OpenSys (M) Berhad - TA Online

OpenSys (M) Berhad - TA Online

OpenSys (M) Berhad - TA Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>TA</strong> Securities Bhd<br />

29 Jan 2004<br />

N E W L I S T I N G<br />

<strong>TA</strong> SECURITIES BHD<br />

Participating Organisations of<br />

Malaysia Securities Exchange <strong>Berhad</strong><br />

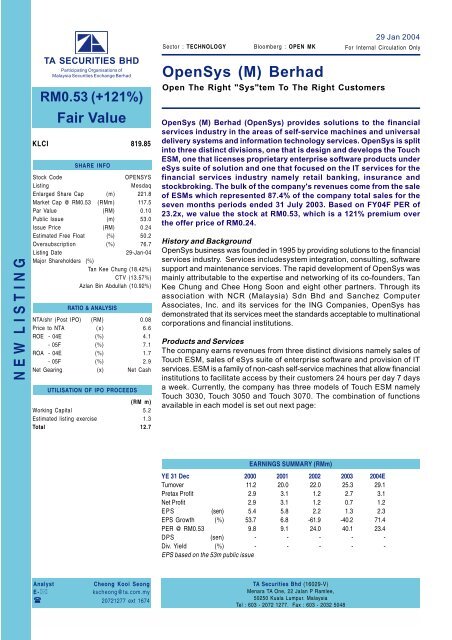

RM0.53 (+121%)<br />

Fair Value<br />

KLCI 819.85<br />

SHARE INFO<br />

Stock Code<br />

OPENSYS<br />

Listing<br />

Mesdaq<br />

Enlarged Share Cap (m) 221.8<br />

Market Cap @ RM0.53 (RMm) 117.5<br />

Par Value (RM) 0.10<br />

Public Issue (m) 53.0<br />

Issue Price (RM) 0.24<br />

Estimated Free Float (%) 50.2<br />

Oversubscription (%) 76.7<br />

Listing Date<br />

29-Jan-04<br />

Major Shareholders (%)<br />

Tan Kee Chung (18.42%)<br />

CTV (13.57%)<br />

Azlan Bin Abdullah (10.92%)<br />

RATIO & ANALYSIS<br />

N<strong>TA</strong>/shr (Post IPO) (RM) 0.08<br />

Price to N<strong>TA</strong> (x) 6.6<br />

ROE - 04E (%) 4.1<br />

- 05F (%) 7.1<br />

ROA - 04E (%) 1.7<br />

- 05F (%) 2.9<br />

Net Gearing (x) Net Cash<br />

UTILISATION OF IPO PROCEEDS<br />

(RM m)<br />

Working Capital 5.2<br />

Estimated listing exercise 1.3<br />

Total 12.7<br />

29 Jan 2004<br />

Sector : TECHNOLOGY Bloomberg : OPEN MK For Internal Circulation Only<br />

<strong>OpenSys</strong> (M) <strong>Berhad</strong><br />

Open The Right "Sys"tem To The Right Customers<br />

<strong>OpenSys</strong> (M) <strong>Berhad</strong> (<strong>OpenSys</strong>) provides solutions to the financial<br />

services industry in the areas of self-service machines and universal<br />

delivery systems and information technology services. <strong>OpenSys</strong> is split<br />

into three distinct divisions, one that is design and develops the Touch<br />

ESM, one that licenses proprietary enterprise software products under<br />

eSys suite of solution and one that focused on the IT services for the<br />

financial services industry namely retail banking, insurance and<br />

stockbroking. The bulk of the company's revenues come from the sale<br />

of ESMs which represented 87.4% of the company total sales for the<br />

seven months periods ended 31 July 2003. Based on FY04F PER of<br />

23.2x, we value the stock at RM0.53, which is a 121% premium over<br />

the offer price of RM0.24.<br />

History and Background<br />

<strong>OpenSys</strong> business was founded in 1995 by providing solutions to the financial<br />

services industry. Services includesystem integration, consulting, software<br />

support and maintenance services. The rapid development of <strong>OpenSys</strong> was<br />

mainly attributable to the expertise and networking of its co-founders, Tan<br />

