Volume 9 Edition 2 2012 - The ASIA Miner

Volume 9 Edition 2 2012 - The ASIA Miner

Volume 9 Edition 2 2012 - The ASIA Miner

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

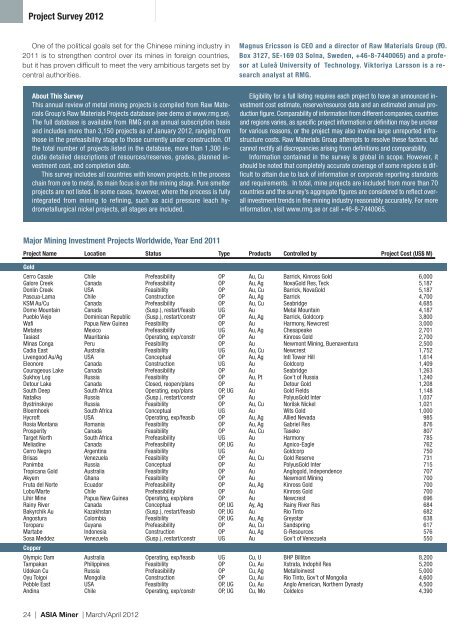

Project Survey <strong>2012</strong><br />

One of the political goals set for the Chinese mining industry in<br />

2011 is to strengthen control over its mines in foreign countries,<br />

but it has proven difficult to meet the very ambitious targets set by<br />

central authorities.<br />

Magnus Ericsson is CEO and a director of Raw Materials Group (P.O.<br />

Box 3127, SE-169 03 Solna, Sweden, +46-8-7440065) and a profesor<br />

at Luleå University of Technology. Viktoriya Larsson is a research<br />

analyst at RMG.<br />

About This Survey<br />

This annual review of metal mining projects is compiled from Raw Materials<br />

Group’s Raw Materials Projects database (see demo at www.rmg.se).<br />

<strong>The</strong> full database is available from RMG on an annual subscription basis<br />

and includes more than 3,150 projects as of January <strong>2012</strong>, ranging from<br />

those in the prefeasibility stage to those currently under construction. Of<br />

the total number of projects listed in the database, more than 1,300 include<br />

detailed descriptions of resources/reserves, grades, planned investment<br />

cost, and completion date.<br />

This survey includes all countries with known projects. In the process<br />

chain from ore to metal, its main focus is on the mining stage. Pure smelter<br />

projects are not listed. In some cases, however, where the process is fully<br />

integrated from mining to refining, such as acid pressure leach hydrometallurgical<br />

nickel projects, all stages are included.<br />

Eligibility for a full listing requires each project to have an announced investment<br />

cost estimate, reserve/resource data and an estimated annual production<br />

figure. Comparability of information from different companies, countries<br />

and regions varies, as specific project information or definition may be unclear<br />

for various reasons, or the project may also involve large unreported infrastructure<br />

costs. Raw Materials Group attempts to resolve these factors, but<br />

cannot rectify all discrepancies arising from definitions and comparability.<br />

Information contained in the survey is global in scope. However, it<br />

should be noted that completely accurate coverage of some regions is difficult<br />

to attain due to lack of information or corporate reporting standards<br />

and requirements. In total, mine projects are included from more than 70<br />

countries and the survey’s aggregate figures are considered to reflect overall<br />

investment trends in the mining industry reasonably accurately. For more<br />

information, visit www.rmg.se or call +46-8-7440065.<br />

Major Mining Investment Projects Worldwide, Year End 2011<br />

Project Name Location Status Type Products Controlled by Project Cost (US$ M)<br />

Gold<br />

Cerro Casale Chile Prefeasibility OP Au, Cu Barrick, Kinross Gold 6,000<br />

Galore Creek Canada Prefeasibility OP Au, Ag NovaGold Res, Teck 5,187<br />

Donlin Creek USA Feasibility OP Au, Cu Barrick, NovaGold 5,187<br />

Pascua-Lama Chile Construction OP Au, Ag Barrick 4,700<br />

KSM Au/Cu Canada Prefeasibility OP Au, Cu Seabridge 4,685<br />

Dome Mountain Canada (Susp.), restart/feasib UG Au Metal Mountain 4,187<br />

Pueblo Viejo Dominican Republic (Susp.), restart/constr OP Au, Ag Barrick, Goldcorp 3,800<br />

