Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Harman</strong> International Industries, Incorporated and Subsidiaries<br />

(Dollars in thousands, except per-share data and unless otherwise indicated)<br />

in 2023. The alternative minimum tax credit does not expire. The foreign tax credit will begin to expire in 2016.<br />

A $117.8 million valuation allowance has been recorded for U. S. Federal foreign tax credits. Additionally, we<br />

have a German net operating loss carryforward valued at $23.8 million that will not expire and other foreign tax<br />

loss carryforwards and credits before valuation allowance of $20.3 million that do not expire. A valuation<br />

allowance of $13.8 million has been established for certain of the foreign net operating loss carryforwards.<br />

Management believes the results of future operations will generate sufficient taxable income to realize the net<br />

deferred tax asset.<br />

We have not provided U.S. Federal or foreign withholding taxes on foreign subsidiary undistributed<br />

earnings as of June 30, 2009, because these foreign earnings are intended to be permanently reinvested. Such<br />

earnings would be subject to U.S. taxation if repatriated to the U.S. Determination of the amount of unrecognized<br />

deferred tax liability associated with the permanently reinvested cumulative undistributed earnings is not<br />

practicable.<br />

Effective July 1, 2007, we adopted FIN 48, “Accounting for Uncertainty in Income Taxes—an interpretation<br />

of FASB Statement No. <strong>10</strong>9” (“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income taxes by<br />

prescribing rules for recognition, measurement and classification in our consolidated financial statements of tax<br />

positions taken or expected to be taken in a tax return. For tax benefits to be recognized under FIN 48, a tax<br />

position must be more-likely-than-not to be sustained upon examination by taxing authorities. The amount<br />

recognized is measured as the largest amount of benefit that is greater than 50% likely of being realized upon<br />

settlement. The cumulative effect of applying the recognition and measurement provisions upon adoption of<br />

FIN 48 resulted in a decrease of $7.2 million of unrealized tax benefits to our balance of $31.2 million. This<br />

reduction was included as an increase to the July 1, 2007 balance of retained earnings.<br />

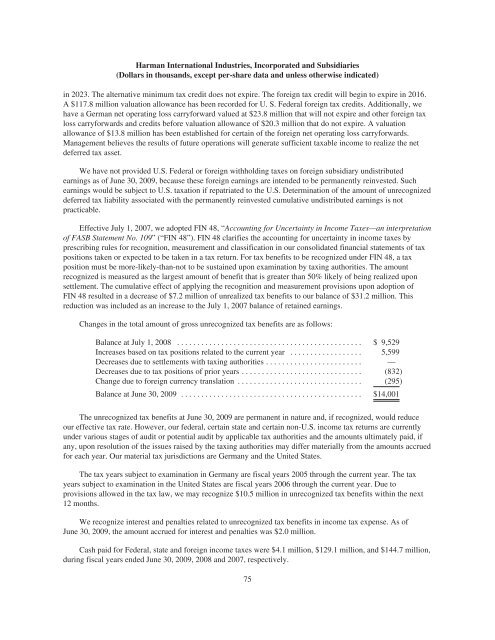

Changes in the total amount of gross unrecognized tax benefits are as follows:<br />

Balance at July 1, 2008 .............................................. $ 9,529<br />

Increases based on tax positions related to the current year .................. 5,599<br />

Decreases due to settlements with taxing authorities ........................ —<br />

Decreases due to tax positions of prior years .............................. (832)<br />

Change due to foreign currency translation ............................... (295)<br />

Balance at June 30, 2009 ............................................. $14,001<br />

The unrecognized tax benefits at June 30, 2009 are permanent in nature and, if recognized, would reduce<br />

our effective tax rate. However, our federal, certain state and certain non-U.S. income tax returns are currently<br />

under various stages of audit or potential audit by applicable tax authorities and the amounts ultimately paid, if<br />

any, upon resolution of the issues raised by the taxing authorities may differ materially from the amounts accrued<br />

for each year. Our material tax jurisdictions are Germany and the United States.<br />

The tax years subject to examination in Germany are fiscal years 2005 through the current year. The tax<br />

years subject to examination in the United States are fiscal years 2006 through the current year. Due to<br />

provisions allowed in the tax law, we may recognize $<strong>10</strong>.5 million in unrecognized tax benefits within the next<br />

12 months.<br />

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. As of<br />

June 30, 2009, the amount accrued for interest and penalties was $2.0 million.<br />

Cash paid for Federal, state and foreign income taxes were $4.1 million, $129.1 million, and $144.7 million,<br />

during fiscal years ended June 30, 2009, 2008 and 2007, respectively.<br />

75