Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>report</strong> <strong>2008</strong>

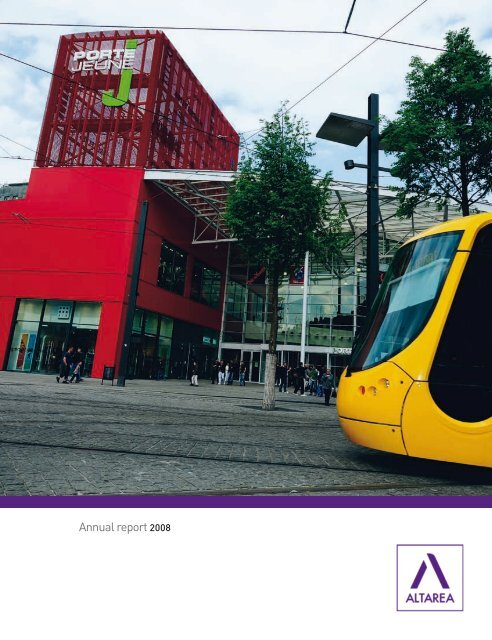

Cover photo<br />

Porte Jeune – Mulhouse<br />

Opened in october <strong>2008</strong><br />

Architect : Reichen & Robert et Associés<br />

This registration document was filed with the Autorité des Marchés Financiers on 30 April 2009 in<br />

accordance with article 212-13 of the General Regulations. It may not be used in the context of any<br />

financial operation unless completed by a transaction summary («note d’opération») in respect of<br />

which the Autorité des Marchés Financiers has granted a visa.<br />

Pursuant to Article 28 of Commission regulation (EC) No. 809/2004, the following information<br />

is incorporated by reference in this Registration Document:<br />

• The consolidated financial statements and corresponding audit <strong>report</strong> provided on pages 107 and<br />

223, the annual financial statements and corresponding audit <strong>report</strong> provided on pages 68 and 100,<br />

as well as the management <strong>report</strong> provided on page 22 of the 2007 registration document filed with<br />

the Autorité des Marchés Financiers on 8 April <strong>2008</strong> under number D. 08-0215.<br />

• The consolidated financial statements and corresponding audit <strong>report</strong> provided on pages 64 and<br />

136, as well as the management <strong>report</strong> appearing on page 34 of the 2006 registration document<br />

registered by the Autorité des Marchés Financiers on 7 June 2007 under number R. 07-092.<br />

• The consolidated and annual financial statements and corresponding audit <strong>report</strong>s provided on<br />

pages 80, 58, 148 and 75, as well as the management <strong>report</strong> provided on page 32 of the<br />

2005 registration document registered by the Autorité des Marchés Financiers on 30 June 2006<br />

under number R. 06-112.

ALtarea GROUP<br />

1 Profile 3<br />

2 Business review 27<br />

3 Financial statements ALTAREA<br />

Individual company<br />

financial statements 54<br />

Consolidated financial<br />

statements for the financial 77<br />

4 General information 171<br />

5 Corporate governance 191<br />

6 Supervisory board chairman’s<br />

<strong>report</strong> on internal control 205<br />

7 Draft resolutions 221<br />

8 Cross-reference table 231<br />

1

ALtarea GROUP / PROFILE<br />

1 Profile<br />

ALTAREA<br />

Investment<br />

(Shopping centres)<br />

Third-party development<br />

(residential, offices, hotels)<br />

Founded in 1994, <strong>Altarea</strong> is both a multi-product property developer and a property<br />

investment company specialising in shopping centres. <strong>Altarea</strong> observes and anticipates<br />

trends in contemporary lifestyle to create innovative property developments<br />

that generate growth and urban cohesion.<br />

As a specialist property investment company, <strong>Altarea</strong> has built up a portfolio of<br />

shopping centres, which are the most profitable asset class in the long-term and<br />

provide the Group with steady cash flow growth.<br />

As a multi-product property developer, <strong>Altarea</strong> has operating and development<br />

expertise in the retail, office, hotel and residential sectors. It is now the leading French<br />

developer of mixed urban projects combining some or all of these components.<br />

Its unique profile – property development at source combined with secure cash<br />

flows – enables <strong>Altarea</strong> to optimise its risk-reward ratio.<br />

<strong>Altarea</strong> is listed on Eurolist by Euronext Paris and operates in France, Italy and<br />

Spain.<br />

3

<strong>Altarea</strong>’s business model<br />

Property investment company specialising in shopping centres<br />

<strong>Altarea</strong> allocates most of its capital to owning and developing a portfolio of shopping<br />

centres. A well-designed and well-managed shopping centre offers better longer-term<br />

value creation prospects with lower volatility than any other property asset class.<br />

At 31 December <strong>2008</strong>, <strong>Altarea</strong> owned a portfolio of shopping centres in France, Italy and<br />

Spain totalling 589,000 m² GLA and valued at € 2.27 billion.<br />

Family Village – Les Hunaudières, Ruaudin.<br />

Shopping centre portfolio:<br />

589,000 million² GLA<br />

Value: € 2,270 million<br />

Gross rental income: € 142.2 million<br />

Own developments:<br />

705,600 m² GLA of shopping centres<br />

Net investment: € 1,941 million<br />

Projected gross rental income: € 170.6 million<br />

4

Third-party development<br />

The real value-added is generated early on in the property development chain.<br />

<strong>Altarea</strong> has expertise in identifying land opportunities, anticipating needs to design the<br />

product best suited to the end user and controlling the construction process. With its<br />

proven experience in the retail, office and residential markets, <strong>Altarea</strong> offers local<br />

authorities and private investors innovative global urban development solutions.<br />

This broad-based expertise is reflected more particularly in its large mixed urban<br />

projects currently under development. At end <strong>2008</strong>, <strong>Altarea</strong> had almost 2.6 million m²<br />

of space under development, all asset classes combined.<br />

Own developments: 900,000 m² of shopping centres (705,600 million² GLA)<br />

Third-party developments: 1,700,000 m² in all asset classes.<br />

Paris – La Défense aera.<br />

5

Key figures<br />

Shopping centres<br />

Net rental income<br />

(in €m)<br />

Development Revenue<br />

(in €m)<br />

92.7<br />

117.3<br />

■ Offices<br />

■ Residential<br />

595.9<br />

177.3<br />

769.0<br />

34.2<br />

57.3<br />

+ 26 %<br />

2007/<strong>2008</strong><br />

82.0<br />

513.9<br />

591.7<br />

+ 29 %<br />

2005 2006 2007 <strong>2008</strong><br />

* 12 months.<br />

2007 * <strong>2008</strong><br />

Korus 1 – Philips head office –<br />

Suresnes.<br />

L’Arboretum – Garches.<br />

Les Boutiques Gare de l’Est –<br />

Paris 10 e .<br />

French National Assembly –<br />

Paris 7 e .<br />

Recurring earnings<br />

(in €m)<br />

Net asset value<br />

(in €m)<br />

93.7<br />

1,323.4 1,273.6<br />

74.3<br />

922.8<br />

25.1<br />

38.2<br />

+ 26 %<br />

2007/<strong>2008</strong><br />

514.4<br />

– 3,7 %<br />

2007/<strong>2008</strong><br />

2005 2006 2007 <strong>2008</strong><br />

€ per share + 9.2 %<br />

4.02 5.36 9.41 10.28<br />

2005 2006 2007 <strong>2008</strong><br />

€ per share –24.8%<br />

77.8 117.7 165.0 124.2<br />

6

significant events of <strong>2008</strong><br />

Corporate<br />

<strong>Altarea</strong> merges with Altafinance and becomes SIIC 4 compliant<br />

Capital increase of €374.5 million, with ABP acquiring an interest<br />

Development business housed within Altareit, a listed company acquired in March <strong>2008</strong>.<br />

L’Aubette, shopping centre –<br />

Strasbourg.<br />

Les Portes de Brest-Guipavas,<br />

retail parks – Brest.<br />

Porte Jeune, shopping centre –<br />

Mulhouse.<br />

I Due Valli, shopping centre –<br />

Pinerolo – Piedmont, Italy.<br />

Operations<br />

Completion of Korus 1, the new Philips head office and sale of Korus 2 to Laboratoires Servier<br />

Completion of L’Arboretum, a development of 70 apartments in Garches<br />

Opening of the Les Boutiques Gare de l’Est in Paris<br />

Completion of the French National Assembly offices<br />

Opening of L’Aubette shopping centre in Strasbourg<br />

Opening of Saint-Aunès and «Les Portes de Brest-Guipavas» retail parks in Brest<br />