Wafi Papua New Guinea Feasibility OP Au Harmony, Newcrest 3,000<br />

Metates Mexico Prefeasibility UG Au, Ag Chesapeake 2,701<br />

Tasiast Mauritania Operating, exp/constr OP Au Kinross Gold 2,700<br />

Minas Conga Peru Feasibility OP Au Newmont Mining, Buenaventura 2,500<br />

Cadia East Australia Feasibility UG Au, Cu Newcrest 1,752<br />

Livengood Au/Ag USA Conceptual OP Au, Ag Intl Tower Hill 1,614<br />

Eleonore Canada Construction UG Au Goldcorp 1,409<br />

Courageous Lake Canada Prefeasibility OP Au Seabridge 1,263<br />

Sukhoy Log Russia Feasibility OP Au, Pt Gov’t of Russia 1,240<br />

Detour Lake Canada Closed, reopen/plans OP Au Detour Gold 1,208<br />

South Deep South Africa Operating, exp/plans OP, UG Au Gold Fields 1,148<br />

Natalka Russia (Susp.), restart/constr OP Au PolyusGold Inter 1,037<br />

Bystrinskoye Russia Feasibility OP Au, Cu Norilsk Nickel 1,021<br />

Bloemhoek South Africa Conceptual UG Au Wits Gold 1,000<br />

Hycroft USA Operating, exp/feasib OP Au, Ag Allied Nevada 0,985<br />

Rosia Montana Romania Feasibility OP Au, Ag Gabriel Res 0,876<br />

Prosperity Canada Feasibility OP Au, Cu Taseko 0,807<br />

Target North South Africa Prefeasibility UG Au Harmony 0,785<br />

Meliadine Canada Prefeasibility OP, UG Au Agnico-Eagle 0,762<br />

Cerro Negro Argentina Feasibility UG Au Goldcorp 0,750<br />

Brisas Venezuela Feasibility OP Au, Cu Gold Reserve 0,731<br />

Panimba Russia Conceptual OP Au PolyusGold Inter 0,715<br />

Tropicana Gold Australia Feasibility OP Au Anglogold, Independence 0,707<br />

Akyem Ghana Feasibility OP Au Newmont Mining 0,700<br />

Fruta del Norte Ecuador Prefeasibility OP Au, Ag Kinross Gold 0,700<br />

Lobo/Marte Chile Prefeasibility OP Au Kinross Gold 0,700<br />

Lihir Mine Papua New Guinea Operating, exp/plans OP Au Newcrest 0,696<br />

Rainy River Canada Conceptual OP, UG Ay, Ag Rainy River Res 0,684<br />

Bakyrchik Au Kazakhstan (Susp.), restart/feasib OP, UG Au Rio Tinto 0,682<br />

Angostura Colombia Feasibility OP, UG Au, Ag Greystar 0,638<br />

Toroparu Guyana Prefeasibility OP Au, Cu Sandspring 0,617<br />

Martabe Indonesia Construction OP Au, Ag G-Resources 0,576<br />

Sosa Meddez Venezuela (Susp.), restart/constr UG Au Gov’t of Venezuela 0,550<br />

Copper<br />

Olympic Dam Australia Operating, exp/feasib UG Cu, U BHP Billiton 8,200<br />

Tampakan Philippines Feasibility OP Cu, Au Xstrata, Indophil Res 05,200<br />

Udokan Cu Russia Prefeasibility OP Cu, Ag Metalloinvest 05,000<br />

Oyu Tolgoi Mongolia Construction OP Cu, Au Rio Tinto, Gov’t of Mongolia 04,600<br />

Pebble East USA Feasibility OP, UG Cu, Au Anglo American, Northern Dynasty 04,500<br />

Andina Chile Operating, exp/constr OP, UG Cu, Mo Coldelco 04,390<br />

24 | <strong>ASIA</strong> <strong>Miner</strong> | March/April <strong>2012</strong>