br />

Table IV-4 Proposed Capital Expenditures – FY 05/06 – 09/10.......................... IV-10<br />

Table IV-5 Planned Capital Expansion Expenditures .......................................... IV-11<br />

Table IV-6 Distribution of Capital Expansion Expenditures ............................... IV-12<br />

Table IV-7 Historical Revenue Sources ............................................................... IV-14<br />

Table IV-8 Changes in the Assessment <strong>Fee</strong> Rates ............................................... IV-15<br />

Table IV-9 Total Credit per Resident................................................................... IV-16<br />

Table IV-10 Changes in the Fund Balance............................................................. IV-17<br />

Table IV-11 Net <strong>Impact</strong> Cost ................................................................................. IV-18<br />

Table IV-12 Single Family Solid Waste <strong>Impact</strong> <strong>Fee</strong>.............................................. IV-19<br />

Table IV-13 Proposed Solid Waste <strong>Impact</strong> <strong>Fee</strong> Schedule...................................... IV-20<br />

Table V-1 Summary of Public Building Inventory............................................. V-2<br />

Table V-2 Leased-Out/Rented <strong>County</strong>-Owned Public Facilities........................ V-5<br />

Table V-3 Leased Public Facilities ..................................................................... V-5<br />

Table V-4 Current Level of Service.................................................................... V-6<br />

Table V-5 Level of Service Comparison............................................................. V-7<br />

Table V-6 Public Building Replacement Cost .................................................... V-8<br />

Table V-7 Total <strong>Impact</strong> Cost per Functional Resident ...................................... V-9<br />

Table V-8 Programmed Expenditures per Functional Resident ......................... V-10<br />

Table V-9 Capital Improvement Credit per Functional Resident ...................... V-11<br />

Table V-10 Vacant Land Value Percentage.......................................................... V-12<br />

Table V-11 Net Public Building <strong>Impact</strong> Cost per Functional Resident................ V-13<br />

Table V-12 Proposed Public Building <strong>Impact</strong> <strong>Fee</strong> Schedule................................ V-14<br />

Table V-13 2025 Demand and Cost Forecast ...................................................... V-16<br />

Table V-14 Annual <strong>Impact</strong> <strong>Fee</strong> Revenue Estimates ........................................... V-17<br />

Table VI-1 Summary of IRC Library Building Inventory ................................... VI-1<br />

Table VI-2 Summary of IRC Library Material Inventory.................................... VI-5<br />

Table VI-3 Summary of IRC Library Equipment Inventory................................ VI-6<br />

Table VI-4 Current Level of Service.................................................................... VI-7<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 v <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Table VI-5 Comparison of IRC Current LOS to FLA Standards Library<br />

Materials and Computers ................................................................... VI-8<br />

Table VI-6 Comparison of IRC LOS to Surrounding Counties ........................... VI-8<br />

Table VI-7 Comparison of Current LOS and LOS Standards.............................. VI-9<br />

Table VI-8 Building Unit Costs............................................................................ VI-10<br />

Table VI-9 Land Costs ......................................................................................... VI-11<br />

Table VI-10 Summary of Building and Land Costs per Resident.......................... VI-11<br />

Table VI-11 Library Material Unit Costs............................................................... VI-12<br />

Table VI-12 Library Equipment Unit Costs........................................................... VI-13<br />

Table VI-13 Library Materials and Equipment Cost per Resident......................... VI-14<br />

Table VI-14 Library Historical and Programmed Capital Expansion<br />

Funding Sources................................................................................. VI-15<br />

Table VI-15 Vacant Land Value Percentage.......................................................... VI-16<br />

Table VI-16 Equipment Value Credit .................................................................... VI-17<br />

Table VI-17 Total Credit per Resident................................................................... VI-18<br />

Table VI-18 Net Library Facilities <strong>Impact</strong> Cost..................................................... VI-19<br />

Table VI-19 Persons per Housing Unit by Land Use ............................................ VI-20<br />

Table VI-20 Proposed Library <strong>Impact</strong> <strong>Fee</strong> Schedule ............................................. VI-20<br />

Table VI-21 2025 Demand and Cost Forecast ...................................................... VI-21<br />

Table VI-22 Annual <strong>Impact</strong> <strong>Fee</strong> Revenue Estimates ............................................. VI-23<br />

Table VII-1 Land & Buildings Inventory .............................................................. VII-2<br />

Table VII-2 Vehicle Inventory Replacement Cost ................................................ VII-5<br />

Table VII-3 Capital Equipment Replacement Cost ............................................... VII-6<br />

Table VII-4 Current Level of Service (2009) ........................................................ VII-7<br />

Table VII-5 Current Level of Service Comparison ............................................... VII-8<br />

Table VII-6 Building Replacement Cost ............................................................... VII-9<br />

Table VII-7 Station Equipment Costs.................................................................... VII-10<br />

Table VII-8 Five Year Programmed and Planned Capital Expenditures............... VII-10<br />

Table VII-9 <strong>Impact</strong> Cost per Functional Resident ................................................ VII-11<br />

Table VII-10 Six-Year Historical Capital Expenditures.......................................... VII-12<br />

Table VII-11 Credit per Functional Resident .......................................................... VII-13<br />

Table VII-12 Percent of Past Property Tax Payments on Vacant Land .................. VII-14<br />

