Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

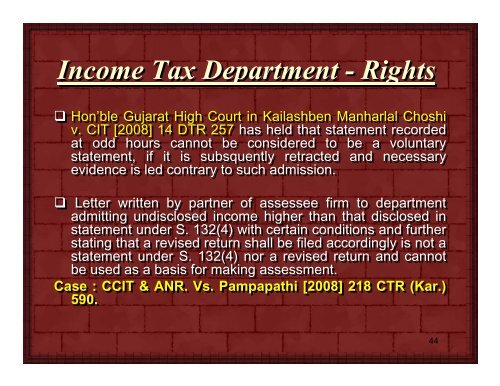

<strong>Income</strong> <strong>Tax</strong> Department - Rights<br />

Hon’ble Gujarat High Court in Kailashben Manharlal Choshi<br />

v. CIT [2008] 14 DTR 257 has held that statement recorded<br />

at odd hours cannot be considered to be a voluntary<br />

statement, if it is subsquently retracted and necessary<br />

evidence is led contrary to such admission.<br />

Letter written by partner of assessee firm to department<br />

admitting undisclosed income higher than that disclosed in<br />

statement under S. 132(4) with certain conditions and further<br />

stating that a revised return shall be filed accordingly is not a<br />

statement under S. 132(4) nor a revised return and cannot<br />

be used as a basis for making assessment.<br />

Case : CCIT & ANR. Vs. Pampapathi [2008] 218 CTR (Kar.)<br />

590.<br />

44