DPS Resources Berhad - TA Online

DPS Resources Berhad - TA Online

DPS Resources Berhad - TA Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>TA</strong> Securities Bhd<br />

12 Aug 2004<br />

N E W L I S T I N G<br />

<strong>TA</strong> SECURITIES BHD<br />

A Participating Organisations of<br />

Bursa Malaysia Securities <strong>Berhad</strong><br />

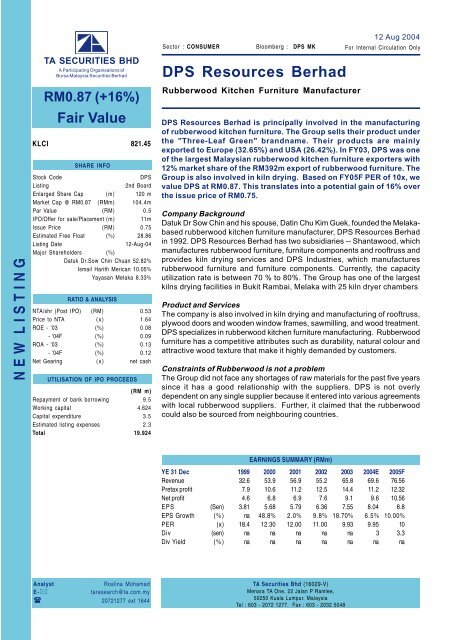

RM0.87 (+16%)<br />

Fair Value<br />

KLCI 821.45<br />

SHARE INFO<br />

Stock Code<br />

<strong>DPS</strong><br />

Listing<br />

2nd Board<br />

Enlarged Share Cap (m) 120 m<br />

Market Cap @ RM0.87 (RMm) 104.4m<br />

Par Value (RM) 0.5<br />

IPO/Offer for sale/Placement (m) 11m<br />

Issue Price (RM) 0.75<br />

Estimated Free Float (%) 28.86<br />

Listing Date<br />

12-Aug-04<br />

Major Shareholders (%)<br />

Datuk Dr.Sow Chin Chuan 52.82%<br />

Ismail Harith Merican 10.05%<br />

Yayasan Melaka 8.33%<br />

RATIO & ANALYSIS<br />

N<strong>TA</strong>/shr (Post IPO) (RM) 0.53<br />

Price to N<strong>TA</strong> (x) 1.64<br />

ROE - '03 (%) 0.08<br />

- '04F (%) 0.09<br />

ROA - '03 (%) 0.13<br />

- '04F (%) 0.12<br />

Net Gearing (x) net cash<br />

UTILISATION OF IPO PROCEEDS<br />

(RM m)<br />

Repayment of bank borrowing 9.5<br />

Working capital 4.624<br />

Capital expenditure 3.5<br />

Estimated listing expenses 2.3<br />

Total 19.924<br />

12 Aug 2004<br />

Sector : CONSUMER Bloomberg : <strong>DPS</strong> MK For Internal Circulation Only<br />

<strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong><br />

Rubberwood Kitchen Furniture Manufacturer<br />

<strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong> is principally involved in the manufacturing<br />

of rubberwood kitchen furniture. The Group sells their product under<br />

the "Three-Leaf Green" brandname. Their products are mainly<br />

exported to Europe (32.65%) and USA (26.42%). In FY03, <strong>DPS</strong> was one<br />

of the largest Malaysian rubberwood kitchen furniture exporters with<br />

12% market share of the RM392m export of rubberwood furniture. The<br />

Group is also involved in kiln drying. Based on FY05F PER of 10x, we<br />

value <strong>DPS</strong> at RM0.87. This translates into a potential gain of 16% over<br />

the issue price of RM0.75.<br />

Company Background<br />

Datuk Dr Sow Chin and his spouse, Datin Chu Kim Guek, founded the Melakabased<br />

rubberwood kitchen furniture manufacturer, <strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong><br />

in 1992. <strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong> has two subsidiaries -- Shantawood, which<br />

manufactures rubberwood furniture, furniture components and rooftruss and<br />

provides kiln drying services and <strong>DPS</strong> Industries, which manufactures<br />

rubberwood furniture and furniture components. Currently, the capacity<br />

utilization rate is between 70 % to 80%. The Group has one of the largest<br />

kilns drying facilities in Bukit Rambai, Melaka with 25 kiln dryer chambers<br />

