On high ground Container Corporation of India - The Smart Investor

On high ground Container Corporation of India - The Smart Investor

On high ground Container Corporation of India - The Smart Investor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Container</strong> <strong>Corporation</strong> <strong>of</strong> <strong>India</strong><br />

CCRI is undertaking<br />

the capex to position<br />

itself strategically for the<br />

huge opportunity around<br />

FY17-18<br />

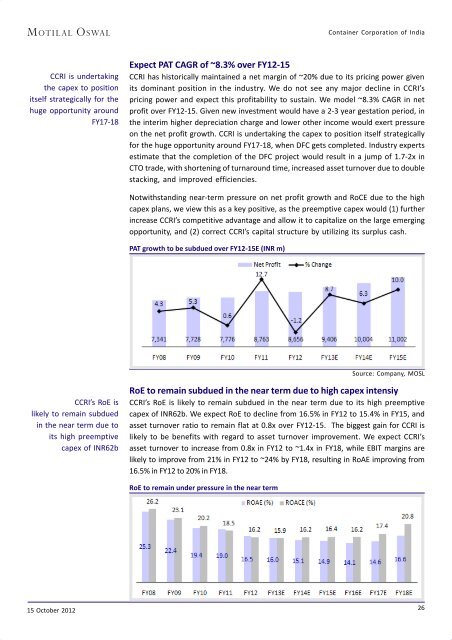

Expect PAT CAGR <strong>of</strong> ~8.3% over FY12-15<br />

CCRI has historically maintained a net margin <strong>of</strong> ~20% due to its pricing power given<br />

its dominant position in the industry. We do not see any major decline in CCRI’s<br />

pricing power and expect this pr<strong>of</strong>itability to sustain. We model ~8.3% CAGR in net<br />

pr<strong>of</strong>it over FY12-15. Given new investment would have a 2-3 year gestation period, in<br />

the interim <strong>high</strong>er depreciation charge and lower other income would exert pressure<br />

on the net pr<strong>of</strong>it growth. CCRI is undertaking the capex to position itself strategically<br />

for the huge opportunity around FY17-18, when DFC gets completed. Industry experts<br />

estimate that the completion <strong>of</strong> the DFC project would result in a jump <strong>of</strong> 1.7-2x in<br />

CTO trade, with shortening <strong>of</strong> turnaround time, increased asset turnover due to double<br />

stacking, and improved efficiencies.<br />

Notwithstanding near-term pressure on net pr<strong>of</strong>it growth and RoCE due to the <strong>high</strong><br />

capex plans, we view this as a key positive, as the preemptive capex would (1) further<br />

increase CCRI’s competitive advantage and allow it to capitalize on the large emerging<br />

opportunity, and (2) correct CCRI’s capital structure by utilizing its surplus cash.<br />

PAT growth to be subdued over FY12-15E (INR m)<br />

Source: Company, MOSL<br />

CCRI’s RoE is<br />

likely to remain subdued<br />

in the near term due to<br />

its <strong>high</strong> preemptive<br />

capex <strong>of</strong> INR62b<br />

RoE to remain subdued in the near term due to <strong>high</strong> capex intensiy<br />

CCRI’s RoE is likely to remain subdued in the near term due to its <strong>high</strong> preemptive<br />

capex <strong>of</strong> INR62b. We expect RoE to decline from 16.5% in FY12 to 15.4% in FY15, and<br />

asset turnover ratio to remain flat at 0.8x over FY12-15. <strong>The</strong> biggest gain for CCRI is<br />

likely to be benefits with regard to asset turnover improvement. We expect CCRI’s<br />

asset turnover to increase from 0.8x in FY12 to ~1.4x in FY18, while EBIT margins are<br />

likely to improve from 21% in FY12 to ~24% by FY18, resulting in RoAE improving from<br />

16.5% in FY12 to 20% in FY18.<br />

RoE to remain under pressure in the near term<br />

15 October 2012 26