Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Harman</strong> International Industries, Incorporated and Subsidiaries<br />

(Dollars in thousands, except per-share data and unless otherwise indicated)<br />

Modification of Certain Stock Option Awards<br />

The award agreements under the 2002 Plan state that vested options not exercised are forfeited upon<br />

termination of employment for any reason other than death or disability. However, the award agreements provide<br />

that the Compensation and Option Committee of the Board of Directors may extend the time period to exercise<br />

vested options 90 days beyond the employment termination date for certain employees. During fiscal year 2009,<br />

no extensions were granted. During the fiscal year ended June 30, 2008, the Compensation and Option<br />

Committee used this authority. This action represented a modification of the terms or conditions of an equity<br />

award and therefore was accounted for as an exchange of the original award for a new award. During fiscal year<br />

2008, $1.3 million of incremental share-based compensation cost was recognized for the excess of the fair value<br />

of the new award over the fair value of the original award immediately before the terms were modified.<br />

Grant of Stock Options with Market Conditions<br />

We granted 330,470 stock options containing a market condition to employees on March 21, 2008. The<br />

options vest three years from the date of grant based on a comparison of our total shareholder return (“TSR”) to a<br />

selected peer group of publicly listed multinational companies. TSR will be measured as the annualized increase<br />

in the aggregate value of a company’s stock price plus the value of dividends, assumed to be reinvested into<br />

shares of the company’s stock at the time of dividend payment. The base price to be used for the TSR calculation<br />

of $42.19 was the 20-day trading average from February 6, 2008 through March 6, 2008. The ending price to be<br />

used for the TSR calculation will be the 20-day trading average prior to and through March 6, 2011. The grant<br />

date fair value of $4.2 million was calculated using a combination of Monte Carlo simulation and lattice-based<br />

models. Share-based compensation expense for this grant was $1.4 million and $0.5 million for the fiscal year<br />

ended June 30, 2009 and 2008, respectively.<br />

Restricted Stock Awards<br />

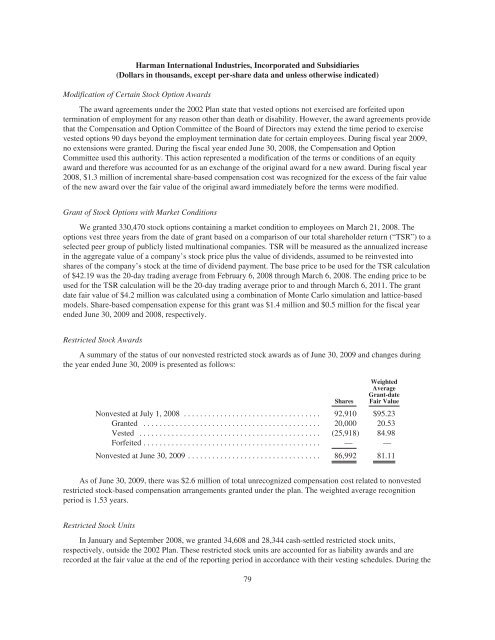

A summary of the status of our nonvested restricted stock awards as of June 30, 2009 and changes during<br />

the year ended June 30, 2009 is presented as follows:<br />

Shares<br />

Weighted<br />

Average<br />

Grant-date<br />

Fair Value<br />

Nonvested at July 1, 2008 .................................. 92,9<strong>10</strong> $95.23<br />

Granted ............................................ 20,000 20.53<br />

Vested ............................................. (25,918) 84.98<br />

Forfeited ............................................ — —<br />

Nonvested at June 30, 2009 ................................. 86,992 81.11<br />

As of June 30, 2009, there was $2.6 million of total unrecognized compensation cost related to nonvested<br />

restricted stock-based compensation arrangements granted under the plan. The weighted average recognition<br />

period is 1.53 years.<br />

Restricted Stock Units<br />

In January and September 2008, we granted 34,608 and 28,344 cash-settled restricted stock units,<br />

respectively, outside the 2002 Plan. These restricted stock units are accounted for as liability awards and are<br />

recorded at the fair value at the end of the reporting period in accordance with their vesting schedules. During the<br />

79