Product and Services<br />

The company is also involved in kiln drying and manufacturing of rooftruss,<br />

plywood doors and wooden window frames, sawmilling, and wood treatment.<br />

<strong>DPS</strong> specializes in rubberwood kitchen furniture manufacturing. Rubberwood<br />

furniture has a competitive attributes such as durability, natural colour and<br />

attractive wood texture that make it highly demanded by customers.<br />

Constraints of Rubberwood is not a problem<br />

The Group did not face any shortages of raw materials for the past five years<br />

since it has a good relationship with the suppliers. <strong>DPS</strong> is not overly<br />

dependent on any single supplier because it entered into various agreements<br />

with local rubberwood suppliers. Further, it claimed that the rubberwood<br />

could also be sourced from neighbouring countries.<br />

EARNINGS SUMMARY (RMm)<br />

YE 31 Dec 1999 2000 2001 2002 2003 2004E 2005F<br />

Revenue 32.6 53.9 56.9 55.2 65.8 69.6 76.56<br />

Pretax profit 7.9 10.6 11.2 12.5 14.4 11.2 12.32<br />

Net profit 4.6 6.8 6.9 7.6 9.1 9.6 10.56<br />

EPS (Sen) 3.81 5.68 5.79 6.36 7.55 8.04 8.8<br />

EPS Growth (%) na 48.8% 2.0% 9.8% 18.70% 6.5% 10.00%<br />

PER (x) 18.4 12.30 12.00 11.00 9.93 9.95 10<br />

Div (sen) na na na na na 3 3.3<br />

Div Yield (%) na na na na na na na<br />

Analyst<br />

Roslina Mohamad<br />

E-*<br />

taresearch@ta.com.my<br />

( 20721277 ext 1644<br />

<strong>TA</strong> Securities Bhd (16029-V)<br />

Menara <strong>TA</strong> One, 22 Jalan P Ramlee,<br />

50250 Kuala Lumpur. Malaysia<br />

Tel : 603 - 2072 1277. Fax : 603 - 2032 5048<br />

[ 1 ] <strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Bhd<br />

12 Aug 2004<br />

Competition<br />

The furniture manufacturing industry is fragmented and highly competitive.<br />

Malaysia has 2000 furniture manufacturers where 20% (400) are capable of<br />

exporting. While <strong>DPS</strong> uses solely rubberwood, many of its competitors use<br />

other raw materials such as oak, metal and MDF. <strong>DPS</strong> is however the largest<br />

Malaysian rubberwood kitchen furniture exporter with 12% market share of<br />

the country’s total export of RM392m in 2003.<br />

Mainly for Export<br />

For FY03, approximately 70% of its turnover and 63% of its PAT are contributed<br />

by exports. Europe is the major export market accounting for 32.7% of total<br />

export turnover and USA accounting for 26.4% of total export turnover. In<br />

terms of profit after tax, 62% is derived from exports and 36% is from local<br />

distribution. In terms of products, rubberwood furniture contributed RM5.9m<br />

to PAT, Kiln drying services and furniture, RM2.2m and rooftruss RM0.9m.<br />

PROPORTION OF 2003 TO<strong>TA</strong>L EXPORT TURNOVER<br />

Asia Pacific<br />

17%<br />

Europe<br />

33%<br />

Middle East<br />

24%<br />

USA<br />

26%<br />

Strong customer relations<br />

The group has a strong relationship with its customers, as most of them<br />

have been with the company for more than 5 years. The company can transfer<br />

the increase in raw materials cost to their customers, which reflect a strong<br />