Opening of Porte Jeune shopping centre in Mulhouse<br />

Opening of «I Due Valli» shopping centre in Pinerolo (Piedmont, Italy).<br />

7

Message from Alain Taravella<br />

Last year was somewhat paradoxical for our Group. On the one hand, <strong>Altarea</strong><br />

was not spared from the financial crisis and was forced to significantly revise its<br />

asset values as a result of the macro-economic turmoil. On the other hand, the<br />

Group posted cash flow growth of over 25% following a number of remarkable<br />

successes given the economic climate.<br />

In the retail sector, we completed six shopping centres totalling almost<br />

78,000 m². They were fully let on completion and increased our portfolio value<br />

by almost €260 million, offsetting the inevitable loss of value on our other<br />

assets caused by rising yields. All in all, rental income rose by 26.5%,<br />

comprising entirely organic growth. It is during difficult times like these that our<br />

robust business model really comes to the fore and enables us to offset<br />

declines in value through strong operating performances.<br />

“In 2009, we will keep sight<br />

of the values that set <strong>Altarea</strong> apart:<br />

risk awareness, lucidity, rigour,<br />

creativity and drive!“<br />

8

In third-party property development, our relative performance is all the more<br />

remarkable given the particularly difficult environment especially in the<br />

residential sector, which saw a 38% slump in sales across the French market<br />

as a whole. In this climate, our subsidiary <strong>Cogedim</strong> managed to contain the<br />

decline in reservations to 17% whilst maintaining its profitability. Lastly, several<br />

major deals enabled us to double our fee income from our commercial property<br />

services. All in all, the €210 million net-of-tax write-down of <strong>Cogedim</strong>’s<br />

acquisition value is more a reflection of the poor economic environment, as<br />

<strong>Cogedim</strong> showed considerable resilience in <strong>2008</strong> on an operating level, thanks<br />

to its teams and strong brand.<br />

At a time when the economic crisis seems to be taking a hold, <strong>Altarea</strong> has<br />

some significant strengths which should enable us to capitalise on the<br />

opportunities that never fail to materialise in this type of environment. First,<br />

<strong>Altarea</strong> has a robust financial structure underpinned by a strong cash flow<br />

generating model, which enabled us to raise €375 million in new capital last<br />

July. Second, and most importantly, <strong>Altarea</strong> is a universal property operator<br />

able to capture all market opportunities thanks to the quality and diversity of its<br />

operating expertise. In 2009, we will keep sight of the values that set <strong>Altarea</strong><br />

apart: risk awareness, lucidity, rigour, creativity and drive!<br />

Founder and Manager<br />

9

Positioning<br />

11

Observing trends in society to develop property<br />

and invest in shopping centres<br />

Palacz of justice – Nantes. Thiais village – Thiais. La Murri – Rimini, Italy.<br />

<strong>Altarea</strong> observes and identifies new trends in contemporary lifestyle to create urban<br />

developments that meet people’s needs and expectations. Through this attentive<br />

approach, social aspirations can be translated into lasting urban concepts.<br />

<strong>Altarea</strong>’s shopping centre portfolio meets these requirements. It comprises recentlydesigned<br />

assets that not only meet local market demand but also reflect underlying<br />

trends in consumer behaviour.<br />

<strong>Altarea</strong>’s developments and projects are designed to provide people with what they<br />

really want, thereby creating new proximities.<br />

12

Positioning<br />

Property development<br />

Social aspirations<br />

Property requirements<br />

1 • Urban diversity Mixed projects and new districts<br />

2 • Environmental concerns HQE quality standards, sustainable development<br />

3 • New solidarity Urban regeneration, social housing, retirement housing<br />

4 • Pleasure, free time, leisure Fun shopping, leisure facilities<br />

5 • Authenticity Modernisation of use, redevelopment of historical sites<br />

6 • Personalisation Custom-design, attention to detail and materials<br />

Retail<br />

Consumer trends<br />

Retail concept<br />

1 • Edge-of-town shopping Retail parks et Lifestyle centers no hypermarcket<br />

2 • Leisure shopping Town centre shopping centres<br />

3 • Fun Shopping Urban leisure centres<br />

4 • Time saving shopping Shopping centres in transport hubs<br />

5 • Best prices for everyday shopping Edge-of-town centres with hypermarket<br />

6 • Food safety Wholesale food markets<br />

13

Porte Jeune in Mulhouse<br />

New solidarities, leisure shopping.<br />

Town-centre shopping centre development forming<br />

the heart of a major urban regeneration project.<br />

12,200 m 2 GLA Group share.<br />

October <strong>2008</strong>.<br />

Les Boutiques Gare de l’Est in Paris<br />

Urban diversity, authenticity, time saving.<br />

Shopping centre development in the heart<br />

of the Gare de l’Est railway station.<br />

Second railway station shopping centre opened by <strong>Altarea</strong>.<br />

5,500 m 2 GLA.<br />

June <strong>2008</strong>.<br />

14

Positioning<br />

retail<br />

<strong>2008</strong> Retail: 6 shopping centres opened totalling<br />

58,600 m² GLA and €19.6 million in gross rental income.<br />

Several projects in <strong>2008</strong> illustrate the new proximities created<br />

by <strong>Altarea</strong>: Les Boutiques Gare de l’Est in Paris, which helps<br />

commuters save time on their daily shopping, L’Aubette in<br />

Strasbourg, which not only improves shopping facilities in the<br />

town centre but also enhances the city’s historical heritage,<br />

and the Okabe project, which has created a mixed urban<br />

development in the centre of Le Kremlin-Bicêtre. <strong>Altarea</strong>’s<br />

shopping centres thus combine personal proximity with<br />

collective experience.<br />

<strong>2008</strong> completions<br />

Les Portes de Brest-Guipavas<br />

Edge-of-town retailing, environmental concerns<br />

Retail park development dedicated to the home and lifestyle,<br />

with an IKEA anchor store.<br />

28,000 m 2 GLA.<br />

September <strong>2008</strong>.<br />

I Due Valli in Pinerolo – Piedmont, Italy<br />

Best prices for everyday shopping.<br />

Edge-of-town shopping centre with a Ipercoop<br />

hypermarket anchor store.<br />

7,800 million² GLA Group share for the shopping mall.<br />

November <strong>2008</strong>.<br />

L’Aubette in Strasbourg<br />

Authenticity, leisure shopping, personalisation.<br />

Shopping centre development in Strasbourg’s historic city<br />

centre buildings.<br />

5,900 m 2 GLA.<br />

September <strong>2008</strong>.<br />

15

Carré de Soie<br />

Fun shopping, new solidary, free time, leisure.<br />

Own development. Between Vaulx-en-Velin and Villeurbanne,<br />

a retail and leisure development in partnership with UCPA,<br />

within a designated urban regeneration zone.<br />

60,000 m² GLA total.<br />

Due to open in 2009.<br />

16

Positioning<br />

Cœur d’Orly<br />

Urban diversity, time saving shopping.<br />

Cœur d’Orly is an original project combining offices, a hotel<br />

complex and a congress centre (Essonne – Val-de-Marne<br />

project) with a retail, services and leisure park, generating<br />

a value-creating, vibrant mix.<br />

Due to open in 2014.<br />

Okabe<br />

Urban diversity, new solidarity,<br />

best prices for everyday shopping.<br />

Development project which is HQE ® certified for the design<br />

stage. Urban development just 500 metres from the Paris<br />

ring road and the Porte d’Italie.<br />

41,000 m² of retail, 27,000 m² of offices.<br />

<strong>Altarea</strong> will keep the retail space in its portfolio.<br />

Due for completion in 2009.<br />

Dalmine<br />

Best prices for everyday shopping.<br />

New shopping centre between Milan and Bergamo, in the heart<br />

of one of Northern Italy’s richest economic areas.<br />

34,000 m² GLA including an Esselunga hypermarket.<br />

Due to open in 2009.<br />

17

La Môle – Var<br />

Village development<br />

with villas, apartment blocks<br />

and public amenities<br />

18

Positioning<br />

<strong>2008</strong> Residential<br />

In residential development, the Group covers a broad range<br />

through its subsidiary <strong>Cogedim</strong>. <strong>Cogedim</strong> is the French leader in<br />

upscale housing. The midscale range, sold under the Citalis<br />

brand, is designed to meet the needs of first-time buyers and<br />

investors. The Group also builds single-family homes in village<br />

developments, especially in the South of France.<br />

Personalisation, attention to detail, high quality materials.<br />

L’Arboretum in Garches<br />

70 apartments<br />

completed in April <strong>2008</strong><br />

Oxygène in Saint-Cloud (project)<br />

19 apartments and 2 town houses designed Jean-Jacques Ory.<br />

Launched In March <strong>2008</strong>.<br />

19

Cinetic in Paris 20 th<br />

Environmental concerns, hqe<br />

quality standards, urban diversity.<br />

This 17,300 million² HQE certified<br />

building with 250 parking places<br />

at the Porte des Lilas was<br />

let in September <strong>2008</strong>.<br />

Developed by <strong>Cogedim</strong> Entreprise,<br />

Cinetic was sold from plan<br />

to Caisse des Dépôts and Predica.<br />

The building comprises 3,500 m²<br />

of retail space, completion<br />

of which is scheduled<br />

for the first quarter of 2009.<br />

20

Positioning<br />

<strong>2008</strong> Offices<br />

Through its subsidiary <strong>Cogedim</strong> Entreprise, <strong>Altarea</strong> is involved in<br />

three areas of the office property market: development,<br />

construction management and planning. In each of its buildings<br />

and projects, <strong>Cogedim</strong> Entreprise uses all its design ingenuity to<br />

meet the user’s specific needs. <strong>2008</strong> saw the completion of the<br />

new Philips head office in Suresnes and the second phase of the<br />

French National Assembly offices.<br />

Korus in Suresnes<br />

Personalisation.<br />

Completion at end May <strong>2008</strong> of the new Philips head office in<br />

