DK Leather Corporation Bhd - TA Online

DK Leather Corporation Bhd - TA Online

DK Leather Corporation Bhd - TA Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>TA</strong> Securities <strong>Bhd</strong><br />

20 May 2004<br />

N E W L I S T I N G<br />

<strong>TA</strong> SECURITIES BHD<br />

Participating Organisations of<br />

Malaysia Securities Exchange Berhad<br />

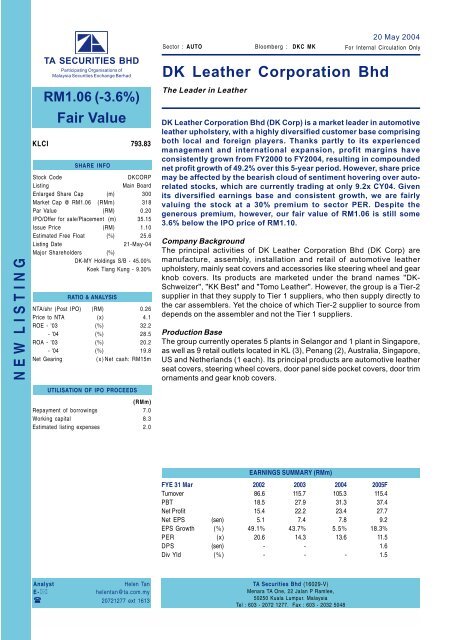

RM1.06 (-3.6%)<br />

Fair Value<br />

KLCI 793.83<br />

SHARE INFO<br />

Stock Code<br />

<strong>DK</strong>CORP<br />

Listing<br />

Main Board<br />

Enlarged Share Cap (m) 300<br />

Market Cap @ RM1.06 (RMm) 318<br />

Par Value (RM) 0.20<br />

IPO/Offer for sale/Placement (m) 35.15<br />

Issue Price (RM) 1.10<br />

Estimated Free Float (%) 25.6<br />

Listing Date<br />

21-May-04<br />

Major Shareholders (%)<br />

<strong>DK</strong>-MY Holdings S/B - 45.00%<br />

Koek Tiang Kung - 9.30%<br />

RATIO & ANALYSIS<br />

N<strong>TA</strong>/shr (Post IPO) (RM) 0.26<br />

Price to N<strong>TA</strong> (x) 4.1<br />

ROE - '03 (%) 32.2<br />

- '04 (%) 28.5<br />

ROA - '03 (%) 20.2<br />

- '04 (%) 19.8<br />

Net Gearing<br />

(x) Net cash: RM15m<br />

UTILISATION OF IPO PROCEEDS<br />

(RMm)<br />

Repayment of borrowings 7.0<br />

Working capital 8.3<br />

Estimated listing expenses 2.0<br />

20 May 2004<br />

Sector : AUTO Bloomberg : <strong>DK</strong>C MK For Internal Circulation Only<br />

<strong>DK</strong> <strong>Leather</strong> <strong>Corporation</strong> <strong>Bhd</strong><br />

The Leader in <strong>Leather</strong><br />

<strong>DK</strong> <strong>Leather</strong> <strong>Corporation</strong> <strong>Bhd</strong> (<strong>DK</strong> Corp) is a market leader in automotive<br />

leather upholstery, with a highly diversified customer base comprising<br />

both local and foreign players. Thanks partly to its experienced<br />

management and international expansion, profit margins have<br />

consistently grown from FY2000 to FY2004, resulting in compounded<br />

net profit growth of 49.2% over this 5-year period. However, share price<br />

may be affected by the bearish cloud of sentiment hovering over autorelated<br />

stocks, which are currently trading at only 9.2x CY04. Given<br />

its diversified earnings base and consistent growth, we are fairly<br />

valuing the stock at a 30% premium to sector PER. Despite the<br />

generous premium, however, our fair value of RM1.06 is still some<br />

3.6% below the IPO price of RM1.10.<br />

Company Background<br />

The principal activities of <strong>DK</strong> <strong>Leather</strong> <strong>Corporation</strong> <strong>Bhd</strong> (<strong>DK</strong> Corp) are<br />

manufacture, assembly, installation and retail of automotive leather<br />

upholstery, mainly seat covers and accessories like steering wheel and gear<br />

knob covers. Its products are marketed under the brand names "<strong>DK</strong>-<br />

