Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

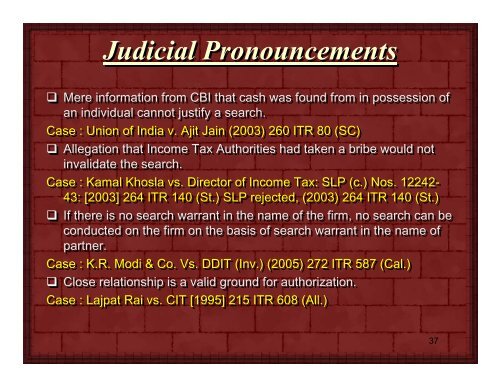

Judicial Pronouncements<br />

Mere information from CBI that cash was found from in possession of<br />

an individual cannot justify a search.<br />

Case : Union of India v. Ajit Jain (2003) 260 ITR 80 (SC)<br />

Allegation that <strong>Income</strong> <strong>Tax</strong> Authorities had taken a bribe would not<br />

invalidate the search.<br />

Case : Kamal Khosla vs. Director of <strong>Income</strong> <strong>Tax</strong>: SLP (c.) Nos. 12242-<br />

43: [2003] 264 ITR 140 (St.) SLP rejected, (2003) 264 ITR 140 (St.)<br />

If there is no search warrant in the name of the firm, no search can be<br />

conducted on the firm on the basis of search warrant in the name of<br />

partner.<br />

Case : K.R. Modi & Co. Vs. DDIT (Inv.) (2005) 272 ITR 587 (Cal.)<br />

Close relationship is a valid ground for authorization.<br />

Case : Lajpat Rai vs. CIT [1995] 215 ITR 608 (All.)<br />

37