NEWLISTING Kein Hing International Berhad - TA Online

NEWLISTING Kein Hing International Berhad - TA Online

NEWLISTING Kein Hing International Berhad - TA Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

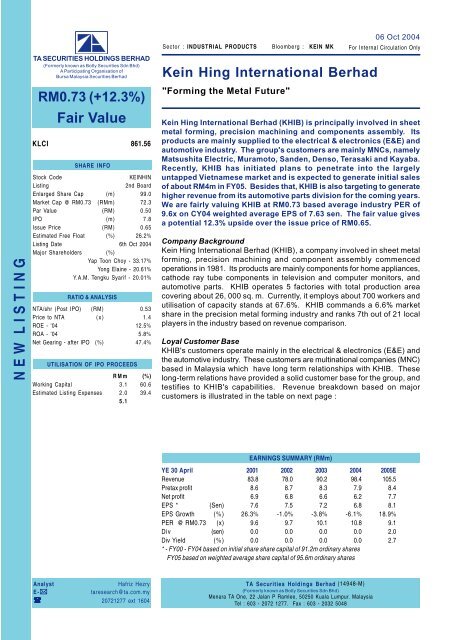

<strong>TA</strong> Securities Holdings Bhd06 Oct 2004N E W L I S T I N G<strong>TA</strong> SECURITIES HOLDINGS BERHAD(Formerly known as Botly Securities Sdn Bhd)A Participating Organisation ofBursa Malaysia Securities <strong>Berhad</strong>RM0.73 (+12.3%)Fair ValueKLCI 861.56SHARE INFOStock CodeKEINHINListing2nd BoardEnlarged Share Cap (m) 99.0Market Cap @ RM0.73 (RMm) 72.3Par Value (RM) 0.50IPO (m) 7.8Issue Price (RM) 0.65Estimated Free Float (%) 26.2%Listing Date 6th Oct 2004Major Shareholders (%)Yap Toon Choy - 33.17%Yong Elaine - 20.61%Y.A.M. Tengku Syarif - 20.01%RATIO & ANALYSISN<strong>TA</strong>/shr (Post IPO) (RM) 0.53Price to N<strong>TA</strong> (x) 1.4ROE - '04 12.5%ROA - '04 5.8%Net Gearing - after IPO (%) 47.4%UTILISATION OF IPO PROCEEDSRMm (%)Working Capital 3.1 60.6Estimated Listing Expenses 2.0 39.45.106 Oct 2004Sector : INDUSTRIAL PRODUCTS Bloomberg : KEIN MK For Internal Circulation Only<strong>Kein</strong> <strong>Hing</strong> <strong>International</strong> <strong>Berhad</strong>"Forming the Metal Future"<strong>Kein</strong> <strong>Hing</strong> <strong>International</strong> <strong>Berhad</strong> (KHIB) is principally involved in sheetmetal forming, precision machining and components assembly. Itsproducts are mainly supplied to the electrical & electronics (E&E) andautomotive industry. The group's customers are mainly MNCs, namelyMatsushita Electric, Muramoto, Sanden, Denso, Terasaki and Kayaba.Recently, KHIB has initiated plans to penetrate into the largelyuntapped Vietnamese market and is expected to generate initial salesof about RM4m in FY05. Besides that, KHIB is also targeting to generatehigher revenue from its automotive parts division for the coming years.We are fairly valuing KHIB at RM0.73 based average industry PER of9.6x on CY04 weighted average EPS of 7.63 sen. The fair value givesa potential 12.3% upside over the issue price of RM0.65.Company Background<strong>Kein</strong> <strong>Hing</strong> <strong>International</strong> <strong>Berhad</strong> (KHIB), a company involved in sheet metalforming, precision machining and component assembly commencedoperations in 1981. Its products are mainly components for home appliances,cathode ray tube components in television and computer monitors, andautomotive parts. KHIB operates 5 factories with total production areacovering about 26, 000 sq. m. Currently, it employs about 700 workers andutilisation of capacity stands at 67.6%. KHIB commands a 6.6% marketshare in the precision metal forming industry and ranks 7th out of 21 localplayers in the industry based on revenue comparison.Loyal Customer BaseKHIB's customers operate mainly in the electrical & electronics (E&E) andthe automotive industry. These customers are multinational companies (MNC)based in Malaysia which have long term relationships with KHIB. Theselong-term relations have provided a solid customer base for the group, andtestifies to KHIB's capabilities. Revenue breakdown based on majorcustomers is illustrated in the table on next page :EARNINGS SUMMARY (RMm)YE 30 April 2001 2002 2003 2004 2005ERevenue 83.8 78.0 90.2 98.4 105.5Pretax profit 8.6 8.7 8.3 7.9 8.4Net profit 6.9 6.8 6.6 6.2 7.7EPS * (Sen) 7.6 7.5 7.2 6.8 8.1EPS Growth (%) 26.3% -1.0% -3.8% -6.1% 18.9%PER @ RM0.73 (x) 9.6 9.7 10.1 10.8 9.1Div (sen) 0.0 0.0 0.0 0.0 2.0Div Yield (%) 0.0 0.0 0.0 0.0 2.7* - FY00 - FY04 based on initial share share capital of 91.2m ordinary sharesFY05 based on weighted average share capital of 95.6m ordinary sharesAnalystHafriz HezryE-taresearch@ta.com.my 20721277 ext 1604<strong>TA</strong> Securities Holdings <strong>Berhad</strong> (14948-M)(Formerly known as Botly Securities Sdn Bhd)Menara <strong>TA</strong> One, 22 Jalan P Ramlee, 50250 Kuala Lumpur. MalaysiaTel : 603 - 2072 1277. Fax : 603 - 2032 5048[ 1 ] <strong>Kein</strong> <strong>Hing</strong> <strong>International</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd06 Oct 2004Customer Percentage of Revenue Length of Relationship(%) (No. of years)Matsushita