Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONSOLIDATED FINANCIAL STATEMENTS<br />

• In 2007<br />

The change in the fair value of investment property yielded a gain of €411.9 million at 31 December 2007.<br />

Assets delivered during the financial year led to an increase of €182 million in the fair value of investment property.<br />

The impairment loss on other non-current assets, an expense of €2.35 million, derived predominantly from land on which<br />

construction is no longer permitted.<br />

The net allowance to provisions represented an expense of €0.13 million.<br />

The difference in goodwill corresponds entirely to the reversal of negative goodwill resulting from <strong>Cogedim</strong>’s acquisition of<br />

90% of the ownership units of Arbitrage & Investissements and Arbitrage & Investissements 2 during the second half of 2007.<br />

<strong>Cogedim</strong> had previously held a 10% interest in each of these companies, whose business is selling individual housing units.<br />

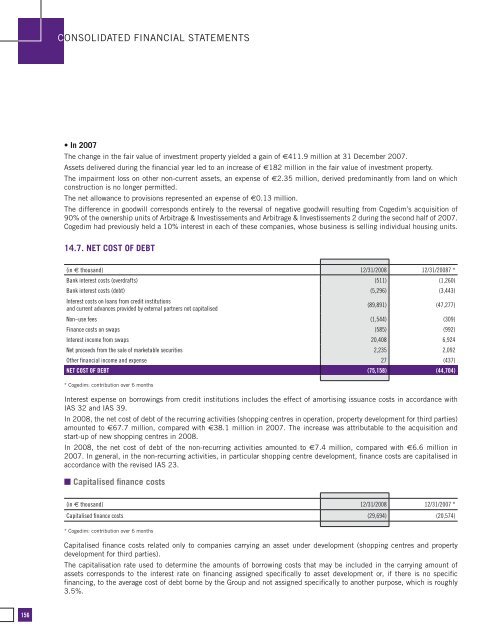

14.7. Net cost of debt<br />

(in € thousand) 12/31/<strong>2008</strong> 12/31/<strong>2008</strong>7 *<br />

Bank interest costs (overdrafts) (511) (1,260)<br />

Bank interest costs (debt) (5,296) (3,443)<br />

Interest costs on loans from credit institutions<br />

and current advances provided by external partners not capitalised<br />

(89,891) (47,277)<br />

Non–use fees (1,544) (309)<br />

Finance costs on swaps (585) (992)<br />

Interest income from swaps 20,408 6,924<br />

Net proceeds from the sale of marketable securities 2,235 2,092<br />

Other financial income and expense 27 (437)<br />

NET COST OF DEBT (75,158) (44,704)<br />

* <strong>Cogedim</strong>: contribution over 6 months<br />

Interest expense on borrowings from credit institutions includes the effect of amortising issuance costs in accordance with<br />

IAS 32 and IAS 39.<br />

In <strong>2008</strong>, the net cost of debt of the recurring activities (shopping centres in operation, property development for third parties)<br />

amounted to €67.7 million, compared with €38.1 million in 2007. The increase was attributable to the acquisition and<br />

start-up of new shopping centres in <strong>2008</strong>.<br />

In <strong>2008</strong>, the net cost of debt of the non-recurring activities amounted to €7.4 million, compared with €6.6 million in<br />

2007. In general, in the non-recurring activities, in particular shopping centre development, finance costs are capitalised in<br />

accordance with the revised IAS 23.<br />

n Capitalised finance costs<br />

(in € thousand) 12/31/<strong>2008</strong> 12/31/2007 *<br />

Capitalised finance costs (29,694) (20,574)<br />

* <strong>Cogedim</strong>: contribution over 6 months<br />

Capitalised finance costs related only to companies carrying an asset under development (shopping centres and property<br />

development for third parties).<br />

The capitalisation rate used to determine the amounts of borrowing costs that may be included in the carrying amount of<br />

assets corresponds to the interest rate on financing assigned specifically to asset development or, if there is no specific<br />

financing, to the average cost of debt borne by the Group and not assigned specifically to another purpose, which is roughly<br />

3.5%.<br />

156