Kee Chung and Chee Hong Soon and eight other partners. Through its<br />

association with NCR (Malaysia) Sdn Bhd and Sanchez Computer<br />

Associates, Inc. and its services for the ING Companies, <strong>OpenSys</strong> has<br />

demonstrated that its services meet the standards acceptable to multinational<br />

corporations and financial institutions.<br />

Products and Services<br />

The company earns revenues from three distinct divisions namely sales of<br />

Touch ESM, sales of eSys suite of enterprise software and provision of IT<br />

services. ESM is a family of non-cash self-service machines that allow financial<br />

institutions to facilitate access by their customers 24 hours per day 7 days<br />

a week. Currently, the company has three models of Touch ESM namely<br />

Touch 3030, Touch 3050 and Touch 3070. The combination of functions<br />

available in each model is set out next page:<br />

EARNINGS SUMMARY (RMm)<br />

YE 31 Dec 2000 2001 2002 2003 2004E<br />

Turnover 11.2 20.0 22.0 25.3 29.1<br />

Pretax Profit 2.9 3.1 1.2 2.7 3.1<br />

Net Profit 2.9 3.1 1.2 0.7 1.2<br />

EPS (sen) 5.4 5.8 2.2 1.3 2.3<br />

EPS Growth (%) 53.7 6.8 -61.9 -40.2 71.4<br />

PER @ RM0.53 9.8 9.1 24.0 40.1 23.4<br />

DPS (sen) - - - - -<br />

Div. Yield (%) - - - - -<br />

EPS based on the 53m public issue<br />

Analyst<br />

Cheong Kooi Seong<br />

E-*<br />

kscheong@ta.com.my<br />

( 20721277 ext 1674<br />

<strong>TA</strong> Securities Bhd (16029-V)<br />

Menara <strong>TA</strong> One, 22 Jalan P Ramlee,<br />

50250 Kuala Lumpur. Malaysia<br />

Tel : 603 - 2072 1277. Fax : 603 - 2032 5048<br />

[ 1 ] <strong>OpenSys</strong> (M) <strong>Berhad</strong>

<strong>TA</strong> Securities Bhd<br />

29 Jan 2004<br />

ESM 3030 ESM 3050 ESM 3070<br />

Functions Functions Functions<br />

Draft Issuance - Draft Issuance<br />

CD/FD - CD/FD<br />

Insurance - Insurance<br />

- Cheque Deposit Cheque Deposit<br />

- Bill Payment Bill Payment<br />

Stock Stock Stock<br />

Prepaid Cards Prepaid Cards Prepaid Cards<br />

eCash eCash eCash<br />

Status Enquiry Status Enquiry Status Enquiry<br />

Sources: Prospectus<br />

eSys enterprise software is a tool that offers many functional modules which<br />

can be used either individually or collectively. The multi-channel delivery<br />

system enables customers to access financial services such as loan<br />

application, bill payments, real-time stock quotes, automobile insurance,<br />

life and medical insurance products. The company's IT services are focused<br />

mainly on the financial services industry such as retail banking, insurance<br />

and stockbroking.<br />

REVENUE BREAKDOWN BY PRODUCT (RMm)<br />

Product 1999 2000 2001 2002 2003^<br />

ESM 0.0 0.0 9.8 13.9 11.8<br />

eSys 0.2 1.0 3.1 2.4 0.6<br />

IT services 7.2 10.3 7.2 5.7 1.1<br />

Total 7.3 11.2 20.0 22.0 13.5<br />

^ 7 months ended 31 July 2003<br />

Mainly for Financial Services Industry<br />

Its notable clients include Malayan Bank <strong>Berhad</strong>, EON Bank <strong>Berhad</strong>, United<br />

Overseas Bank Malaysia, Standard Chartered Bank, Public Bank, Alliance<br />

Bank, CSA (its distributor and support partner in Malaysia), MAA,<br />

AmAssurance <strong>Berhad</strong>, Berjaya General Insurance <strong>Berhad</strong> and Maxis Mobile<br />

