NEWLISTING Tricubes Berhad - TA Online

NEWLISTING Tricubes Berhad - TA Online

NEWLISTING Tricubes Berhad - TA Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

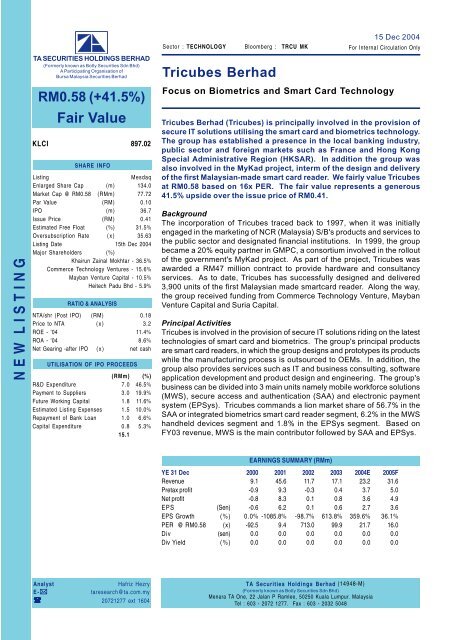

<strong>TA</strong> Securities Holdings Bhd15 Dec 2004N E W L I S T I N G<strong>TA</strong> SECURITIES HOLDINGS BERHAD(Formerly known as Botly Securities Sdn Bhd)A Participating Organisation ofBursa Malaysia Securities <strong>Berhad</strong>RM0.58 (+41.5%)Fair ValueKLCI 897.02SHARE INFOListingMesdaqEnlarged Share Cap (m) 134.0Market Cap @ RM0.58 (RMm) 77.72Par Value (RM) 0.10IPO (m) 36.7Issue Price (RM) 0.41Estimated Free Float (%) 31.5%Oversubscription Rate (x) 35.63Listing Date 15th Dec 2004Major Shareholders (%)Khairun Zainal Mokhtar - 36.5%Commerce Technology Ventures - 15.6%Mayban Venture Capital - 10.5%Heitech Padu Bhd - 5.9%RATIO & ANALYSISN<strong>TA</strong>/shr (Post IPO) (RM) 0.18Price to N<strong>TA</strong> (x) 3.2ROE - '04 11.4%ROA - '04 8.6%Net Gearing -after IPO (x) net cashUTILISATION OF IPO PROCEEDS(RMm) (%)R&D Expenditure 7.0 46.5%Payment to Suppliers 3.0 19.9%Future Working Capital 1.8 11.6%Estimated Listing Expenses 1.5 10.0%Repayment of Bank Loan 1.0 6.6%Capital Expenditure 0.8 5.3%15.115 Dec 2004Sector : TECHNOLOGY Bloomberg : TRCU MK For Internal Circulation Only<strong>Tricubes</strong> <strong>Berhad</strong>Focus on Biometrics and Smart Card Technology<strong>Tricubes</strong> <strong>Berhad</strong> (<strong>Tricubes</strong>) is principally involved in the provision ofsecure IT solutions utilising the smart card and biometrics technology.The group has established a presence in the local banking industry,public sector and foreign markets such as France and Hong KongSpecial Administrative Region (HKSAR). In addition the group wasalso involved in the MyKad project, interm of the design and deliveryof the first Malaysian-made smart card reader. We fairly value <strong>Tricubes</strong>at RM0.58 based on 16x PER. The fair value represents a generous41.5% upside over the issue price of RM0.41.BackgroundThe incorporation of <strong>Tricubes</strong> traced back to 1997, when it was initiallyengaged in the marketing of NCR (Malaysia) S/B's products and services tothe public sector and designated financial institutions. In 1999, the groupbecame a 20% equity partner in GMPC, a consortium involved in the rolloutof the government's MyKad project. As part of the project, <strong>Tricubes</strong> wasawarded a RM47 million contract to provide hardware and consultancyservices. As to date, <strong>Tricubes</strong> has successfully designed and delivered3,900 units of the first Malaysian made smartcard reader. Along the way,the group received funding from Commerce Technology Venture, MaybanVenture Capital and Suria Capital.Principal Activities<strong>Tricubes</strong> is involved in the provision of secure IT solutions riding on the latesttechnologies of smart card and biometrics. The group's principal productsare smart card readers, in which the group designs and prototypes its productswhile the manufacturing process is outsourced to OEMs. In addition, thegroup also provides services such as IT and business consulting, softwareapplication development and product design and engineering. The group'sbusiness can be divided into 3 main units namely mobile workforce solutions(MWS), secure access and authentication (SAA) and electronic paymentsystem (EPSys). <strong>Tricubes</strong> commands a lion market share of 56.7% in theSAA or integrated biometrics smart card reader segment, 6.2% in the MWShandheld devices segment and 1.8% in the EPSys segment. Based onFY03 revenue, MWS is the main contributor followed by SAA and EPSys.EARNINGS SUMMARY (RMm)YE 31 Dec 2000 2001 