relationship between them. The Group has a wide customer base with<br />

approximately 220 export customers across the 73 countries. The large<br />

customer base enabled the Group to have a more stable income.<br />

MAJOR CUSTOMERS<br />

Customers Items sold % of Total Length of<br />

Turnover relationship<br />

(year)<br />

Sunrise Point Sdn. Bhd Treated & kiln-dried rubberwood 11.11 5<br />

Mission Theme Sdn. Bhd Treated & kiln-dried rubberwood 8.19 5<br />

Mohd Azim Furniture,UAE Rubberwood furniture 5.41 6<br />

US Tamex Corp,US Rubberwood furniture 3.94 5<br />

· Sunrise Point Sdn. Bhd. and Mission Theme Sdn. Bhd. is also the major supplier of furniture<br />

components for the Group.<br />

Dependent on foreign labour<br />

<strong>DPS</strong> relies heavily on foreign workers. Employees from countries such as<br />

Vietnam, Indonesia, Nepal and Bangladesh account for approximately 81%<br />

of its workforce. As the cost of foreign labour is cheaper than the cost of<br />

local labour, it provides greater cost advantage to the company. The company<br />

provides training to the foreign workers in order produce higher quality<br />

products.<br />

[ 2 ] <strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Bhd<br />

12 Aug 2004<br />

Future Plans<br />

Going forward, <strong>DPS</strong> wants to expand it facilities by acquiring new plant in<br />

Tanjung Minyak, Melaka. This new factory will be used for sorting and grading<br />

of rubberwood. The Group is also planning to construct a new warehouse<br />

and a dormitory for its employees. Besides, it also plans to enhance its R &<br />

D department in order to develop a new product design. So far, there is no<br />

plan to use another source of wood as their raw materials. The Group also<br />

plans to penetrate further into overseas market such as US, Germany, China<br />

and Canada.<br />

Growth in furniture industry<br />

The industry is highly competitive with many furniture manufactures in<br />

Malaysia. The growth for furniture market is expected for the next few years<br />

where export for furniture is envisaged to hit RM7 billion in FY05 from RM5.7b<br />

in FY03. Malaysia has potential to become one of the world's largest furniture<br />

exporters because the sources of raw materials can be sourced easily in the<br />

country.<br />

PEERS COMPARISON<br />

Company PBV EPS P/E Ratio Market Cap PBT margin<br />

(x) (sen) (x) (RMm) (%)<br />

1. Eurospan Holdings 0.5 4.18 16.03 27.2 8.11<br />

2. Latitude Tree Holdings 0.7 16.0 7.75 79.89 4.11<br />

3. Kenmark Industrial 0.9 13.17 12.3 250.96 7.85<br />

4. Kimble Corp 1.0 20.08 6.23 100.8 8.41<br />

5. Sern Kou <strong>Resources</strong> 1.4 11.75 7.49 80.1 13.92<br />

Average 10.0<br />

<strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong> 1.47 8.04 10.0 104.4 16<br />

Fair Value at RM0.87<br />

We value <strong>DPS</strong> at RM 0.87 based FY05F PER of 10.0x. This is at par with<br />

the industry average of 10x. <strong>DPS</strong> commands one of the highest margins in<br />

the industry with PBT margin of 16% for FY04. Together with the promising<br />

outlook for the industry despite its competive nature and <strong>DPS</strong>’s position as<br />

the largest Malaysian exporter for rubberwood kitchen furniture exporter, we<br />

believe it should at least trade at par with the industry average. At RM0.87,<br />

it is at 16% premium over the IPO price of RM0.75.<br />

The information in this report has been obtained from<br />

sources believed to be reliable. Its accuracy or<br />

completeness is not guaranteed and opinions are subject<br />

to change without notice. This report is for information<br />

only and not to be construed as a solicitation for<br />

contracts. We accept no liability for any direct or indirect<br />

loss arising from the use of this document. We, our<br />

associates, directors, employees may have an interest<br />

in the securities and/or companies mentioned herein.<br />

for <strong>TA</strong> SECURITIES BHD,<br />

Yaw Chun Soon, Executive Director - Operations<br />

[ 3 ] <strong>DPS</strong> <strong>Resources</strong> <strong>Berhad</strong>