Suresnes, totalling 24,000 m² and 572 parking places, fully<br />

furnished and equipped. The building was sold from plan to<br />

Vendôme Croidor (AXA Group).<br />

French National Assembly in Paris<br />

Authenticity, modernisation of use<br />

Completion in July <strong>2008</strong> of the second phase of offices,<br />

restaurants and auditorium at the French National Assembly.<br />

21

Sustainable development<br />

In today’s sustainable development culture,<br />

a company must not only consider its<br />

profitability and growth but also the social<br />

and environmental impacts of its activity.<br />

Through various planned initiatives,<br />

social and environmental responsibility<br />

plays a key role in <strong>Altarea</strong>’s development<br />

strategy as a means of differentiation<br />

and a guarantee of sustainability.<br />

La Cour des Capucins – Thionville.<br />

<strong>Altarea</strong>’s commitment to responsible eco-construction<br />

Very soon, environmentally-friendly buildings will be seen as an asset class in their own right<br />

and will be better valued financially. Aware of these trends, <strong>Altarea</strong> is firmly committed to the<br />

challenge posed by global warming and plans to cut its greenhouse gas emissions to one quarter<br />

of existing levels in the next forty years.<br />

Retail projects can now be quality certified under the NF Bâtiments Tertiaires – Démarche HQE ®<br />

label. Certivéa, a subsidiary of CSTB, has just published its environmental certification standards<br />

adapted to the retail property sector. Like the office sector, it contains fourteen reference targets<br />

and sets out environmental indicators for the construction works. These standards are the result<br />

of much hard work, to which <strong>Altarea</strong> contributed through its involvement in a working group run<br />

by Certivéa and the choice of three pilot developments: Okabé in Kremlin-Bicêtre and other town<br />

centre projects, notably in Thionville. A pioneer in this approach, <strong>Altarea</strong> will seek certification for<br />

all its projects.<br />

In residential property, at the HQE* Association’s 6 th National Conference, Cerqual, the Qualitel<br />

Group’s certification agency, officially presented <strong>Cogedim</strong> Résidence with a certificate giving it the<br />

right to use the NF Logement Démarche HQE label.<br />

This certification is tangible proof of <strong>Cogedim</strong> Résidence’s commitment to a strong environmental<br />

approach. It also reflects <strong>Cogedim</strong> Résidence’s responsible attitude towards its business as<br />

property developer.<br />

Projects under development will systematically be subject to quality certification. The «Dolce<br />

Villa» project in Paris 19th reflects this commitment. The project, designed by architect<br />

Christophe Girat, has particularly strong ambitions in energy performance by meeting THPE EnR<br />

2005 standards. The project’s key features are selection of materials based on reliability and<br />

recyclability, waste management and substantial energy savings. The hot water system is<br />

operated by Compagnie Parisienne de Chauffage Urbain (CPCU) and is more than 50%<br />

generated by roof-mounted solar panels, whilst a combination of interior and exterior insulation<br />

provides better heating regulation. As a result of this optimum energy management, the house<br />

will use half as much energy as a typical 1980s building.<br />

Lastly, in office development, at the beginning of 2011 <strong>Cogedim</strong> is due to complete a HQE certified<br />

3* hotel under the Kyriad Prestige brand, in the Saint-Priest technology park on the south-east<br />

outskirts of Lyon. Its design has a high sustainable development content aiming for a significant<br />

reduction in greenhouse gases.<br />

22

Hôtel Saint-Priest – Lyon. Dolce Villa – Paris 19 e .<br />

<strong>Altarea</strong>’s commitment to a more balanced town<br />

By systematically supporting its projects through initiatives to promote employment and training,<br />

<strong>Altarea</strong> has developed expertise in creating the «urban intensity» and social link essential to the<br />

sustainable town. In 2007, <strong>Altarea</strong> and FACE Grand Lyon, with the support of Vaulx-en-Velin town<br />

council, signed a charter committing to integration and employment at the Carré de Soie retail<br />

and leisure park. The charter is designed to promote actions to get people back to work by<br />

encouraging and developing employment and integration. It resulted in 309 employment<br />

contracts being signed during <strong>2008</strong>, including training contracts, temporary employment and<br />

permanent and fixed-term contracts. Of the total, more than half were signed with local people<br />

from Vaulx-en-Velin.<br />

The sustainable town is one that excludes nobody, respects the most vulnerable and does not<br />

create social ghettos. By signing a partnership agreement with the Habitat et Humanisme<br />

association, <strong>Altarea</strong> has undertaken to ensure that social housing is no longer stigmatised.<br />

For the past two years, the Group has provided financial support to Habitat et Humanisme, which<br />

develops new town-centre housing for people who cannot afford private homes or existing social<br />

housing. The Group is financing two full-time employees in the Paris Region for property<br />

acquisition and management. It has contributed equity to the association for building two family<br />

boarding houses in Lyon.<br />

Once again this year, the Group’s shopping centres have involved their retail stores in an<br />

awareness and fund raising campaign for the association.<br />

23

Message from Jacques Nicolet<br />

“The Group now has €482 million<br />

in available cash, which is sufficient<br />

to meet all its commitments without<br />

further financing.“<br />

In <strong>2008</strong>, <strong>Altarea</strong>’s Supervisory Board paid close attention to risk management<br />

and control over the company’s commitments. With hindsight, the measures<br />

anticipated by <strong>Altarea</strong> at the end of 2007 and implemented during last year have<br />

proved to be particularly appropriate.<br />

• First, <strong>Altarea</strong>’s liquidity position was substantially improved through the<br />

€ 375 million rights issue launched in early <strong>2008</strong> and completed in July. The<br />

Group now has €482 million in available cash, which is sufficient to meet all its<br />

commitments without further financing. The rights issue has also kept the<br />

consolidated LTV ratio down to 53.4% (compared with a covenant of 65%)<br />

despite the sharp corrections in values at the end of the year. Lastly, no<br />

significant loan repayments are due before mid-2013, which puts <strong>Altarea</strong> in a<br />

comfortable position given the difficulties in raising liquidity in today’s market.<br />

• From an operating point of view, <strong>Altarea</strong> has also adapted its commitment<br />

policy.<br />

– In third-party development, it has considerably tightened its criteria for taking<br />

on projects, including measures such as unilateral undertakings, anticipating<br />

retail launches and raising pre-letting thresholds. <strong>Altarea</strong> had virtually no<br />

finished housing stocks at the year-end reflecting the success of this policy<br />

focused on preserving capital. The risk profile of <strong>Altarea</strong>’s property development<br />

model is more like that of a service provider with low capital commitments.<br />

24

– In shopping centre investment, the projects under development have been<br />

reviewed and classified according to their risk profile (commercial,<br />

administrative, technical, financial position). A number of projects have been<br />

restructured to adapt their yields to the current environment. Today, the <strong>Altarea</strong><br />

Group’s investment commitments are controlled, profitable and fully financed.<br />

