Annual Reports 2011 V ontob el Group - Vontobel Holding AG

Annual Reports 2011 V ontob el Group - Vontobel Holding AG

Annual Reports 2011 V ontob el Group - Vontobel Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

trading. Here, the Financial Products division was able to defend its strong market<br />

position in Switzerland and Germany, even if the demand for structured products<br />

declined noticeably towards the end of <strong>2011</strong>. In addition, valuation effects on the<br />

asset and liability side had a significant negative net impact of CHF 24 mn on trading<br />

income due to the renewed rise in risk premiums in Europe. The sale of a commercial<br />

property in Geneva contributed CHF 21.6 mn to other income.<br />

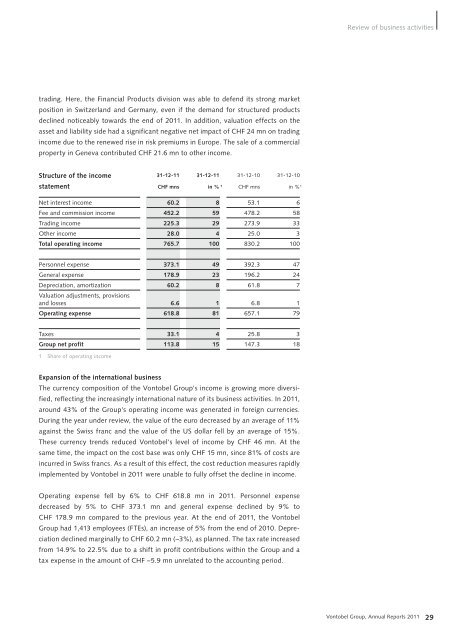

Structure of the income<br />

statement<br />

31-12-11 31-12-11 31-12-10 31-12-10<br />

CHF mns in % 1 CHF mns in % 1<br />

Net interest income 60.2 8 53.1 6<br />

Fee and commission income 452.2 59 478.2 58<br />

Trading income 225.3 29 273.9 33<br />

Other income 28.0 4 25.0 3<br />

Total operating income 765.7 100 830.2 100<br />

Personn<strong>el</strong> expense 373.1 49 392.3 47<br />

General expense 178.9 23 196.2 24<br />

Depreciation, amortization<br />

Valuation adjustments, provisions<br />

60.2 8 61.8 7<br />

and losses 6.6 1 6.8 1<br />

Operating expense 618.8 81 657.1 79<br />

Taxes 33.1 4 25.8 3<br />

<strong>Group</strong> net profit 113.8 15 147.3 18<br />

1 Share of operating income<br />

Expansion of the international business<br />

The currency composition of the V<strong>ontob</strong><strong>el</strong> <strong>Group</strong>'s income is growing more diversified,<br />

reflecting the increasingly international nature of its business activities. In <strong>2011</strong>,<br />

around 43% of the <strong>Group</strong>'s operating income was generated in foreign currencies.<br />

During the year under review, the value of the euro decreased by an average of 11%<br />

against the Swiss franc and the value of the US dollar f<strong>el</strong>l by an average of 15%.<br />

These currency trends reduced V<strong>ontob</strong><strong>el</strong>'s lev<strong>el</strong> of income by CHF 46 mn. At the<br />

same time, the impact on the cost base was only CHF 15 mn, since 81% of costs are<br />

incurred in Swiss francs. As a result of this effect, the cost reduction measures rapidly<br />

implemented by V<strong>ontob</strong><strong>el</strong> in <strong>2011</strong> were unable to fully offset the decline in income.<br />

Operating expense f<strong>el</strong>l by 6% to CHF 618.8 mn in <strong>2011</strong>. Personn<strong>el</strong> expense<br />

decreased by 5% to CHF 373.1 mn and general expense declined by 9% to<br />

CHF 178.9 mn compared to the previous year. At the end of <strong>2011</strong>, the V<strong>ontob</strong><strong>el</strong><br />

<strong>Group</strong> had 1,413 employees (FTEs), an increase of 5% from the end of 2010. Depreciation<br />

declined marginally to CHF 60.2 mn (–3%), as planned. The tax rate increased<br />

from 14.9% to 22.5% due to a shift in profit contributions within the <strong>Group</strong> and a<br />

tax expense in the amount of CHF –5.9 mn unr<strong>el</strong>ated to the accounting period.<br />

Review of business activities<br />

V<strong>ontob</strong><strong>el</strong> <strong>Group</strong>, <strong>Annual</strong> <strong>Reports</strong> <strong>2011</strong> 29