Table VII-13 Net <strong>Impact</strong> Cost per Functional Resident ......................................... VII-15<br />

Table VII-14 Proposed Fire/EMS <strong>Impact</strong> <strong>Fee</strong> Schedule ......................................... VII-16<br />

Table VII-15 2025 Demand and Cost Forecast ....................................................... VII-18<br />

Table VII-16 Annual <strong>Impact</strong> <strong>Fee</strong> Revenue Estimates ............................................ VII-19<br />

Table VIII-1 Land and Building Inventory............................................................. VIII-2<br />

Table VIII-2 Current Level of Service (2004) ........................................................ VIII-5<br />

Table VIII-3 Level of Service Comparison – Year 2000........................................ VIII-5<br />

Table VIII-4 Functional Residents Level of Service .............................................. VIII-6<br />

Table VIII-5 Building and Land Replacement Cost ............................................... VIII-7<br />

Table VIII-6 Equipment Cost.................................................................................. VIII-8<br />

Table VIII-7 Unit Cost per Functional Resident..................................................... VIII-9<br />

Table VIII-8 Historical Capital Expenditures – Expansion/Replacement ..............VIII-10<br />

Table VIII-9 Revenue per Functional Resident ......................................................VIII-11<br />

Table VIII-10 Vacant Land Value Percentage..........................................................VIII-12<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 vi <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Table VIII-11 Credit per Functional Resident ..........................................................VIII-13<br />

Table VIII-12 Net <strong>Impact</strong> Cost .................................................................................VIII-14<br />

Table VIII-13 Proposed Law Enforcement <strong>Impact</strong> <strong>Fee</strong> Schedule ............................VIII-15<br />

Table VIII-14 2025 Demand and Cost Forecast ......................................................VIII-17<br />

Table VIII-15 Annual <strong>Impact</strong> <strong>Fee</strong> Revenue Estimates .............................................VIII-18<br />

Table IX-1 Current Level of Service (2004) ........................................................ IX-5<br />

Table IX-2 Facility Cost Per Student Station ...................................................... IX-7<br />

Table IX-3 Total <strong>Impact</strong> Cost per Student ........................................................... IX-9<br />

Table IX-4 State Revenue Credit.......................................................................... IX-11<br />

Table IX-5 2-Mill Revenue Credit ....................................................................... IX-12<br />

Table IX-6 Vacant Land Credit............................................................................ IX-13<br />

Table IX-7 Net <strong>Impact</strong> Cost per Student.............................................................. IX-14<br />

Table IX-8 Student Generation Rate .................................................................... IX-14<br />

Table IX-9 Proposed School <strong>Impact</strong> <strong>Fee</strong> Schedule.............................................. IX-15<br />

Table IX-10 2025 Demand and Cost Forecast ...................................................... IX-16<br />

Table IX-11 Annual <strong>Impact</strong> <strong>Fee</strong> Revenue Estimates ............................................. IX-17<br />

Table X-1 Parks & Recreation Facilities Inventory –<br />

Unincorporated <strong>County</strong> Area............................................................. X-3<br />

Table X-2 Parks & Recreation Facilities Current Level of Service.................... X-10<br />

Table X-3 Level of Service Comparison............................................................. X-10<br />

Table X-4 Landscaping and Site Improvements Cost per Acre.......................... X-11<br />

Table X-5 Utilities and Paving Cost per Acre..................................................... X-12<br />

Table X-6 Total Land Cost per Resident ............................................................ X-13<br />

Table X-7 Regional Parks Equipment/Buildings Replacement Cost.................. X-14<br />

Table X-8<br />

Community/Neighborhood Parks Equipment/Buildings<br />

Replacement Cost .............................................................................. X-15<br />

Table X-9 Programmed Capital Costs ................................................................ X-16<br />

Table X-10 Unit Cost per Resident....................................................................... X-16<br />

Table X-11 Historical Capital Expenditures – Funding Sources .......................... X-18<br />

Table X-12 Capital Improvement Credit per Resident ......................................... X-19<br />

Table X-13 Vacant Land Value Percentage.......................................................... X-20<br />

Table X-14 Credit per Resident ............................................................................ X-21<br />

Table X-15 Net <strong>Impact</strong> Cost per Resident ............................................................ X-22<br />

Table X-16 Residents per Housing Unit by Housing Type .................................. X-23<br />

Table X-17<br />

Proposed Parks and Recreation Facilities <strong>Impact</strong><br />

<strong>Fee</strong> Schedule ...................................................................................... X-23<br />

Table X-18 2025 Demand and Cost Forecast ...................................................... X-24<br />

Table X-19 Annual <strong>Impact</strong> <strong>Fee</strong> Revenue Estimates ............................................. X-25<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 vii <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Maps<br />

Map III-1 Correctional Facility Locations.......................................................... III-3<br />

Map IV-1 Solid Waste Facility Locations .......................................................... IV-5<br />

Map V-1 Public Building Facility Locations .................................................... V-3<br />

Map VI-1 Library Facility Locations.................................................................. VI-3<br />

Map VII-1 Fire/EMS Facility Locations.............................................................. VII-3<br />

Map VIII-1 Law Enforcement Facility Locations................................................. VIII-3<br />

Map IX-1 Public Education Facility Locations .................................................. IX-3<br />

Map X-1 <strong>County</strong> Parks Locations ..................................................................... X-7<br />