Electric Co (M) S/B 35.95 23Muramoto Technics (M) S/B 15.12 7Muramoto Asia (S) Pte Ltd 7.07 7Sanden <strong>International</strong> (M) S/B 5.87 16Denso (M) S/B 5.20 19Terasaki Electric (M) S/B 4.25 13Hirotako <strong>Kein</strong> <strong>Hing</strong> S/B 4.15 2Sanden <strong>International</strong> (S) Pte Ltd 2.83 11Kayaba (M) S/B 2.59 9Matsushita Electronic Motor S/B 1.83 4A Diversified Range of ProductsKHIB's products, are well diversified where 39% of FY04 turnover was derivedfrom home appliances, 27% from components & devices, 25% from automotiveparts, 5% from audio visual and another 4% from various products. Althoughthere is some dependency on its home appliances, components and devicesdivision (which together contributes about 66% of total revenue), KHIBattempts to alleviate this concern by further growing its automotive business.Therefore, the group will not be severely affected if any one of the sectorsfaces a decline.A One-Stop Metal Components and Machining CenterBesides providing a comprehensive combination of manufacturing processes(precision machining, stamping, tooling development and design, deepdrawing, precision cold forging), KHIB is also supported by secondaryprocesses such as spot welding, tapping, grinding, degreasing and subassemblyworks. In addition, the group is involved in the designing processof products for its customers, based on its capability to do in-house design,prototyping, R&D and tooling development. This in turn has enabled KHIB tosustain its contracts and support the long-term relationship that it hasestablished with its customers. In addition, the complete range of servicesit provides is cost effective and minimizes production lead-time. The group'scapabilities have also enabled it to acquire the flexibility to change anddiversify production specifications according to the needs of its customers.Penetrating Into VietnamÖKHIB has recently initiated plans to penetrate into the Vietnamese market,through a JV with one of its customer's parent company, Muramoto Asia (S)Pte Ltd. The group's new plant in Hanoi is still under construction and isexpected to commence operations in January 2005. KHIB intends to focuson E&E products and claims to be one of the pioneer companies to providemetal forming services in Vietnam. Given the low labour costs and relativelyuntapped market in the country, KHIB should be able to generate significantcontribution from Vietnam in the long run. Current and potential customersin Vietnam include Canon, Toa, Matsushita, Denso and Kayaba. The groupexpects revenue in the next few years to increase by RM30m to RM40mfrom the new factory. KHIB has invested RM12m in the factory and land (15,690 sq. m.), plus another RM5m for purchase of new machineries.[ 2 ] <strong>Kein</strong> <strong>Hing</strong> <strong>International</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd06 Oct 2004Moving Focus Towards Automotive PartBesides the plant in Vietnam, the group is also building another factory inSeri Kembangan, Selangor, which will commence operations in December2004. The group plans to place more emphasis on automotive parts fromthe new factory, based on the higher margin yield of 10% to 15% comparedto home appliances which yields a lower margin of 7% to 8%. KHIB iscurrently a Tier-1 supplier (forms many automotive parts and componentstogether in one piece) for Honda (Malaysia) and an indirect supplier of partsto Perodua. Among components produced by the group are radiators, carair conditioning, engine control unit, condenser, relay, car compressor, carshock absorber and pump shaft. The group expects revenue contributionfrom automotive parts to increase by 5% - 10% in the future. Managementbelieves, growth in this segment will be underpinned by the continuedoutsourcing trend in automotive parts and accessories, besides the 40%local content requirement by AF<strong>TA</strong>.Strategic PartnershipsKHIB also engages in strategic partnership to enhance its business. Its JVwith Muramoto Asia to penetrate into the Vietnamese market is one suchexample. The JV, which is 51% owned by KHIB, has opened new opportunitiesfor the group to penetrate into this new market. Muramoto is one of thegroup's major customers and is known as one of the largest