2002 2003 2004E 2005FRevenue 9.1 45.6 11.7 17.1 23.2 31.6Pretax profit -0.9 9.3 -0.3 0.4 3.7 5.0Net profit -0.8 8.3 0.1 0.8 3.6 4.9EPS (Sen) -0.6 6.2 0.1 0.6 2.7 3.6EPS Growth (%) 0.0% -1085.8% -98.7% 613.8% 359.6% 36.1%PER @ RM0.58 (x) -92.5 9.4 713.0 99.9 21.7 16.0Div (sen) 0.0 0.0 0.0 0.0 0.0 0.0Div Yield (%) 0.0 0.0 0.0 0.0 0.0 0.0AnalystHafriz HezryE-taresearch@ta.com.my 20721277 ext 1604<strong>TA</strong> Securities Holdings <strong>Berhad</strong> (14948-M)(Formerly known as Botly Securities Sdn Bhd)Menara <strong>TA</strong> One, 22 Jalan P Ramlee, 50250 Kuala Lumpur. MalaysiaTel : 603 - 2072 1277. Fax : 603 - 2032 5048[ 1 ] <strong>Tricubes</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd15 Dec 2004Focus on Biometrics Based Products<strong>Tricubes</strong>' principal products are smart card and fingerprint readers. Theseproducts are the outcome of over 5 years of experience and technology knowhowof the MyKad project (the first multi-application national ID project inthe world), in which the group has worked extensively with the biometricstechnology. As to date, the principal products that have been released areas follows:1. <strong>Tricubes</strong> 10xx series - A wireless handheld computer targeted at enterpriseusers that require access information to and from their legacy systemsvia wireless connectivity. The device is optionally equipped with a chipbasedbiometrics scanner and a smart card reader.2. Tripaq Sleeve - Primary market for this device are enterprise-PDA usersthat require wireless connectivity. The product is developed with variousfunctionalities such as GSM or GPRS connectivity and smartcard readermodule.3. Sekure - A low-cost biometrics reader that was developed due to demandsby users for a simple reader that reads MyKad. The biometrics scannerfeature provides users with the possibility of checking a person's identityusing the biometrics template available in MyKad.4. Secure Xcess Console - A console that is developed to provide the solutionto using MyKad as an access card for entry to buildings and premises.Typically the console is integrated with applications such as timeattendance or visitor's registration for control purposes.Inroads into European and China Markets<strong>Tricubes</strong>' revenue is derived mainly from the local market, while a small 5%is derived from overseas namely Hong Kong Special Administrative Region(HKSAR) and France. The group had in 2002, secured a contract with ClipCard of Sofia Antipolis, France for the design, manufacture and supply of200 initial units of customised sleeves codenamed Tripaq. These hybridPDAs are to be the front-end devices for a pilot project deploying a smartcard based parking summons system in a few cities in France and Italy.Besides the European market, <strong>Tricubes</strong> has also established its presencein HKSAR through the implementation of the SMARTIC's ID project, a similarproject to MyKad. These foreign projects serve as an important platform for<strong>Tricubes</strong> to penetrate into the European and China markets. In addition,<strong>Tricubes</strong> has already opened a representative office in Paris and are targetingthe government and enterprise sectors of major European countries. <strong>Tricubes</strong>expects its overseas revenue to contribute 25-30% by FY08.Emphasis on R&D<strong>Tricubes</strong> places high emphasis on R&D given its active involvement in designand engineering of biometrics and smart card based devices. This is reflectedin its historical R&D expenses, where the group spent approximately RM5.1million in FY02, RM2.8 million in FY03 and RM1.8 million for the 8 monthsended August this year. Most of the group's current lines of products weredeveloped through its R&D and currently major focus is to ensure <strong>Tricubes</strong>'products are applicable to a wider spectrum of usage.