Appendices<br />

Appendix A<br />

Appendix B<br />

Appendix C<br />

Appendix D<br />

Appendix E<br />

Appendix F<br />

Appendix G<br />

Appendix H<br />

Population Estimate & Functional Population – Supplemental Information<br />

Property Values – Supplemental Information<br />

Solid Waste <strong>Impact</strong> <strong>Fee</strong> Schedule – WGU Based<br />

Current and Future School District Facility Inventories<br />

Legal Requirements for Imposing <strong>Impact</strong> <strong>Fee</strong>s<br />

Review of Standards by <strong>Impact</strong> <strong>Fee</strong> Program Area<br />

Comparison of Selected <strong>Fee</strong>s in Florida<br />

Policy Presentation to Elected Officials<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 viii <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

FINAL REPORT<br />

INDIAN RIVER COUNTY IMPACT FEE STUDY<br />

I. Introduction and Policy Summary<br />

INTRODUCTION<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong> (IRC) has been experiencing significant growth over the past two<br />

decades. During the 1980’s, the county population increased by 51 percent and in the<br />

1990’s by 24 percent.<br />

To address the infrastructure costs associated with new growth, the <strong>County</strong> retained<br />

Tindale-Oliver & Associates (TOA), in conjunction with Freilich, Leitner, and Carlisle<br />

(FLC) and Dr. A. Chris Nelson, to conduct impact fee studies for eight service/facility<br />

categories, including:<br />

• Correctional Facilities<br />

• Solid Waste Facilities<br />

• Public Buildings<br />

• Libraries<br />

• Fire/Emergency Services<br />

• Law Enforcement<br />

• Public Education Facilities<br />

• Parks<br />

The purpose of these studies is to create a legally defensible and economically<br />

supportable set of impact fees for the above areas.<br />

This final report identifies the methodology upon which each of the impact fees will be<br />

based, including the service area, level of service, demand, cost and credit <strong>com</strong>ponents.<br />

This report starts with an overview of policy issues that should be considered in the<br />

implementation of new impact programs. The remainder of this report is organized in the<br />

following sections:<br />

Section<br />

II<br />

III<br />

IV<br />

V<br />

VI<br />

VII<br />

VIII<br />

IX<br />

X<br />

Title<br />

Current and Projected Population<br />

Correctional Facilities<br />

Solid Waste Facilities<br />

Public Buildings<br />

Libraries<br />

Emergency Services<br />

Law Enforcement<br />

Public Education Facilities<br />

Parks and Recreation Facilities<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-1 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Appendix A<br />

Appendix B<br />

Appendix C<br />

Appendix D<br />

Appendix E<br />

Appendix F<br />

Appendix G<br />

Appendix H<br />

Functional Population – Supplemental Information<br />

Property Values – Supplemental Information<br />

Solid Waste <strong>Impact</strong> <strong>Fee</strong> Schedule – WGU Based<br />

Current and Future School District Facility Inventories<br />

Legal Requirements for Imposing <strong>Impact</strong> <strong>Fee</strong>s<br />

Review of Standards by <strong>Impact</strong> <strong>Fee</strong> Program Area<br />

Comparison of Selected <strong>Fee</strong>s in Florida<br />

Policy Presentation to Elected Officials<br />

Sections III through X are organized in the following manner:<br />

• Inventory<br />

• Population<br />

• Level of Service<br />

• Cost Component<br />

• Credit Component<br />

• Existing Deficiencies<br />

• Net <strong>Impact</strong> <strong>Fee</strong> Cost<br />

• Proposed <strong>Impact</strong> <strong>Fee</strong> Schedule<br />

• Future Demand Analysis<br />

• Estimated Revenues<br />

Policy Summary<br />

In response to the growth and development occurring in IRC, the Board of <strong>County</strong><br />

Commissioners (BCC) initiated a study of impact fees for eight service/facility<br />

categories. As part of this study, a policy summary was <strong>com</strong>pleted prior to the technical<br />

analysis contained in Section II through Section X in this final report.<br />

This Policy Summary is designed to provide a clear, concise, and easy-to-read synopsis<br />

of policy issues related to the potential adoption and implementation of impact fees in<br />

IRC.<br />

This section provides a summary of legal issues that are identified and discussed<br />

throughout the policy summary. Legal matters addressed herein merely summarize<br />

the <strong>com</strong>prehensive discussion set forth in Appendix E, which should be referenced<br />

as appropriate. The summary concludes with a review of legal requirements.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-2 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

OVERVIEW<br />

Purpose of the Policy Summary<br />

• Introduce the concept of impact fees to the elected officials in IRC.<br />

• Summarize the legal requirements for imposing impact fees.<br />

• Discuss impact fee level of service considerations.<br />

• Discuss impact fee revenues and their effect on current capital funding of impact<br />

fee program areas.<br />

LEGAL REQUIREMENTS FOR IMPACT FEES<br />

<strong>Impact</strong> <strong>Fee</strong> Definition<br />

• An impact fee is a one-time capital charge levied against new development.<br />

• An impact fee is designed to cover the portion of the capital costs of infrastructure<br />

capacity consumed by new development.<br />

• The principle purpose of an impact fee is to assist in funding the implementation<br />

of projects identified in the Capital Improvements Element (CIE) and other<br />

capital improvement programs for the respective facility/service categories.<br />

