Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

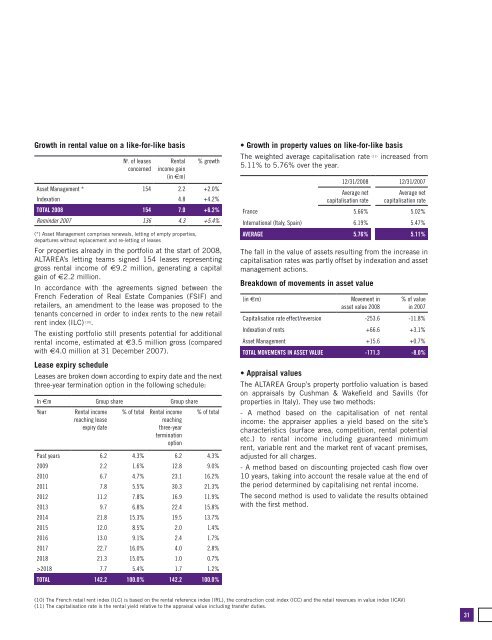

Growth in rental value on a like-for-like basis<br />

N o . of leases<br />

concerned<br />

Rental<br />

income gain<br />

(in €m)<br />

% growth<br />

Asset Management * 154 2.2 +2.0%<br />

Indexation 4.8 +4.2%<br />

Total <strong>2008</strong> 154 7.0 +6.2%<br />

Reminder 2007 136 4.3 +5.4%<br />

(*) Asset Management comprises renewals, letting of empty properties,<br />

departures without replacement and re-letting of leases<br />

For properties already in the portfolio at the start of <strong>2008</strong>,<br />

ALTAREA’s letting teams signed 154 leases representing<br />

gross rental income of €9.2 million, generating a capital<br />

gain of €2.2 million.<br />

In accordance with the agreements signed between the<br />

French Federation of Real Estate Companies (FSIF) and<br />

retailers, an amendment to the lease was proposed to the<br />

tenants concerned in order to index rents to the new retail<br />

rent index (ILC) (10) .<br />

The existing portfolio still presents potential for additional<br />

rental income, estimated at €3.5 million gross (compared<br />

with €4.0 million at 31 December 2007).<br />

Lease expiry schedule<br />

Leases are broken down according to expiry date and the next<br />

three-year termination option in the following schedule:<br />

In €m Group share Group share<br />

Year<br />

Rental income<br />

reaching lease<br />

expiry date<br />

% of total Rental income<br />

reaching<br />

three-year<br />

termination<br />

option<br />

% of total<br />

Past years 6.2 4.3% 6.2 4.3%<br />

2009 2.2 1.6% 12.8 9.0%<br />

2010 6.7 4.7% 23.1 16.2%<br />

2011 7.8 5.5% 30.3 21.3%<br />

2012 11.2 7.8% 16.9 11.9%<br />

2013 9.7 6.8% 22.4 15.8%<br />

2014 21.8 15.3% 19.5 13.7%<br />

2015 12.0 8.5% 2.0 1.4%<br />

2016 13.0 9.1% 2.4 1.7%<br />

2017 22.7 16.0% 4.0 2.8%<br />

2018 21.3 15.0% 1.0 0.7%<br />

>2018 7.7 5.4% 1.7 1.2%<br />

Total 142.2 100.0% 142.2 100.0%<br />

• Growth in property values on like-for-like basis<br />

The weighted average capitalisation rate (11) increased from<br />

5.11% to 5.76% over the year.<br />

12/31/<strong>2008</strong> 12/31/2007<br />

Average net<br />

capitalisation rate<br />

Average net<br />

capitalisation rate<br />

France 5.66% 5.02%<br />

International (Italy, Spain) 6.19% 5.47%<br />

Average 5.76% 5.11%<br />

The fall in the value of assets resulting from the increase in<br />

capitalisation rates was partly offset by indexation and asset<br />

management actions.<br />

Breakdown of movements in asset value<br />

(in €m)<br />

Movement in<br />

asset value <strong>2008</strong><br />

% of value<br />

in 2007<br />

Capitalisation rate effect/reversion -253.6 -11.8%<br />

Indexation of rents +66.6 +3.1%<br />

Asset Management +15.6 +0.7%<br />

Total movements in asset value -171.3 -8.0%<br />

• Appraisal values<br />

The ALTAREA Group’s property portfolio valuation is based<br />

on appraisals by Cushman & Wakefield and Savills (for<br />

properties in Italy). They use two methods:<br />

- A method based on the capitalisation of net rental<br />

income: the appraiser applies a yield based on the site’s<br />

characteristics (surface area, competition, rental potential<br />

etc.) to rental income including guaranteed minimum<br />

rent, variable rent and the market rent of vacant premises,<br />

adjusted for all charges.<br />

- A method based on discounting projected cash flow over<br />

10 years, taking into account the resale value at the end of<br />

the period determined by capitalising net rental income.<br />

The second method is used to validate the results obtained<br />

with the first method.<br />

(10) The French retail rent index (ILC) is based on the rental reference index (IRL), the construction cost index (ICC) and the retail revenues in value index (ICAV)<br />

(11) The capitalisation rate is the rental yield relative to the appraisal value including transfer duties.<br />

31