Schweizer", "KK Best" and "Tomo <strong>Leather</strong>". However, the group is a Tier-2<br />

supplier in that they supply to Tier 1 suppliers, who then supply directly to<br />

the car assemblers. Yet the choice of which Tier-2 supplier to source from<br />

depends on the assembler and not the Tier 1 suppliers.<br />

Production Base<br />

The group currently operates 5 plants in Selangor and 1 plant in Singapore,<br />

as well as 9 retail outlets located in KL (3), Penang (2), Australia, Singapore,<br />

US and Netherlands (1 each). Its principal products are automotive leather<br />

seat covers, steering wheel covers, door panel side pocket covers, door trim<br />

ornaments and gear knob covers.<br />

EARNINGS SUMMARY (RMm)<br />

FYE 31 Mar 2002 2003 2004 2005F<br />

Turnover 86.6 115.7 105.3 115.4<br />

PBT 18.5 27.9 31.3 37.4<br />

Net Profit 15.4 22.2 23.4 27.7<br />

Net EPS (sen) 5.1 7.4 7.8 9.2<br />

EPS Growth (%) 49.1% 43.7% 5.5% 18.3%<br />

PER (x) 20.6 14.3 13.6 11.5<br />

DPS (sen) - - 1.6<br />

Div Yld (%) - - - 1.5<br />

Analyst<br />

Helen Tan<br />

E-*<br />

helentan@ta.com.my<br />

( 20721277 ext 1613<br />

<strong>TA</strong> Securities <strong>Bhd</strong> (16029-V)<br />

Menara <strong>TA</strong> One, 22 Jalan P Ramlee,<br />

50250 Kuala Lumpur. Malaysia<br />

Tel : 603 - 2072 1277. Fax : 603 - 2032 5048<br />

[ 1 ] <strong>DK</strong> <strong>Leather</strong> <strong>Corporation</strong> <strong>Bhd</strong>

<strong>TA</strong> Securities <strong>Bhd</strong><br />

20 May 2004<br />

Production Process<br />

The production process is briefly summarised below:<br />

Inspect Raw Materials<br />

Process: Random check for<br />

quality defects. If fail test,<br />

reject whole batch<br />

Product: <strong>Leather</strong> Seat<br />

Covers<br />

Process: trimming, sewing<br />

Product: Pocket Covers<br />

Process: Attach 3mm foam onto<br />

fibreboard, staple with piece of<br />

leather, then staple sewn leather<br />

pocket<br />

Die Cut or Drawing/Manual cut<br />

q Re-check for defect; any defect is<br />

marked and excluded from use<br />

q Cut according to superimposed<br />

template<br />

Product: Steering Wheel Covers<br />

Process: Fasten to steering wheel, glue<br />

onto frame, then stitched. Blow dry wheel<br />

Product: Door Trim<br />

Ornament<br />

Process:Glue foam on front<br />

side of ornament, then glue<br />

leather and polyfill on foam.<br />

Wrap excess leather on back<br />

Product: Gear Knob<br />

Process: Glue die-cut<br />

perforated leather onto<br />

knob, trim excess leather<br />

and clean off excess glue<br />

Experienced Management<br />

The group is led by Executive Chairman/Managing Director Koek Tiang Kung,<br />

who has accumulated more than 10 years of experience in the leather related<br />

industry. He is in turn assisted by a team of capable and experienced<br />

management staff. Their experience and technical expertise enable <strong>DK</strong> Corp<br />

to capitalise on market opportunities to help the group outpace its<br />

competitors.<br />

Major Customers and Market Share<br />

The major customers for <strong>DK</strong> Corp for the 7-month period ended 31 October<br />