<strong>Impact</strong> <strong>Fee</strong> vs. Tax<br />

• An impact fee is a regulatory function established as a condition for improving<br />

property and is not established for the purpose of generating revenue.<br />

• An impact fee must convey a proportional benefit to the fee payer.<br />

• An impact fee must be tied to a proportional need for infrastructure created by<br />

development.<br />

Legal Framework for Imposing <strong>Impact</strong> <strong>Fee</strong>s<br />

• Legal standards and criteria have been established through state case law<br />

decisions that:<br />

o support local government authority to impose impact fees.<br />

o require that fees <strong>com</strong>ply with state and federal constitutional requirements.<br />

Authority to Impose <strong>Impact</strong> <strong>Fee</strong>s in IRC<br />

• IRC is a non-charter county.<br />

o A non-charter county derives its authority from the state constitution and<br />

statutory sources;<br />

o A non-charter county may adopt ordinances that are not inconsistent with<br />

general law; and<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-3 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

o A non-charter county may adopt countywide ordinances that do not<br />

conflict with municipal ordinances.<br />

• The fiscal burden of providing countywide services must be borne by property<br />

owners in both the unincorporated and incorporated areas of the county.<br />

Compliance with State and Federal Constitutional Requirements<br />

• Local government impact fee programs must satisfy the “dual rational nexus test”<br />

by demonstrating that:<br />

o the need for capital facilities created by new development is proportionate<br />

to the amount of the fee charged; and<br />

o the expenditure of impact fee funds creates a reasonable benefit to the new<br />

development paying the fees.<br />

• Compliance with the dual rational nexus test is achieved by:<br />

o using a methodology that establishes a proportionate need for capital<br />

facilities; and<br />

o implementing an ordinance that contains safeguards and restrictions to<br />

guarantee reasonable benefit to the fee payer.<br />

Defensible <strong>Impact</strong> <strong>Fee</strong> Methodology<br />

• A local government impact fee program must be based on a study that documents:<br />

o the need for additional capital facility capacity created by new<br />

development;<br />

o the cost of providing needed facilities;<br />

o the new development’s proportionate share of the costs; and<br />

o the maximum amount per unit of development consistent with the<br />

proportionate share.<br />

• The <strong>County</strong> may, by policy, charge less than the maximum amount per unit of<br />

development.<br />

Level of Service (LOS) Standards<br />

• The <strong>County</strong> must establish LOS standards for each impact fee program area.<br />

• The <strong>County</strong> must apply the same LOS standard to both existing and new<br />

development.<br />

• An “existing deficiency” is created when a <strong>County</strong> establishes a LOS standard<br />

that is greater than the current LOS.<br />

• New development cannot be charged a rate designed to correct an existing<br />

deficiency.<br />

• To charge new development based on a LOS standard higher than what exists<br />

today, the <strong>County</strong> must have a financial plan (non-impact fee revenue sources) to<br />

eliminate the existing deficiency within a reasonable amount of time (generally<br />

five years or less). The following example illustrates this concept.<br />

o The current parks acreage level of service is 4 acres per 1000 residents.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-4 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Revenue Credits<br />

o The <strong>County</strong> desires to establish a standard of 5 acres per 1000 residents<br />

(hypothetical example).<br />

o The current population of the unincorporated county, including both<br />

permanent and seasonal residents, is approximately 89,000.<br />

o An increase in the standard of 1 acre per 1000 population would require an<br />

additional 89 acres of parks acreage to be added to the inventory of parks<br />

acreage.<br />

o The <strong>County</strong> budgets the acquisition of 89 acres of park land using nonimpact<br />

fee revenues in its Five-Year Capital Improvement Program.<br />

o The <strong>County</strong> can base its Park <strong>Impact</strong> <strong>Fee</strong> on a standard of 5 acres per 1000<br />

residents because it has a financial plan to correct the existing deficiency.<br />

• The <strong>County</strong> must evaluate the revenue credit that each unit of new development<br />

generates and could be used to fund new capital facilities (property tax, sales tax,<br />

etc.).<br />

• The present value of these revenues per unit of land use that historically have<br />

been used or projected in the future to be used for capital facility expansion is<br />

subtracted from the cost per unit of land use of providing capital expansion<br />

facilities (i.e., the revenue credit).<br />

• The revenue credit ensures that new development does not pay more than its<br />

proportionate share of future capital costs.<br />

• As non-impact fee revenues increase for capital facility expansion (e.g., sales tax),<br />

the revenue credit increases and the impact fee decreases.<br />

• As non-impact fee revenues decrease for capital facility expansion (e.g.,<br />

reallocate sales tax to other capital investment or operating/maintenance), the<br />

revenue credit decreases and the impact fee increases.<br />

IMPACT FEE IMPLEMENTATION CONSIDERATIONS<br />

Administration<br />

• The program must be easy for the public to understand through the use of web site<br />

access of the ordinance, an administrative manual, forms, impact fee schedules,<br />

and brochures.<br />

• If multiple impact fees are adopted, an <strong>Impact</strong> <strong>Fee</strong> Coordinator position will be<br />

necessary as a point of public contact and to manage the increased administrative<br />

responsibilities created by the program. Similar positions exist in counties with<br />

multiple impact fees.<br />

Effective Date of Implementation<br />

• The ordinance may be effective upon filing with the Department of State.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-5 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

