The Carbon Price and the Cost of Living - The Climate Institute

The Carbon Price and the Cost of Living - The Climate Institute

The Carbon Price and the Cost of Living - The Climate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AECOM<br />

<strong>The</strong> <strong>Carbon</strong> <strong>Price</strong> <strong>and</strong> <strong>the</strong> <strong>Cost</strong> <strong>of</strong> <strong>Living</strong><br />

9 November 2011<br />

17<br />

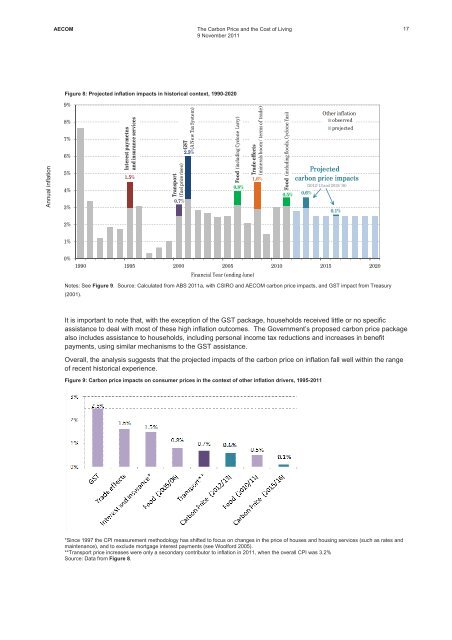

Figure 8: Projected inflation impacts in historical context, 1990-2020<br />

Annual inflation<br />

9%<br />

8%<br />

7%<br />

6%<br />

5%<br />

4%<br />

3%<br />

Interestpaymetns<br />

<strong>and</strong>insuranceservices<br />

1.5%<br />

Transport<br />

(fuelpricerises)<br />

0.7%<br />

GST<br />

(ANewTaxSystem)<br />

2.5%<br />

Food (includingCycloneLarry)<br />

0.8%<br />

Trade effects<br />

(mineralsboom/terms<strong>of</strong>trade)<br />

1.6%<br />

Food (includingfloods,CycloneYasi)<br />

0.5%<br />

0.6%<br />

O<strong>the</strong>rinflation<br />

observed<br />

projected<br />

Projected<br />

carbon priceimpacts<br />

(2012/13<strong>and</strong>2015/16)<br />

0.1%<br />

2%<br />

1%<br />

0%<br />

1990 1995 2000 2005 2010 2015 2020<br />

Financial Year(endingJune)<br />

Notes: See Figure 9. Source: Calculated from ABS 2011a, with CSIRO <strong>and</strong> AECOM carbon price impacts, <strong>and</strong> GST impact from Treasury<br />

(2001).<br />

It is important to note that, with <strong>the</strong> exception <strong>of</strong> <strong>the</strong> GST package, households received little or no specific<br />

assistance to deal with most <strong>of</strong> <strong>the</strong>se high inflation outcomes. <strong>The</strong> Government’s proposed carbon price package<br />

also includes assistance to households, including personal income tax reductions <strong>and</strong> increases in benefit<br />

payments, using similar mechanisms to <strong>the</strong> GST assistance.<br />

Overall, <strong>the</strong> analysis suggests that <strong>the</strong> projected impacts <strong>of</strong> <strong>the</strong> carbon price on inflation fall well within <strong>the</strong> range<br />

<strong>of</strong> recent historical experience.<br />

Figure 9: <strong>Carbon</strong> price impacts on consumer prices in <strong>the</strong> context <strong>of</strong> o<strong>the</strong>r inflation drivers, 1995-2011<br />

*Since 1997 <strong>the</strong> CPI measurement methodology has shifted to focus on changes in <strong>the</strong> price <strong>of</strong> houses <strong>and</strong> housing services (such as rates <strong>and</strong><br />

maintenance), <strong>and</strong> to exclude mortgage interest payments (see Woolford 2005).<br />

**Transport price increases were only a secondary contributor to inflation in 2011, when <strong>the</strong> overall CPI was 3.2%<br />

Source: Data from Figure 8.