You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Harman</strong> International Industries, Incorporated and Subsidiaries<br />

(Dollars in thousands, except per-share data and unless otherwise indicated)<br />

Automotive Supply Arrangements<br />

We have arrangements with our automotive customers to provide products that meet predetermined<br />

technical specifications and delivery dates. In the event that we do not satisfy the performance obligations under<br />

these arrangements, we may be required to indemnify the customer. We accrue for any loss that we expect to<br />

incur under these arrangements when that loss is probable and can be reasonably estimated. For the years ended<br />

June 30, 2009 and 2008, we incurred $9.2 million and $0.6 million, respectively, of costs relating to delayed<br />

delivery of product to an automotive customer. An inability to meet performance obligations on automotive<br />

platforms to be delivered in future periods could adversely affect our results of operations and financial condition<br />

in future periods.<br />

Note 17 – Investment in Joint Venture<br />

In October 2005, we formed <strong>Harman</strong> Navis Inc., a joint venture located in Korea, to engage in the design<br />

and development of navigation systems for Asian markets. We evaluated the joint venture agreement under FIN<br />

No. 46R, Consolidation of Variable Interest Entities, and determined that the newly formed joint venture was a<br />

variable interest entity requiring consolidation. We own a 50 percent equity interest in the joint venture. We are<br />

not obligated to fund any joint venture losses beyond our investment. At June 30, 2009, the net assets of the joint<br />

venture were approximately $14.6 million. The minority interest is less than $0.8 million. Our investment in this<br />

joint venture is not material to our consolidated financial statements.<br />

We recently entered into a restructuring agreement which amends the <strong>Harman</strong> Navis Inc. joint venture<br />

agreement and other related agreements. Over time, we will sell our share of this joint venture to our 50 percent<br />

equity partner. We will deconsolidate this entity when our ownership decreases below 50 percent and the other<br />

partner gains control.<br />

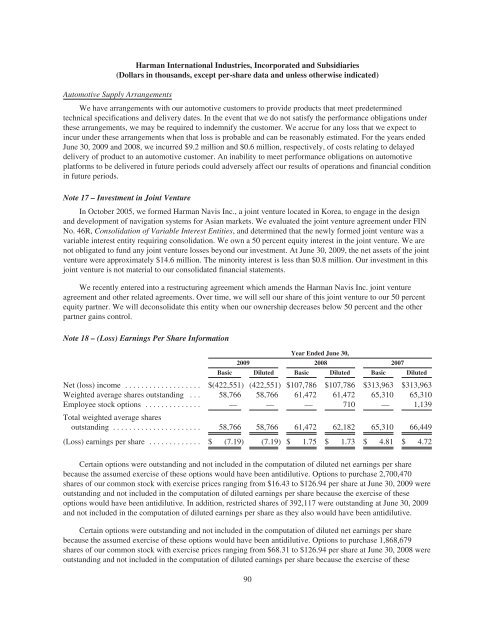

Note 18 – (Loss) Earnings Per Share Information<br />

2009<br />

Year Ended June 30,<br />

2008 2007<br />

Basic Diluted Basic Diluted Basic Diluted<br />

Net (loss) income ................... $(422,551) (422,551) $<strong>10</strong>7,786 $<strong>10</strong>7,786 $313,963 $313,963<br />

Weighted average shares outstanding . . . 58,766 58,766 61,472 61,472 65,3<strong>10</strong> 65,3<strong>10</strong><br />

Employee stock options .............. — — — 7<strong>10</strong> — 1,139<br />

Total weighted average shares<br />

outstanding ...................... 58,766 58,766 61,472 62,182 65,3<strong>10</strong> 66,449<br />

(Loss) earnings per share ............. $ (7.19) (7.19) $ 1.75 $ 1.73 $ 4.81 $ 4.72<br />

Certain options were outstanding and not included in the computation of diluted net earnings per share<br />

because the assumed exercise of these options would have been antidilutive. Options to purchase 2,700,470<br />

shares of our common stock with exercise prices ranging from $16.43 to $126.94 per share at June 30, 2009 were<br />

outstanding and not included in the computation of diluted earnings per share because the exercise of these<br />

options would have been antidilutive. In addition, restricted shares of 392,117 were outstanding at June 30, 2009<br />

and not included in the computation of diluted earnings per share as they also would have been antidilutive.<br />

Certain options were outstanding and not included in the computation of diluted net earnings per share<br />

because the assumed exercise of these options would have been antidilutive. Options to purchase 1,868,679<br />

shares of our common stock with exercise prices ranging from $68.31 to $126.94 per share at June 30, 2008 were<br />

outstanding and not included in the computation of diluted earnings per share because the exercise of these<br />

90