• Most <strong>com</strong>munities make the effective date of impact fees anywhere from one to<br />

six months after the adoption of the ordinance.<br />

• Delaying the effective date allows developments already in the pipeline to<br />

<strong>com</strong>plete their application and get their building permit prior to paying the new<br />

impact fees.<br />

• Delaying the effective date results in lost impact fee revenue from development<br />

that occurs during the delay time period.<br />

Applicability of <strong>Impact</strong> <strong>Fee</strong>s on Future Development<br />

• <strong>Impact</strong> fees will be charged against future development that creates a measurable<br />

demand for new capital facilities and for which no building permit has been<br />

issued prior to the effective date of the ordinance.<br />

• <strong>Impact</strong> fees will not be charged against existing development (e.g., home resales)<br />

or future development that does not create a new demand for capital facilities.<br />

• Examples of new development that will not pay an impact fee include:<br />

o developments where building permits have been issued prior to the<br />

effective date of the impact fee ordinance;<br />

o developments that document no creation of a measurable demand for new<br />

capital facilities; and<br />

o developments that are deed-restricted residential <strong>com</strong>munities restricted to<br />

adults only (excluded from paying a Public Education <strong>Impact</strong> <strong>Fee</strong>).<br />

• <strong>Impact</strong> fees for capital facilities that are provided by the <strong>County</strong> within only the<br />

unincorporated areas of the county must be charged against development within<br />

only the unincorporated areas of the county.<br />

• <strong>Impact</strong> fees for capital facilities that are provided by the <strong>County</strong> within both the<br />

unincorporated and incorporated areas (i.e., “countywide”) must be charged<br />

against development within both the unincorporated and incorporated areas of the<br />

county.<br />

• The Florida Supreme Court has held that those who benefit from the provision of<br />

<strong>County</strong> facilities must share the burden of providing those facilities so that the<br />

burdens of one group are not passed disproportionately to another group.<br />

• <strong>County</strong>wide impact fees must be spent in a manner that reasonably benefits those<br />

in incorporated and unincorporated areas.<br />

Intergovernmental Coordination and <strong>County</strong>wide Administration<br />

• Interlocal Agreements among the <strong>County</strong>, municipalities, and the School Board<br />

must be developed and adopted prior to the effective date of the impact fee<br />

ordinance to address the:<br />

o collection of countywide impact fees within incorporated areas of the<br />

county;<br />

o administrative costs borne by municipalities collecting impact fees for the<br />

<strong>County</strong>;<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-6 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

o municipal reporting requirements concerning the collection and transmittal<br />

of impact fee revenues; and<br />

o development of annual capital improvement programs to expend the fees.<br />

• The administrative charge borne by municipalities will be included within the<br />

impact fee and not as an “add-on” cost.<br />

Imposition, Calculation, and Collection of <strong>Impact</strong> <strong>Fee</strong>s<br />

• <strong>Impact</strong> fees may be imposed as early as subdivision approval and as late as the<br />

issuance of the certificate of occupancy.<br />

• Most <strong>com</strong>munities require payment prior to the issuance of the building permit.<br />

• A procedure must be included in the ordinance that allows the applicant to submit<br />

an independent impact fee calculation following a prescribed county<br />

methodology. For example, the current IRC Traffic <strong>Impact</strong> <strong>Fee</strong> Ordinance<br />

provides that:<br />

o the <strong>County</strong> Administrator or designee shall have the right to accept or<br />

reject the applicant’s Independent <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>; and<br />

o an appeal of the <strong>County</strong> Administrator’s decision may be made to the<br />

BCC.<br />

• <strong>Impact</strong> fee revenue must be deposited into segregated accounts to ensure that<br />

revenues will be expended for the provision of capital facilities for which the fees<br />

are collected.<br />

Use of <strong>Impact</strong> <strong>Fee</strong> Revenue<br />

• Collected impact fees may be spent only on the public facilities for which they<br />

were collected.<br />

• <strong>Fee</strong>s cannot be spent for operations and maintenance and must be spent only for<br />

capital facilities and costs incidental to the capital facilities (e.g., fees can be spent<br />

on additional library books because they are necessary to put the library facilities<br />

to use).<br />

• <strong>Impact</strong> fee revenues spent on privately-owned lands or educational facilities must<br />

revert to the School Board in the event the charter school ceases operation as a<br />

publicly-sponsored school facility.<br />

• <strong>Impact</strong> fees must be spent within a reasonable period of time to strengthen the<br />

nexus between the fee payer and the benefit provided by the capital facilities.<br />

• Most <strong>com</strong>munities in Florida require fees to be spent within six years.<br />

• Reasonable geographic areas for the demonstration of benefit have been<br />

determined by the courts to be as large as countywide.<br />

• The determination of a proper benefit area depends on the background data and<br />

nature of the service being provided (see Table I-1, which summarizes<br />

considerations associated with service areas and benefit districts in IRC).<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-7 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