Having taken swift action at the very onset of crisis, the <strong>Altarea</strong> Group now has<br />

a robust financial structure and a healthy operating position.<br />

Co-Founder<br />

Chairman of the Supervisory Board<br />

25

ALtarea GROUP / Business review<br />

2<br />

Business review<br />

I – Business review 30<br />

1. Highlights of <strong>2008</strong> 30<br />

1.1 Strengthening ALTAREA’s financial structure<br />

1.2 Restructuring of the property development<br />

business and adjustment in the acquisition<br />

value of <strong>Cogedim</strong><br />

1.3 Shopping centres: continuing<br />

the value creationmodel<br />

1.4 Advance compliance with “SIIC 4“<br />

requirements (7)<br />

1.5 Outlook<br />

2. Shopping centre development 31<br />

2.1 Summary<br />

2.2 Proprietary shopping centres<br />

2.3 Recurring operating profit<br />

2.4 Shopping centres under development (12)<br />

3. Property development for third parties 39<br />

3.1 Introduction<br />

3.2 Revenues<br />

3.3 Operating profit<br />

3.4 Operating review by product lin<br />

II – Consolidated results 44<br />

1. Results 44<br />

1.1 Net profit<br />

1.2 ALTAREA SCA parent company results<br />

and SIIC regime requirements<br />

2. Net asset value 46<br />

III – Financial resources 48<br />

1. Financial position 48<br />

2. Hedging and maturity 49<br />

27

Business review<br />

I. Business review<br />

ALTAREA is a property investment company specialising in<br />

shopping centres and a multi-product developer. The company<br />

develops all asset classes, including shopping centres, offices,<br />

housing and hotels.<br />

ALTAREA’s development business in retail is mainly for own account.<br />

This has helped build a portfolio consisting exclusively<br />

of shopping centres with a value of €2.3 billion and generating<br />

an annualised gross rental income of €142 million at 31 December<br />

<strong>2008</strong>.<br />

Property development in other asset classes is exclusively for<br />

third parties. With financial risk under control, this business<br />

line increases the Group’s overall yield.<br />

1. Highlights of <strong>2008</strong><br />

1.1 Strengthening ALTAREA’s financial<br />

structure<br />

In July <strong>2008</strong>, ALTAREA raised €374.5 million in the<br />

form of rights issue followed by a private placement (1).<br />

Subscribed mainly by existing shareholders (Founders,<br />

Predica, Foncière des Régions, Swiss Re), the capital<br />

increase at €170 per share allowed pension fund ABP to<br />

acquire a stake in the company as a strategic shareholder<br />

with around 6% of share capital.<br />

The Group currently presents solid indicators in terms of<br />

both liquidity (2) and balance sheet ratios (3) , allowing it to<br />

cope with the current financial crisis without abandoning<br />

its business model based on creating properties generating<br />

high yields and managing a portfolio of shopping centres.<br />

The commitments identified by the Group are currently<br />

fully covered by available cash (commitments to invest in<br />

shopping centres and development commitments, expenses<br />

etc) and no major loan repayments are due until mid-2013.<br />

Over the next few months, ALTAREA will continue to monitor<br />

the solidity of its balance sheet and may adapt its pace of<br />

expansion and the signature of new commitments in view of<br />

preserving its liquidity and balance sheet solidity.<br />

ALTAREA’s main bank covenants (consolidated loan-tovalue<br />

ratio of less than 65% and interest coverage ratio of<br />

over 2) should be able to withstand any further deterioration<br />

in economic conditions.<br />

1.2 Restructuring of the property<br />

development business and adjustment<br />

in the acquisition value of <strong>Cogedim</strong><br />

At the end of <strong>2008</strong>, ALTAREA’s property development<br />

business underwent operating and legal restructuring<br />

centred around <strong>Cogedim</strong>, with the adjustment of <strong>Cogedim</strong>’s<br />

acquisition value in the Group’s accounts.<br />

On 23 December <strong>2008</strong>, <strong>Cogedim</strong> and Compagnie ALTAREA<br />

Habitation were merged in order to combine all of the<br />

Group’s property development activities within a single<br />

entity. After the merger, the new company was transferred<br />

to Altareit, ALTAREA’s 99.6%-owned subsidiary listed on<br />

Euronext Paris.<br />

This simplification of the Group’s organisational structure<br />

marks the completion of <strong>Cogedim</strong>’s operational integration<br />

into the ALTAREA Group, while also distinguishing its<br />

shopping centre investment activities from its property<br />

development activities for 1:3 parties. In relation to<br />

the merger, on the basis of the <strong>report</strong>s of independent<br />

appraisers, ALTAREA wrote down the acquisition value of<br />

<strong>Cogedim</strong> in its accounts, representing a cumulative impact<br />

of -€210 million after tax.<br />

Despite this value adjustment, <strong>Cogedim</strong> still managed to<br />

outperform the market. Revenues recognised according to<br />

the percentage of completion method increased by 29% yearon-year,<br />

while reservations of new homes fell by just 17% (4)<br />

compared with a decline of 38% for the market as a whole (5) .<br />

1.3 Shopping centres: continuing the value<br />

creationmodel<br />

For the existing portfolio, capitalisation rates increased<br />

from 5.11% to 5.76%. This represents a loss in value of<br />

€254 million on a like-for-like basis excluding the effect<br />

of rents, or a fall of 12%. This loss was partly offset by<br />

indexation and asset management, which had a positive<br />

impact of €82 million (+4%).<br />

The ALTAREA Group opened six shopping centres in <strong>2008</strong><br />

developed on a proprietary basis, representing a total net<br />

floor space of 78,000 m², five of which are in France and<br />

28<br />

(1) This capital increase was the subject of an offer document (“note d’information“) approved by the AMF and registered under number 08-0129 on 13 June <strong>2008</strong><br />

(2) Cash of €482 million<br />

(3) LTV of 53% compared with a consolidated bank covenant of 65%<br />

(4) Reservations of €557 million net of pull-outs<br />

(5) Source: French Ministry of Ecology Group share

one in Italy. These shopping centres, which were 97% let on<br />

opening, generated value creation of €97 million in <strong>2008</strong><br />

(average yield of 9%). Thanks to development projects<br />

secured over the last few years being brought into service,<br />

ALTAREA achieved further very strong cash flow growth in<br />

<strong>2008</strong> (+23% for shopping centres).<br />

ALTAREA also invested a further €295 million in total in<br />

shopping centres (6) in <strong>2008</strong> (shopping centres in operation<br />

and development projects). The Group also secured eight<br />

new development projects representing potential investment<br />

of €416 million with a yield of over 9%.<br />

ALTAREA’s value creation model therefore demonstrates its<br />

relevance during a period of crisis, in which the automatic<br />

impact of higher capitalisation rates can be partially offset<br />

by dynamic management of the portfolio, as well as the<br />

completion of new assets offering high yields.<br />

1.4 Advance compliance with “SIIC 4“<br />

requirements (7)<br />

The merger of Altafinance into ALTAREA was the final stage<br />

of the dissolution of the existing action in concert agreement<br />

between ALTAREA’s main shareholders, allowing ALTAREA<br />

to comply in advance with the final requirements relating to<br />

SIIC tax status, the provisions of which (“SIIC 4“) stipulate<br />

that no shareholder other than an SIIC may control more<br />

than 60% of an SIIC’s share capital and voting rights either<br />

alone or in concert.<br />

As a result of the merger, approved at the <strong>Annual</strong> General<br />

Meeting of 26 May <strong>2008</strong>, legal control of ALTAREA is in<br />

line with its economic control.<br />

1.5 Outlook<br />

The situation observed at the start of 2009 was paradoxical.<br />

While consumer spending remained flat - due to the mixed<br />

success of retailers’ ”winter sales” and a decline in the<br />

number of visitors to shopping centres - sales of new homes<br />

seemed to pick up, with commercial activities achieving a<br />

return to growth.<br />

Against this uncertain backdrop, ALTAREA’s recurring<br />

operating profit should increase further thanks to the quality<br />

and diversity of its portfolio, with three new shopping centres<br />

brought into service already nearly 100% let.<br />

In view of its liquidity position, ALTAREA is planning to<br />

continue with its conventional strategy of creating cash flow<br />

and value, mainly by developing new shopping centres. The<br />

Group may also seize any opportunities arising from market<br />

conditions. ALTAREA has set itself the target of maintaining<br />

the current solidity of its balance sheet.<br />

2. Shopping centre development<br />

2.1 Summary<br />

At 31 December <strong>2008</strong>, the portfolio of shopping centres in operation represented a value of €2.3 billion including transfer duties, with annualised<br />

rental income of €142 million. Current investment in shopping centre projects represents potential GLA of 705,600 m² and projected gross rental<br />

income of €171 million.<br />

Key figures for the asset base and project portfolio at 31 December <strong>2008</strong><br />

12/31/<strong>2008</strong> GLA in m² Current<br />

gross rental<br />

income<br />

Appraisal<br />

value<br />

Provisional<br />

gross rental<br />

income<br />

Total<br />

Already<br />

invested<br />

Committed<br />

investments<br />

still to be<br />

made<br />

Net investment<br />

Remaining<br />

investments<br />

not<br />

committed<br />

Yield<br />

Shopping centres in operation 589,092 142.2 2,270.4 N/A N/A N/A N/A N/A N/A<br />

Shopping centres under construction 131,200 N/A N/A 40.6 509.8 311.3 198.5 0.0 8.0%<br />