are as detailed in Table 1. <strong>DK</strong> Corp caters to a wide variety of clientele-i.e.<br />

automotive assemblers, car distributors and dealers and end-consumers.<br />

The group indirectly sells to Proton and Perodua via Johnson Controls and<br />

Auto Parts Manufacturing. To broaden its customer base and to reduce<br />

dependence on any single customer, the group has expanded its sales to<br />

other marques locally and internationally. Locally, the group has extended<br />

its reach to other marques like Kia, Hyundai, Ford, Honda, Mitsubishi and<br />

Volvo. For the 7-month period ended 31 Oct 2003, exports accounted for<br />

45.6% of group turnover, an improvement over 36.9% share registered in<br />

FYE 31 March 2003. The group is also setting up new subsidiaries to<br />

strengthen its foothold in US, Australia and continental Europe. Management<br />

believes that <strong>DK</strong> Corp is the largest manufacturer of automotive leather<br />

upholstery in Malaysia (source: prospectus, page 78).<br />

<strong>TA</strong>BLE 1: MAJOR CUSTOMERS<br />

Customer Length of Relationship % of<br />

(Years) Group Turnover<br />

Johnson Controls Automotive Seating (M) S/B 7 24.6<br />

Auto Parts Manufacturing Co. S/B 4 7.3<br />

Kah Motor Co. S/B (Singapore) 11 6.6<br />

Cycle & Carriage Kia Pte Ltd (Singapore) 4 5.7<br />

Lous Schweizer <strong>Leather</strong> (Asia) S/B 7 4.7<br />

Abdul Latif Jameel Import & Distribution Co. Ltd (Saudi Arabia) 3 4.4<br />

Mazda Motor (S) Pty Ltd (Singapore) 11 2.7<br />

Regent Motors Ltd (Singapore) 11 2.5<br />

Naza Automotive Manufacturing Sdn <strong>Bhd</strong> 1 1.9<br />

Carinpa (M) S/B 7 1.2<br />

Total -- 61.6<br />

Source: prospectus<br />

[ 2 ] <strong>DK</strong> <strong>Leather</strong> <strong>Corporation</strong> <strong>Bhd</strong>

<strong>TA</strong> Securities <strong>Bhd</strong><br />

20 May 2004<br />

TURNOVER CONTRIBUTION FOR 7M ENDED 31/10/03<br />

Saudi Arabia<br />

4%<br />

Australia<br />

3%<br />

Others<br />

3%<br />

US<br />

16%<br />

Singapore<br />

20%<br />

Source: prospectus<br />

Malaysia<br />

54%<br />

Major suppliers<br />

The principal raw material is leather, which the group obtains from Schweizer<br />

Group (comprising ISA Industrial Ltd, Hong Kong and Lederfabrik Lous<br />

Schweizer KG, Germany) and Conceria Pasubio SPA, Italy, either directly<br />

or through their agent, Lous Schweizer <strong>Leather</strong> (Asia) Sdn <strong>Bhd</strong>. The group<br />

also obtains insubstantial amount (i.e. less than 10% of purchases in any<br />

given year) from other tanneries such as Howe <strong>Leather</strong> (Australia), Bridge of<br />

Weir, Scotland and Elmo, Sweden. However, major suppliers are ISA Industrial<br />

and Conceria Pasubio, which accounted for 16.0% and 66.7% of the group's<br />

total purchases for the 7 months ended 31 October 2003. The group relies<br />

on a small pool of suppliers to ensure consistent quality and supply of raw<br />

materials, which subsequently would minimise disruptions to operations.<br />

No Contractual Agreements<br />

In line with industry norms, <strong>DK</strong> Corp does not enter into long-term contractual<br />

agreements with its customers and/or suppliers. Despite this, the group has<br />

secured the trust and commitment of its customers due to its established<br />

track record in providing high quality products and services.<br />

Forex risk<br />

The group is subject to currency fluctuations as exports are denominated in<br />