• Reasonable administrative costs attributable to the provision of facilities for<br />

which impact fees are assessed also may be covered by impact fee revenues.<br />

These include the reasonable costs of maintaining an impact fee coordinator<br />

position, updating the impact fee ordinance/fee schedule, and covering<br />

administrative costs incurred by municipalities in the collection of fees. The costs<br />

should be fairly apportioned and documented.<br />

Developer Credits<br />

• To ensure that developers pay no more than their proportionate share of capital<br />

costs, developer credits are typically provided for monetary contributions, land<br />

dedications, and construction provided by developers toward the provision of<br />

capital facilities for which impact fees are collected.<br />

• The timing of the decision on developer credits must be specified in the impact<br />

fee ordinance (e.g., credits may be granted only when the improvement is<br />

budgeted in the <strong>County</strong>’s adopted Five-Year Capital Improvement Program,<br />

Capital Improvements Element of the <strong>County</strong> Comprehensive Plan, or School<br />

Board Five Year Capital Improvement Program).<br />

• Requirements for Development Credit Agreements and the associated approval<br />

process must be specified in the impact fee ordinance.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-8 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Table I-1<br />

<strong>Impact</strong> <strong>Fee</strong> Service Area Considerations by Program Area<br />

No. Program Area Service Area Considerations<br />

1 Correctional<br />

Facilities<br />

Correctional facilities are provided on a countywide basis. The proper benefit<br />

district for correctional facilities is countywide.<br />

2 Solid Waste Solid waste facilities (refuse transfer centers, recycling and landfill) are provided on<br />

a countywide basis. The proper benefit district for solid waste is countywide.<br />

3 Public<br />

Education<br />

Public education facilities are provided on a countywide basis. The proper benefit<br />

district for public education is countywide.<br />

4 Library Libraries are a countywide service. Books and items are available and shared<br />

among branches. The proper benefit district for libraries is countywide.<br />

5 Fire/Emergency<br />

Medical<br />

Services (EMS)<br />

Fire services and EMS are countywide services, excluding <strong>Indian</strong> <strong>River</strong> Shores,<br />

which provides its own fire and emergency services. The proper benefit district for<br />

Fire and EMS is countywide, with the exclusion of <strong>Indian</strong> <strong>River</strong> Shores.<br />

6 Law<br />

Enforcement<br />

Law enforcement services are provided by the <strong>County</strong> Sheriff’s Department in the<br />

unincorporated areas of the county. The municipalities have their own law<br />

enforcement agencies. The proper benefit district for law enforcement is the<br />

unincorporated county.<br />

7 Public<br />

Buildings<br />

Public buildings provide many services, some to unincorporated areas of the county<br />

and others to the countywide population (judicial <strong>com</strong>plex, health department, tax<br />

collector, etc.). If public buildings are viewed as countywide, the standard of square<br />

feet per person will be lower than if only the unincorporated population is used.<br />

Thus, the fee will be more conservative if a countywide approach is used. The<br />

proper benefit district for public buildings is countywide.<br />

8 Park and<br />

Recreation<br />

Park and recreation facilities are provided by the <strong>County</strong> and municipalities.<br />

Sebastian has adopted a Park and Recreation <strong>Impact</strong> <strong>Fee</strong> and Vero Beach has its<br />

own park and recreation system. For all parks, an unincorporated county fee and<br />

benefit district is re<strong>com</strong>mended.<br />

Exempting or Paying <strong>Impact</strong> <strong>Fee</strong>s from Other Revenue Sources<br />

• The BCC may exempt particular land uses or development projects (e.g.,<br />

affordable housing or economic development projects) from the impact fee<br />

requirement.<br />

• To survive judicial scrutiny of exemptions:<br />

o exempted land uses or project types must be narrow in scope, clearly<br />

defined and consistent with the adopted Comprehensive Plan policies of<br />

the <strong>County</strong>.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-9 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

• The BCC may establish a policy that pays the calculated impact fees from<br />

revenue sources other than impact fees.<br />

• If the <strong>County</strong> exempts particular land uses or development projects from the fee<br />

requirement and does not reimburse the affected impact fee accounts with nonimpact<br />

fee revenues, the ordinance may be rendered ineffective as a mechanism<br />

for funding capital improvements necessary to serve new development and may<br />

be subject to legal liabilities.<br />

Updating the <strong>Impact</strong> <strong>Fee</strong> Program and Indexing the <strong>Fee</strong>s<br />

• Typically, impact fees are updated every three years to ensure that development<br />

continues to pay a fee that is proportionate to its impact and receives a<br />

proportionate benefit to the fee paid.<br />

• Indexing is a method used to adjust the impact fee on an annual basis between<br />

periodic updates. Indexing of impact fees is be<strong>com</strong>ing increasingly popular as a<br />

way to avoid significant increases when fees are subsequently updated.<br />

o Indexes must reflect cost increases that the <strong>County</strong> can reasonably expect<br />

to incur in the provision of needed capital facilities and be consistent with<br />

the underlying impact fee methodology.<br />

o Common indexes include the Consumer Price Index, local property<br />

appraiser records, and publications such as the Engineering News Record<br />

(ENR) construction cost index.<br />

Appeals Process<br />

• Typically, provisions for appeals of impact fee decisions made by staff, the<br />

<strong>County</strong> Administrator, and the BCC must be defined in the ordinance or through<br />

existing <strong>County</strong> procedures.<br />

• The approach used by many jurisdictions is similar to the appeal process<br />

contained in the <strong>County</strong>’s current Traffic <strong>Impact</strong> <strong>Fee</strong> Ordinance, as summarized<br />

below.<br />

o The <strong>County</strong> Administrator or designee shall have the right to accept or<br />

reject the decision made by staff concerning an impact fee; and<br />

o <strong>Final</strong> appeal of the <strong>County</strong> Administrator’s decision shall be made to the<br />