Development projects and signed<br />

development projects<br />

574,400 N/A N/A 130.0 1,431.2 154.5 125.0 1,151.7 9.1%<br />

Total assets 1,294,692 142.2 2,270.4 170.6 1,941.1 465.8 323.5 1,151.7 8.8%<br />

(6) Group share<br />

(7) This merger was the subject of an offer document (“note d’information“) approved by the AMF and registered under number E.08-0052 on 7 May <strong>2008</strong><br />

29

Business review<br />

2.2 Proprietary shopping centres<br />

2.2.1 Analysis of economic conditions<br />

The consumer climate<br />

The property and banking crisis that originated in the United<br />

States in summer 2007 turned into a global economic crisis<br />

in <strong>2008</strong>, affecting all sectors and regions. In continental<br />

Europe, there was a particularly visible sudden drop<br />

in consumer spending from summer <strong>2008</strong>, due to the<br />

combined effect of the credit crunch and an unprecedented<br />

rise in the cost of petroleum products. Despite the upturn in<br />

inflation at the end of the year, consumer morale was hard<br />

hit, with an increasing number of people taking a “wait-andsee“<br />

stance in view of the sharp rise in unemployment and<br />

building up savings as security.<br />

ALTAREA’s shopping centres<br />

Despite their positioning and up-to-date design, ALTAREA’s<br />

shopping centres sustained a slight fall in retail tenants’<br />

revenues for the first time, sliding 0.9% like-for-like. The<br />

second half of the year was particularly difficult, particularly<br />

in December, due to people waiting for the upcoming sales<br />

to make certain purchases. This decline in activity did not<br />

have an immediate impact on the ALTAREA Group’s rental<br />

income. The variable portion of its rental income represents<br />

just €1.1 million, less than 1% of total rental income in<br />

<strong>2008</strong>.<br />

On a like-for-like basis, the occupancy cost ratio (8) remained<br />

moderate at 9.0% compared with 8.6% in 2007.<br />

2.2.2 Growth of operating shopping centres<br />

At 31 December <strong>2008</strong>, the value (9) of operating properties was<br />

€ 2,270.4 million Group share, an increase of 4.6% compared<br />

with 31 December 2007 (down 8.0% like-for-like).<br />

Growth of operating shopping centres<br />

GLA Group<br />

share<br />

Gross rental<br />

income<br />

(in €m) (1)<br />

Group share<br />

Value<br />

(in €m)<br />

Group share<br />

TOTAL at 31 December 2007 521,660 114.8 2,170.3<br />

Shopping centres opened 58,700 19.6 259.6<br />

Acquisitions/disposals 8,732 0.7 11.9<br />

Variation on a like-for-like basis - 7.0 (171.3)<br />

Sub-total 67,432 27.4 100.1<br />

TOTAL at 31 December <strong>2008</strong> 589,092 142.2 2,270.4<br />

O/w France 506,188 115.4 1,844.8<br />

O/w International 82,904 26.8 425.6<br />

(1) <strong>Annual</strong>ised rental values on signed leases<br />

Shopping centres opened, acquisitions and disposals<br />

Six new shopping centres developed on a proprietary basis<br />

were opened in <strong>2008</strong>:<br />

Centre GLA in m² Gross rental<br />

income<br />

Occupancy<br />

rate<br />

Boutiques Gare de l’Est 5,500 6.6 99%<br />

Pinerolo (Italy) 7,800 3.0 100%<br />

Aubette Strasbourg 3,800 2.5 97%<br />

Porte Jeune Mulhouse 9,600 3.2 97%<br />

Brest Guipavas 28,000 3.9 95%<br />

Montpellier St Aunès 4,000 0.5 100%<br />

Appraisal<br />

value*(in €m)<br />

Total completions 58,700 19.6 97% 259.6<br />

* Gross value, including transfer duties, Group share<br />

Thanks to the work of the Group’s letting teams, all of the<br />

properties completed in <strong>2008</strong> have an occupancy rate of<br />

close to 100%.<br />

Developed on the basis of an average yield of 9%, these<br />

shopping centres generated value creation of €97 million<br />

in <strong>2008</strong>, recognised in the income statement.<br />

Progress made so far in the letting of properties due to be<br />

completed in 2009-10 suggests a similar performance.<br />

In <strong>2008</strong>, 91 leases representing gross rental income of<br />

€9.1 million were signed for these shopping centres,<br />

indicating an occupancy rate of around 100% for shopping<br />

centres due to open in 2009.<br />

30<br />

(8) Ratio of rents and expenses charged to tenants to revenues generated, data available for properties in France<br />

(9) Including transfer duties

Growth in rental value on a like-for-like basis<br />

N o . of leases<br />

concerned<br />

Rental<br />

income gain<br />

(in €m)<br />

% growth<br />

Asset Management * 154 2.2 +2.0%<br />

Indexation 4.8 +4.2%<br />

Total <strong>2008</strong> 154 7.0 +6.2%<br />

Reminder 2007 136 4.3 +5.4%<br />

(*) Asset Management comprises renewals, letting of empty properties,<br />

departures without replacement and re-letting of leases<br />

For properties already in the portfolio at the start of <strong>2008</strong>,<br />

ALTAREA’s letting teams signed 154 leases representing<br />

gross rental income of €9.2 million, generating a capital<br />

gain of €2.2 million.<br />

In accordance with the agreements signed between the<br />

French Federation of Real Estate Companies (FSIF) and<br />

retailers, an amendment to the lease was proposed to the<br />

tenants concerned in order to index rents to the new retail<br />

rent index (ILC) (10) .<br />

The existing portfolio still presents potential for additional<br />

rental income, estimated at €3.5 million gross (compared<br />

with €4.0 million at 31 December 2007).<br />

Lease expiry schedule<br />

Leases are broken down according to expiry date and the next<br />

three-year termination option in the following schedule:<br />

In €m Group share Group share<br />

Year<br />

Rental income<br />

reaching lease<br />

expiry date<br />

% of total Rental income<br />

reaching<br />

three-year<br />

termination<br />

option<br />

% of total<br />

Past years 6.2 4.3% 6.2 4.3%<br />

2009 2.2 1.6% 12.8 9.0%<br />

2010 6.7 4.7% 23.1 16.2%<br />

2011 7.8 5.5% 30.3 21.3%<br />

2012 11.2 7.8% 16.9 11.9%<br />

2013 9.7 6.8% 22.4 15.8%<br />

2014 21.8 15.3% 19.5 13.7%<br />

2015 12.0 8.5% 2.0 1.4%<br />

2016 13.0 9.1% 2.4 1.7%<br />

2017 22.7 16.0% 4.0 2.8%<br />

2018 21.3 15.0% 1.0 0.7%<br />

>2018 7.7 5.4% 1.7 1.2%<br />

Total 142.2 100.0% 142.2 100.0%<br />

• Growth in property values on like-for-like basis<br />

The weighted average capitalisation rate (11) increased from<br />

5.11% to 5.76% over the year.<br />

12/31/<strong>2008</strong> 12/31/2007<br />

Average net<br />

capitalisation rate<br />

Average net<br />

capitalisation rate<br />

France 5.66% 5.02%<br />

International (Italy, Spain) 6.19% 5.47%<br />

Average 5.76% 5.11%<br />

The fall in the value of assets resulting from the increase in<br />

capitalisation rates was partly offset by indexation and asset<br />

management actions.<br />

Breakdown of movements in asset value<br />

(in €m)<br />

Movement in<br />

asset value <strong>2008</strong><br />

% of value<br />

in 2007<br />

Capitalisation rate effect/reversion -253.6 -11.8%<br />

Indexation of rents +66.6 +3.1%<br />

Asset Management +15.6 +0.7%<br />

Total movements in asset value -171.3 -8.0%<br />

• Appraisal values<br />

The ALTAREA Group’s property portfolio valuation is based<br />

on appraisals by Cushman & Wakefield and Savills (for<br />

properties in Italy). They use two methods:<br />

- A method based on the capitalisation of net rental<br />

income: the appraiser applies a yield based on the site’s<br />

characteristics (surface area, competition, rental potential<br />

etc.) to rental income including guaranteed minimum<br />

rent, variable rent and the market rent of vacant premises,<br />

adjusted for all charges.<br />

- A method based on discounting projected cash flow over<br />

10 years, taking into account the resale value at the end of<br />

the period determined by capitalising net rental income.<br />

The second method is used to validate the results obtained<br />

with the first method.<br />

(10) The French retail rent index (ILC) is based on the rental reference index (IRL), the construction cost index (ICC) and the retail revenues in value index (ICAV)<br />

(11) The capitalisation rate is the rental yield relative to the appraisal value including transfer duties.<br />

