Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

Survey, Search & Seizure Income Tax Act, 1961

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

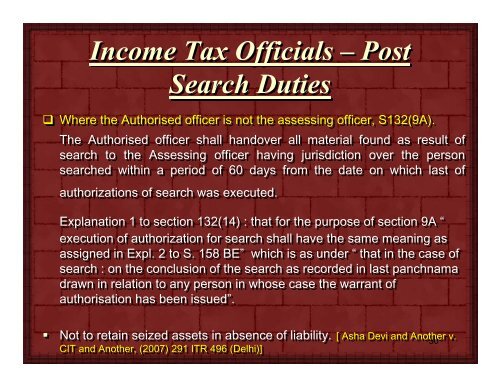

<strong>Income</strong> <strong>Tax</strong> Officials – Post<br />

<strong>Search</strong> Duties<br />

Where the Authorised officer is not the assessing officer, S132(9A).<br />

The Authorised officer shall handover all material found as result of<br />

search to the Assessing officer having jurisdiction over the person<br />

searched within a period of 60 days from the date on which last of<br />

authorizations of search was executed.<br />

Explanation 1 to section 132(14) : that for the purpose of section 9A “<br />

execution of authorization for search shall have the same meaning as<br />

assigned in Expl. 2 to S. 158 BE” which is as under “ that in the case of<br />

search : on the conclusion of the search as recorded in last panchnama<br />

drawn in relation to any person in whose case the warrant of<br />

authorisation has been issued”.<br />

• Not to retain seized assets in absence of liability. [ Asha Devi and Another v.<br />

CIT and Another, (2007) 291 ITR 496 (Delhi)]<br />

50