BCC.<br />

LOS STANDARDS AND FEE REVIEW<br />

Current LOS and adopted LOS standards in IRC were reviewed for each facility service<br />

category being considered in the impact fee study. In addition, performance standards<br />

from impact fees in other Florida counties were <strong>com</strong>piled and reviewed for <strong>com</strong>parative<br />

purposes. Summary data from this review of LOS standards and fees are provided in<br />

Tables I-2 and I-3.<br />

Table I-2 provides the current LOS in IRC, the adopted LOS standard in IRC (if any),<br />

and the re<strong>com</strong>mended LOS standard for each program area. It should be noted that, for<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-10 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

purposes of calculating the current levels of service, performance standards, and in<br />

calculating future demand for capital facilities for each impact fee program area, the<br />

weighted average seasonal population is used. Table I-3 provides actual fee <strong>com</strong>parisons<br />

(single family residential land use) for each of the program areas being considered for<br />

impact fees in IRC.<br />

FUNDING SOURCE REVIEW<br />

Review of Current Capital Funding Sources by Program Area<br />

• The primary non-impact fee source of capital revenues for the eight impact fee<br />

program areas under study has been and will continue to be the <strong>County</strong>’s Local<br />

Option Sales Tax. This tax was recently extended through 2015.<br />

• Table I-4 provides a summary of the actual capital expenditures for capacity<br />

expansion projects during the last six years and the planned capital expenditures<br />

for the next five years.<br />

o Past sales tax capital facility expansion expenditures included:<br />

1. expansion of five parks, an aquatic center, and a shooting range;<br />

2. a new north county library and expansion of the main library facility;<br />

3. three new fire stations and additional support vehicles; and<br />

4. land purchases for government buildings, sheriff evidence center, jail<br />

facility expansion, health department dental clinic, and touch screen<br />

voting machines.<br />

o Planned sales tax expenditures include:<br />

1. a new <strong>County</strong> administration building;<br />

2. two new fire/EMS stations;<br />

3. a new branch library in west county; and<br />

4. a west regional park, indoor south county <strong>com</strong>plex, and north park ball<br />

fields.<br />

• Over 75 percent of the School Board budget is funded with the 2-mill tax<br />

assessment ($137.9 million of $183.4 million).<br />

o Approximately 27 percent of this budget is designated for expansion of the<br />

school system.<br />

• As discussed previously, the allocation of sales tax or other revenues to capital<br />

facility expansion has a significant impact on the magnitude of the impact fee.<br />

o As the use of sales tax or other revenue increases for capital facility<br />

expansion within an impact fee program area, the impact fee for that<br />

program area decreases.<br />

o Conversely, as the use of sales tax or other revenue decreases for capital<br />

facility expansion within an impact fee program area, the impact fee for<br />

that program area increases.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-11 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Table I-2<br />

