Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Benefits payable upon retirement<br />

No provision was set aside to cover benefits payable upon<br />

retirement, since there were no employees likely to qualify<br />

for pension obligations at 31 December <strong>2008</strong>.<br />

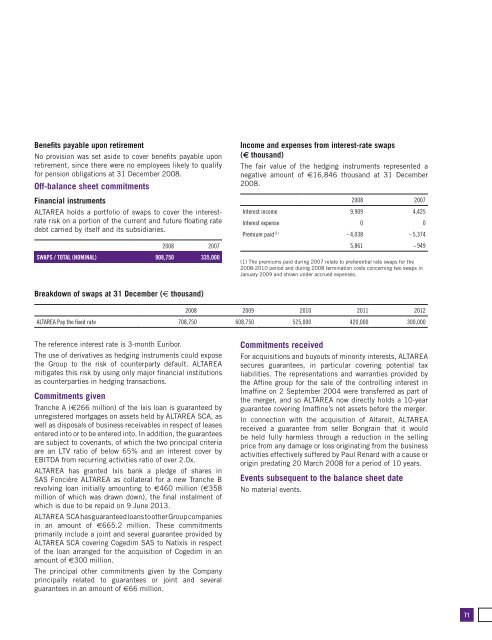

Off-balance sheet commitments<br />

Financial instruments<br />

ALTAREA holds a portfolio of swaps to cover the interestrate<br />

risk on a portion of the current and future floating rate<br />

debt carried by itself and its subsidiaries.<br />

<strong>2008</strong> 2007<br />

Swaps / Total (nominal) 908,750 335,000<br />

Income and expenses from interest-rate swaps<br />

(€ thousand)<br />

The fair value of the hedging instruments represented a<br />

negative amount of €16,846 thousand at 31 December<br />

<strong>2008</strong>.<br />

<strong>2008</strong> 2007<br />

Interest income 9,909 4,425<br />

Interest expense 0 0<br />

Premium paid (1) – 4,038 – 5,374<br />

5,861 – 949<br />

(1) The premiums paid during 2007 relate to preferential rate swaps for the<br />

<strong>2008</strong>-2010 period and during <strong>2008</strong> termination costs concerning two swaps in<br />

January 2009 and shown under accrued expenses.<br />

Breakdown of swaps at 31 December (€ thousand)<br />

<strong>2008</strong> 2009 2010 2011 2012<br />

ALTAREA Pay the fixed rate 708,750 608,750 525,000 420,000 300,000<br />

The reference interest rate is 3-month Euribor.<br />

The use of derivatives as hedging instruments could expose<br />

the Group to the risk of counterparty default. ALTAREA<br />

mitigates this risk by using only major financial institutions<br />

as counterparties in hedging transactions.<br />

Commitments given<br />

Tranche A (€266 million) of the Ixis loan is guaranteed by<br />

unregistered mortgages on assets held by ALTAREA SCA, as<br />

well as disposals of business receivables in respect of leases<br />

entered into or to be entered into. In addition, the guarantees<br />

are subject to covenants, of which the two principal criteria<br />

are an LTV ratio of below 65% and an interest cover by<br />

EBITDA from recurring activities ratio of over 2.0x.<br />

ALTAREA has granted Ixis bank a pledge of shares in<br />

SAS Foncière ALTAREA as collateral for a new Tranche B<br />

revolving loan initially amounting to €460 million (€358<br />

million of which was drawn down), the final instalment of<br />

which is due to be repaid on 9 June 2013.<br />

ALTAREA SCA has guaranteed loans to other Group companies<br />

in an amount of €665.2 million. These commitments<br />

primarily include a joint and several guarantee provided by<br />

ALTAREA SCA covering <strong>Cogedim</strong> SAS to Natixis in respect<br />

of the loan arranged for the acquisition of <strong>Cogedim</strong> in an<br />

amount of €300 million.<br />

The principal other commitments given by the Company<br />

principally related to guarantees or joint and several<br />

guarantees in an amount of €66 million.<br />

Commitments received<br />

For acquisitions and buyouts of minority interests, ALTAREA<br />

secures guarantees, in particular covering potential tax<br />

liabilities. The representations and warranties provided by<br />

the Affine group for the sale of the controlling interest in<br />

Imaffine on 2 September 2004 were transferred as part of<br />

the merger, and so ALTAREA now directly holds a 10-year<br />

guarantee covering Imaffine’s net assets before the merger.<br />

In connection with the acquisition of Altareit, ALTAREA<br />

received a guarantee from seller Bongrain that it would<br />

be held fully harmless through a reduction in the selling<br />

price from any damage or loss originating from the business<br />

activities effectively suffered by Paul Renard with a cause or<br />

origin predating 20 March <strong>2008</strong> for a period of 10 years.<br />

Events subsequent to the balance sheet date<br />

No material events.<br />

71