31

Business review<br />

Rental income includes:<br />

• Rent increases to be applied on lease renewals;<br />

• The normative vacancy rate;<br />

• The impact of future rental capital gains resulting from<br />

the letting of vacant premises;<br />

• The increase in rental income from incremental rents;<br />

• The renewal of leases coming up for expiry.<br />

Appraisal valuations concern only properties in operation<br />

at 31 December <strong>2008</strong>, not including the present or future<br />

value of projects in the portfolio or under construction,<br />

which are stated at cost.<br />

The building permit for Bercy Village was obtained in the<br />

second half of <strong>2008</strong>. A discount is therefore no longer<br />

justified, as confirmed by legal expert Michel Marx.<br />

These valuations are conducted in accordance with the<br />

criteria set out in the RICS Appraisal and Valuation<br />

Standards published by the Royal Institute of Chartered<br />

Surveyors in May 2003. The surveyors’ assignments were<br />

carried out in accordance with the recommendations of the<br />

COB/CNC “Barthes de Ruyter working group“. Surveyors<br />

are paid lump-sum compensation determined in advance<br />

and based on the size and complexity of the appraised<br />

properties. Compensation is therefore totally independent<br />

of the results of the valuation assessment.<br />

The number of shopping centre property transactions slowed<br />

down significantly at the end of <strong>2008</strong>. The few transactions<br />

recorded concern primarily shopping malls attached to<br />

hypermarkets in provincial areas. Depending on the quality<br />

of these properties, the rate of return for investors varied<br />

from 5.20% to 6.50%. Against this backdrop, appraisal<br />

firms have revised the Group’s average rate of return.<br />

2.3 Recurring operating profit<br />

The contribution to consolidated recurring operating profit<br />

increased by 26% to €104 million, mainly as a result of “full<br />

year“ effects and the completion of properties.<br />

(in €m) 12/31/<strong>2008</strong> 12/31/2007<br />

Rental income 122.3 94.4<br />

Other net income (entry rights) 4.3 3.6<br />

Land expense (2.1) (0.7)<br />

Unrecovered rental expenses (7.3) (4.6)<br />

NET RENTAL INCOME 117.3 +26.5% 92.7<br />

% of rental income 95.9% 98.2%<br />

Net overhead expenses (9.5) (9.1)<br />

Miscellaneous (3.9) (1.2)<br />

OPERATING PROFIT 103.8 +26.0% 82.4<br />

% of rental income 84.9% 87.3%<br />

32

Breakdown of operating shopping centres at 31 December <strong>2008</strong> (Group share)<br />

Centre Type Country Opening<br />

Renovation<br />

Driver brand<br />

Area Group<br />

share<br />

Gross rental income<br />

(in €m) (1)<br />

Group share<br />

Value (in €m)<br />

Group share<br />

Lille - Les Tanneurs & Grand’ Place CC F 2004 (R) Fnac, Monoprix, C&A 22,200<br />

Paris - Bercy Village ULC F 2001 (O) UGC Ciné Cité 19,400<br />

Toulouse Saint Georges CC F 2006 (R) Casino, Sephora 14,500<br />

Vichy CC F 2003 (O) Darty, La Grande Récré 14,203<br />

Brest Jean Jaurès CC F 2002 (O) Fnac, Go Sport, H&M 12,800<br />

Reims - Espace d’Erlon CC F 2002 (O) Monoprix, Fnac 7,100<br />

Brest - Coat ar Gueven CC F Sephora 6,339<br />

Roubaix - Espace Grand’ Rue CC F 2002 (O) Géant, Le Furet du Nord 4,400<br />

Troyes CC F H&M, Burton 3,633<br />

Paris - Vaugirard CC F 2,386<br />

Châlons - Hôtel de Ville CC F 2005 (O) Atac 2,100<br />

Paris - Les Boutiques Gare du Nord CC F 2002 (O) Monoprix 1,500<br />

Rome-Casetta Mattei CC I 2005 (O) Conad-Leclerc 14,800<br />

Aix en Provence CC F 1982 (O) Géant, Casino 3,729<br />

Nantes - Espace Océan CC F 1998 (R) Auchan, Camif 11,200<br />

Thiais Village ULC F 2007 (O) Ikea, Fnac, Decathlon etc. 22,324<br />

Sub-total city centre 162,614 48.5 874.1<br />

Toulouse - Occitania CO F 2005 (R ) Auchan, Go Sport 47,850<br />

Massy - -X% CO F 1986 (O) La Halle, Boulanger 18,200<br />

Bordeaux - Grand’ Tour CO F 2004 (R) Leclerc 11,200<br />

Strasbourg-La Vigie CO F 1988 (O) Decathlon, Castorama 8,769<br />

Flins CO F Carrefour 6,999<br />

Toulon - Grand’ Var CO F Go Sport, Planet Saturn 6,336<br />

Montgeron - Valdoly CO F 1984 (O) Auchan, Castorama 5,600<br />

Grenoble - Viallex CO F 1970 (O) Gifi 4,237<br />

Chalon Sur Saone CO F 1989 (O) Carrefour 4,001<br />

Miscellaneous - City outskirts CO F 10,466<br />

Barcelona - San Cugat CO S 1996 (O) Eroski, Media Market 20,488<br />

Ragusa CO I 2007 (O) Coop, Euronics, Upim 12,130<br />

Casale Montferrato CO I 2007 (O) Coop, Unieuro 7,973<br />

Bellinzago CO I 2007 (O) Gigante, H&M 19,713<br />

Sub-total city outskirts 183,961 44.6 877.2<br />

CC: city centre - ULC: urban leisure centre - CO: city outskirts - RP: retail park - S: Spain - O: Opening - R: Renovation<br />

(1) Rental values on signed leases at 1 January 2009<br />

33

Business review<br />

Centre Type Country Opening<br />

Renovation<br />

Driver brand<br />

Area Group<br />

share<br />

Gross rental income<br />

(in €m)<br />

(1)<br />

Group share<br />

Value (in €m)<br />

Group share<br />

Villeparisis RP F 2006 (O) La Grande Recré, Alinea 18,623<br />

Herblay - XIV Avenue RP F 2002 (O) Alinéa, Go Sport 14,200<br />

Pierrelaye RP F 2005 (O) Castorama 9,750<br />

Bordeaux - St Eulalie RP F Tendance, Picard, Gemo 13,400<br />

Gennevilliers RP F 2006 (O) Decathlon, Boulanger 11,291<br />

Family Village Le Mans Ruaudin RP F 2007 (O) Darty 23,800<br />

Family Village Aubergenville RP F 2007 (O) King Jouet, Go Sport 38,620<br />

Other RP F 45,402<br />

Sub-total retail parks 175,085 21.7 419.0<br />

Total at 31 December 2007 521,660 114.8 2 170.3<br />

Paris - Vaugirard CC F (2,386)<br />

Troyes CC F (3,633)<br />

Coulaines- Sarthe RP F (2,021)<br />

Gennevilliers RP F Decathlon, Boulanger 7,572<br />

Other transactions 9,200<br />

Sub-total acquisitions/disposals/other 8,732 0.7 11.9<br />

Gare de l’Est CC F Casino 5,500<br />

Brest Guipavas RP F Ikea, Décathlon, Boulanger 28,000<br />

Mulhouse - Porte Jeune RP F Monoprix 9,600<br />

Montpellier - St Aunes RP F Leroy Merlin 4,000<br />

Strasbourg - L’Aubette CC F Zara, Marionnaud 3,800<br />

Pinerolo RP I Ipercoop 7,800<br />

Sub-total Centres opened 58,700 19.6 259.6<br />

Growth (like-for-like) 7.0 (171.3)<br />

Total at 31 December <strong>2008</strong> 589,092 142.2 2 270.4<br />

O/w France 506,188 115.4 1 844.8<br />

O/w International 82,904 26.8 425.6<br />

CC: city centre - ULC: urban leisure centre - CO: city outskirts - RP: retail park - S: Spain - O: Opening - R: Renovation<br />