Current and Re<strong>com</strong>mended Standards by<br />

<strong>Impact</strong> <strong>Fee</strong> Program Area<br />

<strong>Fee</strong><br />

No<br />

Program Area<br />

1 Correctional<br />

Facilities<br />

IRC<br />

Current LOS<br />

2.97 beds per 1,000<br />

residents<br />

IRC<br />

Current<br />

LOS<br />

Standard<br />

N/A<br />

2 Solid Waste 2.2 tons/capita/year 1.2 tons/<br />

capita/year<br />

Re<strong>com</strong>mended<br />

IRC LOS Standard<br />

Based on beds per 1,000 residents; standard is set<br />

at 4.5 beds per 1,000 residents.<br />

Based on tons per capita per year; final standard<br />

is set at 2.2 tons/capita/year.<br />

3 Public<br />

Education<br />

144.71 SF, 117.26<br />

SF, and 147.57 SF<br />

per student station<br />

per Elementary,<br />

Middle and High<br />

School,<br />

respectively<br />

4 Libraries 580 SF per 1,000<br />

residents<br />

5 Fire/<br />

Emergency<br />

Medical<br />

Services<br />

6 Law<br />

Enforcement<br />

0.089 stations per<br />

1,000 residents<br />

2.09 officers per<br />

1,000 residents<br />

N/A<br />

527 SF per<br />

1,000<br />

residents<br />

4-6 minutes<br />

of response<br />

time - service<br />

area: 5 mile<br />

radius within<br />

urban area<br />

Based on square feet (SF) per student station;<br />

standard is set at 144.71 SF per elementary school<br />

student station, 117.26 SF per middle school<br />

student station, and 147.57 SF per high school<br />

student station, <strong>com</strong>bined for a weighted average<br />

LOS standard of 139.07 square feet per student<br />

station.<br />

Based on SF per resident; standard for buildings<br />

is set at 580 SF per 1,000 residents, plus 3,200<br />

library items per 1,000 residents, 0.7 <strong>com</strong>puter<br />

per 1,000 residents, and 0.2 other library<br />

equipment per 1,000 residents.<br />

Based on the number of stations per 1000<br />

residents; standard is set at 0.089 stations per<br />

1,000 residents.<br />

N/A Based on the number of officers per 1,000<br />

residents; standard is set at 2.09 officers per 1,000<br />

residents.<br />

7 Public<br />

Buildings<br />

1.99 SF per<br />

resident<br />

N/A Based on SF per resident; standard is set at 1.99<br />

SF of building space per resident.<br />

8 Parks and<br />

Recreation<br />

Facilities<br />

6.22 acres of<br />

regional parks per<br />

1,000 residents,<br />

0.39 acres of<br />

<strong>com</strong>munity and<br />

neighborhood<br />

parks per 1,000<br />

residents<br />

4 acres per<br />

1,000<br />

residents<br />

Based on acres of regional parks per 1,000<br />

residents and acres of <strong>com</strong>munity/neighborhood<br />

parks per 1,000 residents for unincorporated IRC;<br />

standard is set based on 6.61 (6.22 acres for<br />

regional parks and 0.39 acres for <strong>com</strong>munity and<br />

neighborhood parks) per 1,000 residents, plus<br />

facility based LOS standards to be developed for<br />

each park type.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-12 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Table I-3<br />

Comparison of <strong>Fee</strong>s by <strong>Impact</strong> <strong>Fee</strong> Program Area<br />

(Single Family Residential Land Use)<br />

<strong>Fee</strong><br />

No.<br />

Program Area<br />

# of<br />

Counties<br />

Range of <strong>Impact</strong> <strong>Fee</strong> per Unit of<br />

Development<br />

in<br />

Sample Low High<br />

1 Correctional Facilities 5 $71.99 (Brevard) $143.00 (Wakulla)<br />

2 Solid Waste 2 $64.00 (Monroe) $160.00 (Brevard)<br />

3 Public Education 12 $636.00 (Citrus) $9,708.30 (Osceola)<br />

4 Libraries 6 $63.84 (Brevard) $296.56 (Collier)<br />

5<br />

Fire/Emergency Medical<br />

Services<br />

5 $92.73 (Brevard) $171.00 (Citrus)<br />

6 Law Enforcement 5 $46.77 (St. Johns) $135.76 (Martin)<br />

7 Public Buildings 5<br />

$138.85<br />

(Palm Beach)<br />

$319.20 (Collier)<br />

8<br />

Parks and Recreation<br />

Facilities<br />

6 $53.00 (Wakulla) $1,296.07 (Martin)<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-13 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Table I-4<br />

Historical and Projected Capital Facility Expenditures<br />

<strong>Fee</strong> No.<br />

Program Area<br />

Capital Expenditures<br />

for Capacity<br />

Expansion<br />

Comments on Planned Projects<br />

Historical<br />

(Last Six<br />

Years)<br />

Planned<br />

(Next Five<br />

Years)<br />

1 Correctional<br />

Facilities<br />

$1,083,500 $14,815,983 Major jail facility expansion planned<br />

2 Solid Waste $7,789,149 $18,322,000 Includes planned closure of existing<br />

landfill segments and construction of<br />

new landfill sections<br />

3 Public Education Not available $42,867,006 From latest School Work Plan of<br />

Building Committee Re<strong>com</strong>mendations,<br />

dated September 7, 2004<br />

4 Libraries $4,235,065 $3,340,000 Planned West Branch Library<br />

5 Fire/Emergency<br />

Medical Services<br />

$2,657,760 $4,482,147 Two new Fire / EMS stations<br />

6 Law Enforcement $678,624 $0 Office administration building expansion<br />

is proposed but not funded at this time.<br />

7 Public Buildings $10,123,458 $6,895,000 Funding for new administration building<br />

8 Parks and<br />

Recreation Facilities<br />

$15,856,006 $5,800,000 West Regional Park, South <strong>County</strong><br />

Indoor Facility, and North <strong>County</strong> Ball<br />

Fields<br />

Notes:<br />

1. The planned projects for all program areas except Solid Waste and Public Education are funded from<br />

the <strong>County</strong> Sales Tax.<br />

2. Planned projects for Solid Waste are funded from Solid Waste District revenues.<br />

3. Planned projects for Public Education are funded from state sources and the local 2 mills for capital<br />

facilities for public schools.<br />

Tindale-Oliver & Associates, Inc.<br />

<strong>Indian</strong> <strong>River</strong> <strong>County</strong><br />

May 2005 I-14 <strong>Impact</strong> <strong>Fee</strong> <strong>Study</strong>

Summary of Legal Requirements<br />

• Local government impact fee programs must satisfy the “dual rational nexus test.”<br />

• A non-charter county may adopt countywide ordinances that do not conflict with<br />

municipal ordinances.<br />

• The fiscal burden of providing countywide services should be borne by property<br />

owners in both the unincorporated and incorporated areas of the county.<br />

• A local government impact fee program must be based on a study reflecting capital<br />

facility needs.<br />

• The <strong>County</strong> must establish level of service (LOS) standards for each impact fee<br />

program area.<br />

• The <strong>County</strong> must evaluate the revenue credit that each unit of new development<br />

generates and could be used to fund new capital facilities (property tax, sales tax,<br />

etc.).<br />

• <strong>Impact</strong> fees are charged against future development that creates a measurable<br />

demand for new capital facilities.<br />

• <strong>Impact</strong> fee revenue must be deposited into segregated accounts to ensure that<br />

revenues will be expended for the provision of the capital facilities for which the fees<br />

are collected.<br />

• The determination of a proper benefit area depends on the background data and<br />

nature of the service being provided.<br />

• To ensure that developers pay no more than their proportionate share of capital costs,<br />