NEWLISTING Kurnia Asia Berhad - TA Online

NEWLISTING Kurnia Asia Berhad - TA Online

NEWLISTING Kurnia Asia Berhad - TA Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

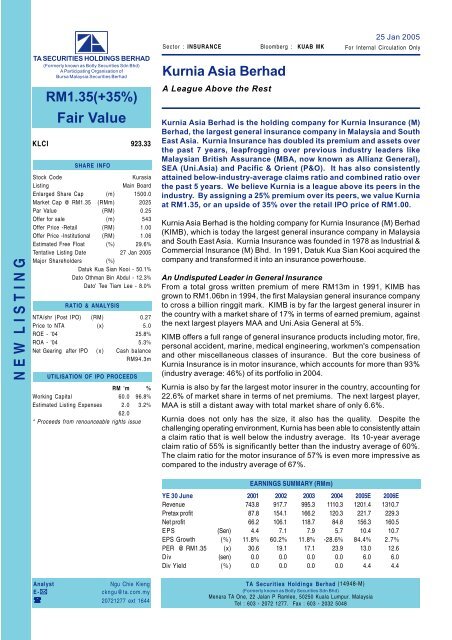

<strong>TA</strong> Securities Holdings Bhd25 Jan 2005GENERAL INSURANCE CLAIMS RATIO - KURNIA VS INDUSTRY80%70%60%50%40%30%20%10%0%59%58%59%68%56%53%57%34%58%54%64%55%64%57%63%57%63%59%62%57%60%55%1994199519961997199819992000200120022003AverageSource : <strong>Kurnia</strong>Industry<strong>Kurnia</strong>MOTOR INSURANCE CLAIMS RATIO - KURNIA VS INDUSTRY80%70%60%50%40%30%20%10%0%69%60%199475%72%199567%60%199665%37%199761%56%199867%57%199970%59%200066%58%200166%60%200266%59%200367%57%AverageIn our opinion, the impressive performance of <strong>Kurnia</strong> is attributable to1) Professional and dedicated management teamThe management team under the leadership of Datuk Kua Sian Kooi hasbeen the key difference in <strong>Kurnia</strong>. Several members of the managementteam possess in-depth knowledge of the industry, having been in theindustry for years. Datuk Kua Sian Kooi's personal background as aninsurance agent at the age of 22 with Inshouse Sdn Bhd and later joinedWellead Sdn Bhd as an underwriter helped him in setting the proper systemand organisation for the group as well as in agency management. Thetop management is also hands-on in terms of formulating group strategiesand proactive in addressing growth constrains facing the company.2) Effective agency development and serviceInsurance is a volume business. And for <strong>Kurnia</strong>, since it is principally adirect underwriter (98.7% of gross premium income), it relies almostcompletely on its agents (7672 as of Nov '04). Hence, agency developmentand service is of paramount important.To maximise the performance of all the agents, <strong>Kurnia</strong> has a group ofmarketing executives who are assigned to look into all the needs of itsagents. The marketing executives agents are also responsible to ensurethat each agent under his care meets the predetermined sales target.Formalised training programmes comprising various external courses,seminars, and in-house courses are also an integral part of <strong>Kurnia</strong> agencydevelopment program.3) Utilisation of IT<strong>Kurnia</strong>'s eagerness to embrace the latest information technology haspositioned the group ahead of its peers. The group has allocated a budgetof RM70m for IT for the next few 3-5 years. KIMB is moving towardspaperless working environment and in line with this, it is migrating itsexisting system to web-based insurance application system, and itsexisting personal computers, network infrastructure and security will beupgraded to cater for the e-business expansion and a web-basedenvironment called Integrated Insurance Management System (IIMS).[ 2 ] <strong>Kurnia</strong> <strong>Asia</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd25 Jan 2005In the meantime, all its branch offices have been converted to wirelesslocal area network and all its marketing staff are provided with notebooksequipped with KIMB's own proprietary, customised e-MMS (electronicMarketing Management System) software that enables staff to provideprompt and efficient services to agents and customers nationwide.The group's web-based Electronic Agency Management Systems (e-AMS)allows agents to download up-to-date customer data, submit policyapplications directly to KIMB and conduct other types of transactionsthrough the internet.4) Innovative Product development<strong>Kurnia</strong>'s product development program also played a crucial role in elevatingthe brand value of the company. Among others, <strong>Kurnia</strong> is the first tolaunch <strong>Kurnia</strong> Express which provides one hour claim services to itsclients. <strong>Kurnia</strong> Auto Assist, a program which provide roadside assistance,is yet another value-added service to its policy holders. Since its initiallaunch in 2000, <strong>Kurnia</strong> Auto Assist membership has grown to over onemillion. These value-added products also helped to promote customerloyalty. This is shown in the relatively high average renewal rate for motorpolicy of 65.7%.Potential Upside to EarningsWe expect <strong>Kurnia</strong>'s gross premium to grow by 9% in 2005 and 9.5% in 2006and net claim ratio to improve to 58% in 2005 from 68% in 2004. Theimprovement in claim ratio is on the expectation that the claim ratio willnormalise in 2005 as the additional provision for reserves that was made lastyear is not expected to recur.Among key growth drivers to <strong>Kurnia</strong>'s earnings for the