(1) Rental values on signed leases at 1 January 2009<br />

34

2.4 Shopping centres under development (12)<br />

At 31 December <strong>2008</strong>, the volume of projects (shopping centres under construction/with authorisation, secured/signed centres)<br />

managed by ALTAREA represented projected net investment of over €1.9 billion and potential rental income of €170.6 million,<br />

representing a projected return on investment of 8.8%.<br />

Development cycle/commitments<br />

Thanks to its integrated development teams, ALTAREA has the operating capacity to put together and design new shopping<br />

centres generating high yields and making a significant contribution to its NAV. New development projects should generate<br />

a minimum spread of 300 basis points relative to the capitalisation rate for similar properties and be financed at the time of<br />

their launch. The entire process can take five to ten years.<br />

Administrative<br />

stage<br />

{<br />

Project secured<br />

(Tender won<br />

or signature)<br />

Administrative<br />

authorization<br />

filings<br />

Secured / signed<br />

Authorisations<br />

obtained<br />

(CDEC / PC)<br />

Under construction / authorised<br />

Completion<br />

In operation<br />

{<br />

{<br />

{<br />

Prospecting<br />

Preparation<br />

Definition of concept<br />

pre-marketing<br />

Administrative<br />

stage<br />

Construction<br />

Final<br />

works<br />

Portfolio<br />

Type of<br />

commitments<br />

{<br />

Research or<br />

tender costs<br />

Compensation for<br />

loss of use / security<br />

for land / technical<br />

research costs<br />

Land<br />

Cost of works<br />

The property agreement is generally signed subject to obtaining administrative authorisations. Without exception, total costs<br />

incurred before construction works begin represent less than 10% of the total cost. The risk profile for the redevelopment<br />

of existing properties (extensions, renovations) is very different, as the site is generally secured and already generates rental<br />

income.<br />

2.4.1 Breakdown of commitments by type<br />

Net investment (in €m)<br />

Already invested (1) 465.8<br />

Committed investments still to be made (2) 323.5<br />

Remaining investments not committed (3) 1,151.7<br />

Projects in development 31 December <strong>2008</strong> 1,941.0<br />

The portfolio of shopping centres under development broke down as follows at 31 December <strong>2008</strong>:<br />

1. Already invested: all investment costs recognised at the accounting date.<br />

2. Committed investments still to be made:<br />

– Developments under construction: all of the remaining amount to be paid on completion<br />

– Developments at the preparation stage: payment commitments (bilateral sale and purchase agreements, signed contracts etc.)<br />

3. Remaining investments not committed: amounts still to be invested in developments at the preparation stage, with ALTAREA<br />

deciding whether to make a commitment (unilateral sales agreements, unsigned contracts etc.)<br />

(12) Group share.<br />

35

Business review<br />

2.4.2 <strong>2008</strong> investments<br />

Investments (in €m)<br />

Assets in operation 23<br />

Projects completed in <strong>2008</strong> 83<br />

Projects completed after <strong>2008</strong> 189<br />

Total 295<br />

The majority of investments made in <strong>2008</strong> concern construction costs.<br />

2.4.3 Breakdown of commitments by type of development project<br />

Group share of shopping centres<br />

Centres GLA in m² Gross rental<br />

income<br />

(in €m)<br />

Year of<br />

completion<br />

Already<br />

invested<br />

(in €m)<br />

Committed<br />

investments<br />

still to be<br />

made (in €m)<br />

Remaining<br />

investments<br />

not committed<br />

(in €m)<br />

Net<br />

investment<br />

(in €m)<br />

Yield<br />

Creches 13,900 1.4 2009<br />

Occitania extension 8,500 4.6 2009<br />

Lyon Carré de Soie 28,800 5.4 2009<br />

Wagram 11,500 7.0 2009<br />

Dalmine 32,400 9.9 2010<br />

Kremlin Bicêtre 25,800 11.1 2010<br />

Miscellaneous 10,300 2010-2012<br />

Sub-total projects under construction 131,200 40.6 311.3 198.5 0.0 509.8 8.0%<br />

Sous-total ready to begin works 61,500 9.6 2010-2012 24.8 44.1 42.5 111.4<br />

Sub-total preparing to begin works 240,700 64.5 2011-2014 54.8 61.1 583.0 698.9<br />

Sub-total development projects<br />

at advanced stage of review<br />

272,200 55.9 2012-2014 74.9 19.8 526.3 620.9<br />

Sub-total development projects 574,400 130.0 154.5 125.0 1,151.7 1,431.2 9.1%<br />

Total 705,600 170.6 465.8 323.5 1,151.7 1,941.1 8.8%<br />

36<br />

Eight new development projects were launched in <strong>2008</strong> representing potential investment of nearly €416 million and a<br />

projected yield of over 9%.<br />

Projects under construction<br />

At 31 December <strong>2008</strong>, 10 projects were under construction,<br />

of which three are due to be completed in 2009:<br />

• The property complex on Avenue de Wagram in Paris is due<br />

to be completed in the second quarter of 2009: this will<br />

comprise a hotel with 118 rooms, as well as retail units<br />

at ground level, with a total GLA of 11,500 m² that is<br />

100% let.<br />

• The Lyon Carré de Soie shopping and leisure centre: this<br />

58,000 m² project created in partnership with Foncière<br />

Euris (share of 28,800 m²) is due to be completed in the<br />

second quarter of 2009. On completion, the property will<br />

be almost 100% let.<br />

• The Creches Retail Park is due to be completed in the<br />

second quarter of 2009. The site’s GLA of 13,900 m² is<br />

nearly 100% let.<br />

All of the developments currently under construction are<br />

wholly financed either by the structure that owns them or<br />

at corporate level.<br />

Development projects<br />

(partly committed, construction works not started)<br />

In addition to development projects under construction,<br />

ALTAREA has a portfolio of projects representing total<br />

investment of around €1.4 billion and projected rental<br />

income of €130 million. These projects, due to be<br />

completed between 2010 and 2014, are at various stages

of advancement and are only partly committed. For each<br />

project, ALTAREA holds the deeds to the property (sales<br />

agreement signed or tender won) but the decision to begin<br />

works definitively is still up to the Group and may be<br />

deferred on the basis of a variety of criteria such as the<br />

administrative and commercial situation of the project,<br />

economic conditions or availability of financing. To this<br />

end, ALTAREA has set up a project classification system<br />

according to their priority, reflecting its risk management<br />

policy:<br />

• Ready for works to begin<br />

(11% of development projects)<br />

This concerns development projects with a favourable risk/<br />

return profile: expected yield of around 9%, proven retail<br />

demand and satisfactory stage of advancement in operating<br />

and administrative procedures. For most of these projects,<br />

the decision to begin construction works should be made in<br />

late 2009 or early 2010. The ALTAREA Group currently has<br />

all of the financial resources needed to go ahead with this<br />

project portfolio.<br />

• Preparing for works to begin<br />

(42% of development projects)<br />

This concerns development projects for which the decision<br />

to begin works should be made in 2010 but which still<br />

present room for improvement in their risk/return profile.<br />

They potentially represent a high rate of return but the legal,<br />

commercial, administrative and financial situation needs to<br />

be stabilised in order to reduce the level of risk. Depending<br />

on how financing conditions develop between now and<br />

2010, these projects could join the above category.<br />

• Development projects under study<br />

(47% of development projects)<br />

This category concerns development projects for which the<br />

start of construction works is not an immediate problem.<br />

Progress still needs to be made in their operating situation<br />

(administrative authorisations, pre-marketing, research etc.)<br />

in order to comply with the Group’s rules of commitment<br />

when the time comes.<br />

3. Property development<br />

for third parties<br />

3.1 Introduction<br />

Since acquiring <strong>Cogedim</strong> in July 2007, the ALTAREA<br />

Group has become one of the market leaders in property<br />

development for third parties, with a business volume of<br />

€1,042 million in <strong>2008</strong> (13) .<br />

3.1.1 Areas of intervention<br />

As an integrated multi-product property developer, the<br />

Group covers a broad range of activities:<br />

In terms of products:<br />

• Commercial property<br />

• Large mixed urban developments;<br />

• Residential property<br />

In terms of business lines:<br />

• Planner/developer<br />

• Developer<br />

• Service provider (delegated project management, marketing)<br />

3.1.2 Geographical presence<br />

In addition to the Paris region - which constitutes its historic<br />

market - the Group also operates in regional areas in large<br />

cities offering the strongest growth prospects on both an<br />

economic and demographic basis:<br />

• Provence-Alpes-Côte d’Azur region: Nice, Marseille<br />

• Rhône-Alpes region: Lyon, Grenoble, French Geneva Region<br />

• Grand-Ouest region: Toulouse, Bordeaux and the Basque<br />

country, Nantes<br />

Each of the eight subsidiaries is involved in the development<br />

of residentials and six of them also develop offices and<br />

hotels, with the support of a central commercial property<br />

team dedicated to regional areas.<br />

In the Paris region, the large size of the respective markets<br />

justifies keeping two separate subsidiaries, one for<br />

residentials and one for commercial property.<br />

3.1.3 Commitment policy<br />

In office properties, where the Group acts as developer<br />

signing off-plan sale agreements or property development<br />

contracts under which it makes a commitment to build a<br />

property, this commitment is subject to the property being<br />

sold in advance or the signature of a contract ensuring<br />

financing of the build. Where it acts as delegated project<br />

(13) Volume including tax.<br />

37

Business review<br />

manager, the Group provides development services for the<br />

owner of a property in exchange for fees. In <strong>2008</strong>, provision<br />

