Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

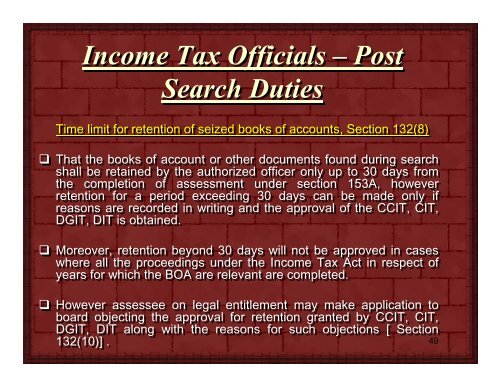

<strong>Income</strong> <strong>Tax</strong> Officials – Post<br />

<strong>Search</strong> Duties<br />

Time limit for retention of seized books of accounts, Section 132(8)<br />

That the books of account or other documents found during search<br />

shall be retained by the authorized officer only up to 30 days from<br />

the completion of assessment under section 153A, however<br />

retention for a period exceeding 30 days can be made only if if<br />

reasons are recorded in writing and the approval of the CCIT, CIT,<br />

DGIT, DIT is obtained.<br />

Moreover, retention beyond 30 days will not be approved in cases<br />

where all the proceedings under the <strong>Income</strong> <strong>Tax</strong> <strong>Act</strong> in respect of<br />

years for which the BOA are relevant are completed.<br />

However assessee on legal entitlement may make application to<br />

board objecting the approval for retention granted by CCIT, CIT,<br />

DGIT, DIT along with the reasons for such objections [ Section<br />

132(10)] .<br />

49