Full Version Guinness Anchor Berhad Annual Report 2009 - Gab

Full Version Guinness Anchor Berhad Annual Report 2009 - Gab

Full Version Guinness Anchor Berhad Annual Report 2009 - Gab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

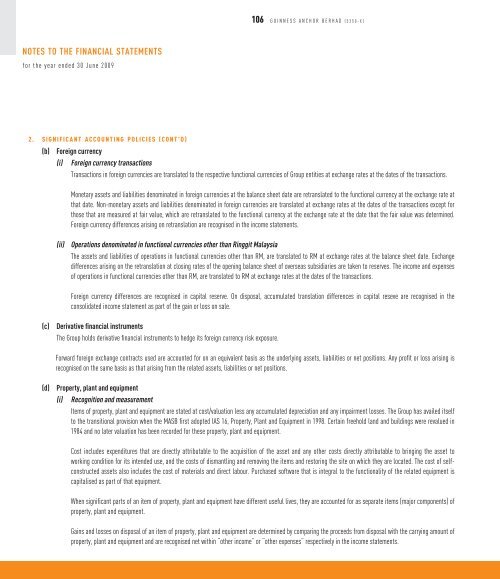

106 GUINNESS ANCHOR BERHAD (5350-X)<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

for the year ended 30 June <strong>2009</strong><br />

2. SIGNIFICANT ACCOUNTING POLICIES (CONT’D)<br />

(b) Foreign currency<br />

(i) Foreign currency transactions<br />

Transactions in foreign currencies are translated to the respective functional currencies of Group entities at exchange rates at the dates of the transactions.<br />

Monetary assets and liabilities denominated in foreign currencies at the balance sheet date are retranslated to the functional currency at the exchange rate at<br />

that date. Non-monetary assets and liabilities denominated in foreign currencies are translated at exchange rates at the dates of the transactions except for<br />

those that are measured at fair value, which are retranslated to the functional currency at the exchange rate at the date that the fair value was determined.<br />

Foreign currency differences arising on retranslation are recognised in the income statements.<br />

(ii)<br />

Operations denominated in functional currencies other than Ringgit Malaysia<br />

The assets and liabilities of operations in functional currencies other than RM, are translated to RM at exchange rates at the balance sheet date. Exchange<br />

differences arising on the retranslation at closing rates of the opening balance sheet of overseas subsidiaries are taken to reserves. The income and expenses<br />

of operations in functional currencies other than RM, are translated to RM at exchange rates at the dates of the transactions.<br />

Foreign currency differences are recognised in capital reserve. On disposal, accumulated translation differences in capital reseve are recognised in the<br />

consolidated income statement as part of the gain or loss on sale.<br />

(c)<br />

Derivative financial instruments<br />

The Group holds derivative financial instruments to hedge its foreign currency risk exposure.<br />

Forward foreign exchange contracts used are accounted for on an equivalent basis as the underlying assets, liabilities or net positions. Any profit or loss arising is<br />

recognised on the same basis as that arising from the related assets, liabilities or net positions.<br />

(d)<br />

Property, plant and equipment<br />

(i) Recognition and measurement<br />

Items of property, plant and equipment are stated at cost/valuation less any accumulated depreciation and any impairment losses. The Group has availed itself<br />

to the transitional provision when the MASB first adopted IAS 16, Property, Plant and Equipment in 1998. Certain freehold land and buildings were revalued in<br />

1984 and no later valuation has been recorded for these property, plant and equipment.<br />

Cost includes expenditures that are directly attributable to the acquisition of the asset and any other costs directly attributable to bringing the asset to<br />

working condition for its intended use, and the costs of dismantling and removing the items and restoring the site on which they are located. The cost of selfconstructed<br />

assets also includes the cost of materials and direct labour. Purchased software that is integral to the functionality of the related equipment is<br />

capitalised as part of that equipment.<br />

When significant parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items (major components) of<br />

property, plant and equipment.<br />

Gains and losses on disposal of an item of property, plant and equipment are determined by comparing the proceeds from disposal with the carrying amount of<br />

property, plant and equipment and are recognised net within “other income” or “other expenses” respectively in the income statements.