[ 2 ] <strong>Tricubes</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Holdings Bhd15 Dec 2004Riding on Growing DemandBased on Frost and Sullivan's market research, the integrated biometricssmart card reader market is expected to grow at CAGR of 32.8% per annumin the next 5 years. Growth in this segment should ride on increasingrequirements for identity authentication and more stringent security measures.In addition, the government's encouragement for the adoption of MyKadnationwide is also expected to fuel demand for the group's products.Leveraging on its major market share, the group is well placed to furtherpenetrate the biometrics smart card reader industry.Meanwhile, the EPSys market segment is expected to grow at a slower rateof 24.7% per annum. Management believes the EPSys segment presentsgrowth potential given BNM's requirement for all electronic payment terminalsto be EMV compliant by 2005, therefore boosting the migration to chip enabledterminals. <strong>Tricubes</strong> plans to offer software, system integration and otherrelated services to banks and merchants. Given the small number of playersin the industry and the group's track record in the MyKad implementation,<strong>Tricubes</strong> is in a strategic position to further penetrate the local and overseasmarket.The MWS segment on the other hand, is currently in the development stages.Frost and Sullivans market research estimates the number of rugged handhelddevices (which are the main devices used in MWS) to grow by 15.8% annuallyfor the next 5 years. Furthermore, a rising number of local corporations areexpected to join the government as a user of the rugged handheld devices.In addition, these rugged handheld devices are actively used in manufacturingand warehousing environment for data collection as well as workforceautomation.Financial HighlightsRevenue in FY01 surged by 401% to RM45.6 million due to completion ofthe GMPC project, which included the final delivery of desktops and portablesmart card readers to the government. Following the completion of the GMPCproject, FY02 and FY03 revenue was significantly lower. Nevertheless, profitwas mainly driven by launches of the group's new products namely, <strong>Tricubes</strong>1020, Tripaq 3800 and Secure Xcess. Annualising the 8 months resultsended August 2004, revenue is estimated to grow by 36.2% to RM23.2 millionand net profit to grow to RM3.6 million. The growth is mainly attributable tohigher maintenance income and higher sales of MWS products.Valuation and RecommendationGiven the growing demand of biometrics and mobile/wireless solutions,limited number of players in the industry and the group's extensiveexperience, we believe the group's prospects are bright. We forecast FY05revenue to grow by 36% to RM31.6 million and net profit to expand by 36.1%to RM4.9 million. Attaching Mesdaq average PER of 16x, <strong>Tricubes</strong>' fair valueis pegged at RM0.58.The information in this report has been obtained fromsources believed to be reliable. Its accuracy orcompleteness is not guaranteed and opinions are subjectto change without notice. This report is for informationonly and not to be construed as a solicitation forcontracts. We accept no liability for any direct or indirectloss arising from the use of this document. We, ourassociates, directors, employees may have an interestin the securities and/or companies mentioned herein.for <strong>TA</strong> SECURITIES HOLDINGS BERHAD(Formerly known as Botly Securities Sdn Bhd)Yaw Chun Soon, Executive Director - Operations[ 3 ] <strong>Tricubes</strong> <strong>Berhad</strong>