Pelangi Publishing Group Berhad - TA Online

Pelangi Publishing Group Berhad - TA Online

Pelangi Publishing Group Berhad - TA Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

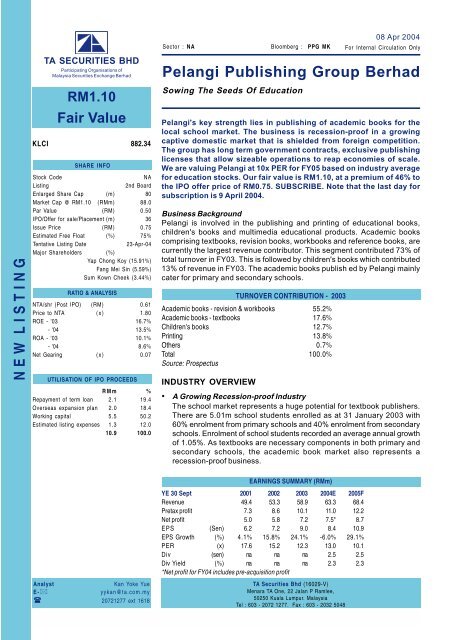

<strong>TA</strong> Securities Bhd08 Apr 2004N E W L I S T I N G<strong>TA</strong> SECURITIES BHDParticipating Organisations ofMalaysia Securities Exchange <strong>Berhad</strong>RM1.10Fair ValueKLCI 882.34SHARE INFOStock CodeNAListing2nd BoardEnlarged Share Cap (m) 80Market Cap @ RM1.10 (RMm) 88.0Par Value (RM) 0.50IPO/Offer for sale/Placement (m) 36Issue Price (RM) 0.75Estimated Free Float (%) 75%Tentative Listing Date23-Apr-04Major Shareholders (%)Yap Chong Koy (15.91%)Fang Mei Sin (5.59%)Sum Kown Cheek (3.44%)RATIO & ANALYSISN<strong>TA</strong>/shr (Post IPO) (RM) 0.61Price to N<strong>TA</strong> (x) 1.80ROE - '03 16.7%- '04 13.5%ROA - '03 10.1%- '04 8.6%Net Gearing (x) 0.07UTILISATION OF IPO PROCEEDSRMm %Repayment of term loan 2.1 19.4Overseas expansion plan 2.0 18.4Working capital 5.5 50.2Estimated listing expenses 1.3 12.010.9 100.008 Apr 2004Sector : NA Bloomberg : PPG MK For Internal Circulation Only<strong>Pelangi</strong> <strong>Publishing</strong> <strong>Group</strong> <strong>Berhad</strong>Sowing The Seeds Of Education<strong>Pelangi</strong>'s key strength lies in publishing of academic books for thelocal school market. The business is recession-proof in a growingcaptive domestic market that is shielded from foreign competition.The group has long term government contracts, exclusive publishinglicenses that allow sizeable operations to reap economies of scale.We are valuing <strong>Pelangi</strong> at 10x PER for FY05 based on industry averagefor education stocks. Our fair value is RM1.10, at a premium of 46% tothe IPO offer price of RM0.75. SUBSCRIBE. Note that the last day forsubscription is 9 April 2004.Business Background<strong>Pelangi</strong> is involved in the publishing and printing of educational books,children's books and multimedia educational products. Academic bookscomprising textbooks, revision books, workbooks and reference books, arecurrently the largest revenue contributor. This segment contributed 73% oftotal turnover in FY03. This is followed by children's books which contributed13% of revenue in FY03. The academic books publish ed by <strong>Pelangi</strong> mainlycater for primary and secondary schools.TURNOVER CONTRIBUTION - 2003Academic books - revision & workbooks 55.2%Academic books - textbooks 17.6%Children's books 12.7%Printing 13.8%Others 0.7%Total 100.0%Source: ProspectusINDUSTRY OVERVIEW• A Growing Recession-proof IndustryThe school market represents a huge potential for textbook publishers.There are 5.01m school students enrolled as at 31 January 2003 with60% enrolment from primary schools and 40% enrolment from secondaryschools. Enrolment of school students recorded an average annual growthof 1.05%. As textbooks are necessary components in both primary andsecondary schools, the academic book market also represents arecession-proof business.AnalystKan Yoke YueE-*yykan@ta.com.my( 20721277 ext 1618EARNINGS SUMMARY (RMm)YE 30 Sept 2001 2002 2003 2004E 2005FRevenue 49.4 53.3 58.9 63.3 68.4Pretax profit 7.3 8.6 10.1 11.0 12.2Net profit 5.0 5.8 7.2 7.5* 8.7EPS (Sen) 6.2 7.2 9.0 8.4 10.9EPS Growth (%) 4.1% 15.8% 24.1% -6.0% 29.1%PER (x) 17.6 15.2 12.3 13.0 10.1Div (sen) na na na 2.5 2.5Div Yield (%) na na na 2.3 2.3*Net profit for FY04 includes pre-acquisition profit<strong>TA</strong> Securities Bhd (16029-V)Menara <strong>TA</strong> One, 22 Jalan P Ramlee,50250 Kuala Lumpur. MalaysiaTel : 603 - 2072 1277. Fax : 603 - 2032 5048[ 1 ] <strong>Pelangi</strong> <strong>Publishing</strong> <strong>Group</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Bhd08 Apr 2004• Captive Market for