of these services accounted for nearly 80% of the Group’s<br />

commercial property business volume.<br />

In residential property, the Group has adapted its commitment<br />

policy to current economic conditions by stepping up the<br />

prudential criteria implemented at the start of the year. The<br />

main aim of these criteria is to favour the signature of a<br />

unilateral preliminary sales agreement rather than bilateral<br />

sale and purchase agreements, to set out conditions for<br />

the acquisition of the site and the start of works with a<br />

high level of pre-marketing, and to abandon developments<br />

that would not profitable enough or the marketing of which<br />

would be disappointing.<br />

The Group’s management of properties for sale is<br />

particularly efficient and has allowed it to control the level<br />

of unsold properties, which represented just €5 million (14)<br />

at 31 December <strong>2008</strong>.<br />

3.1.4 Organisation of the property development division<br />

within the ALTAREA Group<br />

The property development division was legally and<br />

operationally restructured at the end of <strong>2008</strong>, marking the<br />

definitive integration of <strong>Cogedim</strong> into the ALTAREA Group.<br />

<strong>Cogedim</strong> and Compagnie ALTAREA Habitation (15) were<br />

merged to begin with and the new entity was then transferred<br />

to Altareit, a 99.6%-owned subsidiary of ALTAREA listed on<br />

Euronext Paris. On this occasion, the powers of <strong>Cogedim</strong>’s<br />

Supervisory Board were reinforced with regard to deciding<br />

on commitments. The property development division,<br />

managed on an integrated basis, is therefore one of the two<br />

contributors to the Group’s cash flow alongside the shopping<br />

centre business.<br />

3.2 Revenues<br />

On a like-for-like basis, revenues from the property development<br />

division remained robust in <strong>2008</strong>, rising by 29%.<br />

(in €m) 12/31/<strong>2008</strong> 12/31/2007<br />

like-for-like (1)<br />

Property revenues 739.6 577.0<br />

O/w commercial property 147.9 70.2<br />

O/w residential property 591.7 506.8<br />

Services to third parties 29.4 18.9<br />

Total revenues 769.0 +29% 595.9<br />

This growth relates partly to the quality of the backlog at<br />

the start of <strong>2008</strong>, as well as very strong growth in services<br />

provided for third parties.<br />

3.3 Operating profit<br />

The effects of the crisis are visible in operating profit,<br />

which fell by 21% (reduction in selling prices and slower<br />

adjustment of development costs).<br />

(in €m) 12/31/<strong>2008</strong> 12/31/2007<br />

like-for-like (1)<br />

Total revenues 769.0 +29% 595.9<br />

Cost of sales (664.0) (486.5)<br />

Net overhead expenses (43.5) (34.8)<br />

Other (3.6) (0.9)<br />

RECURRING OPERATING PROFIT 57.9 -21% 73.7<br />

% of revenues 7.5% 12.4%<br />

(1) Including one year’s contribution from <strong>Cogedim</strong><br />

3.4 Operating review by product line<br />

3.4.1 Commercial property<br />

At 31 December <strong>2008</strong>, the Group was in charge of<br />

32 commercial property developments representing a total<br />

net floor area of 612,400 m², comprising mainly offices (26<br />

developments), as well as six hotels.<br />

(Net floor area, 000 m², 100%)<br />

Delegated<br />

project<br />

management<br />

Property<br />

development<br />

Total<br />

Offices 214 305 519<br />

Hotels 39 38 76<br />

Miscellaneous<br />

(research centres, multimedia etc.)<br />

– 17 17<br />

Total development projects 253 359 612<br />

Economic conditions in <strong>2008</strong><br />

Investment in commercial property (16) :<br />

With transactions totalling €12.5 billion in <strong>2008</strong>, investment<br />

in commercial property fell by 55% year-on-year to the<br />

level of 2004. This was due to both investors encountering<br />

difficulties in obtaining financing and deterioration in<br />

economic conditions.<br />

(1) Including one year’s contribution from <strong>Cogedim</strong><br />

38<br />

(14) Incomplete properties net of reservations Compared with net reservations of €557 million in <strong>2008</strong>, as a share of ownership<br />

(15) Compagnie ALTAREA Habitation comprised ALTAREA’s property development activities before the acquisition of <strong>Cogedim</strong><br />

(16) CRBE data for <strong>2008</strong>.

The increase in capitalisation rates affected the majority of<br />

sectors and products, with increases of 100 to 150 basis<br />

points (e.g. Paris CBD up from 4.5% to 6.0% / provinces up<br />

from 6.3% to 7.5%).<br />

Commercial property take-ups<br />

In spite of deterioration in economic conditions, take-up<br />

of office properties held up in <strong>2008</strong> with a volume of 2.4<br />

million m², 14% lower than in 2007. Looking for savings,<br />

users favoured new premises, which accounted for 44% of<br />

take-up volumes.<br />

In parallel, immediately available property increased by<br />

13% to 2.7 million m².<br />

<strong>2008</strong> transactions<br />

The Group carried out four major transactions in <strong>2008</strong>.<br />

• TOULOUSE – Bordelongue (Porte Sud): A joint development<br />

with Vinci comprising three office blocks of 21,200 m²,<br />

located close to the future Cancéropôle development, was<br />

sold to Crédit Suisse Asset Management for €56 million.<br />

Due for completion in early 2010.<br />

• KORUS, Tranche 2 in Suresnes: (56,000 m²) Development<br />

by <strong>Cogedim</strong> as delegated project manager on behalf of<br />

AXA REIM and sold off-plan to Servier. Works have just<br />

begun with completion due in mid-2011.<br />

• COLOMBES – Perspectives Défenses (28,000 m²): This<br />

development, under delegated project management on<br />

behalf of AXA REIM was completed in 2007 and let in<br />

full to Areva. It was sold to a German fund managed by<br />

AXA in <strong>2008</strong>.<br />

• NICE MERIDIA – First Tranche -(10,200 m²): Joint development<br />

with Icade Tertial, this first tranche of office space of<br />

10,200 m² is subject to a property development contract<br />

on behalf of <strong>Cogedim</strong> Office Partners for €22.8 million<br />

excluding tax. Works began in the fourth quarter of <strong>2008</strong> for<br />

completion in the first quarter of 2010.<br />

<strong>2008</strong> completions<br />

Three developments were completed in <strong>2008</strong>:<br />

• Korus Tranche 1 in Suresnes: Developed under delegated<br />

project management, this 43,000 m² property leased by<br />

Philips France was completed in late June on behalf of<br />

AXA REIM France.<br />

• Wissous Logistique: 10,000 m² of logistics space<br />

developed as delegated project manager on behalf of Axa<br />

Reim France.<br />

• French National Assembly: (25,000 m², rue de l’Université,<br />

Paris 7). Extensive redevelopment of the offices of<br />

members of parliament on behalf of the French National<br />

Assembly as delegated project manager. The development<br />

was completed in July <strong>2008</strong>.<br />

Revenues and fees<br />

(in €m) 12/31/<strong>2008</strong> 12/31/2007<br />

like-for-like (1)<br />

Revenues 147.9 70.2<br />

NET PROPERTY INCOME 12.0 +9% 11.0<br />

% of revenues 8.1% 15.7%<br />

SERVICES TO THIRD PARTIES 26.2 +122% 11.8<br />

(1) Including one year’s contribution from <strong>Cogedim</strong><br />

Backlog (17) off-plan, property development contracts and<br />

delegated project management)<br />

The backlog of off-plan and property development contracts<br />

represented €141.9 million at the end of <strong>2008</strong> with<br />

€240.3 million at the end of 2007. At the end of December<br />

<strong>2008</strong>, the Group also had a backlog of delegated project<br />

management fees representing €19.8 million.<br />

3.4.2 Large mixed urban developments<br />

The ALTAREA Group is positioned as an urban multiproduct<br />

actor, able to offer complete solutions including<br />

all property classes, with integrated operating expertise<br />

(offices, housing, hotels, shops). The target in terms of final<br />

investment is still shops, which are developed in order to<br />

be kept in the portfolio, while other property classes are<br />

intended to be sold.<br />

At 31 December <strong>2008</strong>, the Group managed six large mixed<br />

urban developments representing a total net floor area of<br />

718,000 m². These developments comprise predominantly<br />

office space but also include 139,000 m² of shops,<br />

intended to be kept in the portfolio for ALTAREA’s share<br />

(GLA of 75,500 m²).<br />

(17) Revenues excluding tax on notarised sales to be recognised according to the percentage of completion method, placements not yet subject to a notarised deed and<br />

fees owed by third parties on contracts signed.<br />

39

Business review<br />

(Net floor area, 000 m²) Shops (1) Offices Hotels Residential Miscellaneous Total<br />

Nice Meridia 29 18 46<br />

Kremlin Bicêtre 45 27 1 73<br />