annual report1-final.qxd - Overseas Indian

annual report1-final.qxd - Overseas Indian

annual report1-final.qxd - Overseas Indian

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

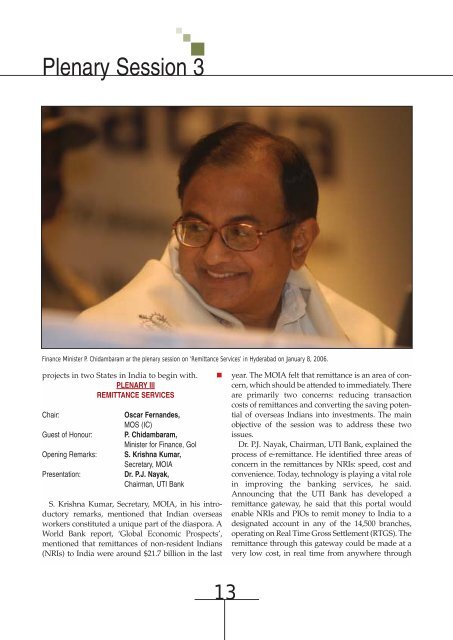

Plenary Session 3<br />

Finance Minister P. Chidambaram ar the plenary session on ‘Remittance Services’ in Hyderabad on January 8, 2006.<br />

projects in two States in India to begin with. !<br />

PLENARY III<br />

REMITTANCE SERVICES<br />

Chair:<br />

Guest of Honour:<br />

Opening Remarks:<br />

Presentation:<br />

Oscar Fernandes,<br />

MOS (IC)<br />

P. Chidambaram,<br />

Minister for Finance, GoI<br />

S. Krishna Kumar,<br />

Secretary, MOIA<br />

Dr. P.J. Nayak,<br />

Chairman, UTI Bank<br />

S. Krishna Kumar, Secretary, MOIA, in his introductory<br />

remarks, mentioned that <strong>Indian</strong> overseas<br />

workers constituted a unique part of the diaspora. A<br />

World Bank report, ‘Global Economic Prospects’,<br />

mentioned that remittances of non-resident <strong>Indian</strong>s<br />

(NRIs) to India were around $21.7 billion in the last<br />

year. The MOIA felt that remittance is an area of concern,<br />

which should be attended to immediately. There<br />

are primarily two concerns: reducing transaction<br />

costs of remittances and converting the saving potential<br />

of overseas <strong>Indian</strong>s into investments. The main<br />

objective of the session was to address these two<br />

issues.<br />

Dr. P.J. Nayak, Chairman, UTI Bank, explained the<br />

process of e-remittance. He identified three areas of<br />

concern in the remittances by NRIs: speed, cost and<br />

convenience. Today, technology is playing a vital role<br />

in improving the banking services, he said.<br />

Announcing that the UTI Bank has developed a<br />

remittance gateway, he said that this portal would<br />

enable NRIs and PIOs to remit money to India to a<br />

designated account in any of the 14,500 branches,<br />

operating on Real Time Gross Settlement (RTGS). The<br />

remittance through this gateway could be made at a<br />

very low cost, in real time from anywhere through<br />

13

![flaxkiqj feuh izoklh Hkkjrh; fnol] vDVwcj 9&11 - Overseas Indian](https://img.yumpu.com/43977040/1/184x260/flaxkiqj-feuh-izoklh-hkkjrh-fnol-vdvwcj-911-overseas-indian.jpg?quality=85)