Established PlayersThe publishing industry has low barriers of entry and large number ofplayers. Nevertheless, the local academic book market is dominated bya small pool of very established players such as Pelanduk PublicationsSdn Bhd, Penerbitan <strong>Pelangi</strong> Sdn Bhd, Berita <strong>Publishing</strong> Sdn Bhd, FalconPress Sdn Bhd and Fajar Bakti Sdn Bhd. In addition, the sector alsoincludes a small number of local subsidiaries of foreign and multinationalcompanies. These local subsidiaries, drawing on their internationalconnections, have built core competency in the publication of academictext for higher education as well as general literature. Given the expertiserequired, the number of publishers in this sector has remained constantin a captive domestic market.• Domestically-oriented IndustryThe market for academic books is largely domestic-oriented as thesebooks are based on the national educational curriculum. This focus onthe domestic curriculum means that local firms have been largely shieldedfrom foreign competition. The group's books mainly cater for the domesticmarket which accounts for about 94% of the total turnover in FY03.COMPETITIVE STRENGTHSLong Term Government Contract<strong>Pelangi</strong> has secured long-term contracts with the Ministry of Education (MOE)for the publishing and supply of school textbooks. The long-term contractsalso allow <strong>Pelangi</strong> to publish the academic textbooks for sale in the openmarket. Academic textbooks accounted for about 18% of the group's totalturnover in FY03. In addition, <strong>Pelangi</strong> was also awarded the MOE's contractto publish Mathematics and Chinese Language textbooks for Chinese primaryschools.Exclusive LicenseIn 1993, <strong>Pelangi</strong> secured the exclusive license to publish Walt Disneystorybooks in Bahasa Malaysia and Chinese language in Malaysia, Singaporeand Brunei. Subsequently, more license agreements were signed with otherrenowned international publishers like Paws Incorporated (Garfield), DCComics (Superman and Batman), Lucasfilm (Star Wars) and Jump Licensing& Merchandising (Tommy & Oscar).Integrated One-Stop <strong>Publishing</strong> CapabilityHaving been in the industry since 1980, <strong>Pelangi</strong> has established itself as anintegrated one-stop publishing house. The group is capable of conductingthe entire process of producing a book, from editing, typesetting, layout,color separation to printing. The benefits of its integrated set-up are consistentproduct quality, improved efficiency and better cost control.Economies of Scale<strong>Pelangi</strong> has built up a fairly substantial presence in the local publishingindustry with approximately 28% market share. The sizeable operation enablesthe group to reap economies of scale through bulk purchases as well assharing of resources and personnel. In addition, the better recovery of fixedoverhead costs on high publication volume helps in achieving lower averageunit cost.[ 2 ] <strong>Pelangi</strong> <strong>Publishing</strong> <strong>Group</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Bhd08 Apr 2004Predictable Demand and Cost PatternThe textbook and reference book market segment shows a uniquecharacteristic as demand is known well in advance. As a result, the risk ofcost fluctuations is small. Paper costs form a small part of the total price ofa book and most costs can be fixed at the time of signing of contract. Pricingis competitive in the textbook and reference book segment. Most of the localtextbooks and reference books displayed on shelves are affordably pricedas compared with imported books.Extensive Network of Distribution<strong>Pelangi</strong>'s distribution network is mainly through retail bookshops, schoolbookdistributors and wholesalers, on-line bookshops and overseas