USD, Australian dollar (AUD), Euro and Singapore dollar (SGD), while raw<br />

materials are imported in USD and SGD. For the 7 months ended 31 Oct<br />

2003, some 45.6% of the group's products were exported in USD, AUD,<br />

Euro and SGD while 83.9% of raw materials (namely leather hides) were<br />

imported in USD and SGD.<br />

Future Plans<br />

The group is aggressively expanding overseas and has spread its wings to<br />

Australia, Saudi Arabia and US in 2001 and to continental Europe in 2003.<br />

Overseas sales are expected to exceed 45% of group turnover in 2004 and<br />

to continue growing thereafter to over 50%. Other plans include diversifying<br />

its local customer base, establishing its own brand name (i.e. <strong>DK</strong>-Schweizer)<br />

and setting up its own distribution facilities overseas.<br />

Actual results under-performed estimates<br />

The group released its proforma income statement for FYE 31 March 2004<br />

on 18 May 2004. Pretax and net profit were 6.4% and 5.7% below<br />

management estimates in the prospectus (see table). The management<br />

attributed this to lower-than-expected sales in the local market. Note that in<br />

view of uncertain sales on the local front, our forecast pretax and net earnings<br />

for FYE March 2005 are 14% and 11% lower respectively than management<br />

forecast.<br />

[ 3 ] <strong>DK</strong> <strong>Leather</strong> <strong>Corporation</strong> <strong>Bhd</strong>

<strong>TA</strong> Securities <strong>Bhd</strong><br />

20 May 2004<br />

ACTUAL VS FORECAST RESULTS<br />

Forecast* Actual<br />

RM'000<br />

RM'000<br />

PBT 33,449 31,299<br />

Tax (8,328) (7,877)<br />

PAT 25,121 23,422<br />

MI (276) -<br />

Net Profit 24,845 23,422<br />

*as contained in the prospectus<br />

Healthy Financial Base<br />

For the year ended 31 March 2004, interest coverage is healthy at 80.4x.<br />

Based on the proforma balance sheet, the group will have net cash of RM15.0<br />

million following the IPO exercise, while current ratio is strong at 2.4x. We<br />

note that profit margin for the group has been consistently growing due to<br />

the group's diversification strategy and overseas expansion. Pretax margin<br />

has increased steadily from 12.1% in FYE 31 March 2000 to an estimated<br />

29.7% in FY2004. This resulted in compounded growth of 52% for pretax<br />

profit and 49% for net profit over the 5-year period.<br />

Fairly valued below IPO price<br />

Although we expect domestic sales to be marred by slower car sales in<br />

anticipation of AF<strong>TA</strong> (where import duties will be reduced to 20% effective 1<br />

January 2005), the group's diversification and overseas expansion should<br />

anchor earnings going forward. Despite its solid financial base and overseas<br />

expansion, however, we expect share price to be affected by the weak<br />

sentiment pervading motor-related stocks, which are currently trading at<br />

average PER of only 9.2x CY04, versus market PER of around 14x. We are<br />

fairly valuing the company at a 30% premium to industry PER to account for<br />

its diversified earnings base and lower dependence on domestic car players.<br />

Our targeted PER is thus 12x on CY04 EPS of 8.9 sen. Despite the generous<br />

premium, this results in a fair value of only RM1.06, which is 3.6% below the<br />

IPO price of RM1.10.<br />

The information in this report has been obtained from<br />

sources believed to be reliable. Its accuracy or<br />

completeness is not guaranteed and opinions are subject<br />

to change without notice. This report is for information<br />

only and not to be construed as a solicitation for<br />

contracts. We accept no liability for any direct or indirect<br />

loss arising from the use of this document. We, our<br />

associates, directors, employees may have an interest<br />

in the securities and/or companies mentioned herein.<br />

for <strong>TA</strong> SECURITIES BHD,<br />

Yaw Chun Soon, Executive Director - Operations<br />

[ 4 ] <strong>DK</strong> <strong>Leather</strong> <strong>Corporation</strong> <strong>Bhd</strong>