Annual Reports 2011 V ontob el Group - Vontobel Holding AG

Annual Reports 2011 V ontob el Group - Vontobel Holding AG

Annual Reports 2011 V ontob el Group - Vontobel Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

V<strong>ontob</strong><strong>el</strong> Gorup's balance sheet. The liabilities resulting from this business totalled<br />

CHF 7.7 bn, compared to CHF 9.3 bn in the previous year.<br />

Of the total regulatory capital of CHF 664.1 mn (31-12-10: CHF 625.1 mn) required<br />

under BIS rules, 50% was allocated to Investment Banking.<br />

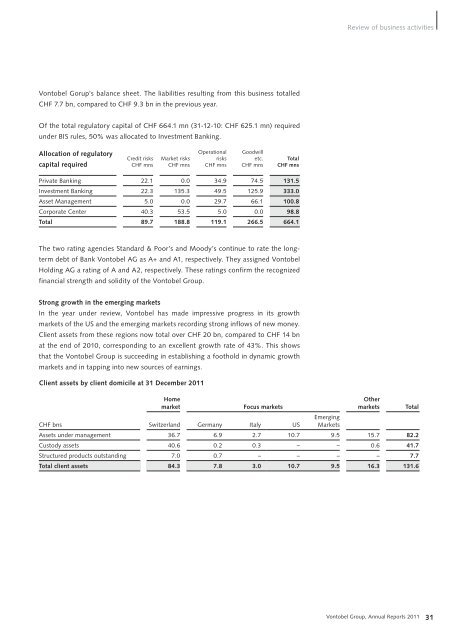

Allocation of regulatory<br />

capital required<br />

Operational Goodwill<br />

Credit risks Market risks risks<br />

etc. Total<br />

CHF mns CHF mns CHF mns CHF mns CHF mns<br />

Private Banking 22.1 0.0 34.9 74.5 131.5<br />

Investment Banking 22.3 135.3 49.5 125.9 333.0<br />

Asset Management 5.0 0.0 29.7 66.1 100.8<br />

Corporate Center 40.3 53.5 5.0 0.0 98.8<br />

Total 89.7 188.8 119.1 266.5 664.1<br />

The two rating agencies Standard & Poor’s and Moody’s continue to rate the longterm<br />

debt of Bank V<strong>ontob</strong><strong>el</strong> <strong>AG</strong> as A+ and A1, respectiv<strong>el</strong>y. They assigned V<strong>ontob</strong><strong>el</strong><br />

<strong>Holding</strong> <strong>AG</strong> a rating of A and A2, respectiv<strong>el</strong>y. These ratings confirm the recognized<br />

financial strength and solidity of the V<strong>ontob</strong><strong>el</strong> <strong>Group</strong>.<br />

Strong growth in the emerging markets<br />

In the year under review, V<strong>ontob</strong><strong>el</strong> has made impressive progress in its growth<br />

markets of the US and the emerging markets recording strong inflows of new money.<br />

Client assets from these regions now total over CHF 20 bn, compared to CHF 14 bn<br />

at the end of 2010, corresponding to an exc<strong>el</strong>lent growth rate of 43%. This shows<br />

that the V<strong>ontob</strong><strong>el</strong> <strong>Group</strong> is succeeding in establishing a foothold in dynamic growth<br />

markets and in tapping into new sources of earnings.<br />

Client assets by client domicile at 31 December <strong>2011</strong><br />

Home<br />

market Focus markets<br />

Review of business activities<br />

Other<br />

markets Total<br />

CHF bns Switzerland Germany Italy US<br />

Emerging<br />

Markets<br />

Assets under management 36.7 6.9 2.7 10.7 9.5 15.7 82.2<br />

Custody assets 40.6 0.2 0.3 – – 0.6 41.7<br />

Structured products outstanding 7.0 0.7 – – – – 7.7<br />

Total client assets 84.3 7.8 3.0 10.7 9.5 16.3 131.6<br />

V<strong>ontob</strong><strong>el</strong> <strong>Group</strong>, <strong>Annual</strong> <strong>Reports</strong> <strong>2011</strong> 31