next few years are1) Revision to Motor TariffMotor tariff for Malaysia was last reviewed in 1996 and another review isoverdue. Industry sources reveal that chances of a review materialisingin the next one-to-two years are quite high. According to them the proposalis already at the cabinet level but is still pending final decision from thegovernment.The industry is expecting the revision, when materialise, to result in anaverage increase of about 7% -7.5% in gross premium. <strong>Kurnia</strong> is likely tobe one of the biggest beneficiaries of the revision given its large exposureto the motor sector.2) Diversification into Other ProductsPresently <strong>Kurnia</strong> is focusing mainly on motor insurance. However, giventhe established agency and customer base, it could easily push for otherinsurance products as well. In fact, <strong>Kurnia</strong> is already looking down thispath with the recent launch of two (2) new medical products namelyMediGuard and MediGuard Express.3) Higher Return from Investment Portfolio<strong>Kurnia</strong> has maintained a conservative investment policy that might havecapped its investment gains thus far. Most of <strong>Kurnia</strong>'s investment forFY04 was in long term bonds and in blue chips shares. Assuming that<strong>Kurnia</strong> adopt a slightly more aggressive stand, say by shifting its totalyield from 5.3% in FY04 by 1%, its investment return could potentiallyincrease the bottomline by 6%[ 3 ] <strong>Kurnia</strong> <strong>Asia</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd25 Jan 2005Valuation & RecommendationPresently, the basket of major insurance companies in Bursa Malaysia istrading at an average PER of 10.3 times CY05 earnings. Based on <strong>Kurnia</strong>'srecent underwriting performance, its orgnisation structure, corporate cultureand agency force, we believe <strong>Kurnia</strong> is a league above its peers, especiallyin the general insurance industry. As such, <strong>Kurnia</strong> deserves to be trading atsubstantial premium to its peers. Based on 25% premium to the industryaverage PER, we value <strong>Kurnia</strong> at RM1.35 (12.9x PER). The fair valuerepresents a premium of 35% over the retail offer price of RM1.00 and 27.3%above the institutional book building price of RM1.06.6.00VALUATION MATRIX6.005.00KURNIA5.00Price-To-Book4.003.002.00LPIMAA4.003.002.001.001.00JERNEHMNIP&O0.000.000.0% 5.0% 10.0% 15.0% 20.0%5 Year CAGR (Net Premium)Source : <strong>TA</strong> ResearchINDUSTRY COMPARISONMAA MNI Jerneh LPI P&O <strong>Kurnia</strong>FYE Dec Mac Dec Dec Sept JuneShare Price @ 24/1(RM) 5.05 2.58 2.34 6.50 1.88 1.35EPS - CY04 (sen) 40.2 41.1 28.0 34.7 0.0 8.0- CY05 (sen) 46.2 46.0 31.0 38.2 0.0 10.6N<strong>TA</strong>/Share 2.1 3.8 2.4 2.5 2.2 0.3PER - CY04 (x) 12.6 6.3 8.4 18.7 n.a. 16.8- CY05 (x) 10.9 5.6 7.5 17.0 n.a. 12.9PBV (x) 2.4 0.7 1.0 2.6 0.9 5.00ROE (%) 22.4% 7.4% 9.5% 12.0% 0.0% 25.8%ROA (%) 1.5% 1.2% 3.8% 6.5% 0.0% 5.3%Source : <strong>TA</strong> Research[ 4 ] <strong>Kurnia</strong> <strong>Asia</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd25 Jan 2005REVENUE ACCOUNT (RMm)Year Ended June 30 2002 2003 2004 2005E 2006FGross Premium 873.7 951.5 1056.3 1151.4 1260.7Less : Reinsurance 84.3 87.3 92.5 103.6 113.5Net Premium 789.4 864.2 963.8 1047.7 1147.3Decrease/(increase) in UPR (58.7) (27.3) (65.6) (68.1) (68.8)Earned Premium Income 730.7 836.9 898.1 979.6 1078.4Net Claims Incurred 428.8 480.3 610.9 568.2 625.5Net Commission 86.5 93.4 94.0 102.9 113.2Management Expenses 141.2 159.5 162.4 176.3 194.1Underwriting Surplus 74.2 103.6 30.9 132.3 145.6Net Investment Income 44.0 43.8 54.0 51.4 55.7Other Income 35.9 18.7 35.3 38.0 28.0Transfer to Profit & Loss 154.1 166.2 120.3 221.7 229.3Pretax Profit 154.1 166.2 120.3 221.7 229.3Tax Expenses -48.0 -47.5 -35.5 -65.4 -68.8Tax Rate (%) 31.1% 28.6% 29.5% 29.5% 30.0%Net Profit 106.1 118.7 84.8 156.3 160.5Source : <strong>TA</strong> ResearchThe information in this report has been obtained fromsources believed to be reliable. Its accuracy orcompleteness is not guaranteed and opinions are subjectto change without notice. This report is for informationonly and not to be construed as a solicitation forcontracts. We accept no liability for any direct or indirectloss arising from the use of this document. We, ourassociates, directors, employees may have an interestin the securities and/or companies mentioned herein.for <strong>TA</strong> SECURITIES HOLDINGS BERHAD(Formerly known as Botly Securities Sdn Bhd)Yaw Chun Soon, Executive Director - Operations[ 5 ] <strong>Kurnia</strong> <strong>Asia</strong> <strong>Berhad</strong>