Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The increase in capitalisation rates affected the majority of<br />

sectors and products, with increases of 100 to 150 basis<br />

points (e.g. Paris CBD up from 4.5% to 6.0% / provinces up<br />

from 6.3% to 7.5%).<br />

Commercial property take-ups<br />

In spite of deterioration in economic conditions, take-up<br />

of office properties held up in <strong>2008</strong> with a volume of 2.4<br />

million m², 14% lower than in 2007. Looking for savings,<br />

users favoured new premises, which accounted for 44% of<br />

take-up volumes.<br />

In parallel, immediately available property increased by<br />

13% to 2.7 million m².<br />

<strong>2008</strong> transactions<br />

The Group carried out four major transactions in <strong>2008</strong>.<br />

• TOULOUSE – Bordelongue (Porte Sud): A joint development<br />

with Vinci comprising three office blocks of 21,200 m²,<br />

located close to the future Cancéropôle development, was<br />

sold to Crédit Suisse Asset Management for €56 million.<br />

Due for completion in early 2010.<br />

• KORUS, Tranche 2 in Suresnes: (56,000 m²) Development<br />

by <strong>Cogedim</strong> as delegated project manager on behalf of<br />

AXA REIM and sold off-plan to Servier. Works have just<br />

begun with completion due in mid-2011.<br />

• COLOMBES – Perspectives Défenses (28,000 m²): This<br />

development, under delegated project management on<br />

behalf of AXA REIM was completed in 2007 and let in<br />

full to Areva. It was sold to a German fund managed by<br />

AXA in <strong>2008</strong>.<br />

• NICE MERIDIA – First Tranche -(10,200 m²): Joint development<br />

with Icade Tertial, this first tranche of office space of<br />

10,200 m² is subject to a property development contract<br />

on behalf of <strong>Cogedim</strong> Office Partners for €22.8 million<br />

excluding tax. Works began in the fourth quarter of <strong>2008</strong> for<br />

completion in the first quarter of 2010.<br />

<strong>2008</strong> completions<br />

Three developments were completed in <strong>2008</strong>:<br />

• Korus Tranche 1 in Suresnes: Developed under delegated<br />

project management, this 43,000 m² property leased by<br />

Philips France was completed in late June on behalf of<br />

AXA REIM France.<br />

• Wissous Logistique: 10,000 m² of logistics space<br />

developed as delegated project manager on behalf of Axa<br />

Reim France.<br />

• French National Assembly: (25,000 m², rue de l’Université,<br />

Paris 7). Extensive redevelopment of the offices of<br />

members of parliament on behalf of the French National<br />

Assembly as delegated project manager. The development<br />

was completed in July <strong>2008</strong>.<br />

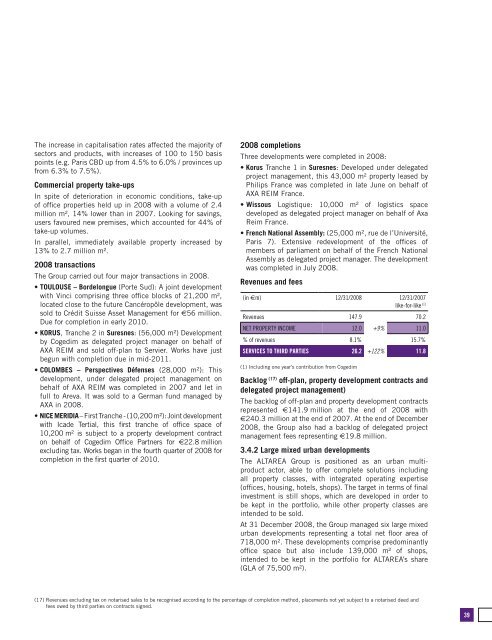

Revenues and fees<br />

(in €m) 12/31/<strong>2008</strong> 12/31/2007<br />

like-for-like (1)<br />

Revenues 147.9 70.2<br />

NET PROPERTY INCOME 12.0 +9% 11.0<br />

% of revenues 8.1% 15.7%<br />

SERVICES TO THIRD PARTIES 26.2 +122% 11.8<br />

(1) Including one year’s contribution from <strong>Cogedim</strong><br />

Backlog (17) off-plan, property development contracts and<br />

delegated project management)<br />

The backlog of off-plan and property development contracts<br />

represented €141.9 million at the end of <strong>2008</strong> with<br />

€240.3 million at the end of 2007. At the end of December<br />

<strong>2008</strong>, the Group also had a backlog of delegated project<br />

management fees representing €19.8 million.<br />

3.4.2 Large mixed urban developments<br />

The ALTAREA Group is positioned as an urban multiproduct<br />

actor, able to offer complete solutions including<br />

all property classes, with integrated operating expertise<br />

(offices, housing, hotels, shops). The target in terms of final<br />

investment is still shops, which are developed in order to<br />

be kept in the portfolio, while other property classes are<br />

intended to be sold.<br />

At 31 December <strong>2008</strong>, the Group managed six large mixed<br />

urban developments representing a total net floor area of<br />

718,000 m². These developments comprise predominantly<br />

office space but also include 139,000 m² of shops,<br />

intended to be kept in the portfolio for ALTAREA’s share<br />

(GLA of 75,500 m²).<br />

(17) Revenues excluding tax on notarised sales to be recognised according to the percentage of completion method, placements not yet subject to a notarised deed and<br />

fees owed by third parties on contracts signed.<br />

39