manufacturersof LCD monitors in Asia. In addition, Muramoto also generates annualrevenues of approximately USD700m and is currently expanding its activitiesin Vietnam. Therefore, the partnership with Muramoto should enable KHIBto leverage on Muramoto's reputation and distribution network.Besides Muramoto, KHIB has also successfully formed a strategic partnershipwith Hirotako Holdings (an automotive parts manufacturer). Through a JV,which is 49% owned by KHIB, the group has successfully secured newcontracts to supply safety belt components, steering wheels and air bags toPerodua. Note here that Hirotako's principal partner is Autoliv (a Swedishcompany), which has around 15 joint ventures in Asia and a well knownsupplier of automotive parts in the Asean region. This in turn should createpotentials for KHIB to become a regional component supplier to Autoliv inthe future.Moderate Barriers to EntryThe precision metal forming industry in Malaysia is characterized by moderatebarriers to entry. Looking into the costs involved, a new company involved inmetal forming would usually require an initial investment of RM10m - RM17m.Due to the low capital requirement, existing players faces threat from newcompetitors entering the industry. However, the industry is highly fragmenteddue to diverse product application of metal forming parts. Based on Infocreditmarket research, there are around 300 players operating in the industry,which comprises mostly small and medium sized companies. These playersusually focus and specialise in their own niche segments. Automotive partsand electronic components for example, require very high precision andtolerance levels to meet customers' requirements, and therefore, requirecertain levels of technology and skilled workers.Concerns on Rising Steel Price and Declining Automotive ProductionSteel price has increased by approximately 64%, from USD405 per metricton (January 03') to the recent high of USD665 per metric ton. This is ofparticular concern to KHIB due to its high reliance on steel products as itsraw material. In addition, KHIB is only able to pass down part of the increaseto its customers. We are also concerned on KHIB's move to focus more onthe manufacturing of automotive parts, in light of declining growth of thelocal automotive sector for the past 3 years.[ 3 ] <strong>Kein</strong> <strong>Hing</strong> <strong>International</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd06 Oct 2004Valuation and RecommendationsWe are fairly valuing KHIB at RM0.73 based on 9.6x PER of CY04 weightedaverage EPS of 7.63 sen. This valuation is at par to the industry averagePER. The valuation has factored in concerns revolving around the risingsteel price, which might badly affect KHIB's profit margin and the group'sdecision to place higher emphasis on manufacturing automotive parts, whichin our opinion is still suffering from industry slowdown. However, comparedto its peers, KHIB commands a stronger operating profit margin and higherROA.INDUSTRY COMPARISONTracoma NHF KHIBFYE Dec. '04 Dec. '04 Apr. 04Share Price @ 05/10 1.36 2.68 0.65Revenue ** 69.3 145.4 103.1Operating Profit Margin (%) 9% 15.9% 16.7%Net Profit ** 6.3 22.3 7.2EPS ** (sen) 13.0 30.9 7.6N<strong>TA</strong>/Share * 1.7 1.4 0.5PER (x) 10.4 8.7 8.5PBV (x) 0.8 1.9 1.2ROE (%) 4.9% 12.1% 12.5%ROA (%) 3.2% 9.6% 5.8%Net Gearing * (%) 86.1% 23.7% 47.4%Profit before tax (%) 7.2% 15.7% 8.1%CAGR - Revenue (FY00-FY03) 8.7% 7.0% 7.7%- Net Profit (FY00-FY03) -18.0% -2.2% 6.4%* based on latest quarter result** calendarised resultsThe information in this report has been obtained fromsources believed to be reliable. Its accuracy orcompleteness is not guaranteed and opinions are subjectto change without notice. This report is for informationonly and not to be construed as a solicitation forcontracts. We accept no liability for any direct or indirectloss arising from the use of this document. We, ourassociates, directors, employees may have an interestin the securities and/or companies mentioned herein.for <strong>TA</strong> SECURITIES HOLDINGS BERHAD(Formerly known as Botly Securities Sdn Bhd)Yaw Chun Soon, Executive Director - Operations[ 4 ] <strong>Kein</strong> <strong>Hing</strong> <strong>International</strong> <strong>Berhad</strong>