Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

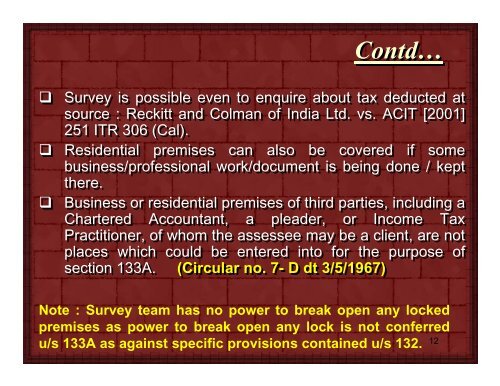

Contd…<br />

<br />

<br />

<br />

<strong>Survey</strong> is possible even to enquire about tax deducted at<br />

source : Reckitt and Colman of India Ltd. vs. ACIT [2001]<br />

251 ITR 306 (Cal).<br />

Residential premises can also be covered if some<br />

business/professional work/document is being done / kept<br />

there.<br />

Business or residential premises of third parties, including a<br />

Chartered Accountant, a pleader, or <strong>Income</strong> <strong>Tax</strong><br />

Practitioner, of whom the assessee may be a client, are not<br />

places which could be entered into for the purpose of<br />

section 133A. (Circular no. 7- D dt 3/5/1967)<br />

Note : <strong>Survey</strong> team has no power to break open any locked<br />

premises as power to break open any lock is not conferred<br />

u/s 133A as against specific provisions contained u/s 132.<br />

12