Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

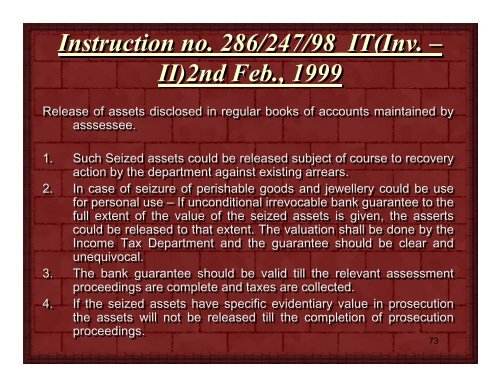

Instruction no. 286/247/98_IT(Inv. –<br />

II)2nd Feb., 1999<br />

Release of assets disclosed in regular books of accounts maintained by<br />

asssessee.<br />

1. Such Seized assets could be released subject of course to recovery<br />

action by the department against existing arrears.<br />

2. In case of seizure of perishable goods and jewellery could be use<br />

for personal use – If unconditional irrevocable bank guarantee to the<br />

full extent of the value of the seized assets is given, the asserts<br />

could be released to that extent. The valuation shall be done by the<br />

<strong>Income</strong> <strong>Tax</strong> Department and the guarantee should be clear and<br />

unequivocal.<br />

3. The bank guarantee should be valid till the relevant assessment<br />

proceedings are complete and taxes are collected.<br />

4. If the seized assets have specific evidentiary value in prosecution<br />

the assets will not be released till the completion of prosecution<br />

proceedings.<br />

73