Full Version Guinness Anchor Berhad Annual Report 2009 - Gab

Full Version Guinness Anchor Berhad Annual Report 2009 - Gab

Full Version Guinness Anchor Berhad Annual Report 2009 - Gab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

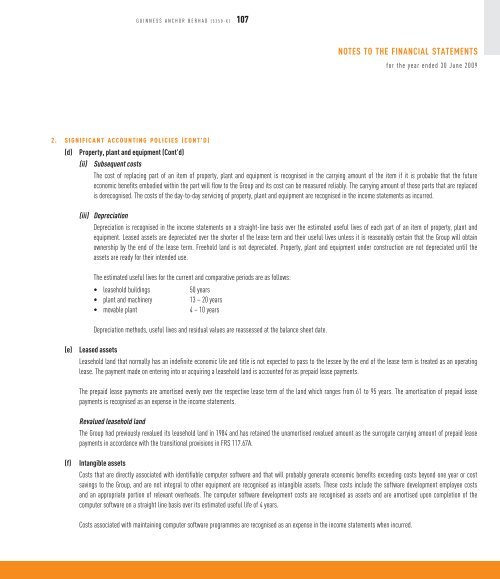

GUINNESS ANCHOR BERHAD (5350-X) 107<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

for the year ended 30 June <strong>2009</strong><br />

2. SIGNIFICANT ACCOUNTING POLICIES (CONT’D)<br />

(d) Property, plant and equipment (Cont’d)<br />

(ii) Subsequent costs<br />

The cost of replacing part of an item of property, plant and equipment is recognised in the carrying amount of the item if it is probable that the future<br />

economic benefits embodied within the part will flow to the Group and its cost can be measured reliably. The carrying amount of those parts that are replaced<br />

is derecognised. The costs of the day-to-day servicing of property, plant and equipment are recognised in the income statements as incurred.<br />

(iii) Depreciation<br />

Depreciation is recognised in the income statements on a straight-line basis over the estimated useful lives of each part of an item of property, plant and<br />

equipment. Leased assets are depreciated over the shorter of the lease term and their useful lives unless it is reasonably certain that the Group will obtain<br />

ownership by the end of the lease term. Freehold land is not depreciated. Property, plant and equipment under construction are not depreciated until the<br />

assets are ready for their intended use.<br />

The estimated useful lives for the current and comparative periods are as follows:<br />

• leasehold buildings<br />

50 years<br />

• plant and machinery<br />

13 – 20 years<br />

• movable plant<br />

4 – 10 years<br />

Depreciation methods, useful lives and residual values are reassessed at the balance sheet date.<br />

(e)<br />

Leased assets<br />

Leasehold land that normally has an indefinite economic life and title is not expected to pass to the lessee by the end of the lease term is treated as an operating<br />

lease. The payment made on entering into or acquiring a leasehold land is accounted for as prepaid lease payments.<br />

The prepaid lease payments are amortised evenly over the respective lease term of the land which ranges from 61 to 95 years. The amortisation of prepaid lease<br />

payments is recognised as an expense in the income statements.<br />

Revalued leasehold land<br />

The Group had previously revalued its leasehold land in 1984 and has retained the unamortised revalued amount as the surrogate carrying amount of prepaid lease<br />

payments in accordance with the transitional provisions in FRS 117.67A.<br />

(f)<br />

Intangible assets<br />

Costs that are directly associated with identifiable computer software and that will probably generate economic benefits exceeding costs beyond one year or cost<br />

savings to the Group, and are not integral to other equipment are recognised as intangible assets. These costs include the software development employee costs<br />

and an appropriate portion of relevant overheads. The computer software development costs are recognised as assets and are amortised upon completion of the<br />

computer software on a straight line basis over its estimated useful life of 4 years.<br />

Costs associated with maintaining computer software programmes are recognised as an expense in the income statements when incurred.