Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Annual report 2008 - Altarea Cogedim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

one in Italy. These shopping centres, which were 97% let on<br />

opening, generated value creation of €97 million in <strong>2008</strong><br />

(average yield of 9%). Thanks to development projects<br />

secured over the last few years being brought into service,<br />

ALTAREA achieved further very strong cash flow growth in<br />

<strong>2008</strong> (+23% for shopping centres).<br />

ALTAREA also invested a further €295 million in total in<br />

shopping centres (6) in <strong>2008</strong> (shopping centres in operation<br />

and development projects). The Group also secured eight<br />

new development projects representing potential investment<br />

of €416 million with a yield of over 9%.<br />

ALTAREA’s value creation model therefore demonstrates its<br />

relevance during a period of crisis, in which the automatic<br />

impact of higher capitalisation rates can be partially offset<br />

by dynamic management of the portfolio, as well as the<br />

completion of new assets offering high yields.<br />

1.4 Advance compliance with “SIIC 4“<br />

requirements (7)<br />

The merger of Altafinance into ALTAREA was the final stage<br />

of the dissolution of the existing action in concert agreement<br />

between ALTAREA’s main shareholders, allowing ALTAREA<br />

to comply in advance with the final requirements relating to<br />

SIIC tax status, the provisions of which (“SIIC 4“) stipulate<br />

that no shareholder other than an SIIC may control more<br />

than 60% of an SIIC’s share capital and voting rights either<br />

alone or in concert.<br />

As a result of the merger, approved at the <strong>Annual</strong> General<br />

Meeting of 26 May <strong>2008</strong>, legal control of ALTAREA is in<br />

line with its economic control.<br />

1.5 Outlook<br />

The situation observed at the start of 2009 was paradoxical.<br />

While consumer spending remained flat - due to the mixed<br />

success of retailers’ ”winter sales” and a decline in the<br />

number of visitors to shopping centres - sales of new homes<br />

seemed to pick up, with commercial activities achieving a<br />

return to growth.<br />

Against this uncertain backdrop, ALTAREA’s recurring<br />

operating profit should increase further thanks to the quality<br />

and diversity of its portfolio, with three new shopping centres<br />

brought into service already nearly 100% let.<br />

In view of its liquidity position, ALTAREA is planning to<br />

continue with its conventional strategy of creating cash flow<br />

and value, mainly by developing new shopping centres. The<br />

Group may also seize any opportunities arising from market<br />

conditions. ALTAREA has set itself the target of maintaining<br />

the current solidity of its balance sheet.<br />

2. Shopping centre development<br />

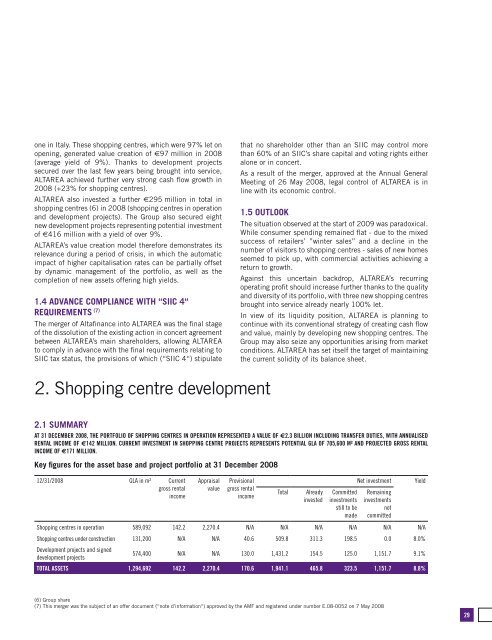

2.1 Summary<br />

At 31 December <strong>2008</strong>, the portfolio of shopping centres in operation represented a value of €2.3 billion including transfer duties, with annualised<br />

rental income of €142 million. Current investment in shopping centre projects represents potential GLA of 705,600 m² and projected gross rental<br />

income of €171 million.<br />

Key figures for the asset base and project portfolio at 31 December <strong>2008</strong><br />

12/31/<strong>2008</strong> GLA in m² Current<br />

gross rental<br />

income<br />

Appraisal<br />

value<br />

Provisional<br />

gross rental<br />

income<br />

Total<br />

Already<br />

invested<br />

Committed<br />

investments<br />

still to be<br />

made<br />

Net investment<br />

Remaining<br />

investments<br />

not<br />

committed<br />

Yield<br />

Shopping centres in operation 589,092 142.2 2,270.4 N/A N/A N/A N/A N/A N/A<br />

Shopping centres under construction 131,200 N/A N/A 40.6 509.8 311.3 198.5 0.0 8.0%<br />

Development projects and signed<br />

development projects<br />

574,400 N/A N/A 130.0 1,431.2 154.5 125.0 1,151.7 9.1%<br />

Total assets 1,294,692 142.2 2,270.4 170.6 1,941.1 465.8 323.5 1,151.7 8.8%<br />

(6) Group share<br />

(7) This merger was the subject of an offer document (“note d’information“) approved by the AMF and registered under number E.08-0052 on 7 May <strong>2008</strong><br />

29