distributors.Presently, <strong>Pelangi</strong> does not rely on any single customer as it has to dateover 800 active customer accounts. For FY03, none of the top ten customerssingly contributed more than 10% of the group's turnover.International Network<strong>Pelangi</strong> is well connected with international publishers and distributorsspanning across the world. This has enabled the group to secure licenserights from some of the leading international players as well as to sell itspublishing rights and books overseas. The international markets includecountries like Singapore, Hong Kong, Indonesia, Brunei, Myanmar, Republicof Maldives and Philippines.Diversified Product Range<strong>Pelangi</strong> has a diversified product range. With over 600 new titles publishedper annum, the group is not overly dependent on any particular single product.<strong>Pelangi</strong>'s mathematics and science revision books are well known amongthe local secondary school students due to the quality of its comprehensivecontent, presentation format and illustrations.Experienced Writer Pool<strong>Pelangi</strong>'s branding has the ability to attract, establish and maintain a largepool of experienced writers and illustrators as well as the entrenched R & Dteam and marketing network. These factors are imperative to the operationof well-established publishing houses and represent barriers of entry to newentrants especially for the non-integrated ones.Expertise in Translation<strong>Pelangi</strong> has also ventured into the translation of foreign works into BahasaMalaysia and Chinese language for school reference books, encyclopedias,language learners and children's books. Todate, <strong>Pelangi</strong> has worked withmore than 25 renowned foreign publishers in translating their works such asUsborne from UK, Paramoun from Spain, Crisp Publication from US andCasterman from Belgium. The group has also translated more than 800 popularforeign books into Bahasa Malaysia, Chinese and English.Valuation<strong>Pelangi</strong> operates in a recession-proof education market with growing captivedomestic demand. Most of the local academic book publishers are nonlistedbut have substantial market presence. Due to the lack of listed peers,we are valuing <strong>Pelangi</strong> based on price multiples of education stocks asdemand for academic books is correlated to the demand for education (i.e.derived demand). On average, education stocks are trading at PER of 10.0xfor FY05. We are thus valuing <strong>Pelangi</strong> at 10x FY05 earnings which results ina fair value of RM1.10, or a 46% premium to the IPO price of RM0.75.SUBSCRIBE.[ 3 ] <strong>Pelangi</strong> <strong>Publishing</strong> <strong>Group</strong> <strong>Berhad</strong>

<strong>TA</strong> Securities Bhd08 Apr 2004PER COMPARISON FOR EDUCATION SECTORPrice EPS04 EPS05 PER04 PER05(RM) (sen) (sen) (x) (x)Stamford College <strong>Berhad</strong> 0.925 6.9 7.3 13.4 12.7SEG International <strong>Berhad</strong> 2.41 22.0 28.7 11.0 8.4Inti Universal Holding <strong>Berhad</strong> 5.15 47.1 58.1 10.9 8.9Average 11.8 10.0(note: earnings have not been calendarised)The information in this report has been obtained fromsources believed to be reliable. Its accuracy orcompleteness is not guaranteed and opinions are subjectto change without notice. This report is for informationonly and not to be construed as a solicitation forcontracts. We accept no liability for any direct or indirectloss arising from the use of this document. We, ourassociates, directors, employees may have an interestin the securities and/or companies mentioned herein.for <strong>TA</strong> SECURITIES BHD,Yaw Chun Soon, Executive Director - Operations[ 4 ] <strong>Pelangi</strong> <strong>Publishing</strong> <strong>Group</strong> <strong>Berhad</strong>