Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Despite the severe slowdown in lending activity at the end of<br />

<strong>2008</strong> in particular, well designed development projects with<br />

a high level of pre-marketing were able to obtain financing<br />

under financially profitable terms for the ALTAREA Group.<br />

1.5 Financial covenants<br />

LTV ratio<br />

The Group’s consolidated LTV ratio was 53.4% at<br />

31 December <strong>2008</strong> compared with 50.4% at the end of<br />

2007.<br />

With a covenant maximum of 65%, the ALTAREA Group<br />

believes that it has significant leeway to allow it to cope with<br />

any further deterioration in economic conditions.<br />

Interest cover ratio (EBITDA (25) /financing costs)<br />

The interest cover ratio stood at 2.6x at 31 December <strong>2008</strong><br />

compared with a covenant of 2.0x.<br />

Other specific covenants<br />

An exhaustive review of the specific covenants for each<br />

credit line was conducted in <strong>2008</strong>.<br />

All covenants relating to the shopping centres business are<br />

largely respected and should be able to hold up against any<br />

further deterioration in values.<br />

All covenants relating to the loan for the acquisition of<br />

<strong>Cogedim</strong> were very largely respected at 31 December<br />

<strong>2008</strong> (27) .<br />

2. Hedging and maturity<br />

The hedging instruments held by the Group at 31 December<br />

<strong>2008</strong> allowed it to hedge a maximum nominal amount of<br />

€2.2 billion, equal to 100% of consolidated gross debt.<br />

Over the full year in <strong>2008</strong>, net cash flow from the hedging<br />

portfolio amounted to €20 million, thereby helping to<br />

maintain the Group’s cost of debt.<br />

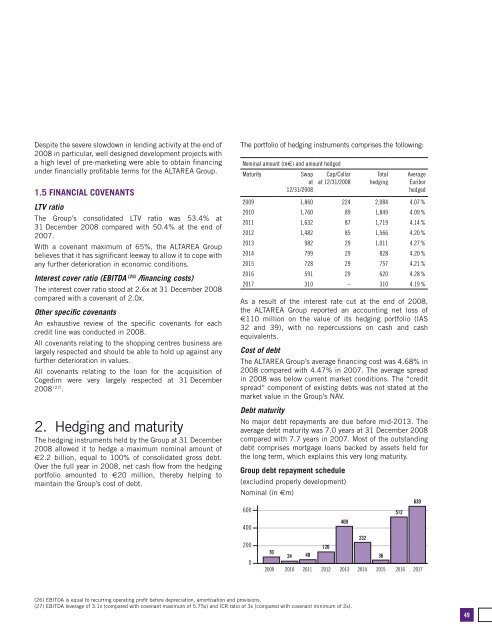

The portfolio of hedging instruments comprises the following:<br />

Nominal amount (m€) and amount hedged<br />

Maturity<br />

Swap<br />

at<br />

12/31/<strong>2008</strong><br />

Cap/Collar<br />

at 12/31/<strong>2008</strong><br />

600<br />

400<br />

200<br />

0<br />

70<br />

24 40<br />

126<br />

409<br />

2009 2010 2011 2012 2013 2014 2015 2016 2017<br />

232<br />

Total<br />

hedging<br />

36<br />

512<br />

Average<br />

Euribor<br />

hedged<br />

2009 1,860 224 2,084 4.07 %<br />

2010 1,760 89 1,849 4.09 %<br />

2011 1,632 87 1,719 4.14 %<br />

2012 1,482 85 1,566 4.20 %<br />

2013 982 29 1,011 4.27 %<br />

2014 799 29 828 4.20 %<br />

2015 728 29 757 4.21 %<br />

2016 591 29 620 4.28 %<br />

2017 310 – 310 4.19 %<br />

As a result of the interest rate cut at the end of <strong>2008</strong>,<br />

the ALTAREA Group <strong>report</strong>ed an accounting net loss of<br />

€110 million on the value of its hedging portfolio (IAS<br />

32 and 39), with no repercussions on cash and cash<br />

equivalents.<br />

Cost of debt<br />

The ALTAREA Group’s average financing cost was 4.68% in<br />

<strong>2008</strong> compared with 4.47% in 2007. The average spread<br />

in <strong>2008</strong> was below current market conditions. The “credit<br />

spread“ component of existing debts was not stated at the<br />

market value in the Group’s NAV.<br />

Debt maturity<br />

No major debt repayments are due before mid-2013. The<br />

average debt maturity was 7.0 years at 31 December <strong>2008</strong><br />

compared with 7.7 years in 2007. Most of the outstanding<br />

debt comprises mortgage loans backed by assets held for<br />

the long term, which explains this very long maturity.<br />

Group debt repayment schedule<br />

(excludind properly development)<br />

Nominal (in €m)<br />

630<br />

(26) EBITDA is equal to recurring operating profit before depreciation, amortisation and provisions.<br />

(27) EBITDA leverage of 3.1x (compared with covenant maximum of 5.75x) and ICR ratio of 3x (compared with covenant minimum of 2x).<br />

49