Sdn Bhd. The top 10 customers based on the percentage of sales value<br />

ended 31 July 2003 are set out below:<br />

Major Customers<br />

% of sales out of total revenue<br />

C S A 59.9<br />

Malayan Banking <strong>Berhad</strong> 12.9<br />

EON Bank <strong>Berhad</strong> 10.5<br />

United Overseas Bank (M) <strong>Berhad</strong> 3.1<br />

Maxis Mobile Sdn Bhd 3.1<br />

ING Interadvies 2.3<br />

Berjaya General Insurance <strong>Berhad</strong> 2.0<br />

MAA 1.7<br />

Uni. Asia General Insurance Bhd 0.9<br />

Sanchez Computer Associates 0.8<br />

As at 31 July 2003, approximately 84% of <strong>OpenSys</strong>'s sales came from CSA,<br />

Malayan Banking <strong>Berhad</strong> and EON Bank <strong>Berhad</strong>. Therefore, a loss of order<br />

from one of these customers could reduce sales and earnings sharply as<br />

the company relies heavily on these customers.<br />

[ 2 ] <strong>OpenSys</strong> (M) <strong>Berhad</strong>

<strong>TA</strong> Securities Bhd<br />

29 Jan 2004<br />

Competitive Strengths<br />

<strong>OpenSys</strong> management team has an average of over 10 years' experience<br />

and 7 years track record in providing IT services to the financial services<br />

industry. This collective expertise and experience could help it to develop<br />

products that are customised to meet industry needs. In addition, at least<br />

43.6% of the enlarged share capital of the company will be held by the<br />

employees. Significant employee ownership will align employees' interests<br />

with the interests of the company and motivate them in their performance.<br />

After the listing,<br />

Investment Risks<br />

Balance sheet (proforma) is strong with current ratio of 1.9x and net cash of<br />

RM13.7m (after public issue). The company has consistently made profits<br />

since FY98 (the earliest record shown in the prospectus). Despite the sound<br />

foundation, there are still a number of risks that could negatively affect the<br />

company. Consolidation in the financial services industry is still continuing.<br />

As a result, the number of customers for Touch ESMs is gradually decreasing.<br />

In addition, <strong>OpenSys</strong> has to develop value-added products and services to<br />

remain competitive.<br />

Moving Into New Markets and Products<br />

<strong>OpenSys</strong>'s growth strategy includes penetrating new geographical markets<br />

and expanding its product range. The company intends to increase its<br />

marketing and sales channels by looking for distributor and support partners<br />

in India, United Kingdom and USA. On the product front, <strong>OpenSys</strong> intends<br />

to develop other models of Touch ESM 3000. This product will expand its<br />

functionability to address specific customer needs such as bar-coded bill<br />

payment, cheque book issuance, optical character recognition and statement<br />

printing. The company also intends to develop further modules of eSys by<br />

providing a wider range of financial services such as banking, insurance and<br />

stockbroking.<br />

Fair Value at RM0.53<br />

Due to their heavy reliance on 3 customers and the investment risks<br />

highlighted above, we are pricing <strong>OpenSys</strong> at 20% discount to estimate<br />

PER of 29x for MESDAQ counters. Based on the results PER of 23.2 and<br />

FY04 net EPS of 2.3 sen, our fair value for <strong>OpenSys</strong> is RM0.53, or some<br />

121% upside over the issue price of RM0.24.<br />

The information in this report has been obtained from<br />

sources believed to be reliable. Its accuracy or<br />

completeness is not guaranteed and opinions are<br />

subject to change without notice. This report is for<br />

information only and not to be construed as a solicitation<br />

for contracts. We accept no liability for any direct or<br />

indirect loss arising from the use of this document. We,<br />

our associates, directors, employees may have an<br />

interest in the securities and/or companies mentioned<br />

herein.<br />

for <strong>TA</strong> SECURITIES BHD,<br />

Yaw Chun Soon, Executive Director - Operations<br />

[ 3 ] <strong>OpenSys</strong> (M) <strong>Berhad</strong>